Co-founder & Chief Investment Officer @WintWealth || @iitroorkee alum

15 subscribers

How to get URL link on X (Twitter) App

Malls have 4 sources of income-

Malls have 4 sources of income-

Firstly let's see how does Paytm earn?

Firstly let's see how does Paytm earn?

Tourism in India is rising rapidly.

Tourism in India is rising rapidly.

The fraud cases keep on rising with fraudsters coming up with new ways everyday.

The fraud cases keep on rising with fraudsters coming up with new ways everyday.

Indian Railways depend heavily on transportation of goods for their revenue.

Indian Railways depend heavily on transportation of goods for their revenue.

Earlier, your service provider (eg- Airtel) would not know which companies are allowed to send you a message.

Earlier, your service provider (eg- Airtel) would not know which companies are allowed to send you a message.

As part of the bond structure the Andhra Pradesh Capital Authority needs to maintain a minimum balance of :

As part of the bond structure the Andhra Pradesh Capital Authority needs to maintain a minimum balance of :

Earlier you could send money direct to a bank account my adding account number, bank name and IFSC through IMPS.

Earlier you could send money direct to a bank account my adding account number, bank name and IFSC through IMPS.

Airport revenues are divided into 2 parts:

Airport revenues are divided into 2 parts:

To stop SIM frauds, government has also come up with-

To stop SIM frauds, government has also come up with-

The death of an investor can be reported by :

The death of an investor can be reported by :

Indian Gold is held with the Bank of England and the Bank of International Settlements (BIS).

Indian Gold is held with the Bank of England and the Bank of International Settlements (BIS).

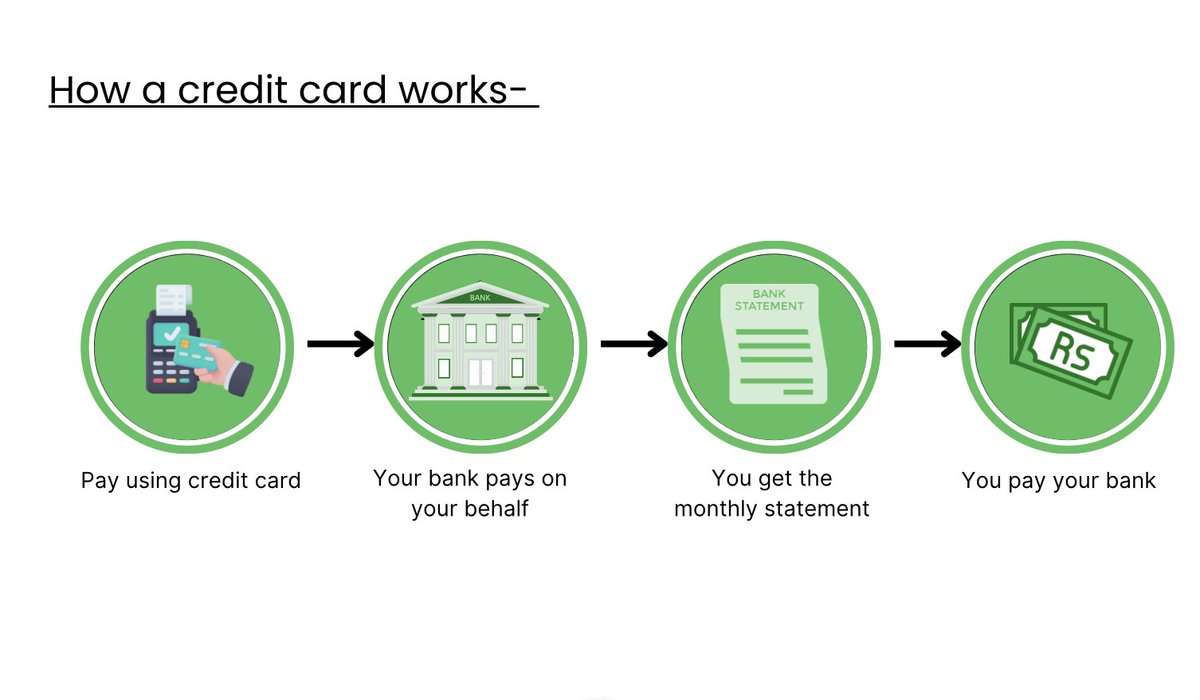

First, let's see how a typical credit card works:

First, let's see how a typical credit card works:

