7 books for automated trading you should read in 2023:

Algorithmic Trading with Python: Quantitative Methods and Strategy Development

Lessons:

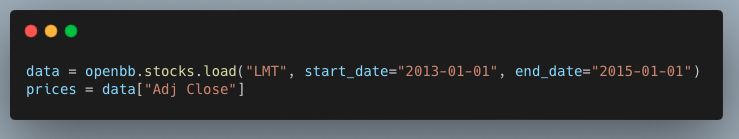

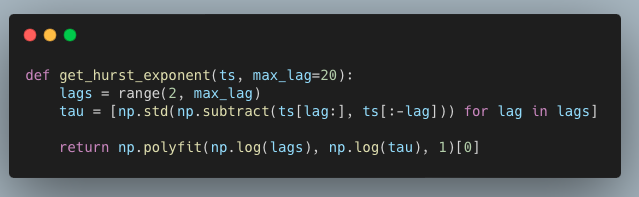

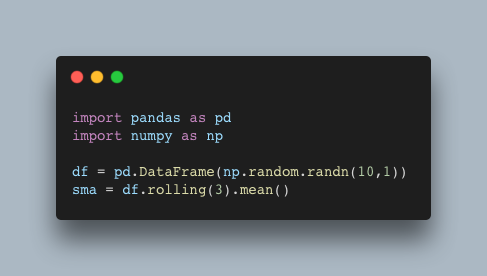

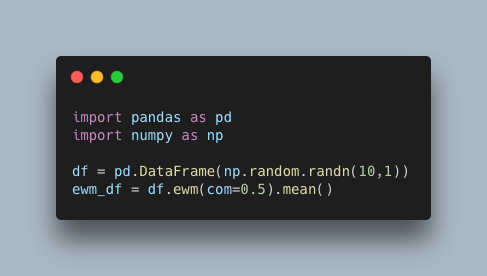

• Modern quant trading methods in Python

• Focus on pandas, numpy, and scikit-learn

Lessons:

• Modern quant trading methods in Python

• Focus on pandas, numpy, and scikit-learn

Algorithmic Trading with Interactive Brokers (Python and C++)

Lessons:

• Developing applications based on TWS

• Implement full-scale trading systems

Lessons:

• Developing applications based on TWS

• Implement full-scale trading systems

Learn Algorithmic Trading: Build and deploy algorithmic trading systems and strategies using Python

Lessons:

• Fundamentals of algorithmic trading

• Apply algorithms to real market data

Lessons:

• Fundamentals of algorithmic trading

• Apply algorithms to real market data

Python for Algorithmic Trading: From Idea to Cloud Deployment

Lessons:

• Ways to apply Python to algorithmic trading

• Interacting with online trading platforms.

Lessons:

• Ways to apply Python to algorithmic trading

• Interacting with online trading platforms.

Machine Learning for Algorithmic Trading

Lessons:

• Leverage ML to design automated trading strategies

• Use pandas, TA-Lib, scikit-learn, TensorFlow, and Backtrader

Lessons:

• Leverage ML to design automated trading strategies

• Use pandas, TA-Lib, scikit-learn, TensorFlow, and Backtrader

Hands-On Financial Trading with Python: A practical guide to using Zipline and other Python libraries for backtesting trading strategies

Lessons:

• Build and backtest your algorithmic trading strategies

• How to gain a true advantage in the market

Lessons:

• Build and backtest your algorithmic trading strategies

• How to gain a true advantage in the market

Python for Finance and Algorithmic Trading: Machine Learning, Deep Learning, Time Series Analysis, Risk and Portfolio Management, Quantitative Trading

Lessons:

• Connect Python algorithms to MetaTrader 5

• Run the strategies with a demo or live trading account

Lessons:

• Connect Python algorithms to MetaTrader 5

• Run the strategies with a demo or live trading account

Reading is foundational to growth and learning.

You can read all these books before July by reading 20 minutes a day.

Make it a priority.

You can read all these books before July by reading 20 minutes a day.

Make it a priority.

To keep this list of books handy:

1. Click the link below to hop to the top tweet

2. Retweet it so it stays on your timeline

I post Python code and tools for quant finance at 8:15 am EST and 8:15 pm EST every day.

1. Click the link below to hop to the top tweet

2. Retweet it so it stays on your timeline

I post Python code and tools for quant finance at 8:15 am EST and 8:15 pm EST every day.

https://twitter.com/3187132960/status/1617693977188208640

The FREE 7-day masterclass that will get you up and running with Python for quant finance.

Here's what you get:

• Working code to trade with Python

• Frameworks to get you started TODAY

• Trading strategy formation framework

7 days. Big results.

pythonforquantfinancemasterclass.com

Here's what you get:

• Working code to trade with Python

• Frameworks to get you started TODAY

• Trading strategy formation framework

7 days. Big results.

pythonforquantfinancemasterclass.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh