Richard and Christopher Chandler are arguably the best investing duo to ever live.

The brothers turned $10M into $5B over a 20-year span for a 36% CAGR!

Here's a thread on three of their biggest trades and three insights you can use in your own investing strategy ... 🧵

The brothers turned $10M into $5B over a 20-year span for a 36% CAGR!

Here's a thread on three of their biggest trades and three insights you can use in your own investing strategy ... 🧵

Background: Finding The Initial $10M Stake

The Brothers worked for the family department store "The Chandler House" through school.

While others learned elementary maths, they got MBAs.

After college, the bros sold the biz for $10M and started Sovereign Global Fund.

The Brothers worked for the family department store "The Chandler House" through school.

While others learned elementary maths, they got MBAs.

After college, the bros sold the biz for $10M and started Sovereign Global Fund.

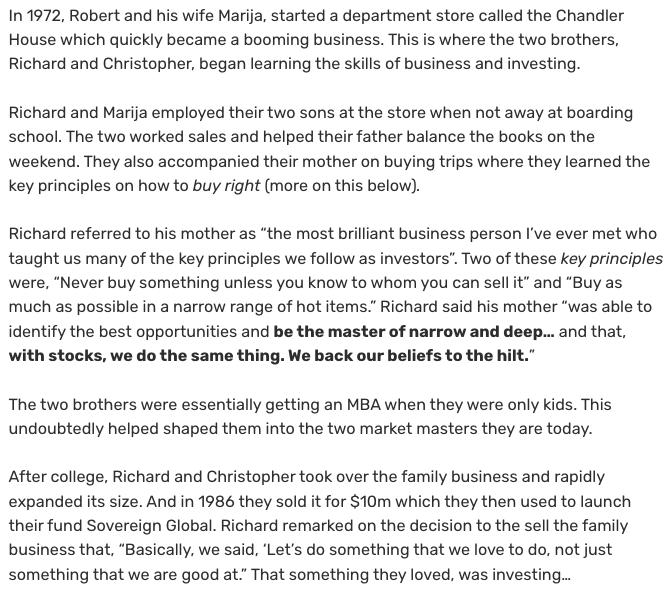

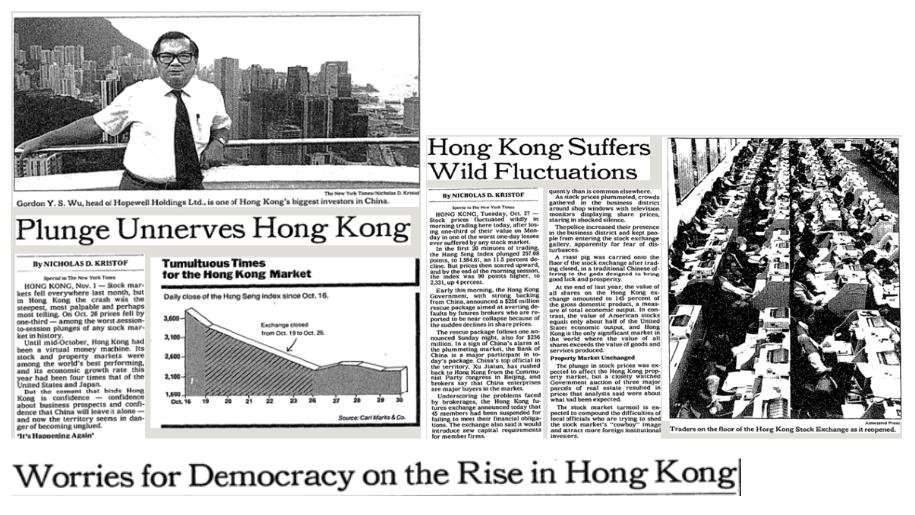

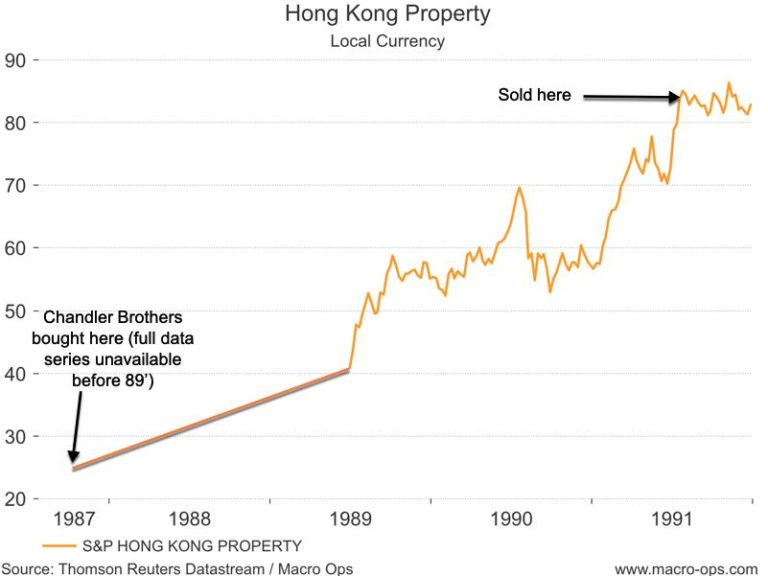

Trade 1: Hong Kong Office Space

At the time, HK real estate was down 70%+ from its peak. Leases were about to lapse. China was about to takeover.

Sentiment was AWFUL.

The brothers believed in their research and leveraged up to buy $27M of HK RE.

They then sold it for $110M.

At the time, HK real estate was down 70%+ from its peak. Leases were about to lapse. China was about to takeover.

Sentiment was AWFUL.

The brothers believed in their research and leveraged up to buy $27M of HK RE.

They then sold it for $110M.

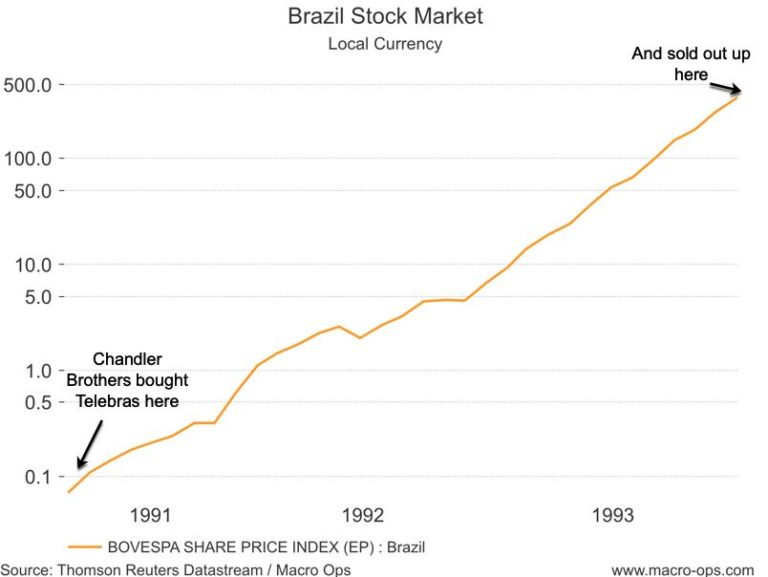

Trade 2: Brazilian Telecommunications

The brothers took their HK profits and shoved 75% of their fund into Brazilian telecom Telebras.

Here's why:

• Telebras traded at $200/line.

• Competitors traded at $2K/line.

• Replacement costs were $1,600/line.

• Bad sentiment

The brothers took their HK profits and shoved 75% of their fund into Brazilian telecom Telebras.

Here's why:

• Telebras traded at $200/line.

• Competitors traded at $2K/line.

• Replacement costs were $1,600/line.

