This is a follow-up series on field research. In my first series, I covered the why and what of field research. In the next series, I am going to focus on the how or procedures. This series will focus on pre-fieldwork. Or what should you do before going into the field?

The investment business is competitive, difficult, and painful. We need tools and processes like field research to increase the probability of preserving capital and making money.

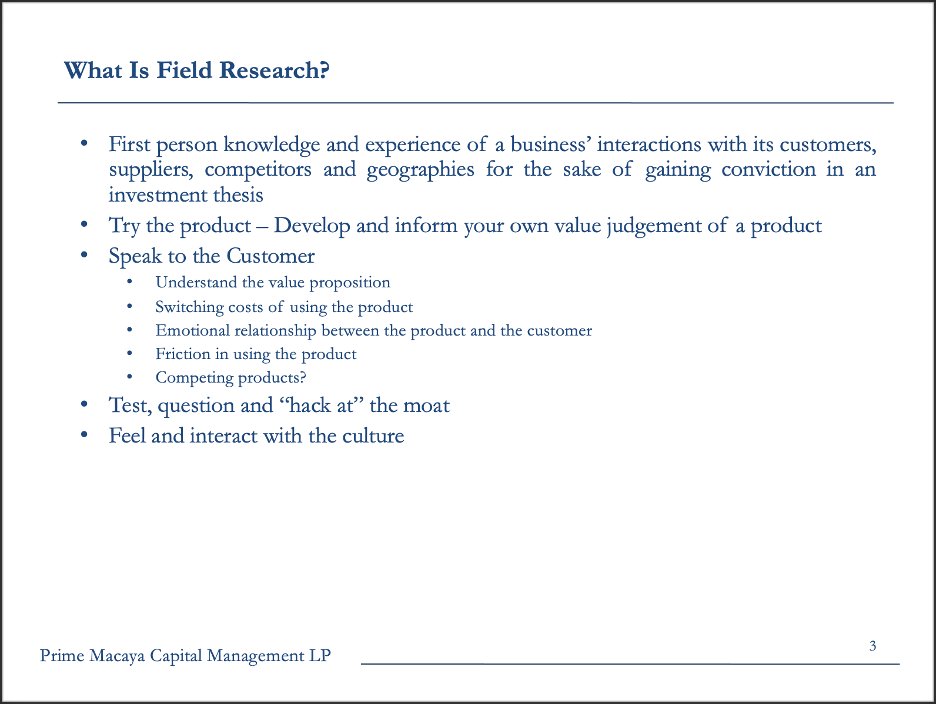

The pre-field work should include: trying the product (if you can), analytical work, thematic and geographic work, knowledge of the players in the ecosystem, and narratives/expectations work. The narratives and expectations work is done to understand what is priced into the stock

One of my mentors has a saying: "you want to be a business analyst first and a stock analyst second." In my opinion, it is important for an analyst to go into the field knowing the relevant issues being debated by diverse market participants, bulls and bears.

This pre-work is necessary as it helps solve a few issues you are going to encounter in the field. Five issues. There are others of course but these are the ones I think are important

Issue#1: preparation, credibility, and respect. How do you prepare so you are credible with field contacts, that you command their respect and they will want to keep an ongoing relationship with you? Your street cred and the reputation of your firm are on the line. Remember that.

Issue#2: build networking and collaboration tactics early in the process to trigger group intelligence early. You need multiple sets of eyes on a target. Enlist collaborators. Share your work early, share it often. You need sanity checks to combat the inevitable behavioral...

...biases (IE confirmation bias and all its cousins) that you will experience. Other people can give you feedback that will help your self-awareness and introspection.

Issue#3: informational avalanche. What should you read? Whom should you call? Where should you go in the field? There is a large amount of information on any particular security and filtering that information into understanding and eventually, wisdom requires pre-work.

Issue#4: informational weighting. How will you know something that you see/hear/feel is important and relevant? Great investors are able to hear a pitch and drill down to the one or few things that matter. It takes experience and pattern recognition to do so or it takes pre-work

Issue#5: strategic benefits and strategic by products. Your network will benefit and these are contacts that will be useful for future research. Also, you may uncover an even better idea as a by product of doing the field work. You have to mentally prepare for that. You also...

...need to prepare your "human touch" and how you are going to be a good human in your interactions with field contacts. Humility, generosity, initiative, empathy, and sacrifice are all qualities you need to imbue in your approach. It is both the right thing to do and...

...self-serving as it increases the chances of you building a long-term relationship with that field contact. The in-bound phone call about something relevant to an idea you cover is one of the goals of field work so you must optimize for that.

