Visa Market Share - 52.6%

Amex Market Share - 19.6%

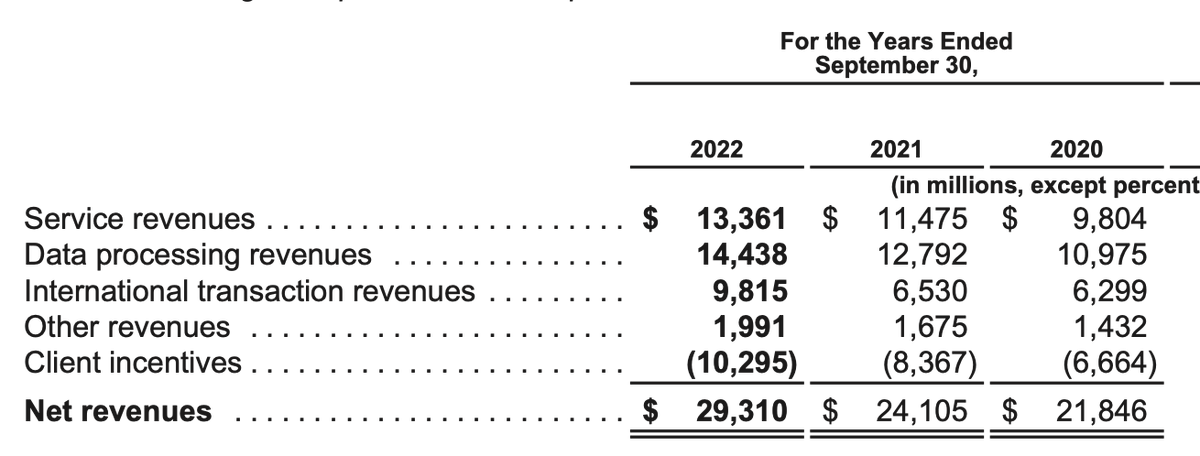

Visa Revenue 2022 - $29.3 B

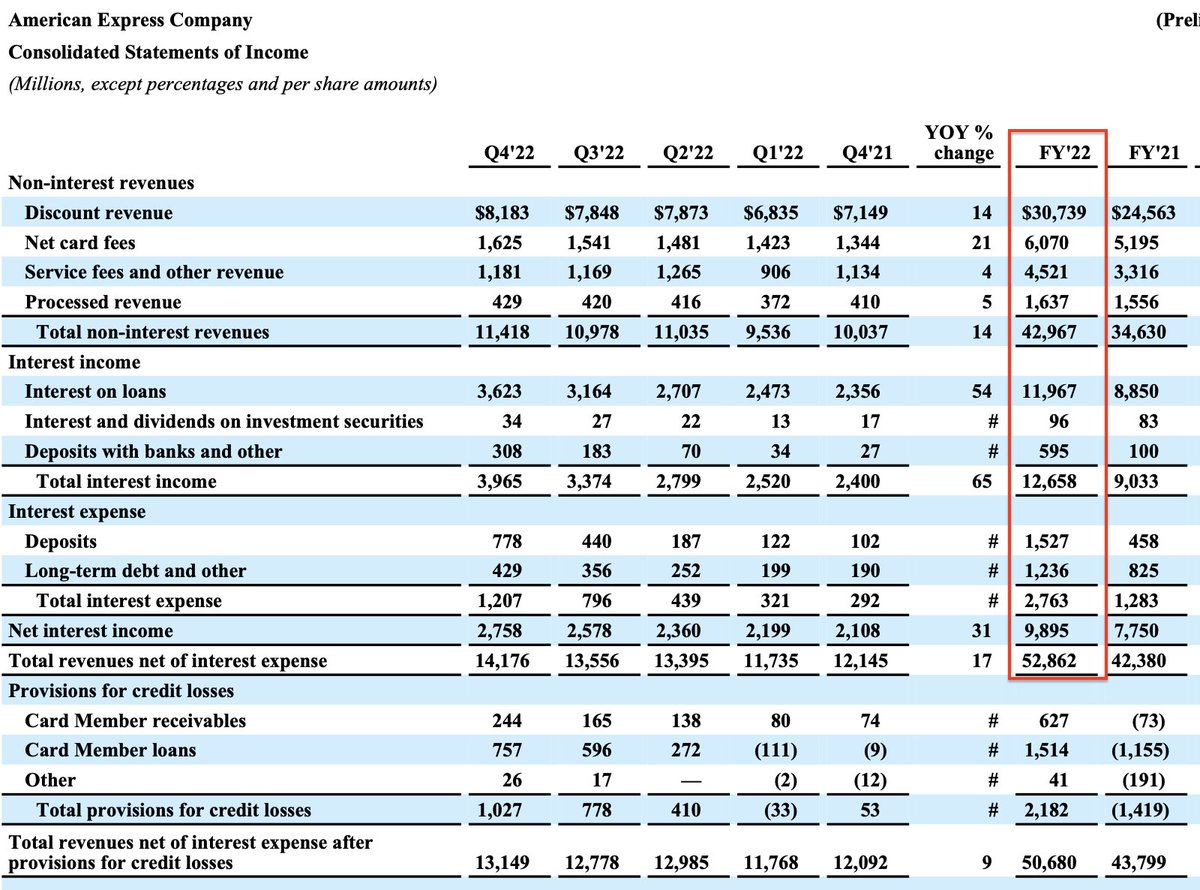

Amex Revenue 2022 - $50.6 B

What is the secret of American Express?

Amex Market Share - 19.6%

Visa Revenue 2022 - $29.3 B

Amex Revenue 2022 - $50.6 B

What is the secret of American Express?

