GM $bbby tomorrow is finally here! Sunday, February 5th, today is a FULL MOON!!🌝

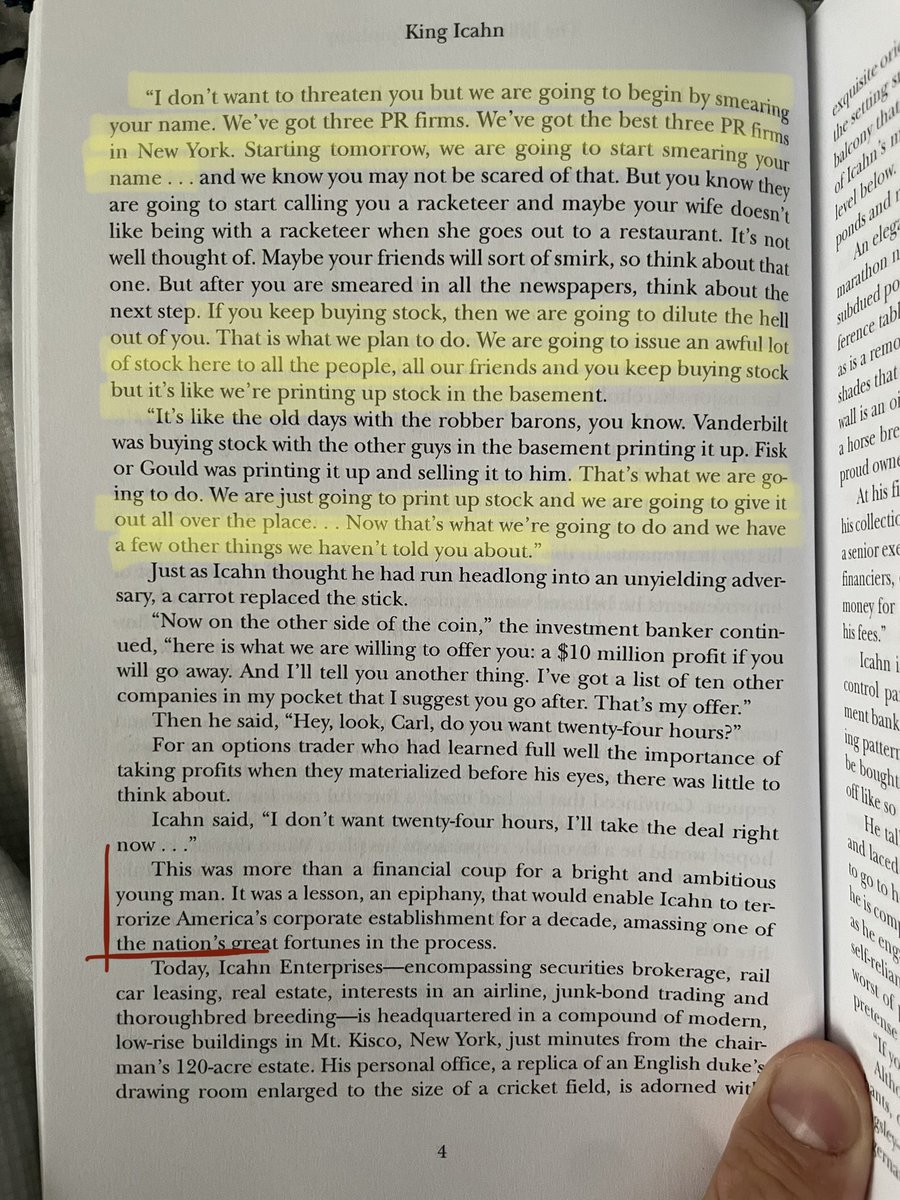

I'm going to share insight on what happened 2/1 and why I believe today (or very soon) we may see @Carl_C_Icahn tweet, "IEP has acquired Bed Bath in a majority-equity transaction for $45/share."

I'm going to share insight on what happened 2/1 and why I believe today (or very soon) we may see @Carl_C_Icahn tweet, "IEP has acquired Bed Bath in a majority-equity transaction for $45/share."

In case you missed Friday's post, here's a brief introduction of the general conditions surrounding $bbby indicating a hostile bond takeover has been in the works for several months now.

https://twitter.com/pirateportfo/status/1621646625696546816?s=46&t=D9_zc29qlHN8QlMfLmxr4Q

2/1 was an interesting day. The WSJ reported bond payments had been missed, but the stock price remained green. Bond prices rose that day and over the week; 24s from 1.20c to 6.50c (!), 34s from 2.01c to 4.56c, 44s from 3.41c to 4.79c. Large volume too, particularly the 44s.

What else happened 2/1?

Fidelity "cost-to-borrow" of the stock had steadily risen ~10% a day for several days in January (thanks for the chart @MikeLeClair16) almost always premarket.

