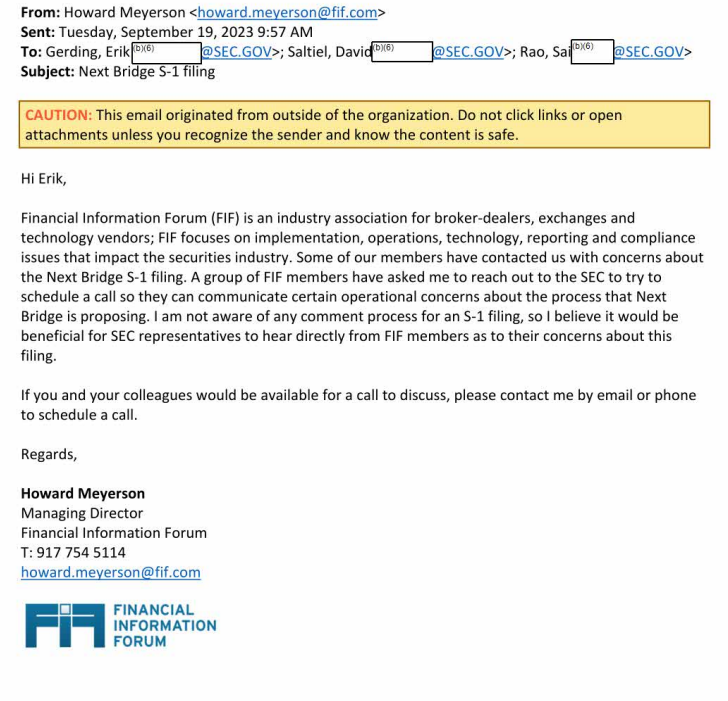

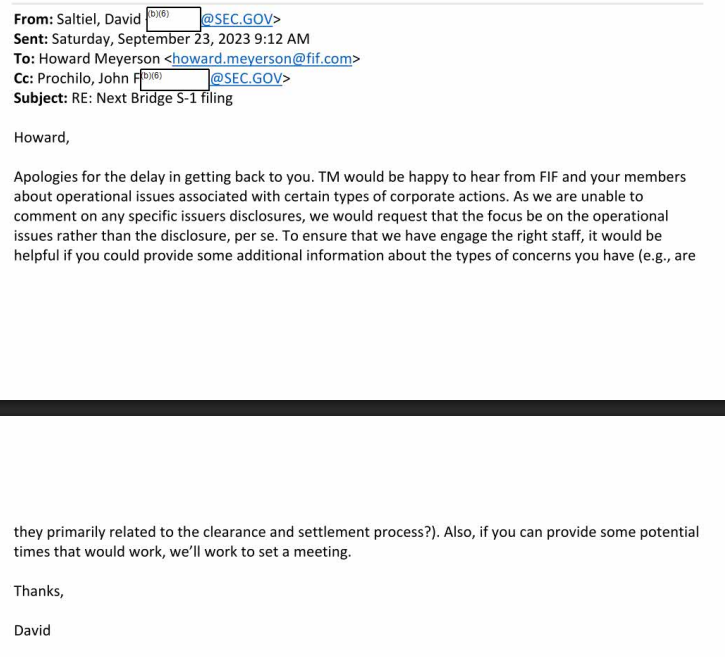

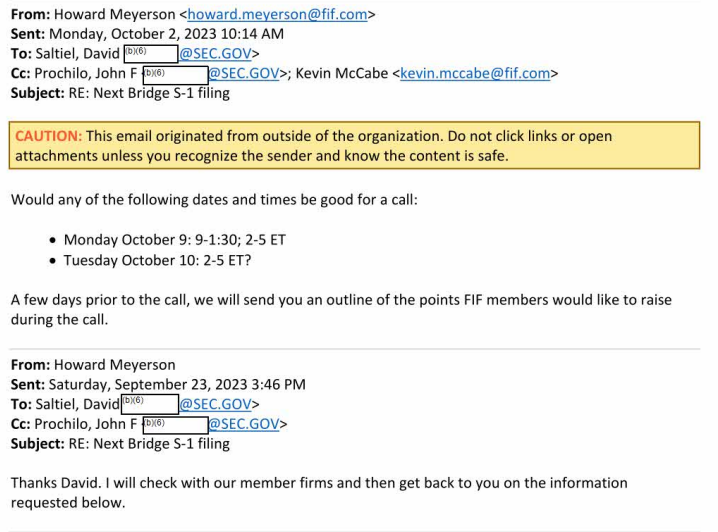

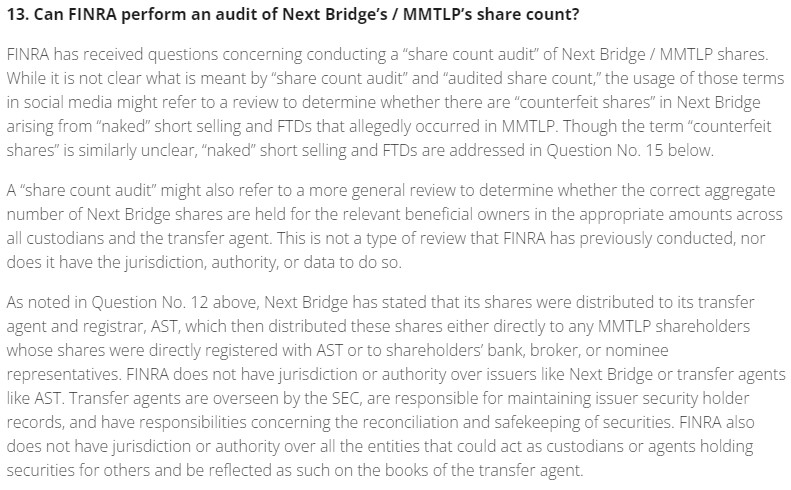

$MMTLP It's time to take the gloves off. It's time to drag those responsible for the MMTLP situation into the light. It's time to narrow our collective focus from organizations that have facilitated fraud to the individual names and responsibilities. A #FINRAfraud exposé thread🧵

The Series A Preferred Shares (now known as MMTLP) became tradable after a Form 211 was submitted without knowledge or permission of the issuer (TRCH/MMAT) and that included FRAUDULENT, outdated information. Video courtesy @johnbrda & @AlfromBoston617.

Who reviews Form 211 submissions? Introducing Yvonne Huber (Yvonne.Huber@finra.org, 240-386-5034), Vice President OTC Compliance and Short Sale Regulation. Yvonne previously served as VP of Market Regulation at FINRA. What an interesting crossover of responsibilities! 🤔

I'd like everyone to take a peek at the @SEC Roundtable on Regulatory Approaches to Combating Retail Investor Fraud featuring recorded comments from Yvonne Huber on Pages 80-82, 85-86, 91-92, 95-96, 99 (pg 21-26 of the pdf). This is going to get juicy. 😏

sec.gov/spotlight/equi…

sec.gov/spotlight/equi…

Ms. Huber has worked at FINRA for over 32 years. She's admittedly been around since the inception of the Form 211 filing process. She heads the OTC compliance team and specializes in surveillance/investigations in fraudulent activity AND short sale regulatory responsibilities.

