Some of my favorite lessons from Beating the Street by Peter Lynch:

1. Flexibility. A growth fund is forced to buy overpriced companies every few years.

1. Flexibility. A growth fund is forced to buy overpriced companies every few years.

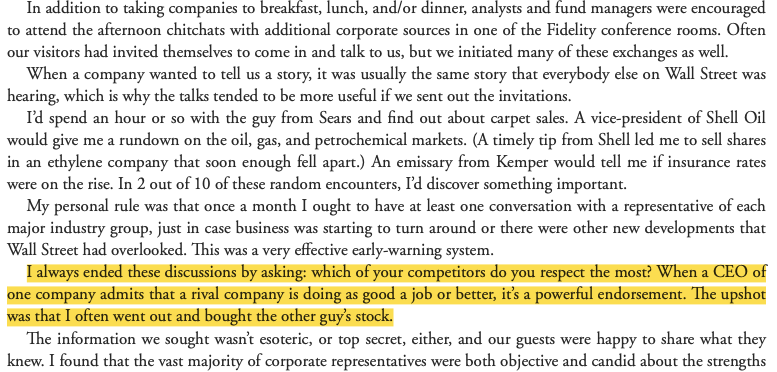

2. He always ended his discussions with management by asking them which competitor they respected the most?

A smart and efficient way to discover new investment ideas!

A smart and efficient way to discover new investment ideas!

3. Growth is good. But so is cheapness!

In 1979, his Magellan Fund's top 10 companies had P/E ratios between 3-5.

"Small is not only beautiful, it also can be lucrative"

In 1979, his Magellan Fund's top 10 companies had P/E ratios between 3-5.

"Small is not only beautiful, it also can be lucrative"

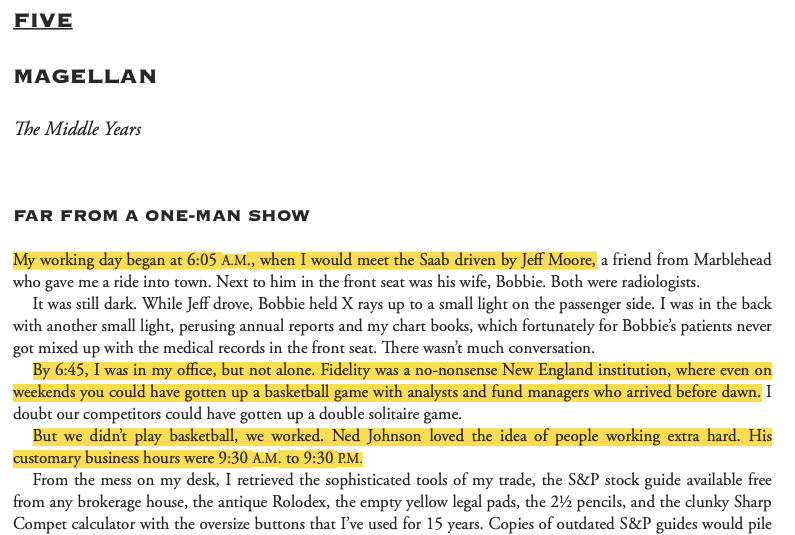

4. No substitute to doing the legwork.

"By 6:45, I was in my office, but not alone. Fidelity was a no-nonsense New England institutions."

Explains why Fidelity produced so many greats in the 1970s; Lynch, Allan Gray, Andrew Bolton etc.

"By 6:45, I was in my office, but not alone. Fidelity was a no-nonsense New England institutions."

Explains why Fidelity produced so many greats in the 1970s; Lynch, Allan Gray, Andrew Bolton etc.

5. Not all common stocks are equally common.

I liked this section because managing a 900-stock portfolio sounds so wild.

That said, in the introduction, Lynch admitted his Kodak Pension Fund portfolio performed much better than Magellan as it was more concentrated.

I liked this section because managing a 900-stock portfolio sounds so wild.

That said, in the introduction, Lynch admitted his Kodak Pension Fund portfolio performed much better than Magellan as it was more concentrated.

