This is a long 🧵TL/DR: it replaces my usual projection format for Q4 (which is summarized in the next tweet). However, it does contains my personal analysis as to why $TSLA is better poised today than any other time in its history. (Not investment advice!)

I am anticipating Tesla Q4 earnings of $1.17 for Q4, vs consensus of $1.13. At current SP of around $140, that is a surprisingly low TTM 35. (Q4 2021 was 148!) Even more stark, the Fwd. 12 Month P/E ratio has collapsed from around 90 in early 2021 to around 26 now.

I believe long-term $TSLA holders shouldn’t be perturbed by this decline. There are reasons to believe that this is a period of great opportunity for Tesla, and that the company will emerge greatly strengthened with its promise of market dominance fulfilled.

One key cause of the share price collapse is the 2022 Fed increase in Fed Funds rate from a nominal .25% to 4.25, to offset 13 years of near zero Fed Funds rate (with a brief excursion to 2% for less than a year prior to the pandemic).

Investors forgot (or were too new to have learned) that the foundation of SP value is the discount rate of future profits; promising growth stocks were valued at extremely low discount rates that would not, could not be maintained

Over time, rates tend to level to historic norms; but market prices trend to rates that are current (it’s a market!). Thus, Buffet’s famous “…be fearful when others are greedy, and…greedy…when others are fearful” (or…when rates are high – Sell! When rates are high – Buy!)

In addition to the exogenous – and controlling – impact of interest rates, there are two forces weighing on the $TSLA: (1) turmoil and politics around Elon Musk’s twitter deal. (2) Disappointing results: 22/Q4 deliveries, and the huge discounts both in China and the US in 23/Q1.

The noise surrounding Twitter will soon resolve. I wrote a thread earlier projecting a path to a healthy economic future; there may be bumps occasionally, but I believe Twitter is likely to prove a financial success.

https://twitter.com/TeslaLarry/status/1597679040806424577

On the larger issue, of the price cuts and demand, what we are seeing is a dramatic moment in the Tesla story. Anyone familiar with the auto industry will tell you that this is a very cyclical industry, booming in the good times, and skirting (or meeting) disaster in the bad.

Auto companies flirt with or enter bankruptcy in recessions. Elon frequently points out that of all the US auto Co’s, only Ford and Tesla have not had to go through bankruptcy: about 3,000 auto companies have come and gone in the US alone bit.ly/3QZMKKO

There are reasons auto Co’s are vulnerable in a recession:

1.Low operating margins: This example (Ford) shows the characteristic pattern of single-digit margins in “normal” times (2021 included Rivian IPO, so it is a one-time event), but losses in each recent recession.

1.Low operating margins: This example (Ford) shows the characteristic pattern of single-digit margins in “normal” times (2021 included Rivian IPO, so it is a one-time event), but losses in each recent recession.

2.High fixed costs: auto manufacturers have very high tooling costs, large investments in plant and Machinery, and long lead cycles for each new product; consequently, they are very vulnerable when volumes, and consequently operating margin, decline.

3.Deep involvement in auto financing: most large automakers have captive finance companies. These firms have historically performed very poorly in periods of rising interest rates, sometimes with disastrous results.

Elon has been preparing for a significant downturn for some time. Following earlier warnings of an impending recession, in May 2022, he began to slim down the ranks at both Tesla and SpaceX. bit.ly/3R30F2E