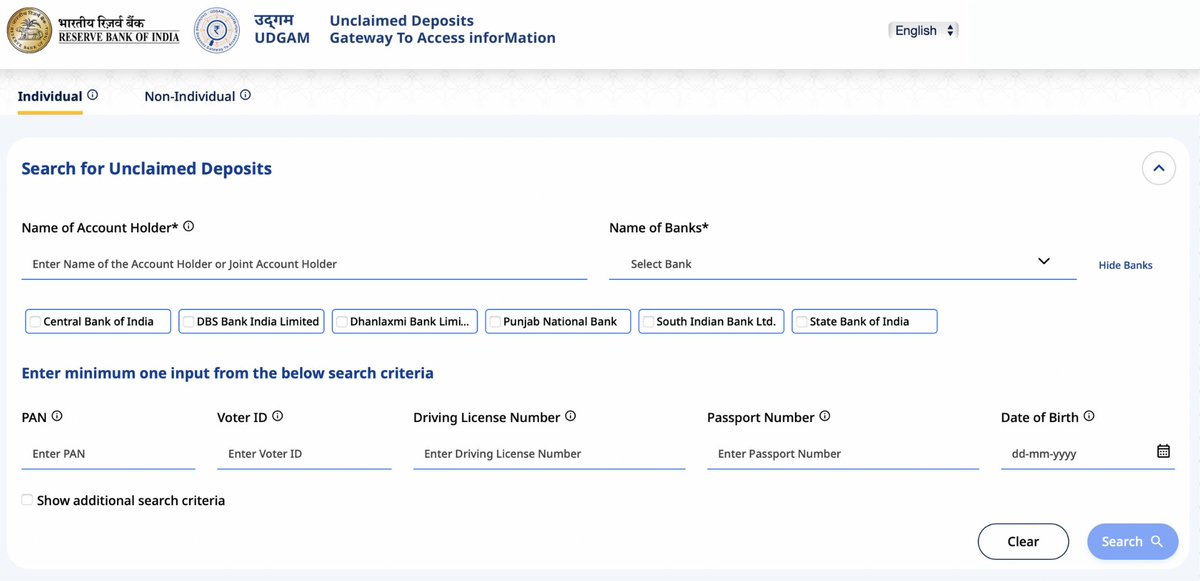

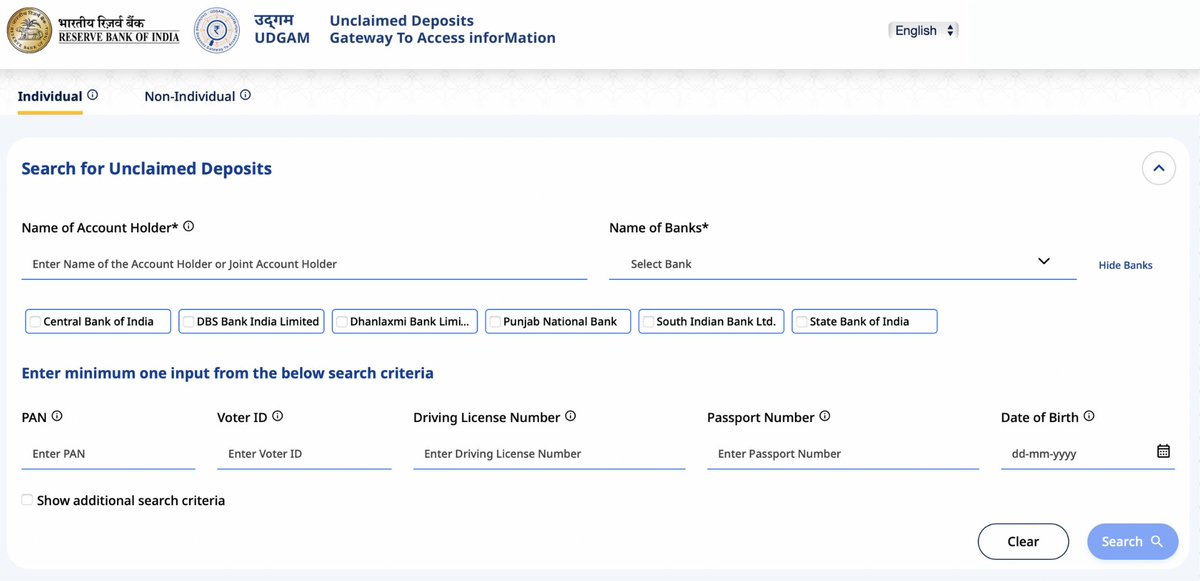

Many savings/current accounts in India are inactive.

Many savings/current accounts in India are inactive.

If you follow Indian debt markets, you will know how illiquid they are.

If you follow Indian debt markets, you will know how illiquid they are.