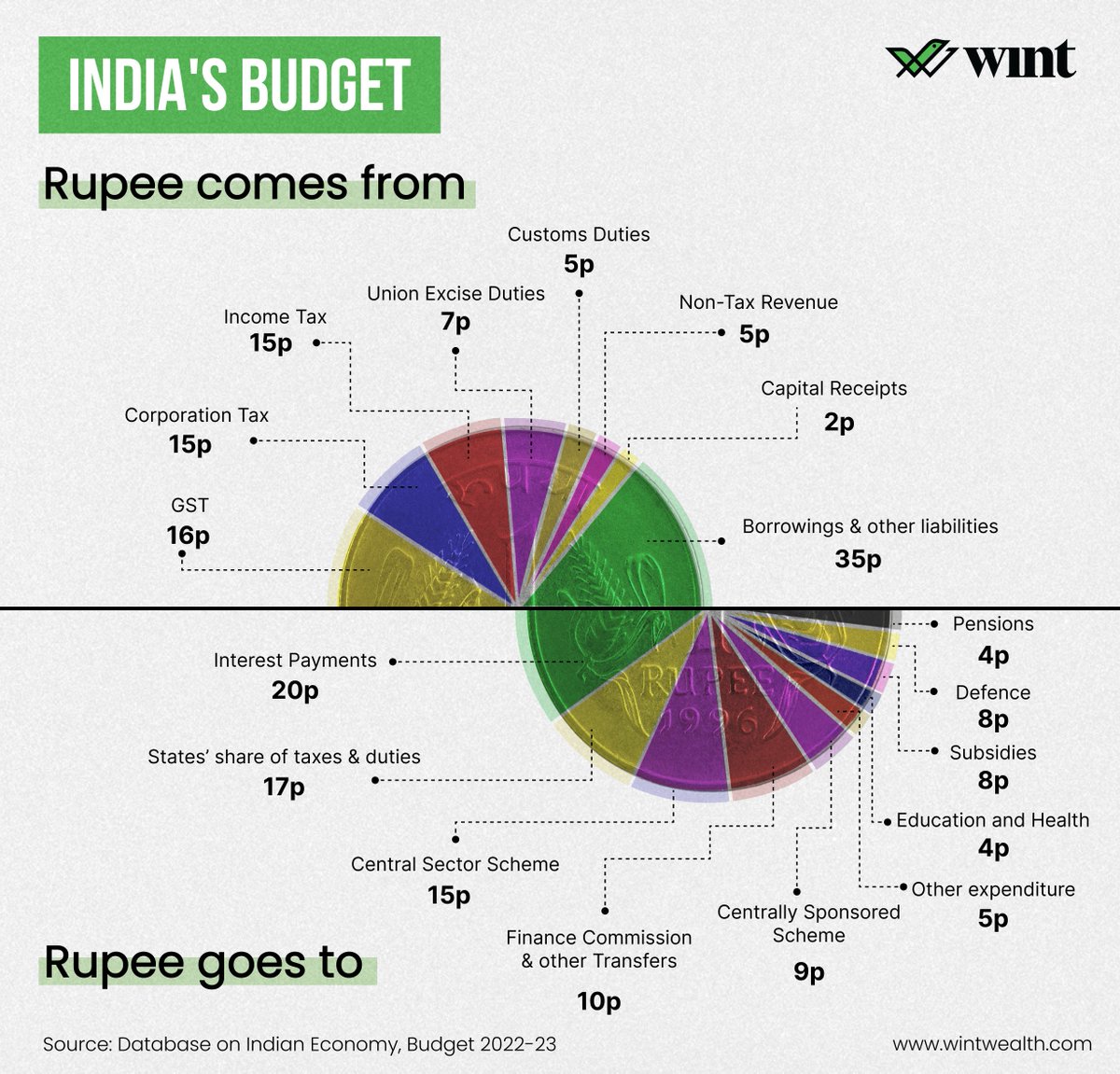

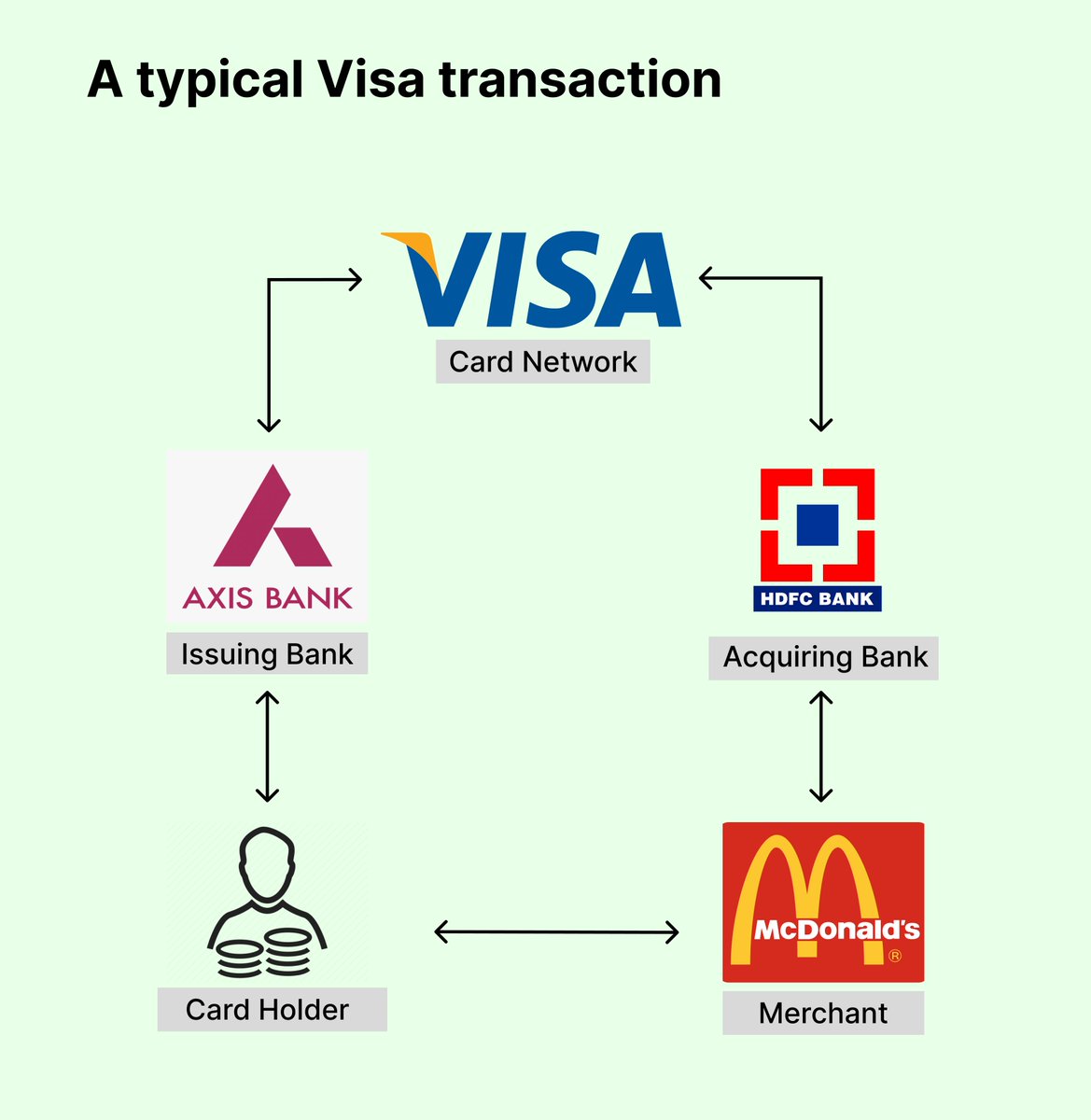

Visa/Mastercard are card networks. Their main role is information sharing. When you swipe your card at a POS Machine, how does your credit card issuer know which merchant to transfer the money to?

Your card doesn’t individually maintain a record of all merchants who can accept credit cards.

Instead it ties up with a card network e.g. Visa/MasterCard. Any merchant that has Visa as a network service provider can accept payments from a Visa card.

Instead it ties up with a card network e.g. Visa/MasterCard. Any merchant that has Visa as a network service provider can accept payments from a Visa card.

When the merchant’s bank (acquiring bank) is registered on the card network, the network is completed. Card networks save banks the hassle of onboarding each merchant and maintaining the infrastructure.

Let us see how a typical credit card transaction works.

There are 3 steps - Authorization, authentication and settlement.

There are 3 steps - Authorization, authentication and settlement.

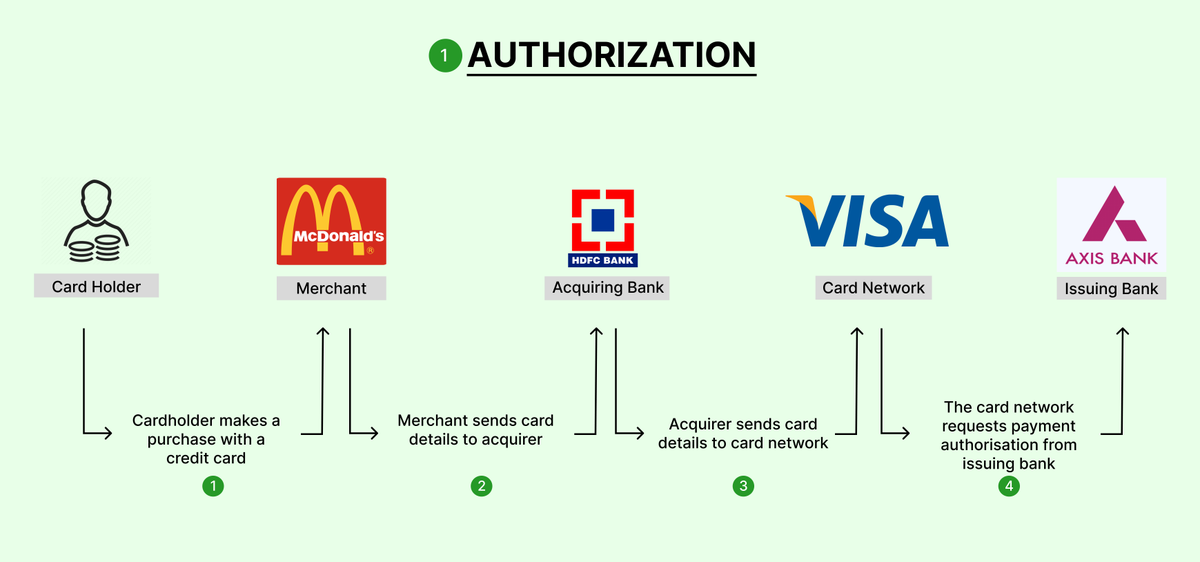

Authorization

1) Cardholder uses their credit card to pay a merchant

2) Merchant shares card details with acquiring bank

3) Acquiring bank forwards these details to the card network

4) Network sends a request to the issuing bank to authorise the payment.

1) Cardholder uses their credit card to pay a merchant

2) Merchant shares card details with acquiring bank

3) Acquiring bank forwards these details to the card network

4) Network sends a request to the issuing bank to authorise the payment.

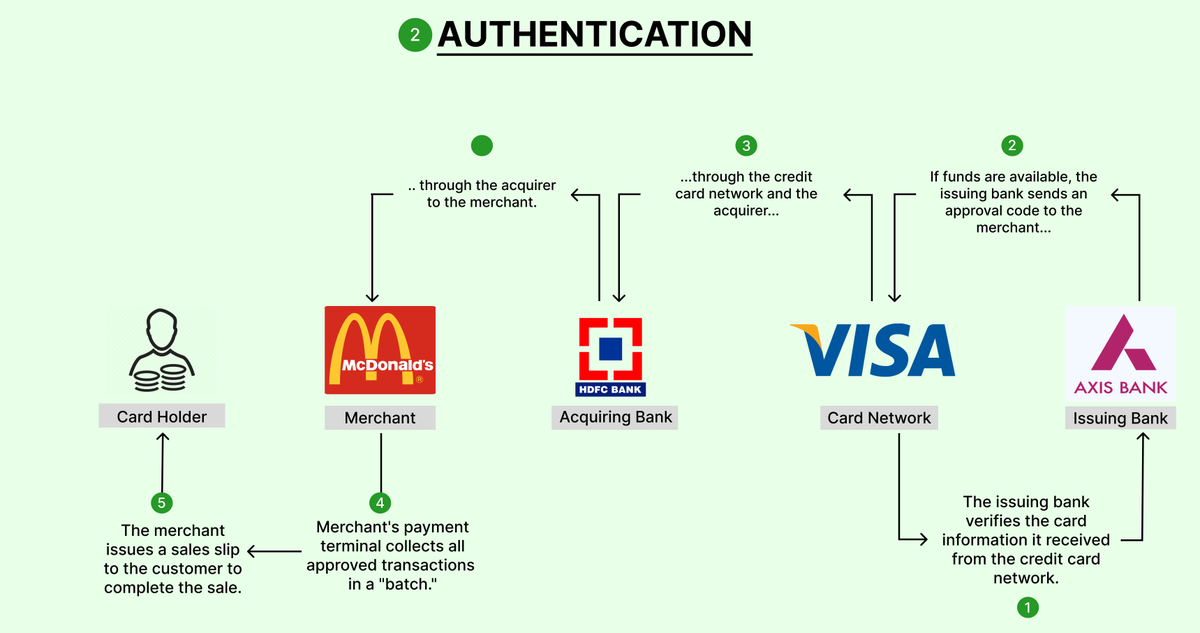

Authentication

5) Issuer validates the details, available limit, and if everything matches, it approves the transaction

6) Network sends the confirmation to the acquirer who in turn sends confirmation to the merchant

7) Customer gets a receipt to confirm the payment

5) Issuer validates the details, available limit, and if everything matches, it approves the transaction

6) Network sends the confirmation to the acquirer who in turn sends confirmation to the merchant

7) Customer gets a receipt to confirm the payment

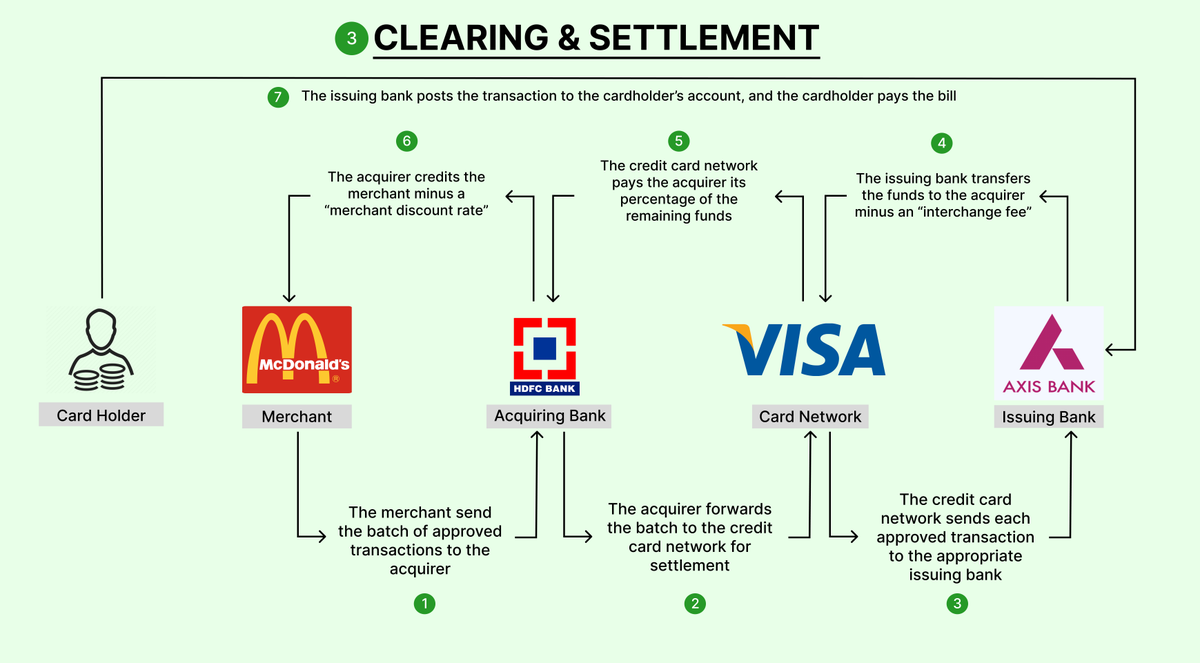

Settlement

8) At the end of the day, merchant sends all transactions details to the acquiring bank

9) Acquiring bank asks network to settle the transactions

10) Network sends payment request to the issuing bank

8) At the end of the day, merchant sends all transactions details to the acquiring bank

9) Acquiring bank asks network to settle the transactions

10) Network sends payment request to the issuing bank

11) Issuing bank transfer funds minus interchange fee

12) Card network takes a cut and transfers funds to acquiring bank

13) Acquiring bank transfers funds to merchant - merchant discount rate (MDR).

12) Card network takes a cut and transfers funds to acquiring bank

13) Acquiring bank transfers funds to merchant - merchant discount rate (MDR).