Here Ms. Huber explicitly states the responsibility of her team, OTC compliance, in reviewing Form 211 applications from broker-dealers (like GTS and Canaccord 🤓). They look for deficiencies, red flags, or discrepancies. You know...like information from Torchlight in 2012?

Continued on Page 82, Ms. Huber states after deficiencies or discrepancies have been addressed, FINRA allows the broker-dealer to begin quoting the security. Again, she emphasizes the COMPLIANCE review.

Page 85 features Troy Carlson, SVP @ FIG Partners commending the effort to transition Form 211 into an electronic submission. Ms. Huber calls additional attention to "onus on the broker-dealers" for potential fraud.

Is there a theme here? Seems important...

Is there a theme here? Seems important...

Page 86 Ms. Huber acknowledges that red flags aren't typically caught in the submission information alone, but rather in their inquiry back to the firm for additional information.

Page 91 - My personal favorite quote from Ms. Huber regarding retail investor protection. "If you let frauds go through, if you let companies who are frauds be traded and quoted, in time, that's going to erode investor confidence."

Yvonne Huber...$MMTLP TRADING FRAUD IS ON YOU!

Yvonne Huber...$MMTLP TRADING FRAUD IS ON YOU!

$MMTLP Do you need more validation? How about @johnbrda not receiving responses back? Why would she answer when the truth reveals either gross incompetence or collusion? You know the answer... #FINRAfraud

https://twitter.com/johnbrda/status/1611010505123979264?s=20&t=pNRvhpskhLUuOnpZIvenWg

• • •

Missing some Tweet in this thread? You can try to

force a refresh