PhD Economist, Founder+CEO @ExanteData & @MarketReaderInc Formerly: MD at Goldman, Head of Research at Nomura & Bridgewater. #1 Ranked by Institutional Investor

26 subscribers

How to get URL link on X (Twitter) App

First,

First,

The trend in global core inflation is almost back to normal (chart above)

The trend in global core inflation is almost back to normal (chart above)

Foreign investors only put about $5bn of fresh capital into China in the form of FDI in Q2, the lowest since the data series began back in the 1990s, when China was a much much smaller economy

Foreign investors only put about $5bn of fresh capital into China in the form of FDI in Q2, the lowest since the data series began back in the 1990s, when China was a much much smaller economy

First,

First,

And here is the same data in time-series format for the Nominal Effective rate (NEER)

And here is the same data in time-series format for the Nominal Effective rate (NEER)

https://twitter.com/jnordvig/status/1639659676466913281

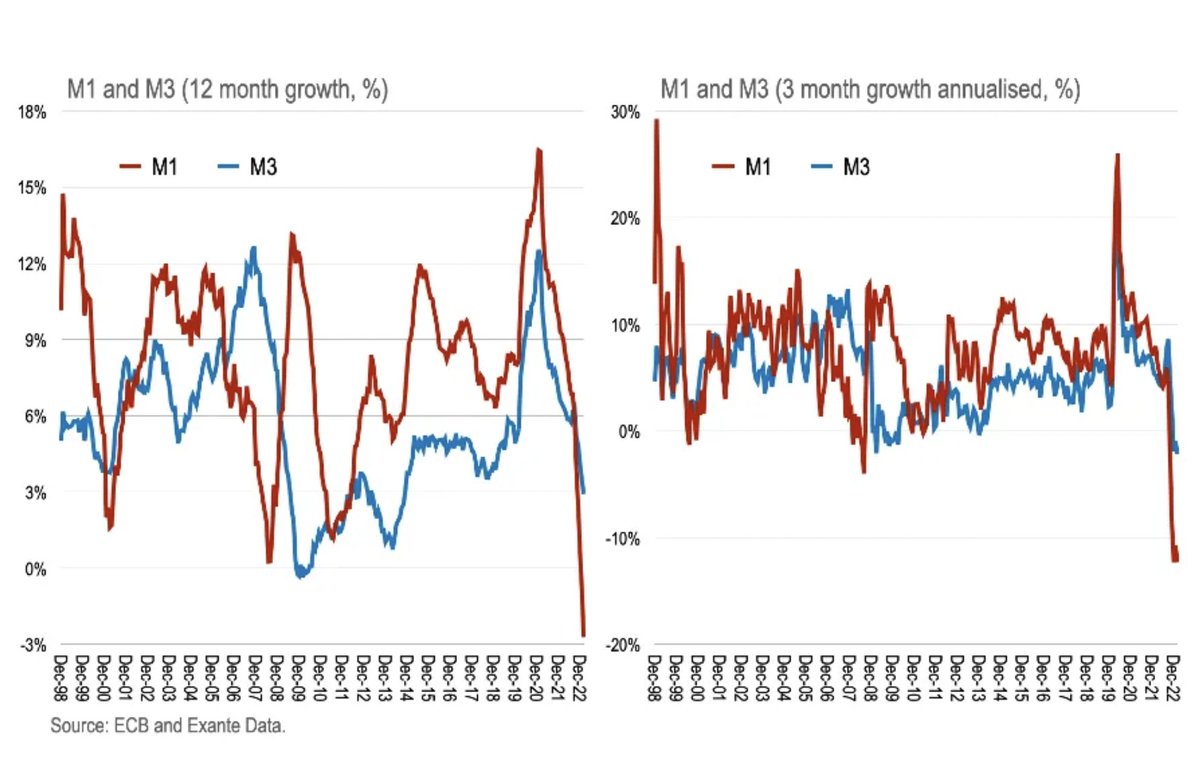

