In my third data update for 2023, I look at what 2022 brought to the bond market, which was mostly pain, and how increasing rates on both treasuries and corporate bonds made it a record-breaking bad year for bond investors. bit.ly/3wFlqbk

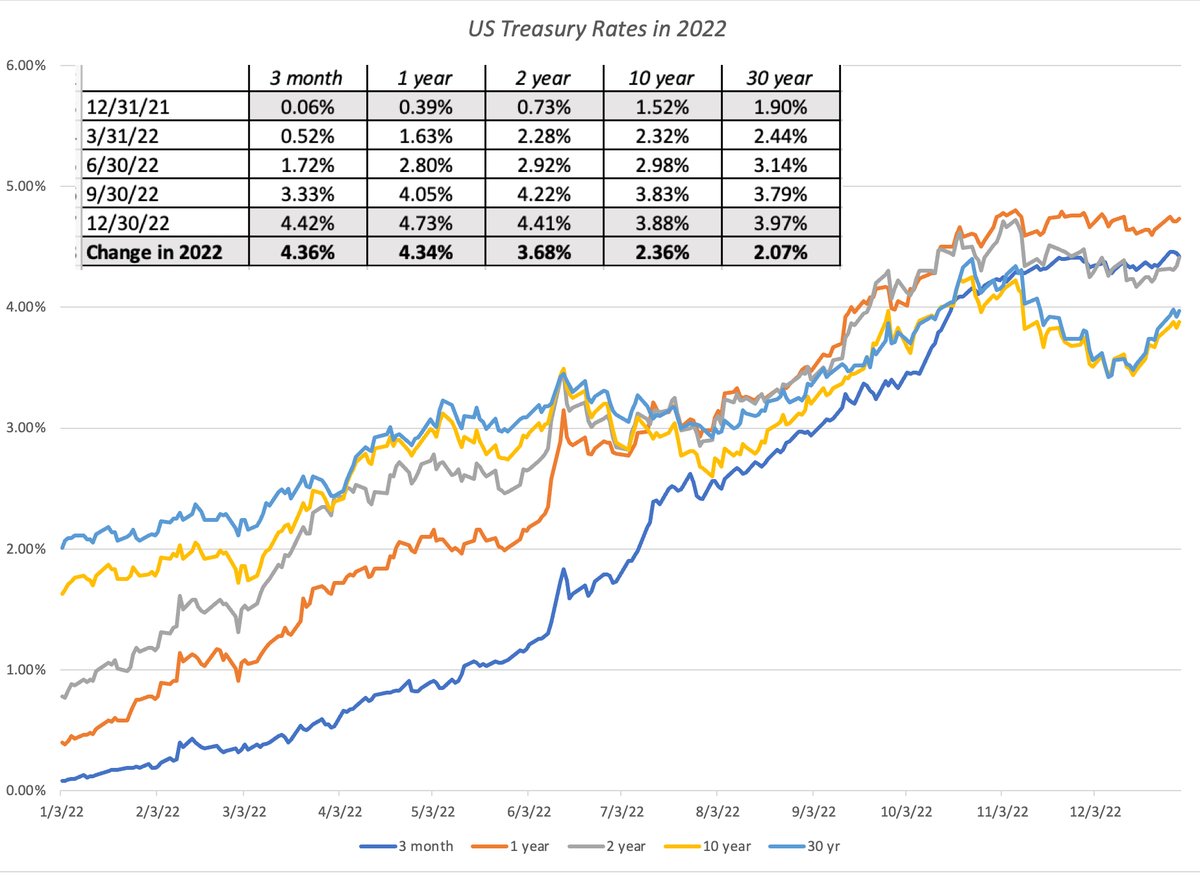

US treasuries were anything but a safe haven as treasury rates rose across the board, but more so at the short end of the maturity spectrum than at the long end, causing the yield curve to invert. bit.ly/3JsDU6M

