𝗧𝗵𝗲 𝗨𝗹𝘁𝗶𝗺𝗮𝘁𝗲 𝟮𝟬𝟬 𝗘𝗠𝗔 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆 𝗳𝗼𝗿 𝗣𝗼𝘀𝗶𝘁𝗶𝗼𝗻𝗮𝗹 𝗧𝗿𝗮𝗱𝗶𝗻𝗴

🧵 𝗔 𝗧𝗵𝗿𝗲𝗮𝗱 🧵

🧵 𝗔 𝗧𝗵𝗿𝗲𝗮𝗱 🧵

200 EMA : THE LONG TERM TREND

🔸 When a stock price crosses its 200-day moving average, it is a

technical signal that a reversal has occurred.

🔸 A stock above 200 ema is considered bullish in its long term trend and if its below 200 ema its considered bearish

[2/18]

🔸 When a stock price crosses its 200-day moving average, it is a

technical signal that a reversal has occurred.

🔸 A stock above 200 ema is considered bullish in its long term trend and if its below 200 ema its considered bearish

[2/18]

🔸 A simple rule of not buying stocks below 200 ema for short term trading could save a lot of money

🔸 Some may not agree with this and its ok!

[3/18]

🔸 Some may not agree with this and its ok!

[3/18]

One may consider investing in stocks if the stock is below 200 ema only if he is confirmed about the fundamentals of the stock

TREND:

🔸 200 ema trending up : Uptrend

🔸 200 ema sideways : Consolidation

🔸 200 ema trending down : downtrend

[4/18]

TREND:

🔸 200 ema trending up : Uptrend

🔸 200 ema sideways : Consolidation

🔸 200 ema trending down : downtrend

[4/18]

𝗥𝗲𝗹𝗮𝘁𝗶𝘃𝗲 𝘀𝘁𝗿𝗲𝗻𝗴𝘁𝗵

Type

“Relative Strength”

By bharattrader

Period : 123 ( for 6 months of trading )

[8/18]

Type

“Relative Strength”

By bharattrader

Period : 123 ( for 6 months of trading )

[8/18]

🔸 Relative Strength has a reference zero line

🔸 Line >0 Stock is 𝗢𝘂𝘁𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗶𝗻𝗴

🔸 Line <0 Stock is 𝗨𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗶𝗻𝗴

🔸 RS period 123 as we have around 123 trading days in 6 month of trading

🔸 RS reference as Nifty50 as benchmark index

[9/18]

🔸 Line >0 Stock is 𝗢𝘂𝘁𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗶𝗻𝗴

🔸 Line <0 Stock is 𝗨𝗻𝗱𝗲𝗿𝗽𝗲𝗿𝗳𝗼𝗿𝗺𝗶𝗻𝗴

🔸 RS period 123 as we have around 123 trading days in 6 month of trading

🔸 RS reference as Nifty50 as benchmark index

[9/18]

Strategy

🔸 Look for Reversal on stocks near 200 ema after a general market pullback in daily time frame

🔸 Buy when stock closes above the 200 ema with the 123 period RS line green

🔸 If the stock is closing above 200 ema but the Rs line is red it should not be bought

[10/18]

🔸 Look for Reversal on stocks near 200 ema after a general market pullback in daily time frame

🔸 Buy when stock closes above the 200 ema with the 123 period RS line green

🔸 If the stock is closing above 200 ema but the Rs line is red it should not be bought

[10/18]

Value stocks generally reverse from 200 ema as it provides a good buy point to investors

