As you know there are many borrowers who put NFTs as collateral on the DApp, offering them in case they don't payback the loan+interest

User can borrow ADA or iUSD and even create bundles of NFTs to ask for liquidity 2/n

User can borrow ADA or iUSD and even create bundles of NFTs to ask for liquidity 2/n

The platform provide data about holders, volume and floor price in this way lenders can check if it's a valuable collateral but always DYOR

You can even see how many loans the borrower has paid back, isn't it crazy? it's monitoring the history of the borrowers

3/n

You can even see how many loans the borrower has paid back, isn't it crazy? it's monitoring the history of the borrowers

3/n

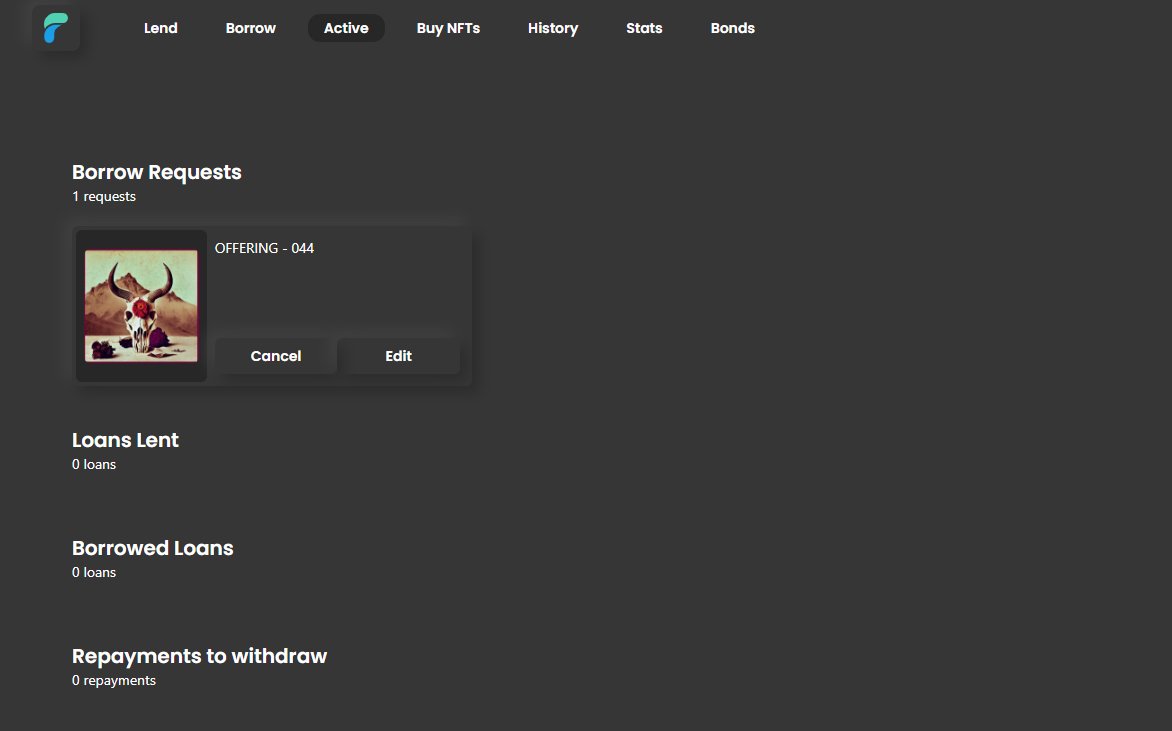

If you are a borrower you can even edit the loan without cancel and submit saving ADA fees

How dare they to innovate in this way?

4/n

How dare they to innovate in this way?

