#SouthIndianBank An interesting personal trivia on South Indian Bank

As added, this at ~Rs 8.4 and get credit from few friends, sharing this trivia. While working as financial consultant in 2013, one of colleague joined from ICICI & his ex-boss was current SIB CEO. 1/n

As added, this at ~Rs 8.4 and get credit from few friends, sharing this trivia. While working as financial consultant in 2013, one of colleague joined from ICICI & his ex-boss was current SIB CEO. 1/n

We did discuss about his experience under previous boss etc. Then, I moved on to another company. In this company, my reporting boss was the one who hired/managed the same gentleman in his previous company. So, I knew someone who reported and someone who managed in terms 2/n

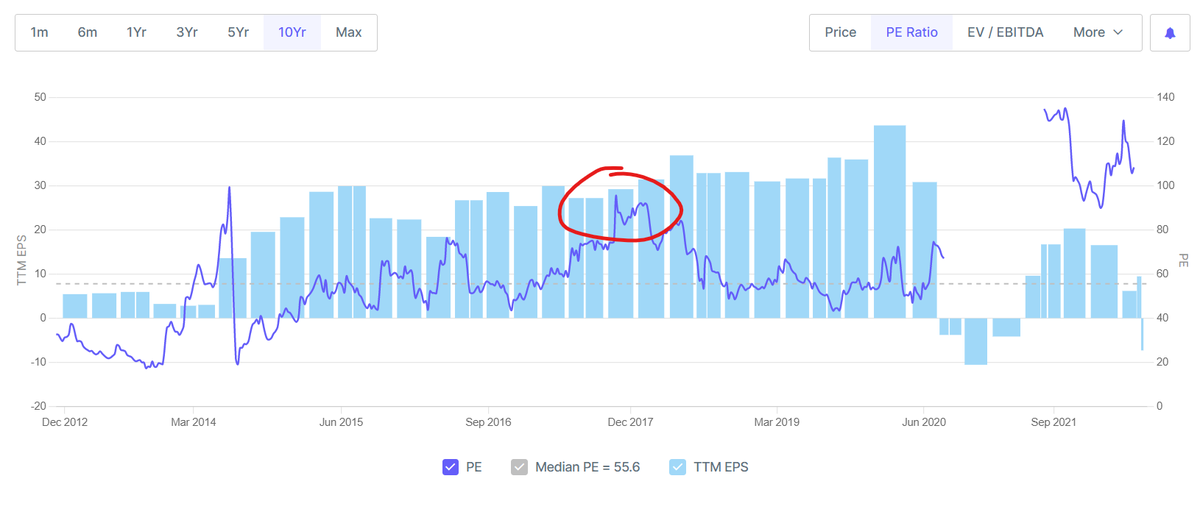

of some discussion over current SIB CEO through these discussions. The day I read, Mr. X joining bank as CEO, those discussions flashed in memory and then, it took almost 8 months of tracking, enquiring further to know about the risks. Further, when the story and charts 3/n

aligned, hit the buy button. You never know what thing in past can connect and help in future, life 🙂.

Thats why I said to @LearningEleven while replying - "Allah meherbaan, to gadha pehelwaan" 😃

Disc: I hold a small position as my process does not allow me to take 4/n

Thats why I said to @LearningEleven while replying - "Allah meherbaan, to gadha pehelwaan" 😃

Disc: I hold a small position as my process does not allow me to take 4/n

substantial position. So, this has nothing to do with boasting of cracking multi-bagger. It does not change my life, in fact, none of stocks in portfolio do but they do provide a peaceful sleep and expected return at portfolio level to keep me satisfied 🙏

End of thread

End of thread

• • •

Missing some Tweet in this thread? You can try to

force a refresh