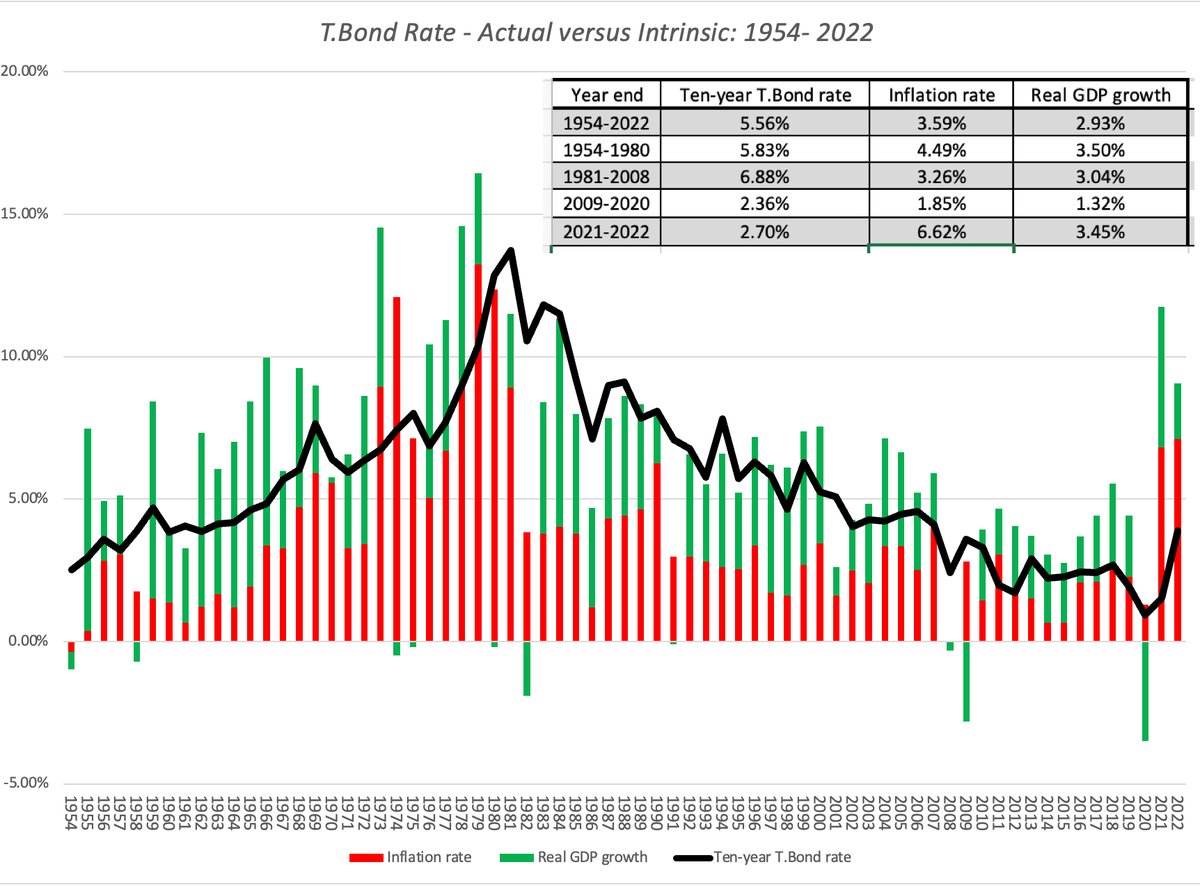

If you are tempted to blame the Fed, don't. The real culprit was inflation, with the Fed (and other central bankers) playing, at best, supporting roles. bit.ly/40e8sz2

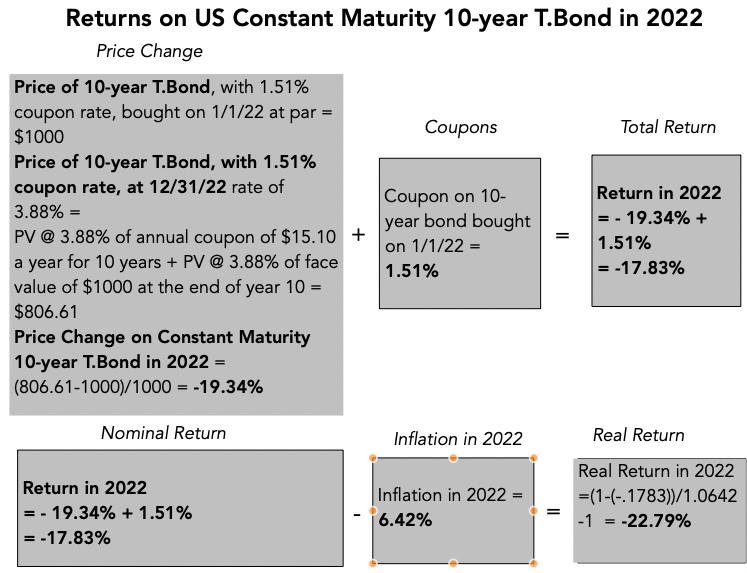

The surge in long term rates translated into a large price drop and negative returns. In 2022, the nominal return on a 10-year T.Bond of -17.83% & a real return of -22.79%, the worst year for treasury bond investors in the last 95 years. bit.ly/3Rkiiev