4/n

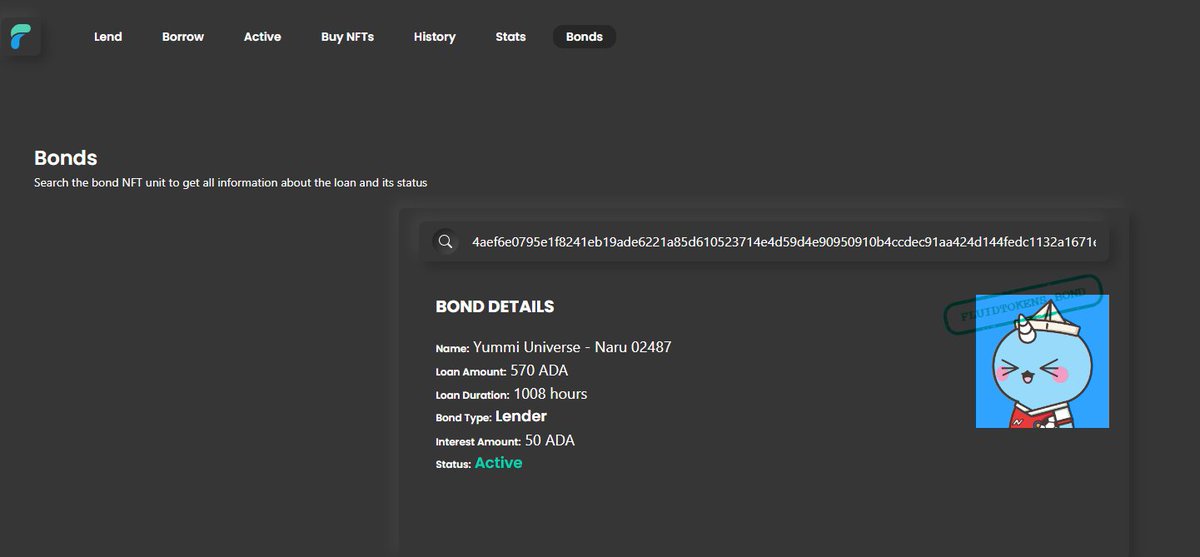

When you become borrower or lender you get an NFT that is a bond, this bond represents the position on the platform and can be sold to liquidate your position

As you know right now there 3 types of bonds on Cardano, optim, Aada and fluid

Have you already got one?

5/n

As you know right now there 3 types of bonds on Cardano, optim, Aada and fluid

Have you already got one?

