How to get URL link on X (Twitter) App

https://twitter.com/pirateportfo/status/1643211914640773120?s=20April 5th, 2023: "Why Would Perella Weinberg Advise Bondholders to Exchange for Equity?"

https://twitter.com/pirateportfo/status/1643574321401716736?s=20

To begin, these figures were reported in FY22 Q3 earnings for the period ending Nov 26th. Much has changed in the six+ months since.

To begin, these figures were reported in FY22 Q3 earnings for the period ending Nov 26th. Much has changed in the six+ months since.

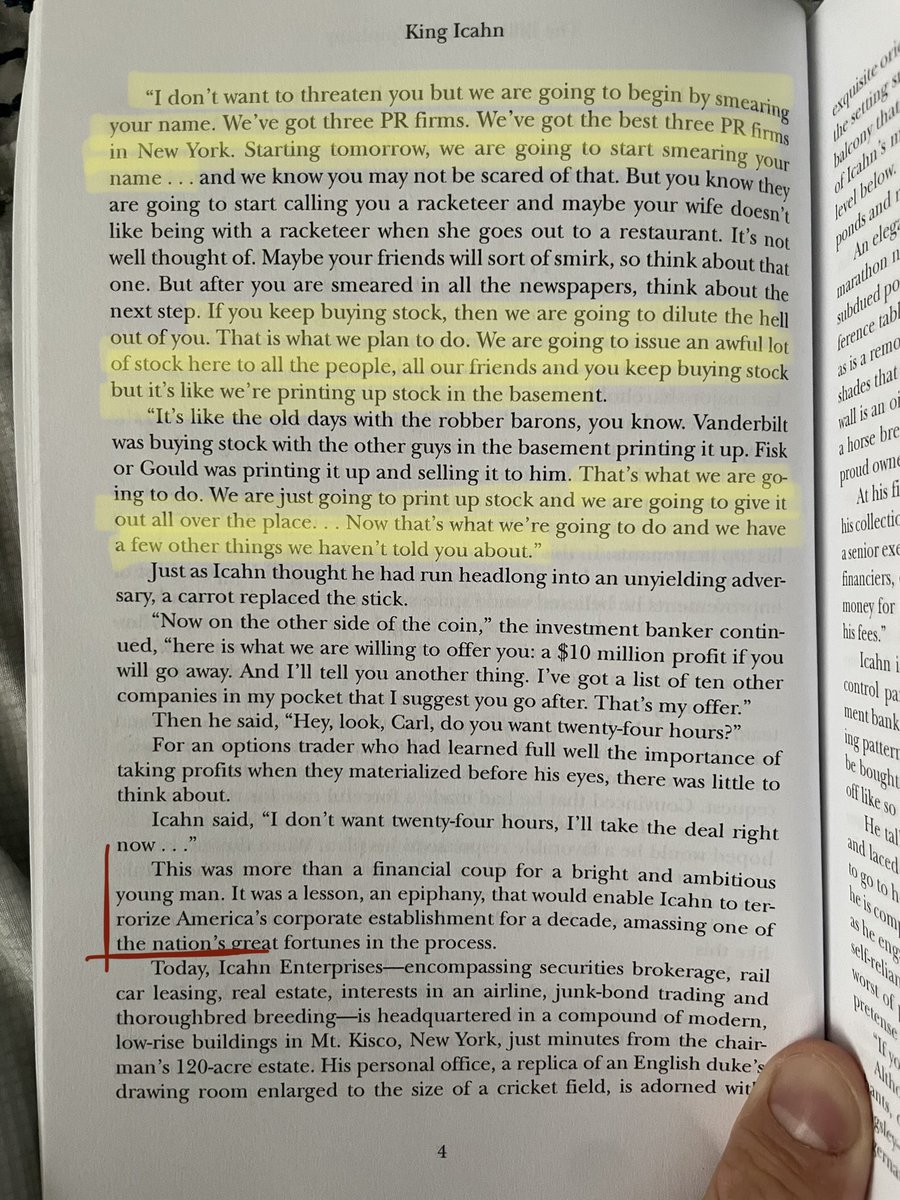

“Convinced that he had made a forceful case for reconfiguring the business, Icahn paced like an expectant father, waiting for what he hoped would be a favorable response to his plan.”

“Convinced that he had made a forceful case for reconfiguring the business, Icahn paced like an expectant father, waiting for what he hoped would be a favorable response to his plan.”

This six page Kirkland and Ellis paper (2009) details Sponsored Buyouts and the Plan Sponsor Transaction through Chapter 11 bankruptcy proceedings. The following quotes will summarize the paper, but it's worth a full read.

This six page Kirkland and Ellis paper (2009) details Sponsored Buyouts and the Plan Sponsor Transaction through Chapter 11 bankruptcy proceedings. The following quotes will summarize the paper, but it's worth a full read.

https://twitter.com/pirateportfo/status/1638138415299579905?s=20"Given that BABY is estimated to reach $1.5 billion in sales in Fiscal Year 2023 with a double-digit growth profile and at least 50% digital penetration, we believe it is likely much more valuable than the Company's entire market capitalization today."

https://twitter.com/pirateportfo/status/1630181171845013505?s=20"Freeman Capital advocates for a debt realignment that does not change or affect the control. BBBY's effective realignment is a top priority for Freeman Capital and is made in the context of a disinterested shareholder-"

https://twitter.com/pirateportfo/status/1630181140245143552"On or around January 13, 2023, certain events of default were triggered under the Company’s Credit Facilities (as defined below) as a result of the Company’s failure to prepay an overadvance and satisfy a financial covenant, among other things."

In case you missed Friday's post, here's a brief introduction of the general conditions surrounding $bbby indicating a hostile bond takeover has been in the works for several months now.

In case you missed Friday's post, here's a brief introduction of the general conditions surrounding $bbby indicating a hostile bond takeover has been in the works for several months now.https://twitter.com/pirateportfo/status/1621646625696546816?s=46&t=D9_zc29qlHN8QlMfLmxr4Q