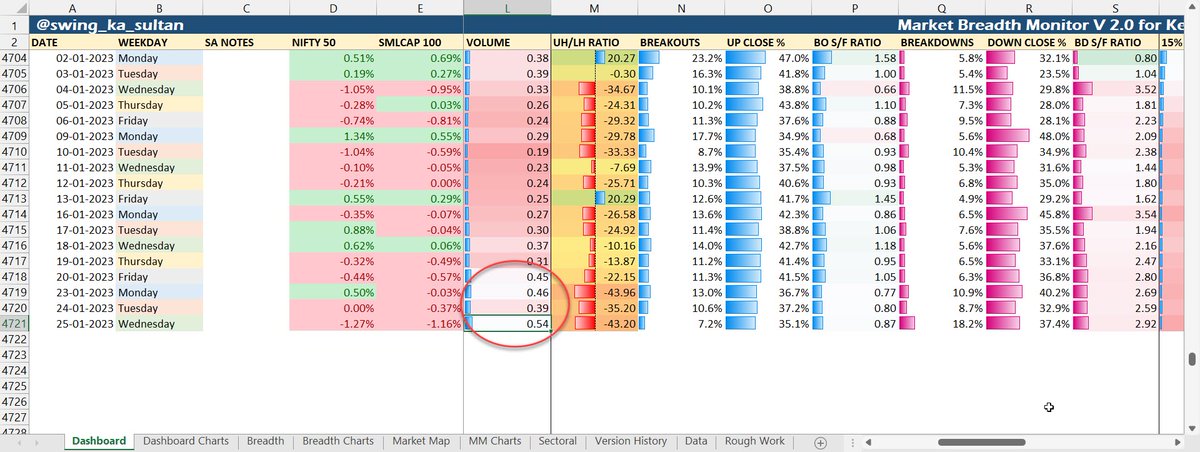

An example of why I believe volume indicator of #MBMV2_0 is the most important indicator for understanding market participants behavior -

From last 3 days before 25th Jan, I was seeing an unusual pick up in volume which might not be very substantial in itself (1/n) #MBMV2_0

From last 3 days before 25th Jan, I was seeing an unusual pick up in volume which might not be very substantial in itself (1/n) #MBMV2_0

but was unusual - because the context wasn't supporting it. We usually see a pick-up in volume only when confidence in the market picks up, when stocks start moving up.

But this time the market was actually negative and had shown a pick-up in volume, that too before (2/n)

But this time the market was actually negative and had shown a pick-up in volume, that too before (2/n)

budget, showing a silent distribution from informed sellers. I expressed my concern to a close friend too.

All I want to show here is - I spent 3 months in fixing my data and creating this market breadth sheet because I didn't want to produce one another half-baked sheet (3/n)

All I want to show here is - I spent 3 months in fixing my data and creating this market breadth sheet because I didn't want to produce one another half-baked sheet (3/n)

which don't have enough backing on data etc. But this entire effort became worth because of this volume indicator - which is currently the most important indicator for me to understand market behavior. Close observation on day-to-day basis will give you a solid grip on it. (4/4)

• • •

Missing some Tweet in this thread? You can try to

force a refresh