1/31: 8:30am (EST), 1/30: 9:15am, 1/27: 7:45am, 1/26: 5:00am (time stamps verified on r/bbby)

Fidelity "cost-to-borrow" of the stock had steadily risen ~10% a day for several days in January (thanks for the chart @MikeLeClair16) almost always premarket.

1/31: 8:30am (EST), 1/30: 9:15am, 1/27: 7:45am, 1/26: 5:00am (time stamps verified on r/bbby)

CTB entered 2/1 at 160% n did not move that morning or in trading. Following a day of bond activity and news of missed payments, CTB finally rose from 160%->180% near the end of AH (5:15pm).

The next morning of 2/2, CTB rose from 180%->225%->250% (8:00am, 8:20am) @MikeLeClair16

The next morning of 2/2, CTB rose from 180%->225%->250% (8:00am, 8:20am) @MikeLeClair16

A staggering 90% (9,000 bps, nerds) increase in CTB from Fidelity in 15 hours. For ref, Gamestop all time high CTB with Fidelity is 38% from June of 2022. I believe it peaked at 30% in Jan 2021? Source?

$bbby cost-to-borrow is now at 265% this weekend.

$bbby cost-to-borrow is now at 265% this weekend.

https://twitter.com/741trey/status/1534628145848270848?s=46&t=D9_zc29qlHN8QlMfLmxr4Q

What else happened 2/2?

Many will remember the stock price rose dramatically the following morning from $2.85 to roughly $4.12 in premarket and again in after hours trading (thanks for the images @741trey)

Many will remember the stock price rose dramatically the following morning from $2.85 to roughly $4.12 in premarket and again in after hours trading (thanks for the images @741trey)

It's impossible to say with certainty what happened on 2/1, but these details seem to imply an event happened, or otherwise matters changed. The market moved.

We've been waiting for this acquisition to close, was that it?

We've been waiting for this acquisition to close, was that it?

If the acq. did close on Wed (or possibly Fri when the 2/1 bond purchases settle), the company has until Tue, 2/7 (or 2/9) to report an occurrence of a reportable event. **It's very much unclear if these events constitute the closing of an acq. however.**

Remains to be seen...

Remains to be seen...

Whatever happened, let's take a second to remember that Bed Bath has financial incentive to execute a deal (or bankruptcy) as quickly as possible. According to the 1/26 10-Q, the JPM default accrues 2% interest beginning 1/25, officially putting the company on the clock.

Why have they taken so long? Wen ch. 11?

We don't know, but it has. All we can do is guess. What we ~do~ know is indicators of an enormous short squeeze have been building. Here you can see the absurdity of the recent 4.8m "failure-to-delivers" and ORTEX shares on loan buildups.

We don't know, but it has. All we can do is guess. What we ~do~ know is indicators of an enormous short squeeze have been building. Here you can see the absurdity of the recent 4.8m "failure-to-delivers" and ORTEX shares on loan buildups.

I'm going to suggest it's ~possible~ everybody knows a squeeze is imminent, including the co, and Bed Bath waited to miss FILO and bond payments as to prove in a future court of law that M/A was necessary for survival and the board has a fiduciary duty to execute it.

Doesn't really matter if that's true. All we can do now is wait, or look ahead at the company schedule to guess if there might be some evidence of clues.

The schedule is empty, other than the 3/3 coupon deadline of the 30-Day Grace Period. Earnings wouldn't be until late March.

The schedule is empty, other than the 3/3 coupon deadline of the 30-Day Grace Period. Earnings wouldn't be until late March.

As a meaningless exercise, I decided to go through February and circle dates I would make an announce myself. My rules;

-Sun/Mon/Tue, allowing markets the week to react

-Avoid major events or holidays

-Minimize default interest $$

-Sun/Mon/Tue, allowing markets the week to react

-Avoid major events or holidays

-Minimize default interest $$

Given there are no more scheduled events this month, the financial incentive to avoid default interest, the activity analyzed on 2/1 and 2/2, and that this weekend is the final weekend to dominate news coverage...

I won't be surprised if the announcement is today 🌝

I won't be surprised if the announcement is today 🌝

DISCLAIMER: I am just guessing of this event based on public info. If I'm wrong, I will roll my 2/17 calls into 4/21 starting Tue and will wait to see what happens w the bonds.

I am just an architect and amateur corporate raider. You're an idiot if you trade on this conclusion.

I am just an architect and amateur corporate raider. You're an idiot if you trade on this conclusion.

And as usual, "pin your shit or fuck off" 🏴☠️🏴☠️

Oh, and @Carl_C_Icahn birthday is Feb 16th. I'd want to get my work done before celebrating too 👀

Oh, and @Carl_C_Icahn birthday is Feb 16th. I'd want to get my work done before celebrating too 👀

• • •

Missing some Tweet in this thread? You can try to

force a refresh