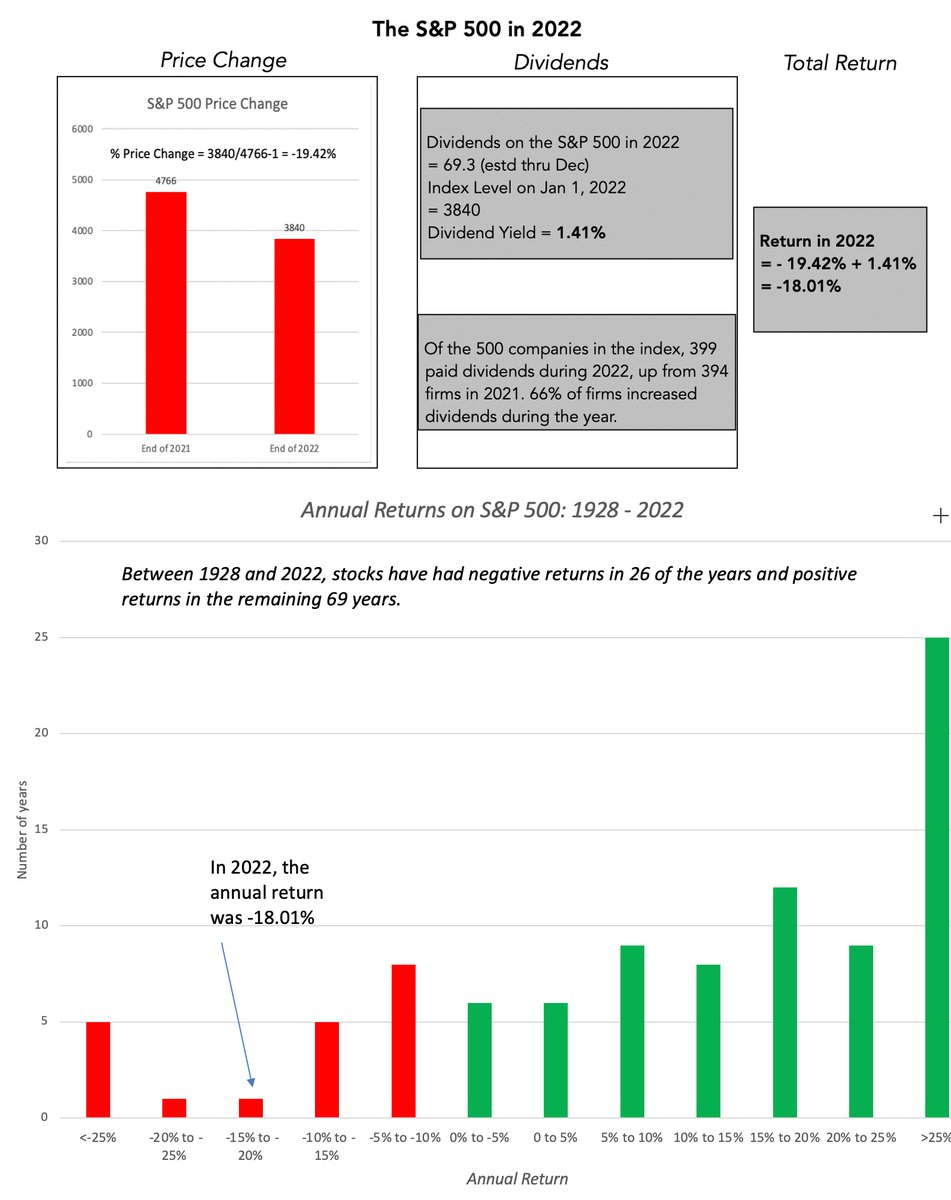

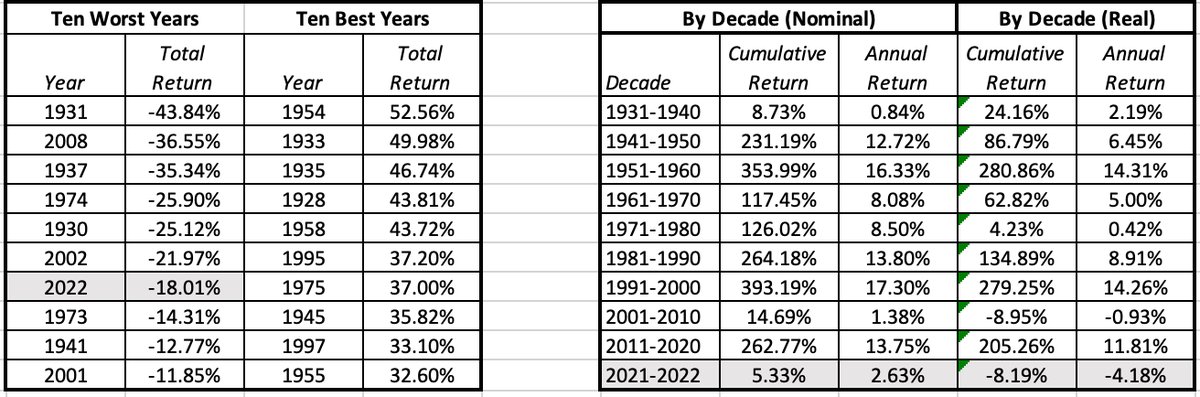

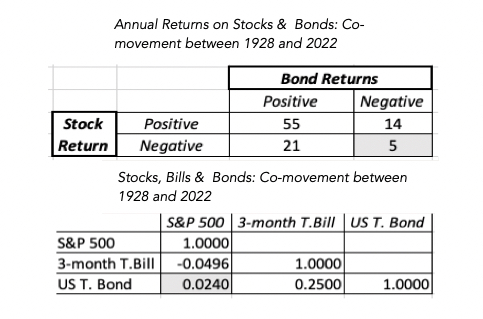

With stock & bond returns considered in tandem, it was only one of five years, in the last 95, where both were negative, and the first year where both equity and bond markets had negative returns that exceeded -10%. bit.ly/3Rkiiev

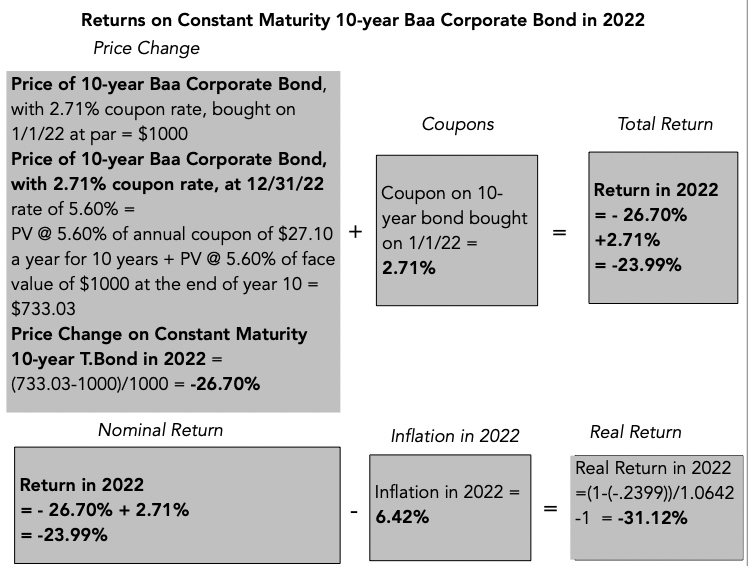

Rising rates on treasuries pushed up corporate bond rates, but during 2022, corporate bond default spreads also widened, and more so on the lowest rated bonds, creating a secondary effect. bit.ly/3HHY1wh

The increase in corporate bond rates meant that corporate bond investors, even in investment grade bonds, saw their worst negative returns in history, with the damage widening at the lower ratings. bit.ly/3wFlqbk