5/n

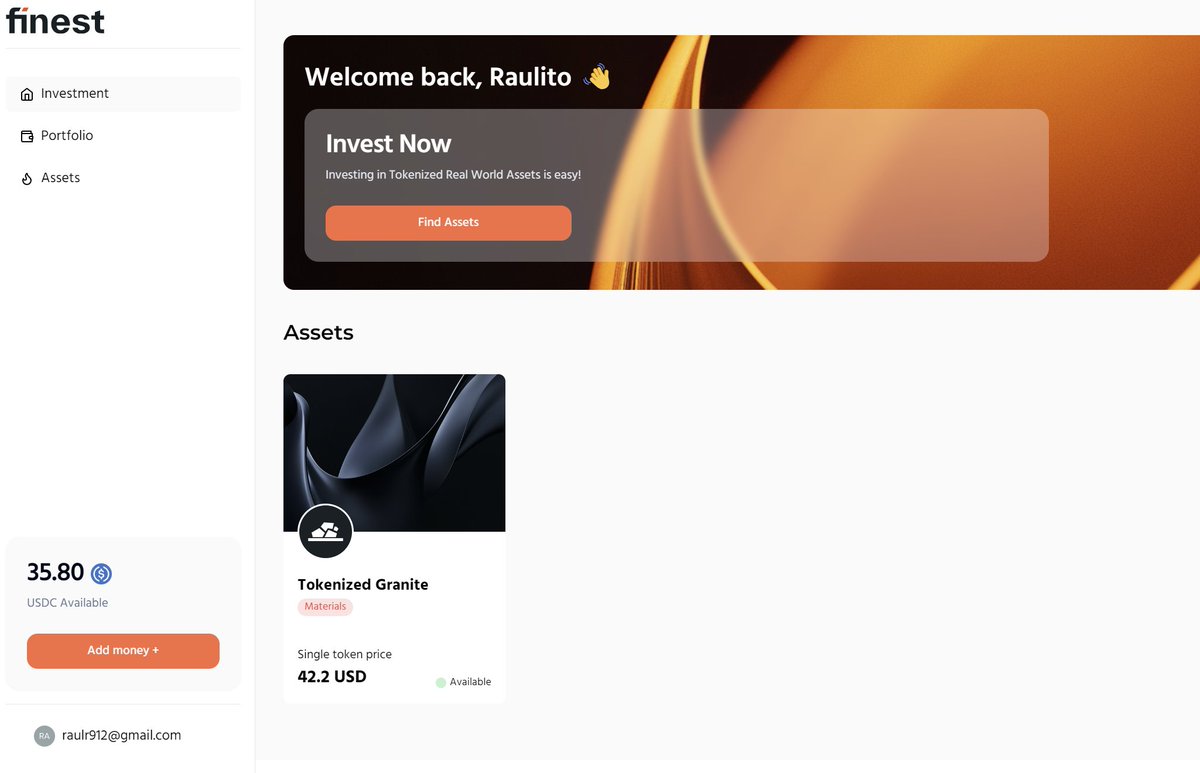

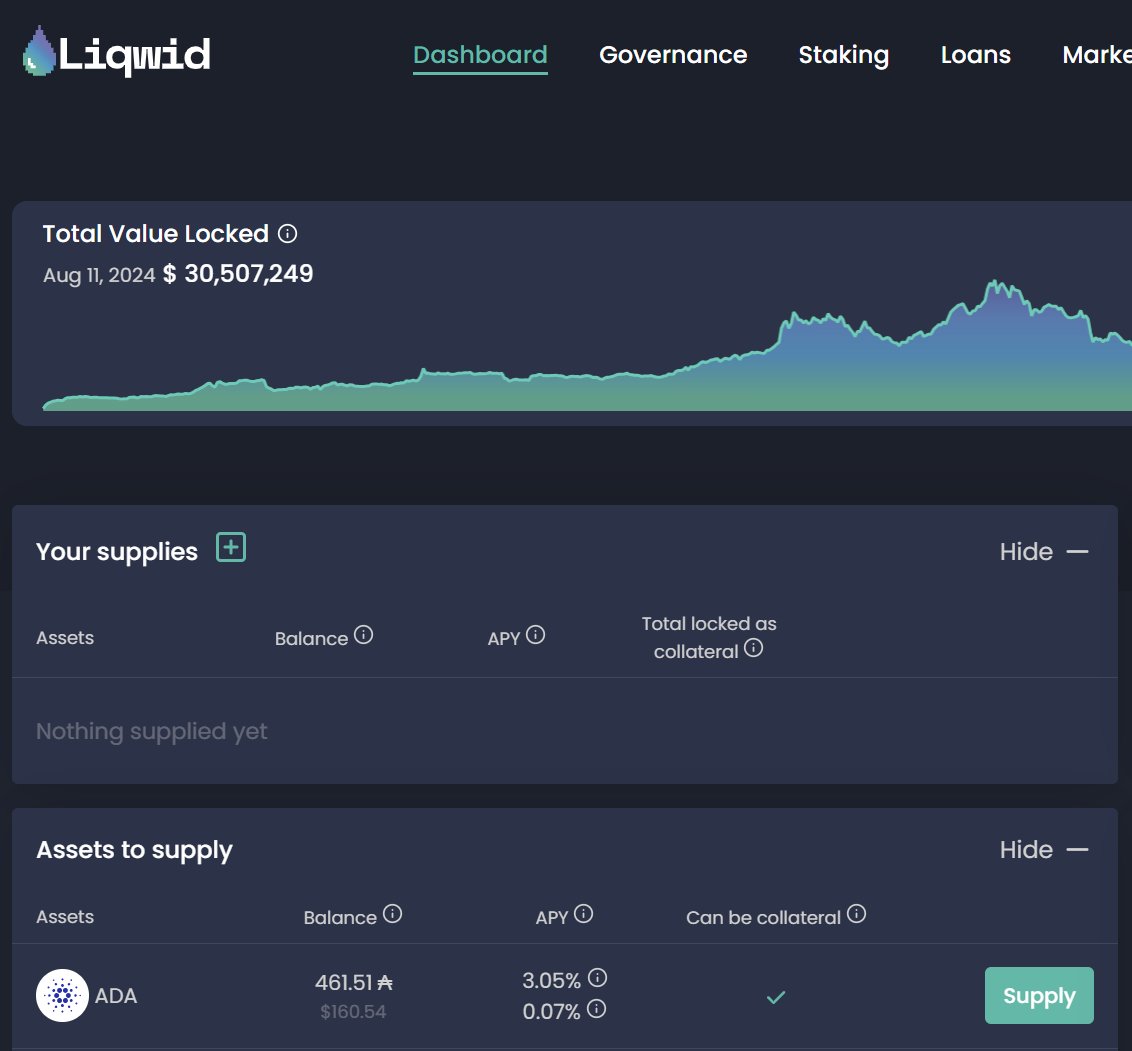

User can even use Tokens for the projects as collaterals and decide the one they would like to use without selling

Basically unlocking liquidity from their NFTs without selling

Are they trying to steal the market to the marketplaces?