A few warnings. First, watch out for early signs that you are anchoring to a point of view or that you are forming quick conclusions. This can be dangerous as you close your mind off to possible scenarios.

2nd, be wary of expert opinions. A set of fresh eyes can be a big advantage and if you believe their opinions early, that advantage can be mitigated. This includes management of the target company you are researching. The pre-work gives you facts that you can see opinions through

3rd, you are going to feel uncertain and overwhelmed. That is a good, healthy sign. Embrace both. The problem is those feelings will happen in a high-pressure investment team context. Preparation, collaboration, and feedback will help attenuate the uncertainty and overwhelm.

4th, rookie analysts and sometimes senior ones are always trying to prove they are smart to contacts in the field and they should not. They try to educate the person they are trying to extract information from. The contact feels this and this inhibits the information flow.

5th, The skill set required to be a good field researcher heavily overlaps with being an extrovert. Most analysts are introverts and do not want to engage with others they do not know. The rare combination of both is what really allows investment analysts to differentiate...

...themselves. If you are an introvert and feel uncomfortable with (for ex:) the cold-calling or cold-approach aspects of fieldwork, you either suck it up and do it or you can collaborate with an extrovert that will help facilitate the interactions in the field.

6th, Though I think that expert networks add value, it's worth mentioning that expert network calls are NOT field research. First, you are not "in the field" and could be missing important contextual cues. Second, there are multiple agency costs associated with expert network...

...calls. Third, these calls are costly and require the fund you work for to have scale. Last, with an expert network call, you do not "own" the relationship. A contact in the field you have a relationship with will call you when he sees something relevant to your research goals

Now, a few housekeeping suggestions. First, keep a journal or log of everything that you do. Date and time stamp it. This is not just important for compliance but also so that you review it later to see if there are any follow-ups or to find areas of improvement in your process

2nd, keep a list of important questions you have about the research target or its ecosystem. Add to it continuously in your pre-work and fieldwork. Remember the zen aphorism: the question is the answer. These are the questions you will ask field contacts but also ask yourself

3rd, Ping your network. Do not go straight to data sources to uncover the relevant information on your own. The best filters of information are smart people. Calling people in your network to ask if they know of knowledge/insights, and contacts pertaining to a target company...

...is invaluable and will save time. You also immediately get opinions/feedback on the company. Most great investors actually suggest not doing this, by the way. I think it's a question of taste or personality. If it works for you, do it. If it doesn't, don't. For me, it works

So how should you start? Start with the Thematic and Geographic work because it gives you context. Who are the competitors, customers, suppliers, bankers, regulators, lawyers and headhunters in the target company's ecosystem? What geographies does the target company conduct...

...its business in? One of the work products of thematic/geographic work is an industry map. I was taught to do these years ago by @mjmauboussin. Here is an example of a map of the PC Industry from his 2002 piece "Measuring the Moat".

Here is another good map I found online. This brings me to an important point. If you uncover a map in an existing research piece or company doc or sent to you by your friends, do not waste the time reproducing it. Give credit to those who have created it but use it build on it

In "Measuring the Moat", @mjmauboussin gave suggestions on how to build a map. I like when analysts do historical profit pools too. It is a great way to see value migrations. See the pic 👇

While doing the industry map: make sure that you use a different color for public companies versus private companies. It's important to do this because you want to prioritize speaking with private companies as it is an advantage to do so. Most public investors rarely speak...

...with private companies. Private companies compete on different time scales than public ones whose incentives are often short-term. Their point of view and objectives can often show you how an industry is going to evolve. Having no stock price to worry about is liberating.

One reason why the industry map is important: when you are presenting your work to your PM or your team, the map can trigger insights and potential contacts to call. IE, one of your teammates might say "I know a guy at this company" or "I just heard a short case on this company"

Another reason you do industry maps is having the visual will help later to get readthroughs or how competitor, supplier, or customer events impact the target company and its ecosystem. It is helpful to view the map and visualize how the event ripples through the ecosystem.

I like this quote from Paul Marshall: "the best that can be said today is that the market is not good at predicting Competitive Advantage Periods and frequently errs in both underestimating and overestimating the speed of change. Scrutiny of industry structure and sector...

...dynamics can generate super-normal returns from industry selection because not enough investors do it." The industry map is foundational in figuring out when industry structures are changing. Helpful tactic: show the map to a field contact and get their feedback and add to it

After the thematic/geographic work began to make a list of the investment players in the ecosystem. Knowledge of the players is important because, in a way, these are the other poker players at the table you are sitting in. You must understand them. For example: who are the...

...private equity firms that have transacted in the sector? Are there any private equity-backed companies competing against your target company? Who are the owner/operators in the ecosystem? Are there analysts or PMs that have a reputation as being knowledgeable on the target...