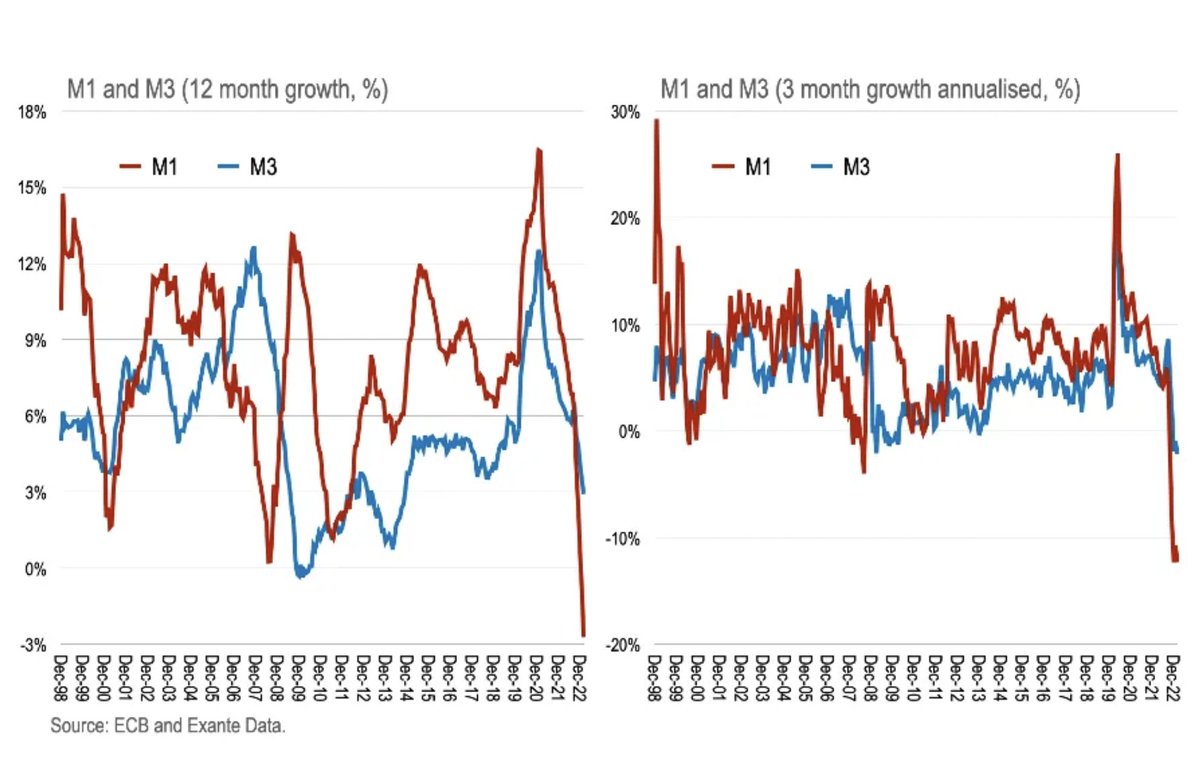

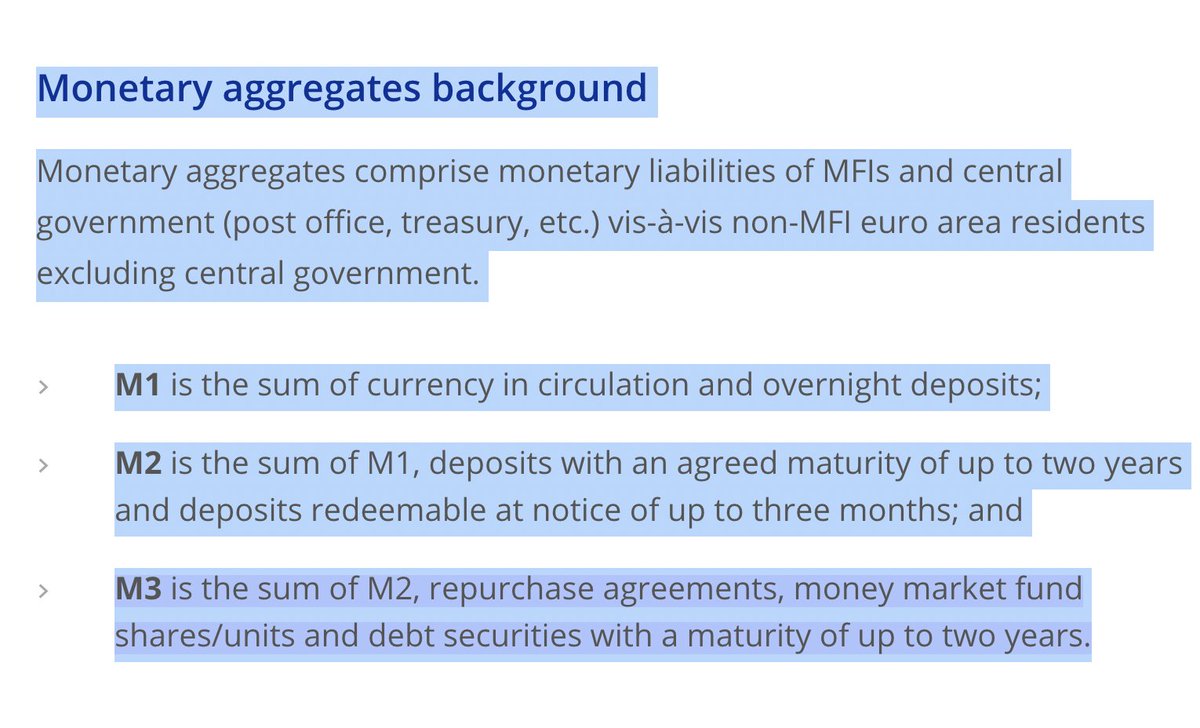

You can see in the charts above that M1 is moving much more than M3. This is because M1 is focussed on sight deposits, while broader money (M2 and M3) includes other bank liabilities, importantly savings deposits.

You can see in the charts above that M1 is moving much more than M3. This is because M1 is focussed on sight deposits, while broader money (M2 and M3) includes other bank liabilities, importantly savings deposits.

Since early 2022, foreigners have been selling CNY bonds almost every single month (with the exception of a tiny inflow in Dec 2022).

Since early 2022, foreigners have been selling CNY bonds almost every single month (with the exception of a tiny inflow in Dec 2022).

https://twitter.com/GeneralTheorist/status/1637213375011725314The balance sheet expansion last week was driven by actions of commercial banks; defensive action at the discount window, generating liquidity for those in need; but liquidity which may be very short-term in nature.