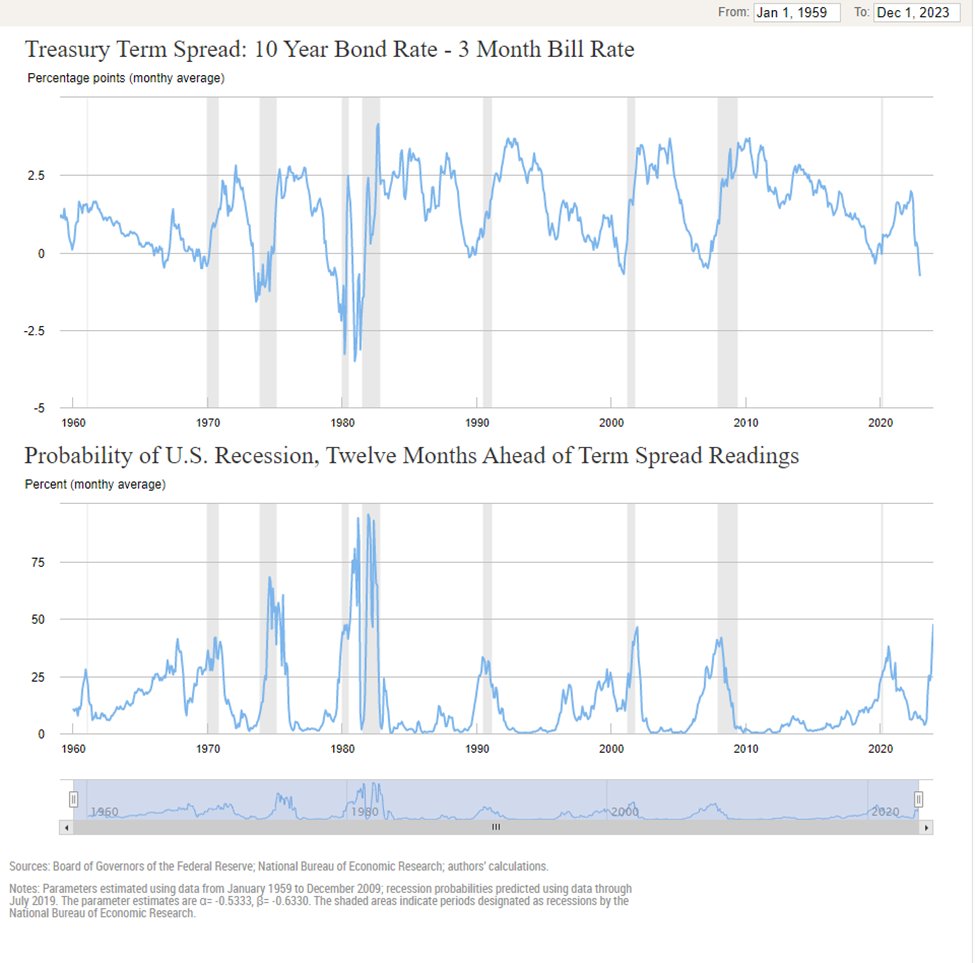

Elon was very early in his projection, but there is now wide acceptance of the rising probability. The most popular harbinger of recession is the so-called Treasury Term Spread – when the 10-year bond rate perversely exceeds that of the 3 month T-bill. Here is the Fed’s take:

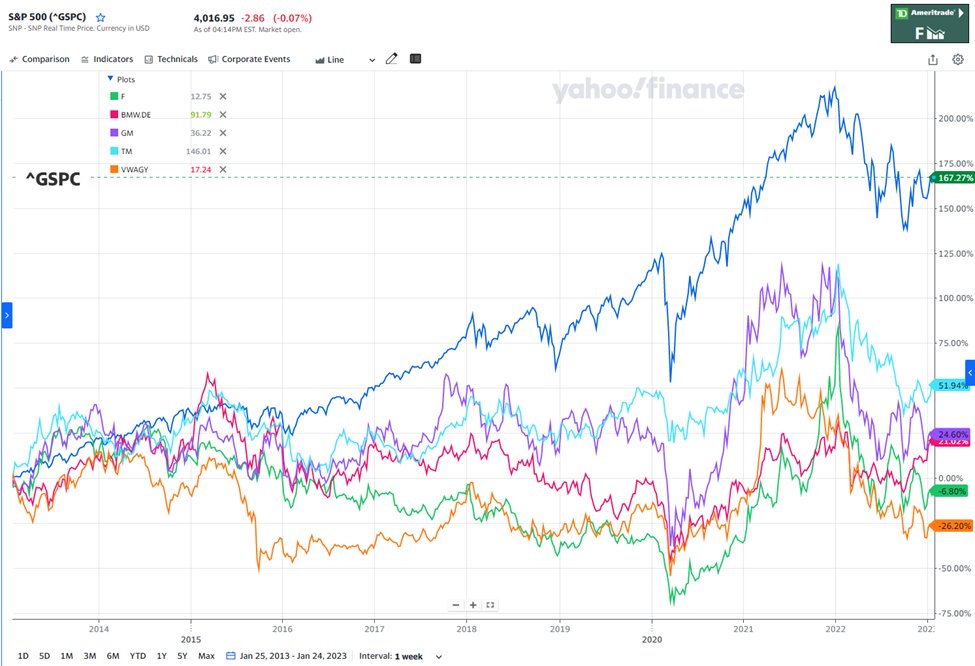

Consequently, Auto Co. stocks are falling. They have, since the 2022 January pandemic peak, all returned to the approximately flat line of the past 10 years. Here is a comparison of an auto portfolio – Ford, GM, BMW, VW, and Toyota – to the S+P.

Returning to the point: how will Tesla fare in the downturn? Tesla has never been stronger. An ambitious product roadmap; a debt free, cash rich balance sheet, and ultra-low operating costs; THIS is how you want to be positioned entering a recession!

1.Given their extraordinary margin, Tesla could discount prices by double digits and still exceed those of its strongest competitors (driving the weaker players into serious, potentially fatal losses)

2.Tesla ccan continue to aggressively expand manufacturing and distribution facilities by flexing their fortress balance sheet (thanks Elon for resisting the buyback pleadings!)

3.Roll out the exciting new products on the roadmap such as Semi, Cybertruck, the Compact car, and a range of Tesla Energy products, expanding the TAM of the company by many $100s of billions, perhaps trillions

4.Continue to tackle and expand the agenda of the future, for which investors have an absolutely zero cost call option, including on: FSD, In-car software subscriptions, Dojo, Optimus, and further emergent technologies from the incredible innovation machine that Tesla has built

It is not in Tesla’s DNA to destroy the competition: the mission is to accelerate the advent of sustainable transport, and Tesla cannot achieve alone. But the scale is reaching an inflection point, and competitors will have to jump on this ride or be left...perhaps to die.

The current stock price is a victim of not just the current macro environment, but the failure of the market to grasp the gross and scope of the revolution. So once again, Tesla stock is a generational opportunity.

It isn’t about “building an electric car”; it’s about re-inventing the machine, the machine that builds that machine, the machine/AI interface, and the business model that sustains it all. When the market begins to fully understand and value that…well, I will be a hodler!

CORRECTION!!! when rates are high – BUY! When rates are low – SELL!

• • •

Missing some Tweet in this thread? You can try to

force a refresh