1/ Thank you very much once again for bringing up pensions @MartynDaySNP yesterday at @CommonsHealth to @SteveBarclay

Some important answers in there (& some factually incorrect ones) so lets break them down, as its very important & shows govmnt (misguided) thinking

👀&RT

Some important answers in there (& some factually incorrect ones) so lets break them down, as its very important & shows govmnt (misguided) thinking

👀&RT

2/ The SOS claims "there's something that was started in Covid, the ability of people to, to return to the workforce whilst continuing to top up their pension" - this is not correct.

3/ That was about "abatement" which only affects a tiny proportion of the workforce (for doctors thats only mental health officers, a *tiny* proportion of all doctors).

4/ Suspension of abatement during covid did not allow them to top up their pension, rather stopped existing pension being depleted (or "abated") for simply coming to work (which is a stupid rule and needs to go forever).

5/ The current consultation that just closed, is, however about allowing - in the future - topping up their pension after retirement (which is a good thing, athough its coming too late, and was previously promised in April 23) @theresecoffey & does *nothing* for those mid career

6/ But then the SoS says " in terms of recognizing we need to be more flexible on pensions is something that I know my, my friend, the chancellor, is also looking at in the wider context, for example, of consultants" @BMA_Consultants @Jeremy_Hunt

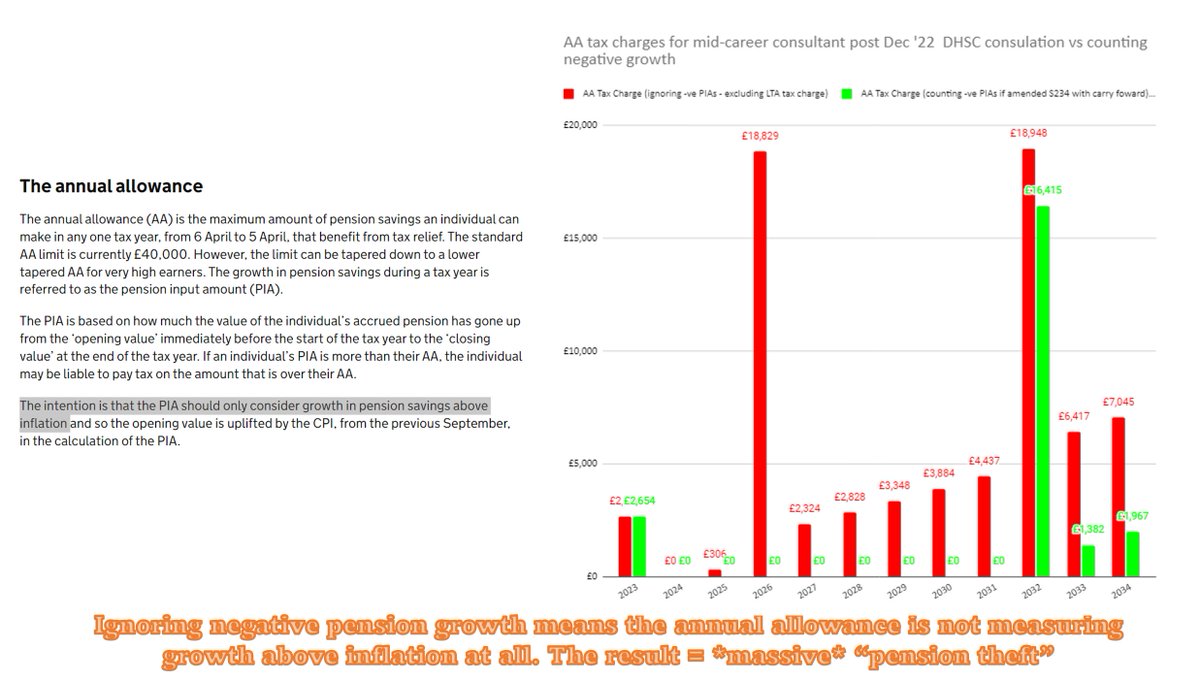

