Yesterday we asked you about the best advice you would give your younger self.

We received hundreds of answers.

Here are the 10 BEST pieces of advice:

We received hundreds of answers.

Here are the 10 BEST pieces of advice:

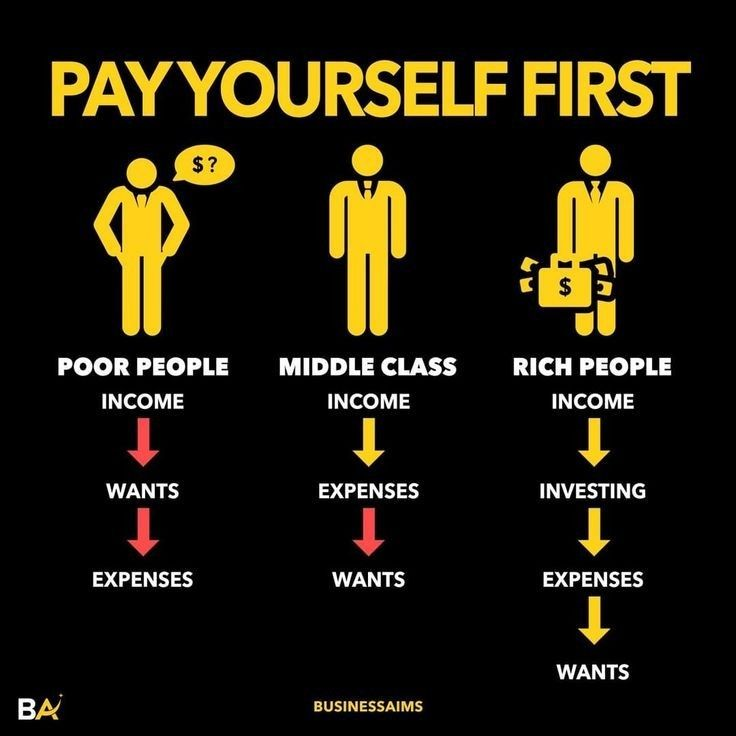

2. Pay yourself first

Save at least 10% of your income every single month.

Use it to invest in assets.

Save at least 10% of your income every single month.

Use it to invest in assets.

5. Invest in yourself

The best investment you can make, is one in yourself.

Follow courses, read books and search a good mentor.

The best investment you can make, is one in yourself.

Follow courses, read books and search a good mentor.

6. The power of consistency

Good things take time.

People overestimate what they can do in a year, and underestimate what they can do in a decade.

Good things take time.

People overestimate what they can do in a year, and underestimate what they can do in a decade.

7. Never use leverage or shorts

Good investing is consistently doing above average without taking too much risk.

Good investing is consistently doing above average without taking too much risk.