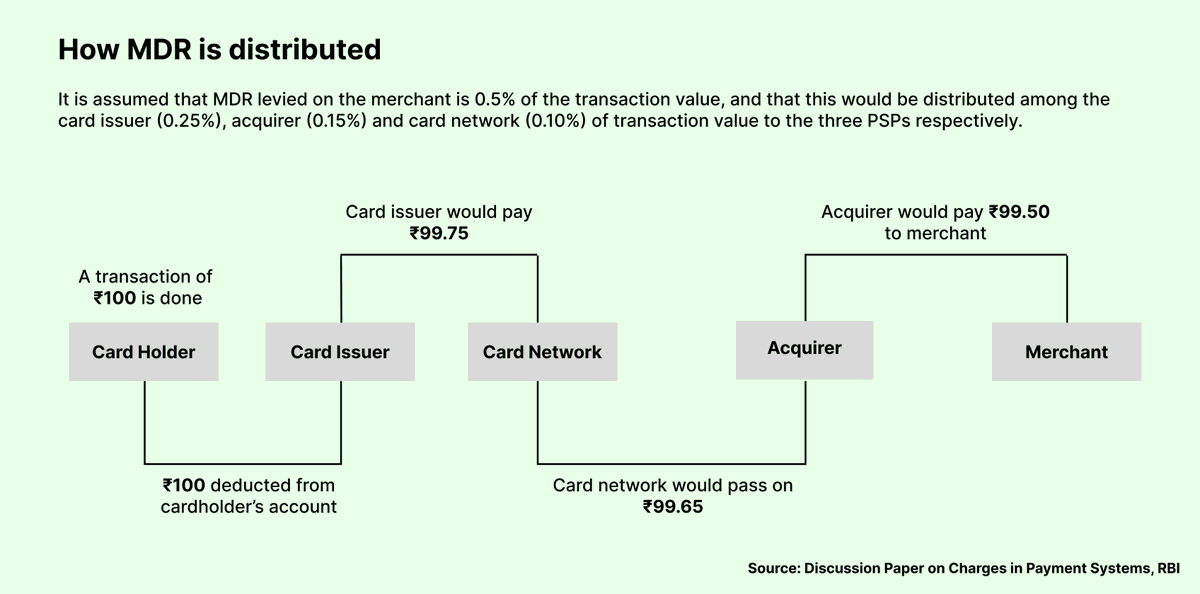

Merchants pay this MDR to receive credit card payments which increases sales and they don’t have to give credit to customers. Bulk of this MDR would go to the issuer since they are providing the free credit and taking the risk of customer default.

The acquiring bank for its own services and Visa will also charge a small fee for maintaining this network.

Visa is like a toll collector where it charges a fee for transferring funds, similar to how we pay toll for using roads which is used for maintaining the roads.

Visa is like a toll collector where it charges a fee for transferring funds, similar to how we pay toll for using roads which is used for maintaining the roads.

How is Amex different?

As we saw, the biggest cut goes to the issuer and that is Amex’s secret. American Express issues its own cards to customers. It acts as an issuing bank as well as the card network.

As we saw, the biggest cut goes to the issuer and that is Amex’s secret. American Express issues its own cards to customers. It acts as an issuing bank as well as the card network.

This is known as a closed loop system - where Amex controls each and every part of the transaction. It issues the cards, maintains the network, onboards each and every merchant individually and collects payments from cardholders.

This slows down the growth and volumes are lower but it gives Amex more control and a bigger role in the transaction.

Visa/Mastercard work on an open loop system - they don’t issue their own cards.

Visa/Mastercard work on an open loop system - they don’t issue their own cards.

Any financial institution which is partnered with Visa can accept payment from Visa cards. You may have noticed that Amex cards are not accepted everywhere and almost all merchants accept Visa cards. This open loop system is one of the main reasons.

How does this affect American Express revenues? It earns from

- discount fees from merchants

- interest income

- annual card fees

- other fees (default penalties/forex/rewards)

- discount fees from merchants

- interest income

- annual card fees

- other fees (default penalties/forex/rewards)

Discount revenue from merchants and interest income is the main differentiator. Visa and Mastercard can’t earn interest income since they are just networks and not issuers.

Have a look at Visa’s revenue sources.

Have a look at Visa’s revenue sources.

While Amex earns from interest income, its real cash cow is merchant revenue (60%).

How does it earn so much from merchants?

Amex’s whole main strategy revolves around getting customers to spend on its cards.

How does it earn so much from merchants?

Amex’s whole main strategy revolves around getting customers to spend on its cards.

Amex earns substantial revenues from annual fees and high-spending cardholders. Amex invests these revenues in incentive programs and offers for customers. This leads to higher revenues for merchants and higher transactions.

Compared to other card networks, it charges a higher MDR but merchants are fine with it since they get access to a very premium customer base.

Amex prioritises merchants and builds many partnerships. One of its main partnerships is its co-branded card with Delta Airlines. Delta co-branded cards account for 9% of its global volumes and 21% of its loan portfolio.

Amex’s closed loop system, also has its advantages like growing slowly compared to other card networks but it ends up with more control over its merchants and bigger take rate on each transaction.

This is a great strategy that has been working out for Amex. Do you think it will work out in the future?

My previous thread on how credit card companies make money.

My previous thread on how credit card companies make money.

https://twitter.com/anshgupta64/status/1530778411257724928

• • •

Missing some Tweet in this thread? You can try to

force a refresh