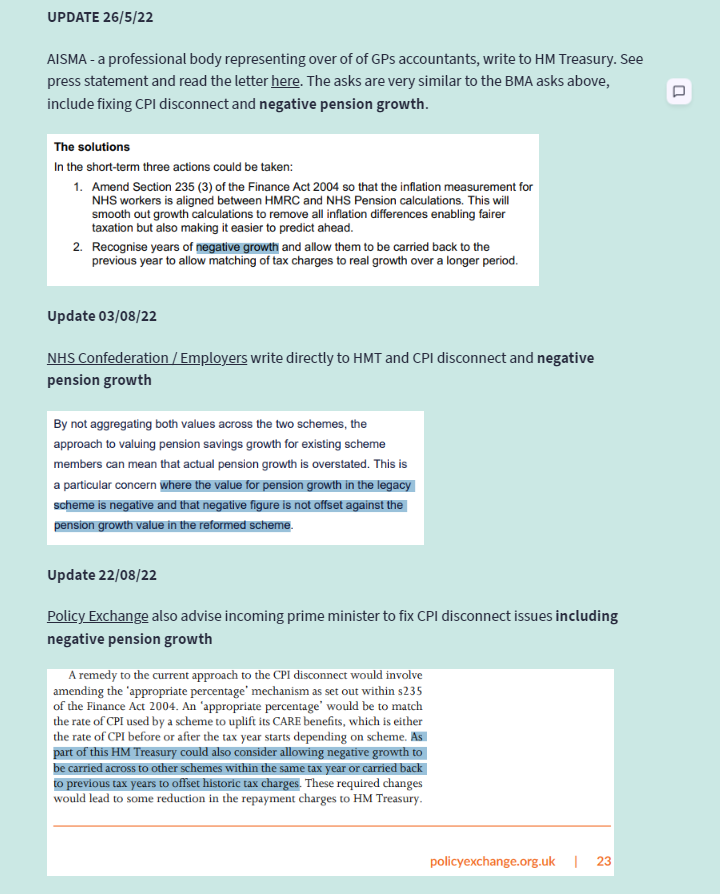

7/ Lets be clear what the SoS is referring to - something called "pension flexibility". We have been here before, and consulted on that already - twice in fact👇. It was clear then, and remains the case now, this *DOESNT* FIX ISSUES WITH PENSION TAX.

gov.uk/government/con…

gov.uk/government/con…

8/ Whats more @MartynDaySNP & colleagues at @CommonsHealth, is that all @SteveBarclay is proposing is a further, disguised, renumeration *CUT*. Even before we consider pension taxation issues both PAY and PENSIONS have *BOTH* been reduced signficantly.

9/ So apart from the fact that flexibility add another *MASSIVE* layer of complexity (and complexity is already a *MASSIVE* part of the problem)

10/ So @SteveBarclay says rob Peter (Pension), flexibly, to pay Paul (Pay) to fix tax (which it doesnt).

Problem is, your're *both* Peter & Paul, & both have been comprehensivley shafted by the government (even without tax)

#DontRobPetertoPayPaul

#DontRobPensiontoFixPay

Problem is, your're *both* Peter & Paul, & both have been comprehensivley shafted by the government (even without tax)

#DontRobPetertoPayPaul

#DontRobPensiontoFixPay

11/ So @MartynDaySNP I'd be very happy to sit down with you & colleagues @CommonsHealth @bma_pensions to explain why it WONT fix the crisis we have in the NHS right now (& more importantly, what will)

#DontRobPensiontoFixPay

#FixNegativePIAs

#TaxUnregistered

#EnoughlsEnough

#DontRobPensiontoFixPay

#FixNegativePIAs

#TaxUnregistered

#EnoughlsEnough

• • •

Missing some Tweet in this thread? You can try to

force a refresh