How to get URL link on X (Twitter) App

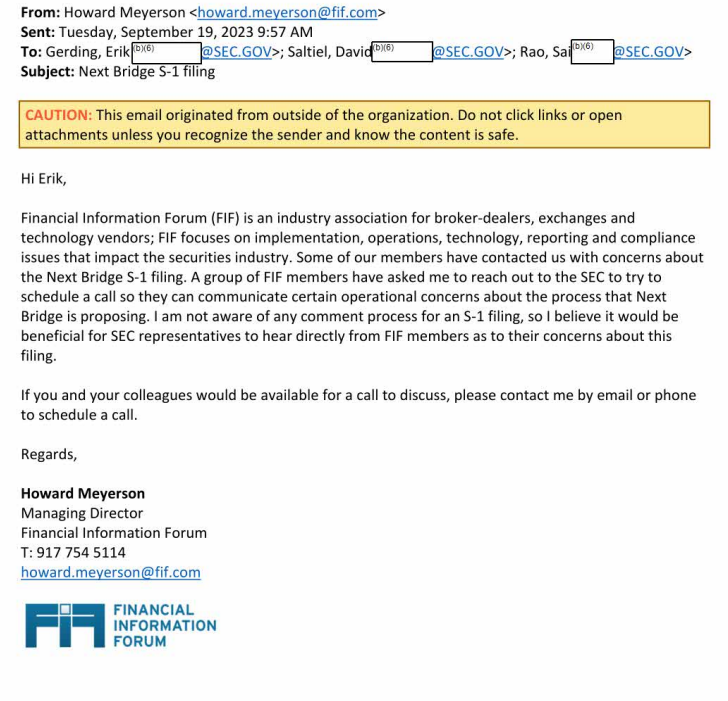

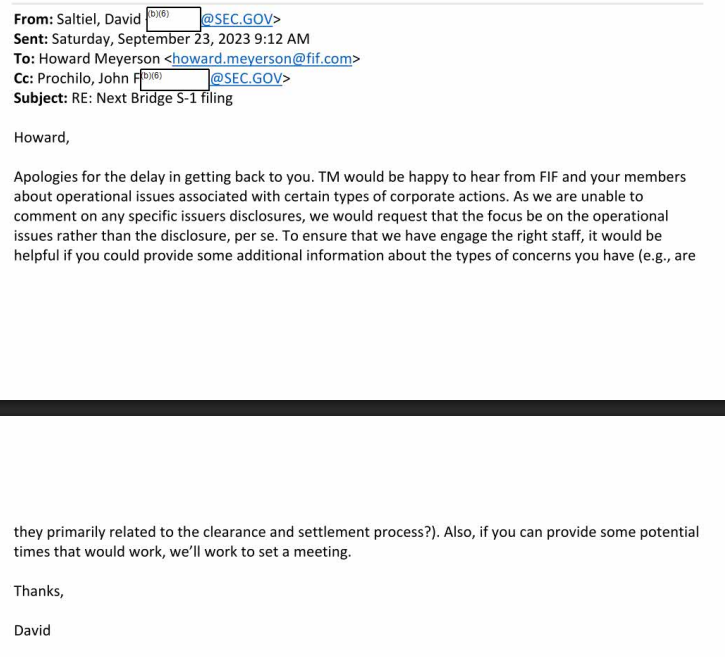

Pg 2 - David Saltiel responds...cautiously.

Pg 2 - David Saltiel responds...cautiously.

https://x.com/bleedblue18/status/1639354486190661638?s=20

12. Were the right number of Next Bridge shares distributed in connection with the corporate action?

12. Were the right number of Next Bridge shares distributed in connection with the corporate action?

It was clearly stated in the SEC approved proxy statement that the Series A Preferred shares were not to be listed or traded on any exchange. Additionally on June 21, 2021, the Options Clearing Corporation (OCC) released a memo stating the settlement of the Series A Pref shares… twitter.com/i/web/status/1…

It was clearly stated in the SEC approved proxy statement that the Series A Preferred shares were not to be listed or traded on any exchange. Additionally on June 21, 2021, the Options Clearing Corporation (OCC) released a memo stating the settlement of the Series A Pref shares… twitter.com/i/web/status/1…