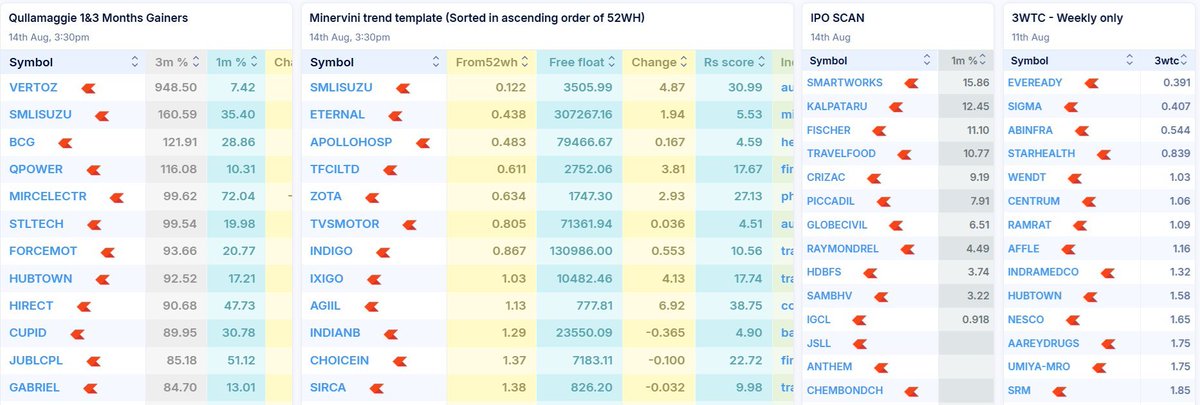

Screener :

𝗵𝘁𝘁𝗽𝘀://𝗰𝗵𝗮𝗿𝘁𝗶𝗻𝗸.𝗰𝗼𝗺/𝘀𝗰𝗿𝗲𝗲𝗻𝗲𝗿/𝗳𝘂𝗻𝗱𝗮𝗺𝗲𝗻𝘁𝗮𝗹-𝘁𝗲𝗰𝗵𝗻𝗶𝗰𝗮𝗹-𝗰𝗿𝗼𝘀𝘀𝗶𝗻𝗴-𝟮𝟬𝟬-𝗲𝗺𝗮

[11/18]

Screener :

𝗵𝘁𝘁𝗽𝘀://𝗰𝗵𝗮𝗿𝘁𝗶𝗻𝗸.𝗰𝗼𝗺/𝘀𝗰𝗿𝗲𝗲𝗻𝗲𝗿/𝗳𝘂𝗻𝗱𝗮𝗺𝗲𝗻𝘁𝗮𝗹-𝘁𝗲𝗰𝗵𝗻𝗶𝗰𝗮𝗹-𝗰𝗿𝗼𝘀𝘀𝗶𝗻𝗴-𝟮𝟬𝟬-𝗲𝗺𝗮

[11/18]

𝗘𝗻𝘁𝗿𝘆 𝗿𝘂𝗹𝗲𝘀 :

🔸 Enter on close above 200 ema with RS 123 +

🔸 Stoploss in this case should be max 5 to 7% as holding stocks below 200 ema is not advised

🔸 Keep Pyramiding if stocks move higher and adding positions with trailing Stoploss using the 200 ema

[12/18]

🔸 Enter on close above 200 ema with RS 123 +

🔸 Stoploss in this case should be max 5 to 7% as holding stocks below 200 ema is not advised

🔸 Keep Pyramiding if stocks move higher and adding positions with trailing Stoploss using the 200 ema

[12/18]

🔸 Trends generally last 6 months to 1+ years depending on the overall trend of the markets as well

🔸 Best suited after the market has been into a correction

[13/18]

🔸 Best suited after the market has been into a correction

[13/18]

[14/18]

𝗧𝗵𝗶𝗻𝗴𝘀 𝘁𝗼 𝗿𝗲𝗺𝗲𝗺𝗯𝗲𝗿🔸 You may have to go in and out of a trade multiple no of times stock is in choppy zone

🔸 Risk Reward is Highly Favourable as on winning trades we make a lot of money

🔸 Works best after general market correction

[16/18]

🔸 Risk Reward is Highly Favourable as on winning trades we make a lot of money

🔸 Works best after general market correction

[16/18]

Join our Telegram for Stock Analysis and know more about how we exited ADANI Stocks just during the crash

t.me/Techno_charts

[18/18]

t.me/Techno_charts

[18/18]

• • •

Missing some Tweet in this thread? You can try to

force a refresh