#orderflow can help make a reasonable guess if markets will remain in range or find potential strong break out points. This then helps build context to take positions on either range reversals or range breaks.

So today markets opened lower. Question- Break lower or pullback?(1/n)

So today markets opened lower. Question- Break lower or pullback?(1/n)

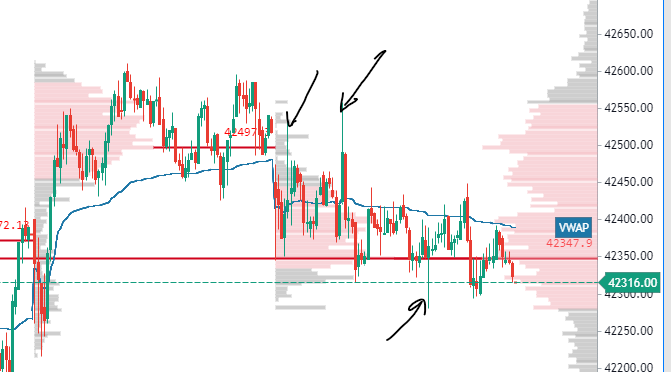

#banknifty as an eg., assuming first scenario as a potential pullback into yday range. This is stopped out by large limit sellers near 42500, this coupled with large OI increase and aggressive selling at 42500CE adds credence to a downside theory. 150K+ traded in 2 candles (2/n)

With large absorptions at top ,about 35K & 30K at tops. This and the OI change should had led to a downside. What we are looking for is a sharp rejection and continuation. This is stalled with poor downside follow through delta and then large absorption of sellers at 1:!5. (3/n)

All we are trying to do is put these pieces together and construct a more probable view. contrast this with yday where we had a 56K absorption at the lows followed by weak selling and aggressive buying at higher levels ensuring the move sustains (4/n) #gocharting #expirytrading

• • •

Missing some Tweet in this thread? You can try to

force a refresh