6/n

Basically unlocking liquidity from their NFTs without selling

Are they trying to steal the market to the marketplaces?

6/n

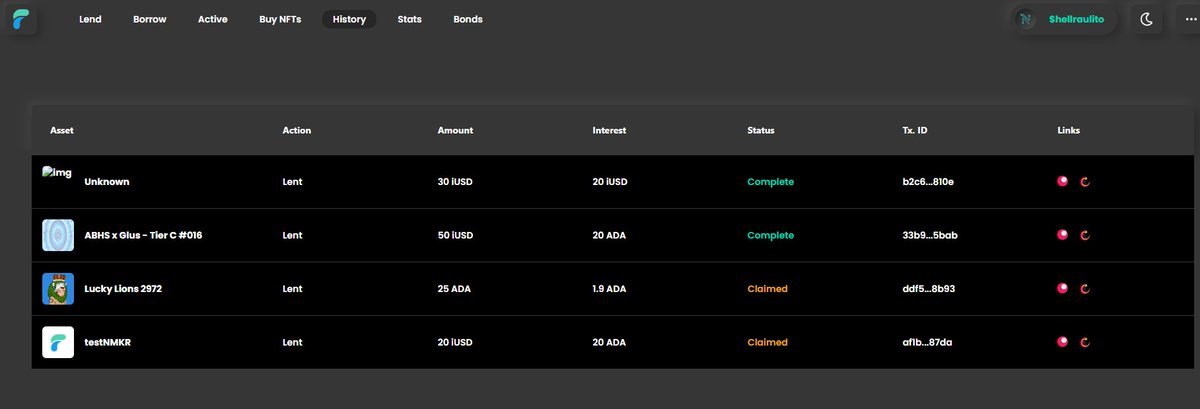

you have even the history of your profile so you can see the profits/loss that you made

are they spying on us?

7/n

are they spying on us?

7/n

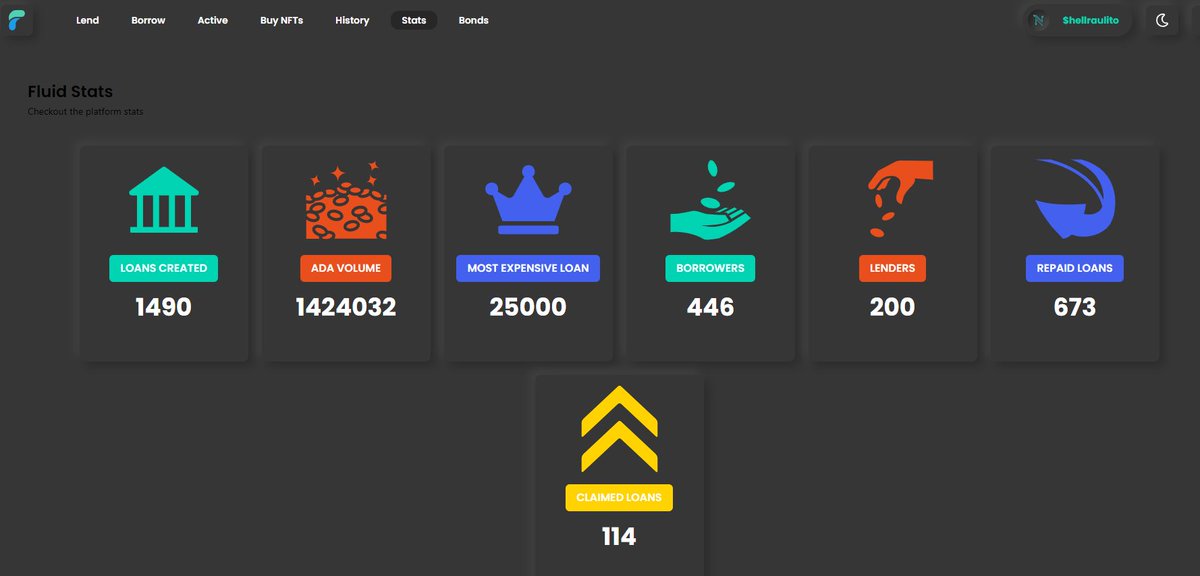

They also provide all the data and stats about their platform, do they want to look better than us because they know some math?

Well as you probably understood I am bullish on @FluidTokens

It was an idea and now it's alive :)

n/n

Well as you probably understood I am bullish on @FluidTokens

It was an idea and now it's alive :)

n/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh