Interested in learning about a new BACKTESTED metric with an edge?

We've produced one at GammaEdge (GE) we know you'll like.

Our traders think it's one of the most powerful & actionable metrics we provide.

Ready to learn how it can make you money?

Let's get to work🧵👇

We've produced one at GammaEdge (GE) we know you'll like.

Our traders think it's one of the most powerful & actionable metrics we provide.

Ready to learn how it can make you money?

Let's get to work🧵👇

1/ Before we get going, here is what you'll be able to answer by the end:

· What is Gamma?

· What is Gamma Exposure (GEX)?

· What is the GammaEdge GEX Ratio (GR)?

· How is the GR different from Put-Call Ratio (PCR)?

· How to make the GR actionable?

Sound good? 👇

· What is Gamma?

· What is Gamma Exposure (GEX)?

· What is the GammaEdge GEX Ratio (GR)?

· How is the GR different from Put-Call Ratio (PCR)?

· How to make the GR actionable?

Sound good? 👇

2/ A common gauge of fear in the market is the Put-Call Ratio (PCR).

However, this gauge is flawed.

Why?

Because it does not have a time component.

However, this gauge is flawed.

Why?

Because it does not have a time component.

3/ If I open a strike with 40,000 put contracts a year from now, PCR changes, and this increase in puts could skew current PCR readings.

In reality, it's a massive trade based in the future.

Not a good interpretation of the "right now".

In reality, it's a massive trade based in the future.

Not a good interpretation of the "right now".

4/ What if we could bring a better time element into this analysis?

What if we could have an adaptation of the PCR that reflected the *current* sentiment of the underlying equity?

Enter the GammaEdge GEX Ratio.

What if we could have an adaptation of the PCR that reflected the *current* sentiment of the underlying equity?

Enter the GammaEdge GEX Ratio.

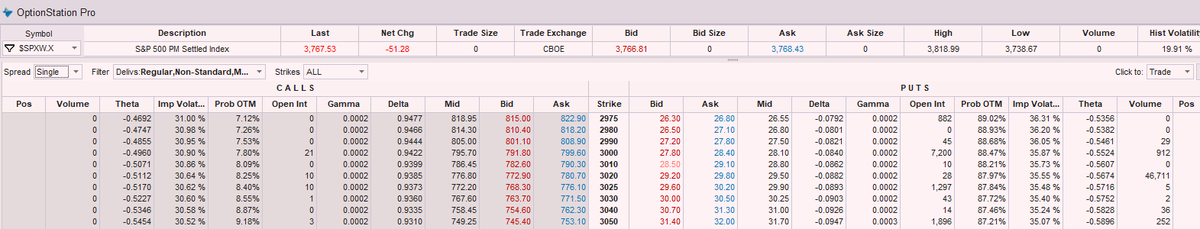

5/ The GEX Ratio looks at the aggregate gamma contained in the calls and puts for an equity.

This gamma is sensitized to price, OI, AND days-to-expiration (DTE).

Because of this, we believe we get a better metric on the "right now" than using a blunt tool like the PCR...

This gamma is sensitized to price, OI, AND days-to-expiration (DTE).

Because of this, we believe we get a better metric on the "right now" than using a blunt tool like the PCR...

6/ Side note:

Remember, gamma is the change in option delta per change in the price of the underlying stock or equity.

Option delta is directly related to our profit/risk to the markets.

You can read more about both here:

Remember, gamma is the change in option delta per change in the price of the underlying stock or equity.

Option delta is directly related to our profit/risk to the markets.

You can read more about both here:

https://twitter.com/GammaEdges/status/1605177328845279234

7/ If we have a large change in gamma, we then have a change in delta, so our profit/risk profile changes.

Dealers are sensitive to changes in delta as price changes, so option strikes containing large, aggregate gamma matter to dealers.

Dealers are sensitive to changes in delta as price changes, so option strikes containing large, aggregate gamma matter to dealers.

8/ Because it is OUR (trader) sentiment that drives buying and selling, we care too.

This is one of many ways to describe GEX or Gamma Exposure.

This is one of many ways to describe GEX or Gamma Exposure.

9/ When we combine:

· spot price close to an ATM strike,

· large open interest (OI) at that ATM strike, and

· shorter time ranges to option contract expiry,

we get large GEX.

· spot price close to an ATM strike,

· large open interest (OI) at that ATM strike, and

· shorter time ranges to option contract expiry,

we get large GEX.

10/ Shifting gears..recall that OI at a strike comprises both put OI and call OI.

As trader sentiment changes, so do the ratio of put OI and call OI.

Traders buy puts if they feel prices are going to go down and buy calls if they feel prices are going to go up.

As trader sentiment changes, so do the ratio of put OI and call OI.

Traders buy puts if they feel prices are going to go down and buy calls if they feel prices are going to go up.

11/ The GEX Ratio looks at the aggregate gamma contained in the calls and puts for an equity.

This gamma is sensitized to price, OI, and days-to-expiration (DTE).

Because of this, we believe we get a better metric on the "right now" than using a blunt tool like the PCR.

This gamma is sensitized to price, OI, and days-to-expiration (DTE).

Because of this, we believe we get a better metric on the "right now" than using a blunt tool like the PCR.

12/ Here's a GR example for the #SPY; the link below is interactive:

charts.gammaedge.us/SPY_90_gex_rat…

charts.gammaedge.us/SPY_90_gex_rat…

13/ The #SPY GR example shows that the current GR is 0.82 and increased this past Friday relative to the interim low established on Thursday (1/19/22).

A GR value less than 1.0 means that shorter-dated, nearer puts are dominant.

The rising GR value indicates that...

A GR value less than 1.0 means that shorter-dated, nearer puts are dominant.

The rising GR value indicates that...

14/ ...shorted-dated, nearer-price puts are being closed and/or shorter-dated, nearer-price long calls are being opened.

If you look closely, you can also see a few instances where GR begins to change a day or two before price.

If you look closely, you can also see a few instances where GR begins to change a day or two before price.

15/ Depending on the GR value, this change in GR may help inform whether your sentiment on the underlying equity should be bullish or bearish.

The #SPY GR example also shows that GR values below 0.6 are often associated with reversals to the upside and GR values above 1.2 ...

The #SPY GR example also shows that GR values below 0.6 are often associated with reversals to the upside and GR values above 1.2 ...

16/ ... often indicate a pending move lower.

In fact, our partnership with @EdgeRater has enabled comprehensive backtesting capabilities to understand the robustness of the GammaEdge GR.

This partnership makes the GR actionable and puts GammaEdge in a different class.

In fact, our partnership with @EdgeRater has enabled comprehensive backtesting capabilities to understand the robustness of the GammaEdge GR.

This partnership makes the GR actionable and puts GammaEdge in a different class.

17/ To make a signal actionable, we need to know if a profit is associated with entering long at a specific GR and exiting at a higher GR.

This chart shows you the results of this test.

To read this chart, "enter" at a column across the top and "exit" at a higher GR row.

This chart shows you the results of this test.

To read this chart, "enter" at a column across the top and "exit" at a higher GR row.

18/ For example, entering when the #SPY GR is between 0.5 and 0.6 and holding until it reaches GR > 1.2 is associated with an average gain of +1.04%

This is calculated with the equity -- not options.

For those who trade options, you most likely see the potential.

This is calculated with the equity -- not options.

For those who trade options, you most likely see the potential.

19/ Looking at the previous chart, you can see various entry/exit levels and their implications.

Clearly, the lower the GR for entry, the higher the potential reward, provided you can withstand the "heat".

What is "heat"?

Intra-trade maximum drawdown (MD).

Clearly, the lower the GR for entry, the higher the potential reward, provided you can withstand the "heat".

What is "heat"?

Intra-trade maximum drawdown (MD).

20/ MD is important because we believe that traders abandon a strategy with a proven edge when they feel heat.

We see they oversize and get emotional with too much intra-trade drawdown in their portfolios.

We can use backtesting to inform possible intra-trade drawdown levels.

We see they oversize and get emotional with too much intra-trade drawdown in their portfolios.

We can use backtesting to inform possible intra-trade drawdown levels.

21/ Here are the results of average intra-trade drawdown levels at various GR entry levels.

We've highlighted the 0.5-0.6 range, and the rows correspond to various exit GR levels.

You can see that the average, worse-case MD50 is -10.6%.

We've highlighted the 0.5-0.6 range, and the rows correspond to various exit GR levels.

You can see that the average, worse-case MD50 is -10.6%.

22/ This suggests that on average, you can expect about -10% heat if you enter when GR is in the 0.5 to 0.6 range.

This makes sense, as we often retest lower levels.

Here's a recent retest example in the #SPY:

This makes sense, as we often retest lower levels.

Here's a recent retest example in the #SPY:

23/ These MD50 results point to having a proper position-sizing process.

You need to be prepared for a retest of lows, so size your positions accordingly.

If I have a $25,000 portfolio and allow 1% equity risk in the position, this is $25K * 1% = $250 allowable risk.

You need to be prepared for a retest of lows, so size your positions accordingly.

If I have a $25,000 portfolio and allow 1% equity risk in the position, this is $25K * 1% = $250 allowable risk.

24/ If I stop this at -11%, the position size could be $250 / 11% = $2,273.

Shares or options: you MUST size accordingly.

We think using options is less risky - review this thread:

We also believe average heat (MD50) is only part of the evaluation.

Shares or options: you MUST size accordingly.

We think using options is less risky - review this thread:

https://twitter.com/GammaEdges/status/1607730528261898240

We also believe average heat (MD50) is only part of the evaluation.

25/ Tail risk, as measured by the 5% tail, is also important.

We and @EdgeRater call this MD95 and here are those results.

It may be wise to use 26% MD95 as the risk allocation (drop from $2,272 to $961 in the previous example).

We and @EdgeRater call this MD95 and here are those results.

It may be wise to use 26% MD95 as the risk allocation (drop from $2,272 to $961 in the previous example).

26/ Given possible gains and possible losses, the question becomes:

"How long does it take to achieve various exit levels given a GR entry level?"

Here are the results for the #SPY.

On average, it is a reasonable expectation that it would take 13 days to achieve a GR > 1.2.

"How long does it take to achieve various exit levels given a GR entry level?"

Here are the results for the #SPY.

On average, it is a reasonable expectation that it would take 13 days to achieve a GR > 1.2.

27/ For options traders, this "Trading Days" information can help select the expiration date of the contract.

Because this is an average, we would be inclined to increase the duration more than indicated.

Four weeks would not be unreasonable as a starting duration.

Because this is an average, we would be inclined to increase the duration more than indicated.

Four weeks would not be unreasonable as a starting duration.

28/ We believe we have made GEX Ratio actionable for you in the context of mechanics and understanding how to build a position, but how does GammaEdge put it together?

The following gives you insight into the outstanding work of one of our members, JB:

The following gives you insight into the outstanding work of one of our members, JB:

29/ We call this the Fish Pond Map, and it gives you a running list of current GRs for highly liquid ETFs and stocks.

Your eye should clearly see areas where we have higher GR (green) and lower GR (red).

Depending on your thesis, you can evaluate opportunities.

Your eye should clearly see areas where we have higher GR (green) and lower GR (red).

Depending on your thesis, you can evaluate opportunities.

30/ It should also be clear, from the Fish Pond Map, of different equities that may be experiencing rotation.

We tend to look for areas of "green" emerging within areas of "red".

The converse works too: look for "red" in areas of "green".

You get the idea.

We tend to look for areas of "green" emerging within areas of "red".

The converse works too: look for "red" in areas of "green".

You get the idea.

31/ The analysis does not stop with the #SPY.

We have written an in-depth comparison using the #QQQ and #IWM index ETFs also.

GR is available on all major stocks and ETFs in the GammaEdge universe and on-demand by our members using a simple command in our Discord.

We have written an in-depth comparison using the #QQQ and #IWM index ETFs also.

GR is available on all major stocks and ETFs in the GammaEdge universe and on-demand by our members using a simple command in our Discord.

32/ You can access these writeups in our discord, and sign up for a free 14-day trial here:

gammaedge.us/pricing/

gammaedge.us/pricing/

33/

TL;DR: How you can make Gex Ratio (GR) Actionable:

Depending on the GR value, this change in GR may help inform whether your sentiment on the underlying equity should be bullish or bearish.

Here are the important values:

TL;DR: How you can make Gex Ratio (GR) Actionable:

Depending on the GR value, this change in GR may help inform whether your sentiment on the underlying equity should be bullish or bearish.

Here are the important values:

34/

✅A GR value less than 1.0 is a short-term, put-dominated environment

✅GR values below 0.6 are often associated with reversals to the upside

✅GR values above 1.2 often indicate a pending move lower

We use these metrics at GammaEdge to build a quantifiable edge.

✅A GR value less than 1.0 is a short-term, put-dominated environment

✅GR values below 0.6 are often associated with reversals to the upside

✅GR values above 1.2 often indicate a pending move lower

We use these metrics at GammaEdge to build a quantifiable edge.

We strive to make gamma actionable, and we hope you've found this thread helpful.

Follow us @GammaEdges for more content on the stock market and trading education.

Like/Retweet the first tweet below if you learned something new:

Follow us @GammaEdges for more content on the stock market and trading education.

Like/Retweet the first tweet below if you learned something new:

https://twitter.com/GammaEdges/status/1617186581215051776

• • •

Missing some Tweet in this thread? You can try to

force a refresh