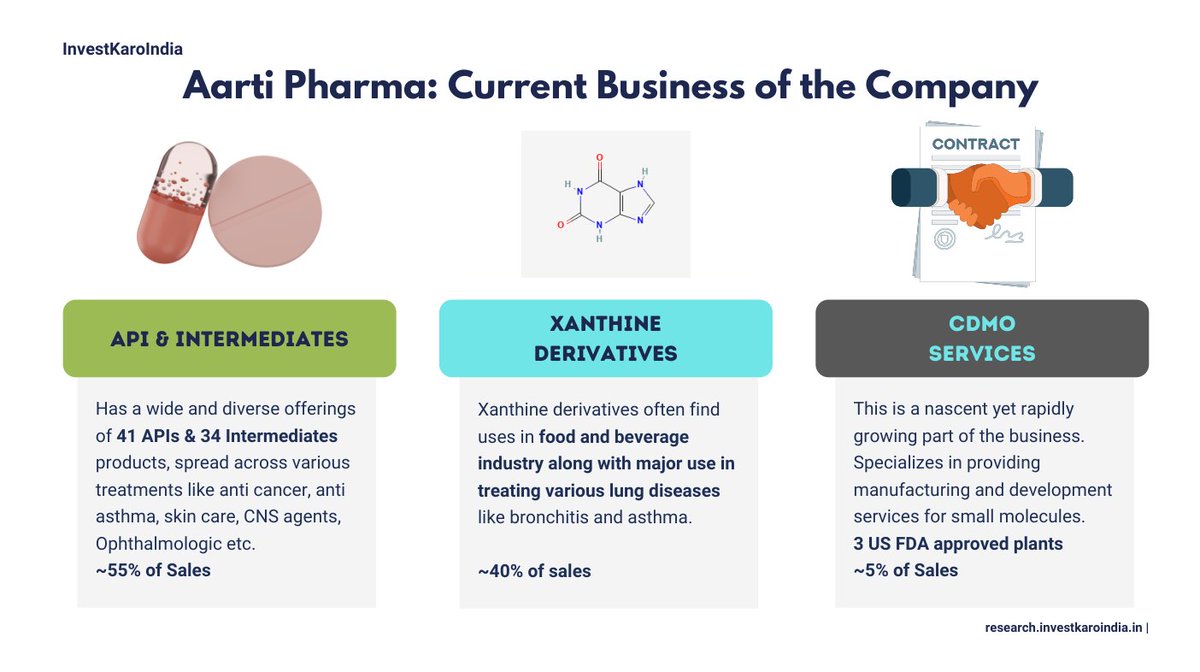

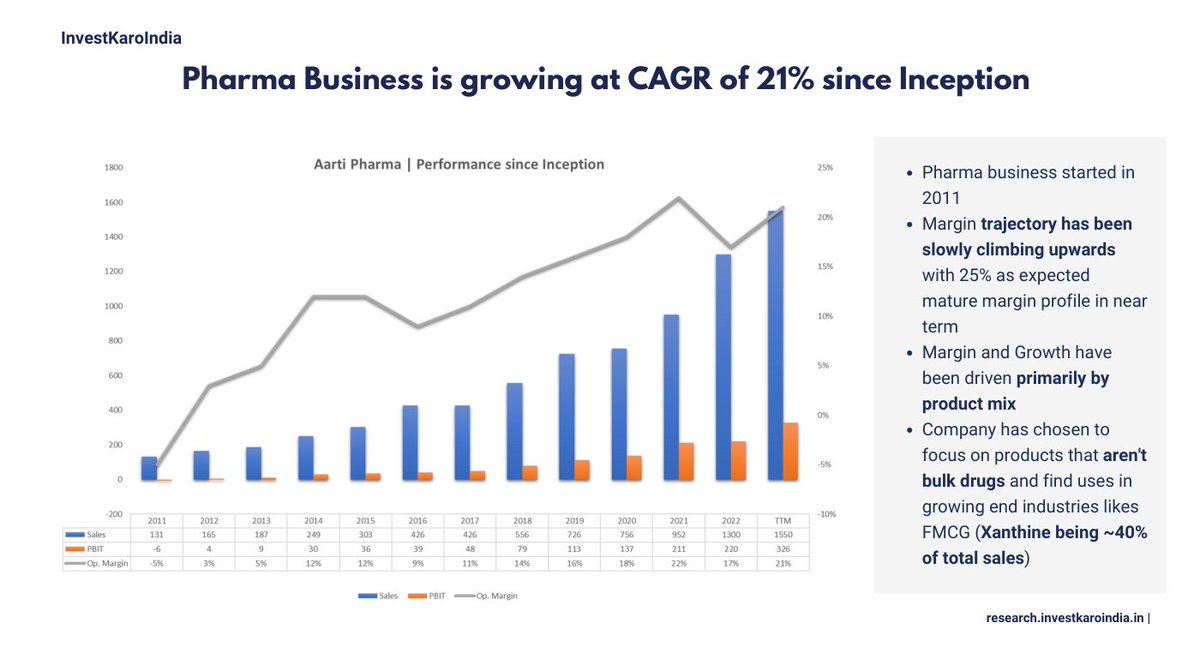

#AartiPharmaLabs lists today, here are some slides from my presentation at @ias_summit to help you understand the business ⤵️

The current share price is expensive, I wouldn't be a buyer at this price 🛑

D: Not an investment recommendation

The current share price is expensive, I wouldn't be a buyer at this price 🛑

D: Not an investment recommendation

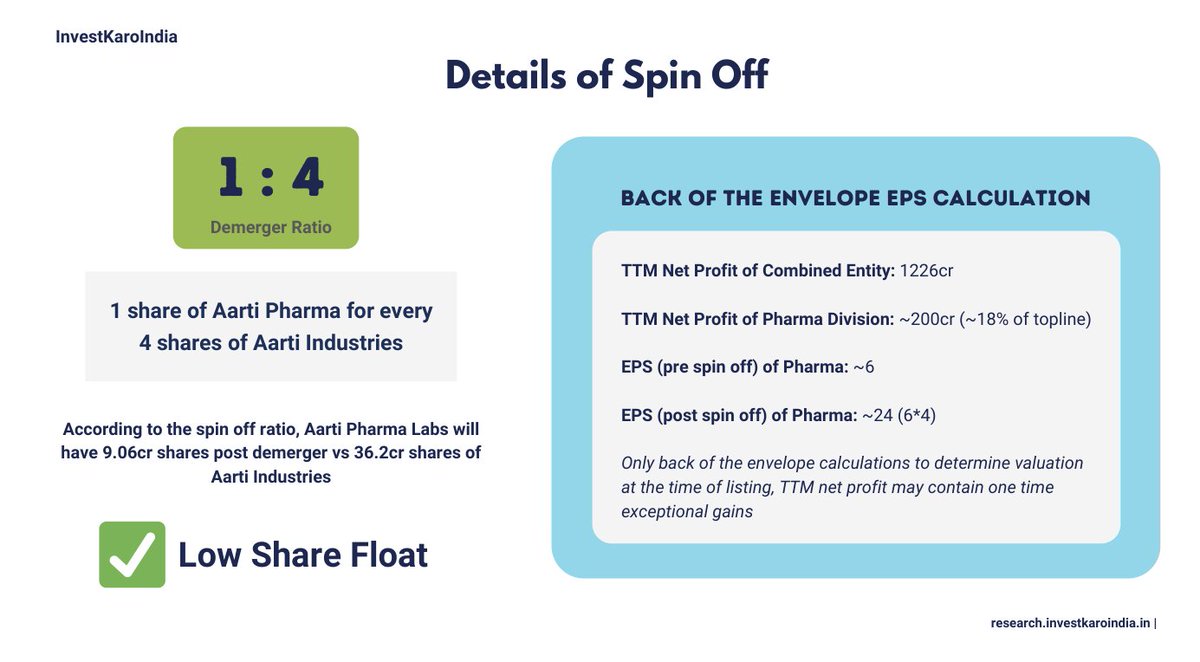

@ias_summit At 315/share, the market is implying a market cap of ~2850.75cr to the company or a PE multiple of ~18x TTM earnings

@ias_summit Since, the implied valuation is towards a premium & there are large institutional holdings in Aarti Industries, expect decent amount of selling in next few weeks

On the other hand, I also believe promoters will raise stake so need to monitor this for sometime before entering

On the other hand, I also believe promoters will raise stake so need to monitor this for sometime before entering

@ias_summit 20.6 Lakh shares worth ~52cr delivered today in Aarti Pharma

This is likely promoter buying

This is likely promoter buying

Prices have finally reached in sync between BSE and NSE

No more arbitrage

No more arbitrage

Promoter increased their stake by 0.78%

(sorry my previous tweet was incorrect, deleted it and reposted with correct information)

(sorry my previous tweet was incorrect, deleted it and reposted with correct information)

Mutual Fund Feb 2023 Activity

https://twitter.com/itsTarH/status/1636300318542827520?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh