Founder of Jenga Investment Partners. Global equities investor. Exploring the world for the best investments. Not investment advice.

How to get URL link on X (Twitter) App

Apple Inc

Apple Inc

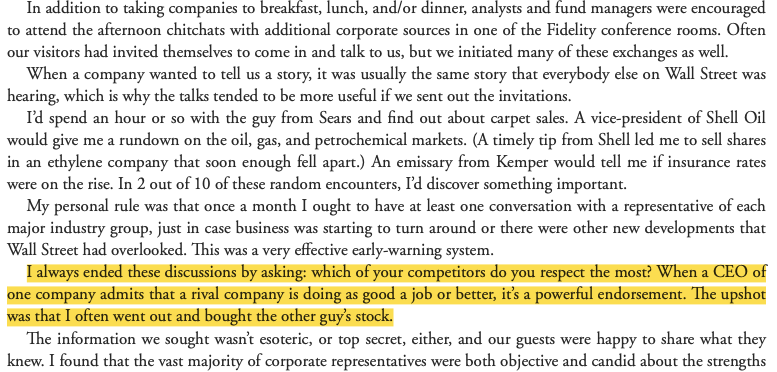

2. He always ended his discussions with management by asking them which competitor they respected the most?

2. He always ended his discussions with management by asking them which competitor they respected the most?

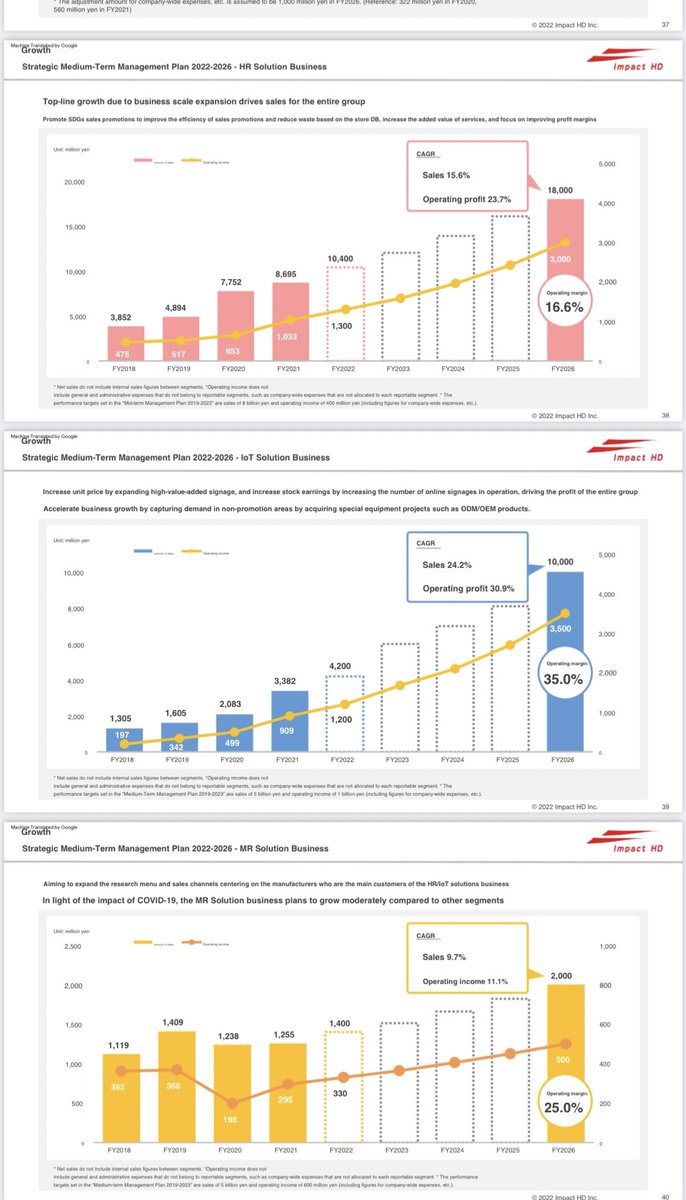

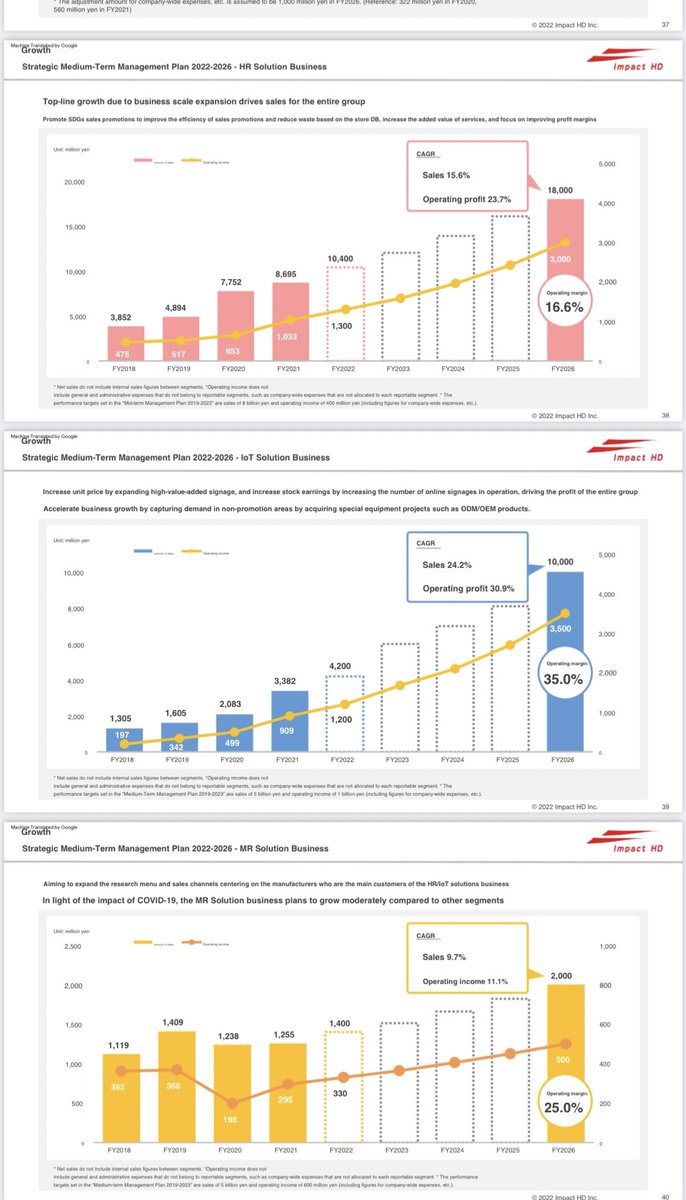

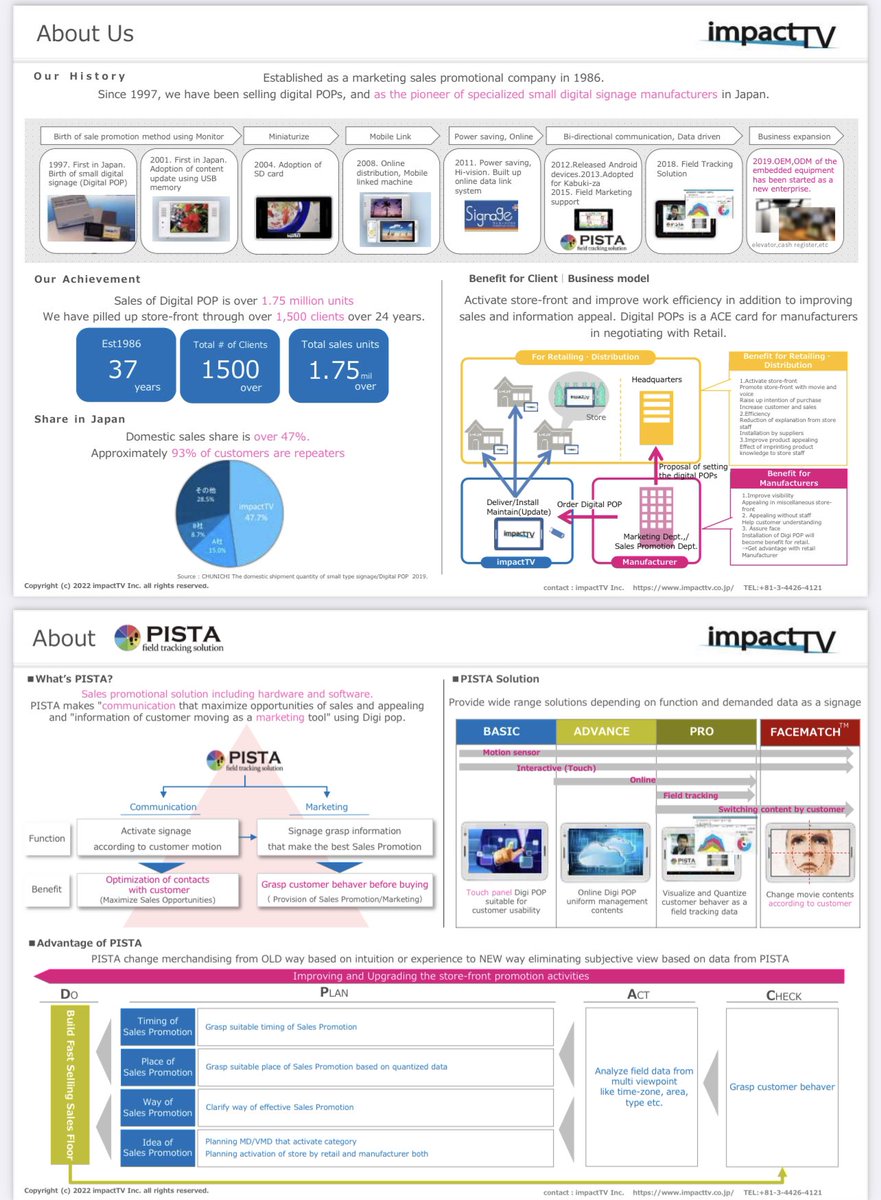

The growth is coming from a hidden Internet of things division, ImpactTV which makes digital signage for retailers to boost sales promotion efficiency.

The growth is coming from a hidden Internet of things division, ImpactTV which makes digital signage for retailers to boost sales promotion efficiency.

There's already some research into this topic, but what makes our research different is the breadth of markets covered, from Australia to Vietnam, our industry coverage, from healthcare to utilities and the depth of our case study research into specific outperformers.

There's already some research into this topic, but what makes our research different is the breadth of markets covered, from Australia to Vietnam, our industry coverage, from healthcare to utilities and the depth of our case study research into specific outperformers.