So @GMX_IO is all the rage at the moment

But what is it, what are its tokenomics and how do they work?

A 🧵 by @giorgionchain

1/10

But what is it, what are its tokenomics and how do they work?

A 🧵 by @giorgionchain

1/10

GMX is a decentralized spot and perpetual exchange enabling low fees and zero price impact trades.

Perpetual contract traders can use up to 30X leverage.

$GMX acts as a governance token, but that's not the whole story...

Here is how it works:

2/10

Perpetual contract traders can use up to 30X leverage.

$GMX acts as a governance token, but that's not the whole story...

Here is how it works:

2/10

The trading experience resembles the features of CEXs, but it’s done through a non-custodial wallet, with lower fees and faster trade settlement times.

GMX uses @chainlink oracles to aggregate prices from other exchanges with no single point of failure nor price impact.

3/10

GMX uses @chainlink oracles to aggregate prices from other exchanges with no single point of failure nor price impact.

3/10

Derivative AMM supports spot and perpetual trading with a minimum slippage and low swap fees.

GMX trading engine has a flashloan resistance function & front-running attack mitigiation.

Strenghts:

- Low costs

- Minimal liquidation risk

- Capital efficency

- Simple swap

4/10

GMX trading engine has a flashloan resistance function & front-running attack mitigiation.

Strenghts:

- Low costs

- Minimal liquidation risk

- Capital efficency

- Simple swap

4/10

/Earnings

- $GMX (gov token): stake & earn 30% of protocol fees, $esGMX and Multiplier Points to boost yield

- $esGMX (utility token): stake & earn to compound $GMX staking yield. $esGMX can be vested, and get converted to $GMX after 1y, without accruing staking rewards.

5/10

- $GMX (gov token): stake & earn 30% of protocol fees, $esGMX and Multiplier Points to boost yield

- $esGMX (utility token): stake & earn to compound $GMX staking yield. $esGMX can be vested, and get converted to $GMX after 1y, without accruing staking rewards.

5/10

/LPs

GMX relies on LPs who deposit crypto assets. Doing so, they mint $GLP.

The GLP pool is a counterparty to traders: if they make profits, then LPs make a loss, and viceversa.

$GLP is automatically staked, earn 70% of protocol fees and additional $esGMX.

6/10

GMX relies on LPs who deposit crypto assets. Doing so, they mint $GLP.

The GLP pool is a counterparty to traders: if they make profits, then LPs make a loss, and viceversa.

$GLP is automatically staked, earn 70% of protocol fees and additional $esGMX.

6/10

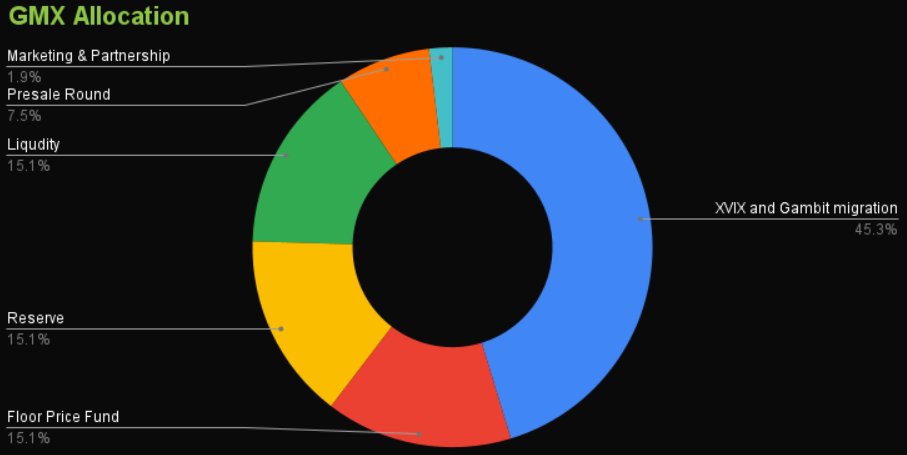

/Distribution

- Forecasted max supply = 13.25M (no hard cap encoded)

- Circulating supply = 8.4M (82% of it is currently staked)

- Estimated annual inflation rate = 19%

At TGE almost half-supply was given to $GMT and $XVIX holders who migrated their tokens to GMX.

7/10

- Forecasted max supply = 13.25M (no hard cap encoded)

- Circulating supply = 8.4M (82% of it is currently staked)

- Estimated annual inflation rate = 19%

At TGE almost half-supply was given to $GMT and $XVIX holders who migrated their tokens to GMX.

7/10

/$GMX demand drivers

- Governance (adjust fees, supported assets, and more)

- Staking rewards (part of them as real cash flow in $ETH/$AVAX)

- Scarcity (a lot of tokens are staked)

- Protocol growth (i.e. speculation)

8/10

- Governance (adjust fees, supported assets, and more)

- Staking rewards (part of them as real cash flow in $ETH/$AVAX)

- Scarcity (a lot of tokens are staked)

- Protocol growth (i.e. speculation)

8/10

/Strong points

- GMX is the leading DeFi futures platform whose market size exceeds the spot's

- Staking mechanism enables users to compound yield

- Large portion of supply is staked, leading to shortage

- $GLP system implies a non-inflationary tokenomics model

9/10

- GMX is the leading DeFi futures platform whose market size exceeds the spot's

- Staking mechanism enables users to compound yield

- Large portion of supply is staked, leading to shortage

- $GLP system implies a non-inflationary tokenomics model

9/10

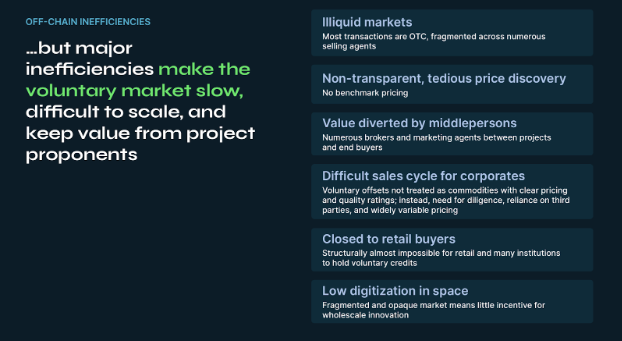

/Weak points

- Anonymous team

- The DAO is far from decentralised

- If traders profit » LPs profit, GLP pool could get drained and suffer low liquidity. The protocol should allow more yield to be attractive for LPs. Often, more yield means more token inflation at the end

10/10

- Anonymous team

- The DAO is far from decentralised

- If traders profit » LPs profit, GLP pool could get drained and suffer low liquidity. The protocol should allow more yield to be attractive for LPs. Often, more yield means more token inflation at the end

10/10

You can read the full detailed breakdown here:

https://twitter.com/tokenomicsdao/status/1618218548785979392

Love tokenomics analysis like these? Head over to own discord: discord.gg/2nv88A3S7q

• • •

Missing some Tweet in this thread? You can try to

force a refresh