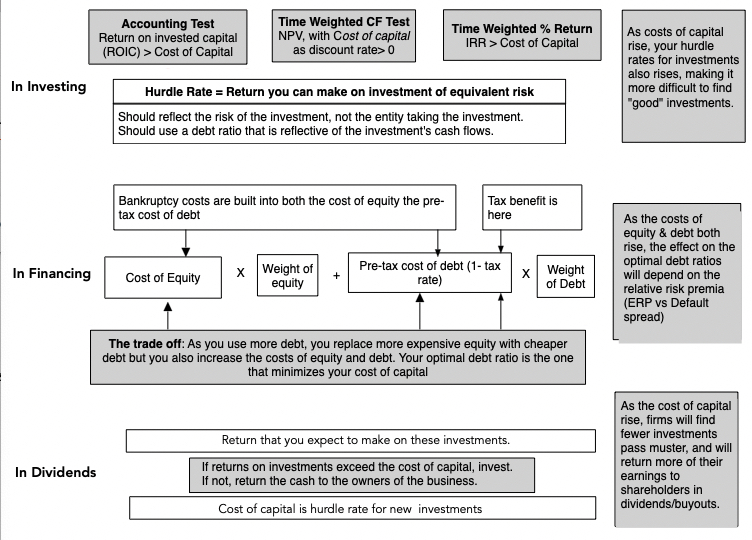

Incorporating the rise on cost of equity during the year into the assessment, the median cost of capital for US (global) companies went up to 9.63% (10.60%) from 5.77% (6.33%) at the start of the year.bit.ly/3wFlqbk

