Founder @tradetm_org | Trader | Philosopher | "I stand at the end of no tradition. I may, perhaps, stand at the beginning of one" - Ayn Rand

21 subscribers

How to get URL link on X (Twitter) App

Brad Koteshwar - The Perfect Speculator

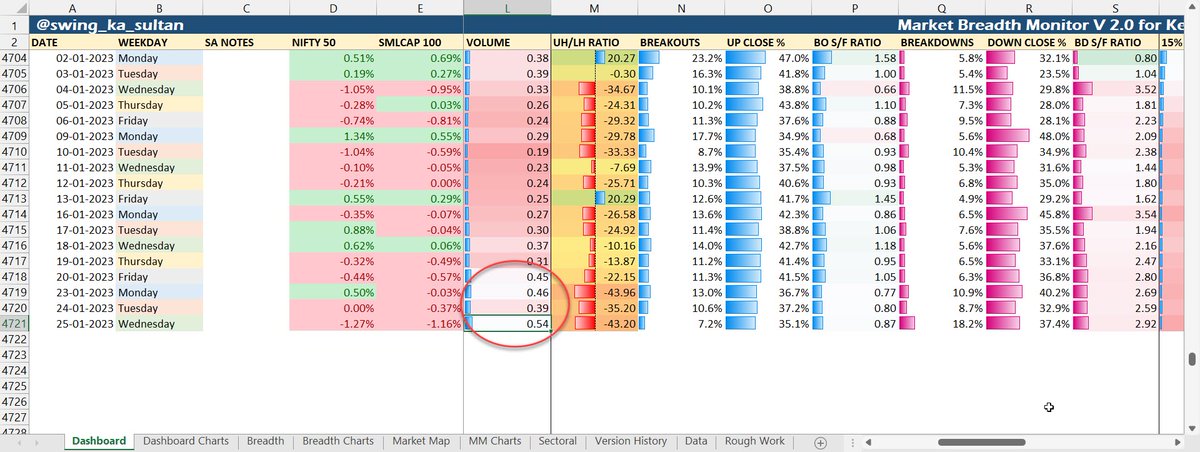

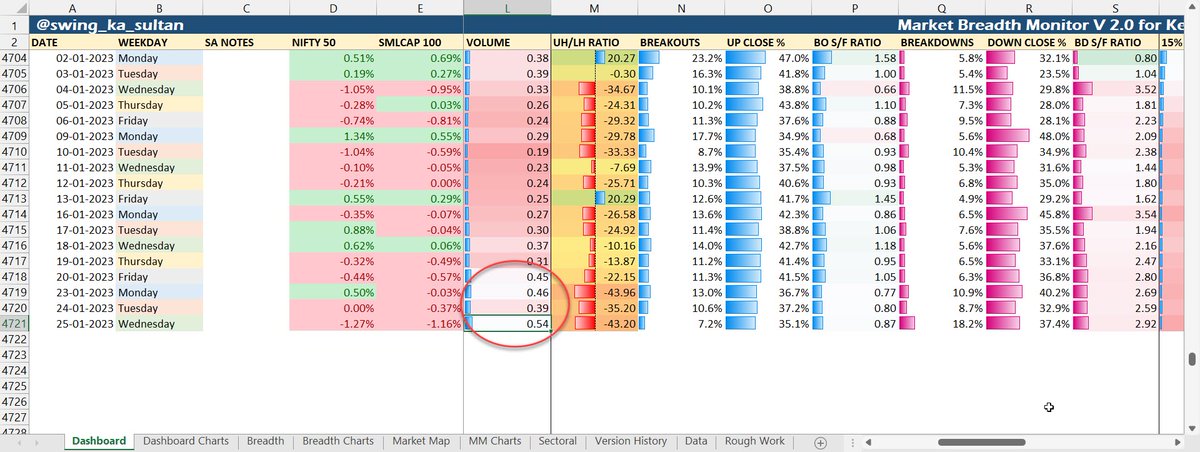

Brad Koteshwar - The Perfect Speculatorhttps://twitter.com/swing_ka_sultan/status/1542788992621494272up on the market confirmed my bias - told me that we are no where near the bottom. We still aren't anywhere close to the bottom. We still lack the pessimism we saw in 2019 July-Aug correction.

but was unusual - because the context wasn't supporting it. We usually see a pick-up in volume only when confidence in the market picks up, when stocks start moving up.

but was unusual - because the context wasn't supporting it. We usually see a pick-up in volume only when confidence in the market picks up, when stocks start moving up. https://twitter.com/NeilBahal/status/1595983913322942466But #IPOBase in not only about buying the high of the listing week. It is infact an extremely poor interpretation of the work.

https://twitter.com/say2alok/status/1597992354668912643entering this stock was 3 days out of which on 18th Nov. gave a strong recovery and closed strongly. Next two days saw a volatility contraction in form of inside bars.

https://twitter.com/mynameisnani75/status/1594417002458001408action is your belief, your conviction which is the cause behind creating demand. Now think, where this conviction comes from?

https://twitter.com/swing_ka_sultan/status/1593426903045922817corner. Don't be in hurry to label any green day a start of a bull swing. Whenever market will stretch in shorter term time frame, it will give a green day or a strong opening, only to be sold off later. Beware of bull traps.

https://twitter.com/mynameisnani75/status/1594022880786120704something happening over another thing.

https://twitter.com/Finstor85/status/1593922985123090435work.

https://twitter.com/DharmenderPers1/status/1593498111833702400price movement, it means no share came into public to be absorbed.

https://twitter.com/nishantpatel9/status/1572310309578346497flat base kind of setup from larger bases like CNH and W Bottom, VCP as pattern etc.