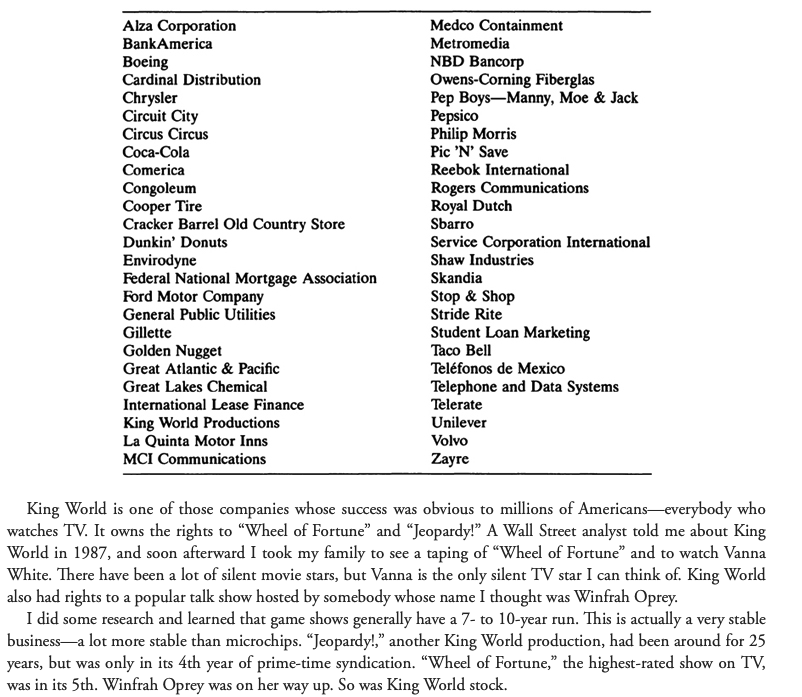

6. Magellan's most important 50 stocks between 1977-1990.

The second half of the book is more interesting for stock pickers. Worth looking at the multiples he paid and the growth some achieved.

Also, check out his hilarious comment on Oprah Winfrey in the first paragraph!

The second half of the book is more interesting for stock pickers. Worth looking at the multiples he paid and the growth some achieved.

Also, check out his hilarious comment on Oprah Winfrey in the first paragraph!

7. Legwork, legwork and more legwork!

In 1987 he recommended 226 stocks for Barron's.

“I’ve always believed that searching for companies is like looking for grubs under rocks: if you turn over 10 rocks you’ll likely find one grub; if you turn over 20 rocks you’ll find two."

In 1987 he recommended 226 stocks for Barron's.

“I’ve always believed that searching for companies is like looking for grubs under rocks: if you turn over 10 rocks you’ll likely find one grub; if you turn over 20 rocks you’ll find two."

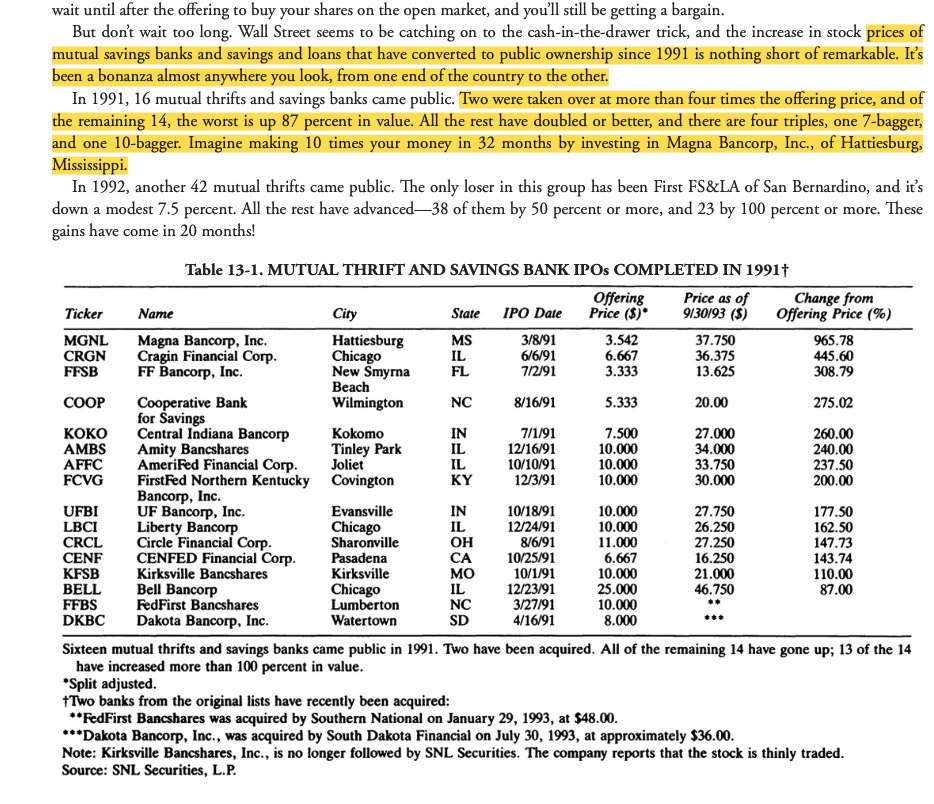

8. The Savings & Loans (S&L) crisis

Chapter 12 & 13 were my favourite chapters. Real insights into Lynch's S&L exploits.

Buying when there's panic, how to read a bank's financials, why they IPO'd so cheaply.

i.e. Glacier Bancorp was a 12-15% grower at 5x P/E.

Chapter 12 & 13 were my favourite chapters. Real insights into Lynch's S&L exploits.

Buying when there's panic, how to read a bank's financials, why they IPO'd so cheaply.

i.e. Glacier Bancorp was a 12-15% grower at 5x P/E.