...company or its sector? Do they have relationships with the target management team?

Knowledge of the investment players is helpful because: a) you then know who to call to get their thesis on the idea, b) you can track their investments through public filings and scuttlebutt, and c) these players have behavioral tendencies that can be anticipated and exploited.

For example: certain private equity firms have strategic and operational game plans that they keep re-using across their portfolio companies. This can be useful to analyze their competitive reactions to your target company's strategies.

Player knowledge is important because their names will often come up while speaking to contacts in the field. These contacts can provide warm introductions to these players. If you do not know who they are, you might let these opportunities pass you by.

Procedure: after you have made a list of the players: a) add them to the industry map. b) Show them to your team to see if they have any connections to them. c) Look on them up on LinkedIn to see if you have any contacts in common with them and ask for warm introductions.

After player knowledge, read to gain knowledge of the targeted customer, the product, the business, and its management. What is the company's history? What were the initial conditions of its founding? Try the product. If you cannot try it: read the reviews or view youtube demos

Do the foundational analytical work to determine business quality: competitive positioning or Five Forces analysis; ROIC, and the opportunities for improvement in the business model; and management capital allocation skills. The key question: how can the moat deepen and expand?

Spend time on understanding sales & distribution. This is an area that most analysts don't understand well. Look for the qualitative aspects of the business: the emotional relationship the product has with the customer, temperament of the management team, culture of the business

We use a few non-standard analytical tools at this stage such as ACH: Analysis of Competing Hypotheses. Very helpful to combat confirmation bias and other tools. Also very helpful as a visual to show your team or individuals in the field.

One helpful book to find non-standard analytical tools is Pherson and Heuer's "Structured Analytic Techniques For Intelligence Analysis". Heuer was the writer of "Psychology of Intelligence Analysis". Both are part of our training materials and we use them as frameworks

After the analytical work, it's helpful to understand the narratives, expectations, & perceptions that are built into the stock and zeitgeist. There are some useful tools here. The first is the Price Implied Expectations tool detailed by @mjmauboussin in "Expectations Investing"

A 2nd tool is to compile magazine articles and research reports about a company, read them and then notice the points that keep popping up or the points that bulls or bears are fighting over. These points of rigidity should be areas you focus your field research on.

I love this quote by Peter Drucker on effective decision-making. Specifically on the importance of gathering divergent opinions to establish a criterion of relevance so that one can know what facts to look for in order to make great decisions. Divergent opinions act as a filter.

A long series, I know. But it's a decent explanation of the pre-work required to do effective field work. The last piece of advice is to not forget the human touch and your dealings in the field. It's the right thing to do and it is also self-serving. Expressing gratitude...

...being humble, respecting others' time and just being a great person will go a long way in the field. Remember to add every contact you meet to your personal database. Find ways to stay in touch with them in the coming years. Send a message on their birthday, etc

A few examples of people that have done this pre-work. First is Warren Buffett as described by Alice Schroeder in a Reddit AMA she did once.

This quote also from Alice Schroeder on how Warren Buffett does pre-work in field research is excellent. Uncle Warren does not just sit at his desk in Omaha reading. "He used to pay people to attend shareholder meetings and ask questions for him." LOVE THAT

@NeckarValue tweeted recently as to why an investor invested with in Buffett Partnership.

@firstadopter article and work last year on NVDA was excellent.

https://twitter.com/firstadopter/status/1528019089301585920?s=20&t=P8c2EMlvBjtuHedGEpMSQA

@mario_cibelli tweet about insights gained in the field. Awesome!

https://twitter.com/mario_cibelli/status/1293305051520348164?s=20&t=WZdU9j7TWQMif0YxsLZcCw

A few book recomendations. First is Rosenzweig's "Halo Effect". Will help you understand how narratives drive investors' understanding of operational performance. Truly a fantastic book.

This is not a book but a memo. Some years ago @EpsilonTheory wrote a memo called Epsilon Theory. A must-read to understand narratives and the missionaries that create them.

And last, the US Army wrote a memo on how to conduct information operations (nice moniker for propaganda). "Massing Effects In the Information Domain". It is excellent and a good primer for understanding narratives.

Thanks for reading. Hope this is helpful. Will continue on the topic when I have the time. Want to thank my friends in the business that helped me in my field work. @SuperMugatu, @RagingVentures, @NeckarValue, @skorusARK, Stirling, Eric, Jason, Davis, Jamie. Grateful to you all!

@threadreaderapp unroll, please

• • •

Missing some Tweet in this thread? You can try to

force a refresh