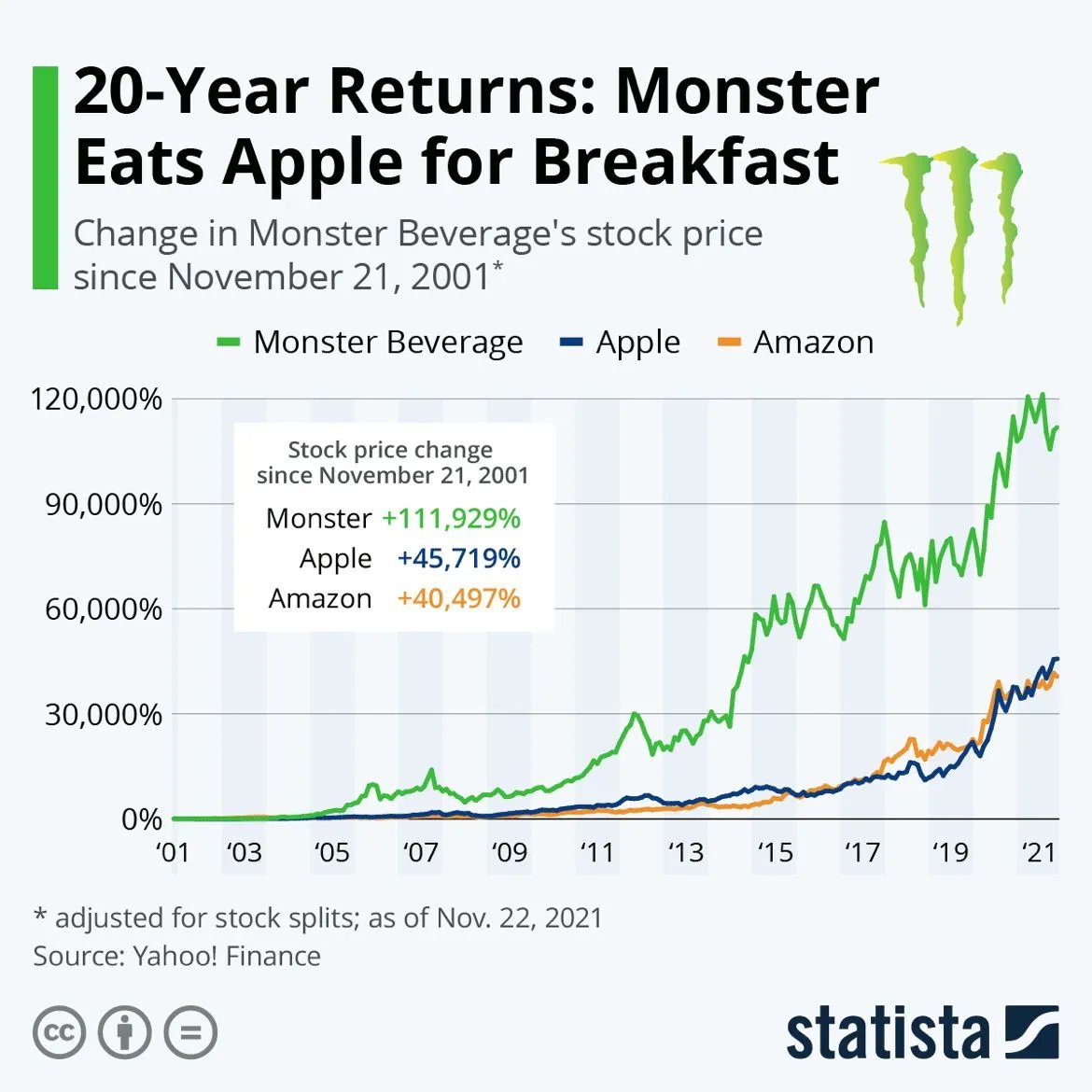

8. Let your winners run

The worst mistake you can make as an investor, is selling your winners too early.

The worst mistake you can make as an investor, is selling your winners too early.

9. Use volatility to your advantage

Volatility offers huge opportunities for rational investors.

In the long run, stocks will evolve to their intrinsic value.

Volatility offers huge opportunities for rational investors.

In the long run, stocks will evolve to their intrinsic value.

10. If it seems to good to be true it often is

Moonshots almost always miss the mark.

Never invest in the next big thing.

Moonshots almost always miss the mark.

Never invest in the next big thing.

11. Prioritize your health

True wealth is being healthy and having time to spend time with your loved ones.

True wealth is being healthy and having time to spend time with your loved ones.

12. Don't forget to live

Be frugal, but not to the point of regretting it later.

Memories and life experiences are important too.

Be frugal, but not to the point of regretting it later.

Memories and life experiences are important too.

14. Buy good companies

Quality companies are the only companies you can hold forever.

Focus on stocks with a sustainable competitive advantage.

Quality companies are the only companies you can hold forever.

Focus on stocks with a sustainable competitive advantage.

15. Set your goals

Determine what you want to achieve financially.

To achieve your goals, you need a clear path.

Determine what you want to achieve financially.

To achieve your goals, you need a clear path.

If you liked this, you'll love our website.

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

qualitycompounding.substack.com/p/how-to-inves…

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

qualitycompounding.substack.com/p/how-to-inves…

• • •

Missing some Tweet in this thread? You can try to

force a refresh