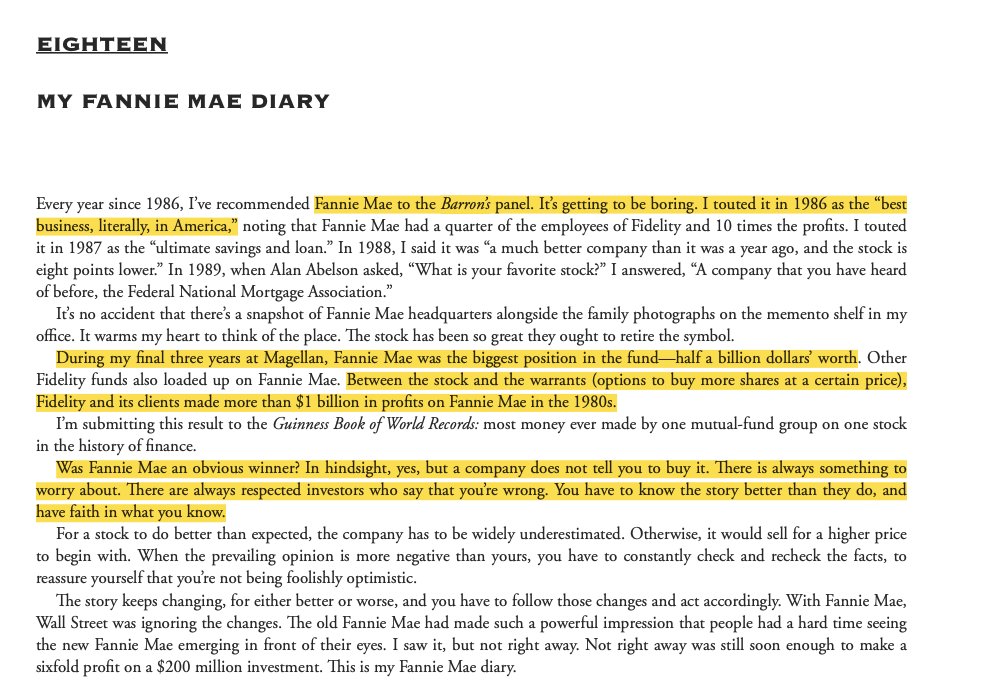

9. "My Fannie Mae Diary"

1980s was a golden period for both Fannie Mae and Freddie Mac.

Buffett, Louis Simpson, the Sequoia Fund etc were also large shareholders.

This chapter has a good overview of why so many great investors loved the stock in the 1980s.

1980s was a golden period for both Fannie Mae and Freddie Mac.

Buffett, Louis Simpson, the Sequoia Fund etc were also large shareholders.

This chapter has a good overview of why so many great investors loved the stock in the 1980s.

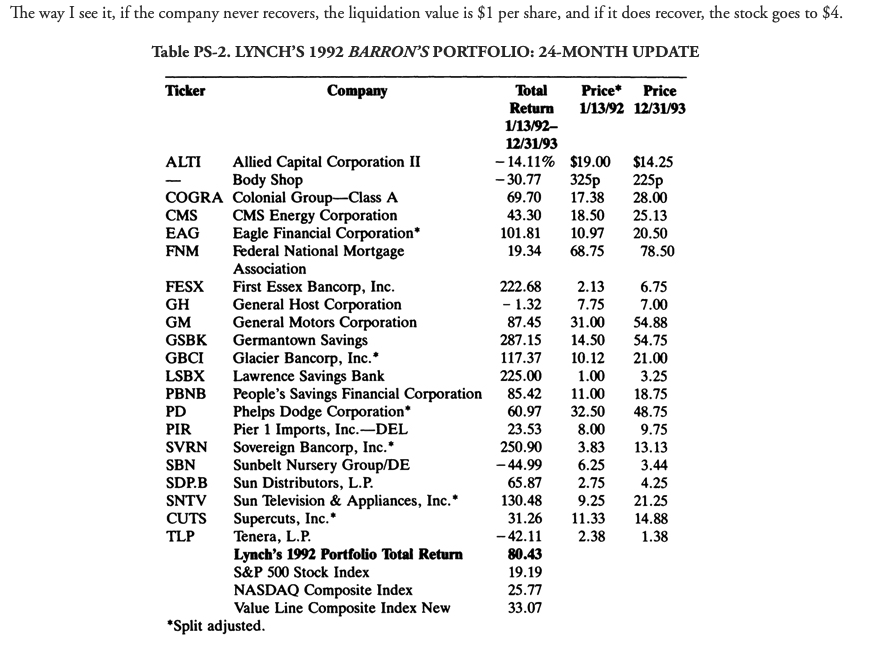

10. His Barron's portfolio annualised 32% after he left Magellan.

“So far, the best performers of my 21 Barron’s picks are the S&Ls. Take the industry that’s surrounded with the most doom and gloom, and if the fundamentals are positive, you’ll find some big winners.”

-P Lynch

“So far, the best performers of my 21 Barron’s picks are the S&Ls. Take the industry that’s surrounded with the most doom and gloom, and if the fundamentals are positive, you’ll find some big winners.”

-P Lynch

• • •

Missing some Tweet in this thread? You can try to

force a refresh