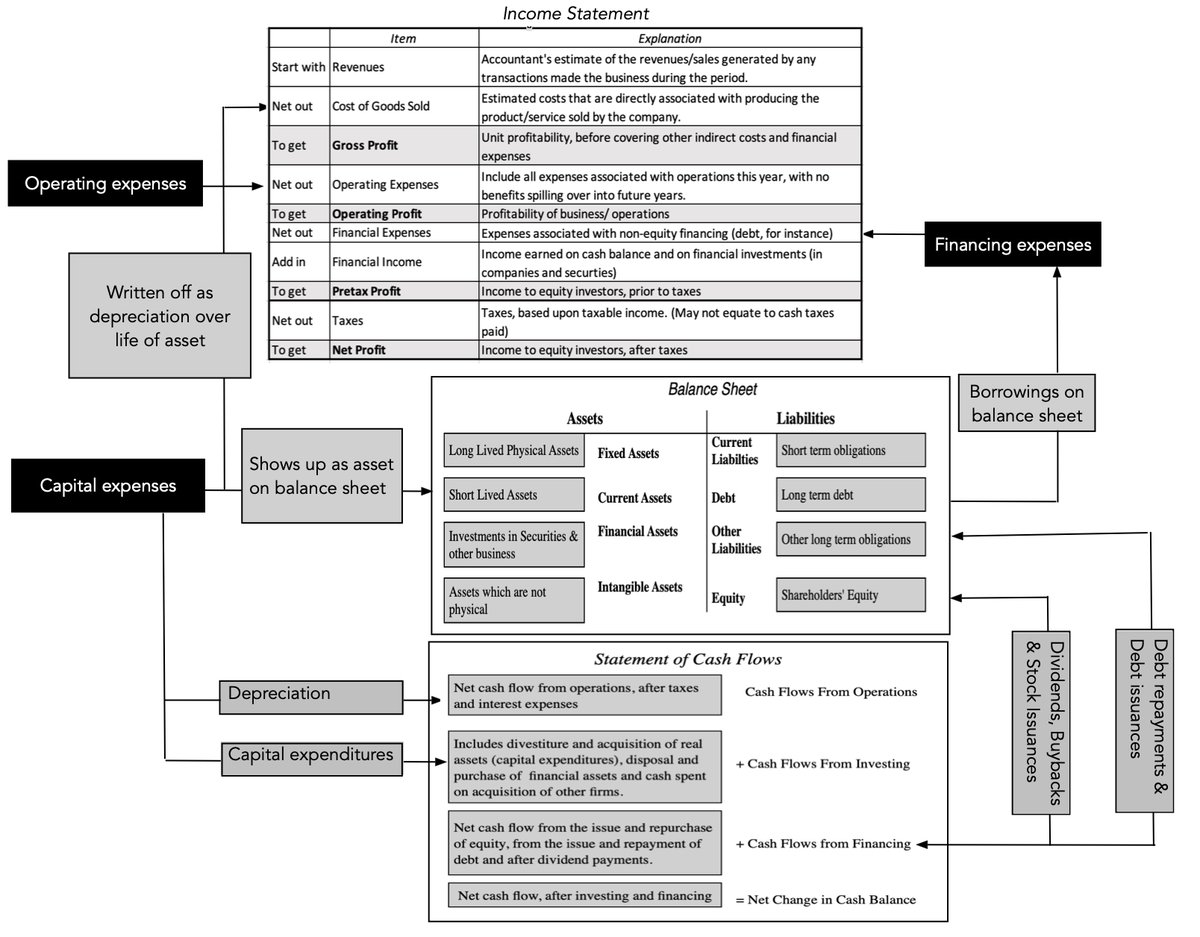

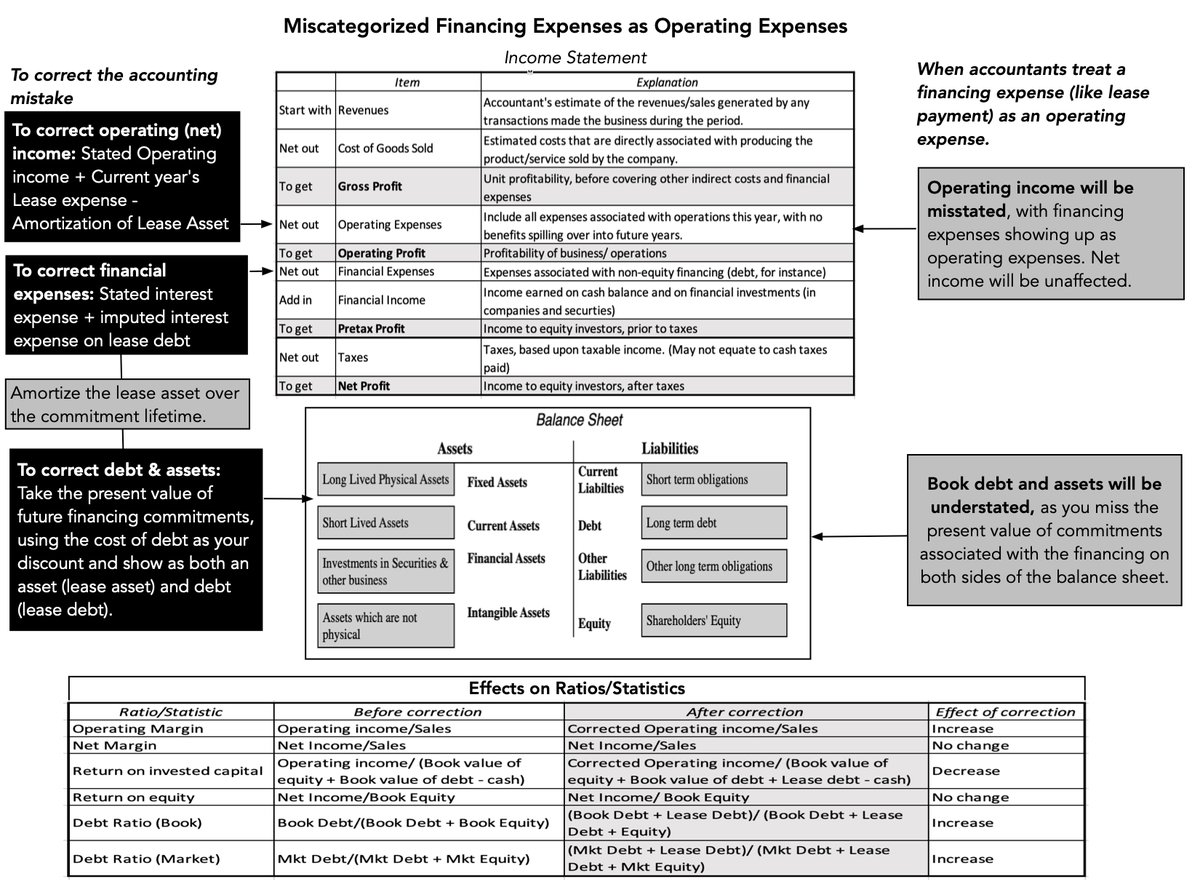

That rise in the cost of capital will not only affect investors but also change the investing, financing and dividend policies of companies, with fewer investments passing muster, more cash returned to shareholders & changes in debt policy. bit.ly/3wFlqbk

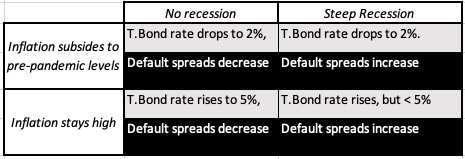

Looking forward, the key driver for interest rates in 2023 will not be the Fed, but fundamentals, with inflation and the real economy determining where treasury rates and default spreads go during the year: bit.ly/3wFlqbk

• • •

Missing some Tweet in this thread? You can try to

force a refresh