After all the talk about the catastrophic impact on the Eurozone from the energy crisis, and sky-high prices for energy imports, it is interesting that the Eurozone current account already bounced back into SURPLUS in the latest official data...

This is especially notable, since natural gas prices have fallen dramatically further into 2023.

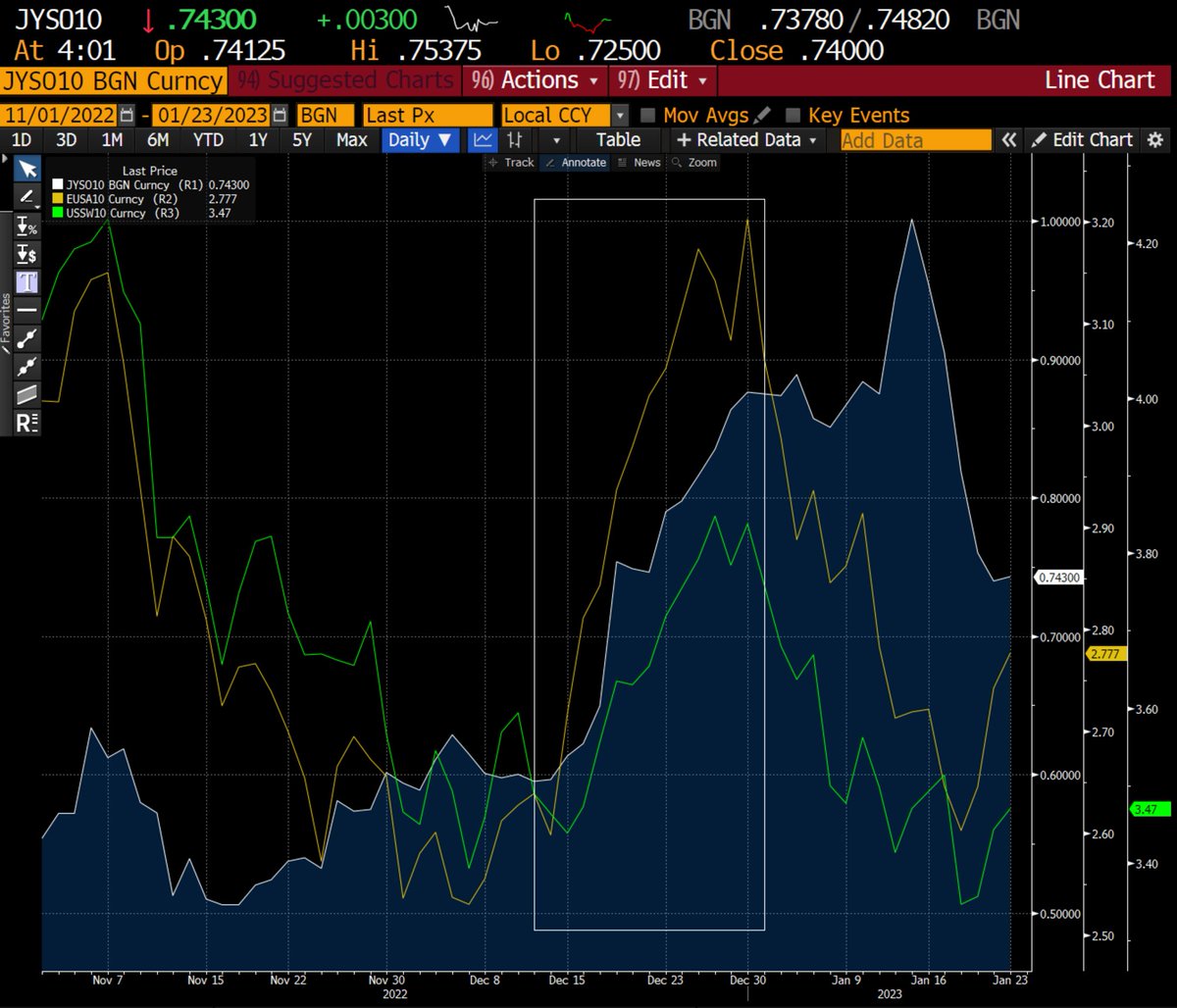

Here I show monthly moving averages of spot NatGas, and the latest reading is down around 50% (!!!) from the November average (when the current account data was recorded)

Here I show monthly moving averages of spot NatGas, and the latest reading is down around 50% (!!!) from the November average (when the current account data was recorded)

The bottom line is:

The hit to the Eurozone balance of payments, which looked enormous (when Russia shut down the Nordstream pipeline flows over the summer) is now looking much more moderate.

The hit to the Eurozone balance of payments, which looked enormous (when Russia shut down the Nordstream pipeline flows over the summer) is now looking much more moderate.

The media narrative has not fully adjusted to the new reality that we can observe in market prices, and now also the official balance of payment data (even if that data is quite lagged)

END

END

• • •

Missing some Tweet in this thread? You can try to

force a refresh