• Bad sentiment

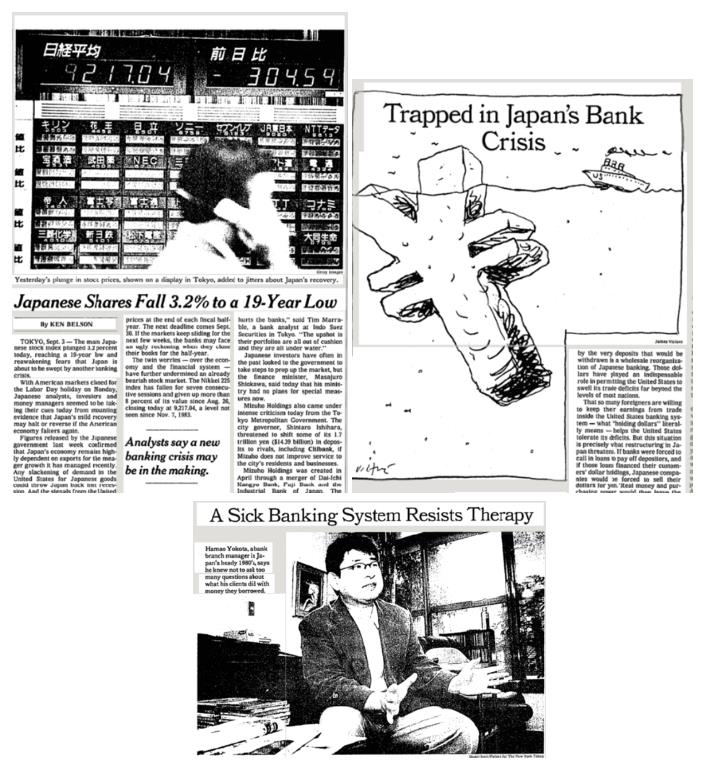

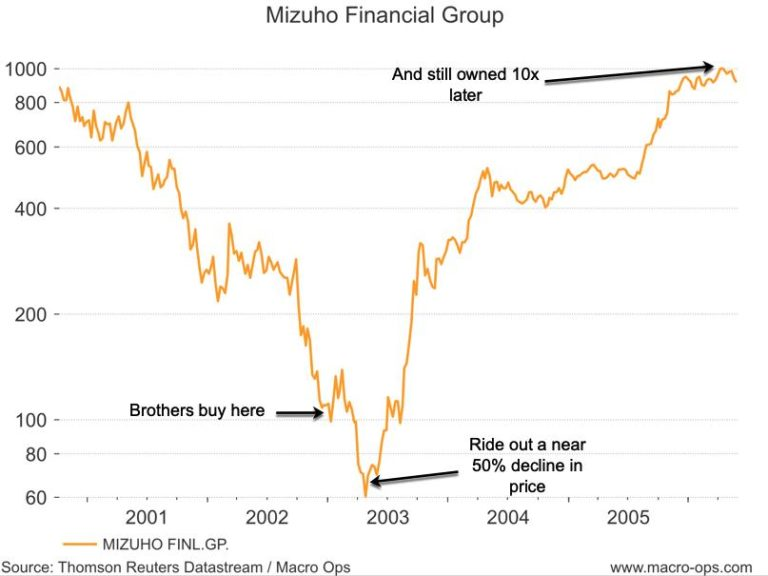

Trade 3: Japanese Banks

Japan was in a recession, it's stock market at 20yr lows, and its banks drowning in debt w/ mounting losses.

Against this backdrop, the Brothers invested $1B+ in UJF, Mizuho, and Sumitomo.

They held through a 50%+ drawdown and as of 2006, were up 10x!

Japan was in a recession, it's stock market at 20yr lows, and its banks drowning in debt w/ mounting losses.

Against this backdrop, the Brothers invested $1B+ in UJF, Mizuho, and Sumitomo.

They held through a 50%+ drawdown and as of 2006, were up 10x!

Recap: The Three Big Trades

The Chandler Brothers took $10M and turned it into $5B by placing mega bets on three trades:

• Hong Kong Real Estate

• Brazil's Telebras Telecom Company

• Japanese Banks

Let's dive into our Three Main Insights from their trades.

The Chandler Brothers took $10M and turned it into $5B by placing mega bets on three trades:

• Hong Kong Real Estate

• Brazil's Telebras Telecom Company

• Japanese Banks

Let's dive into our Three Main Insights from their trades.

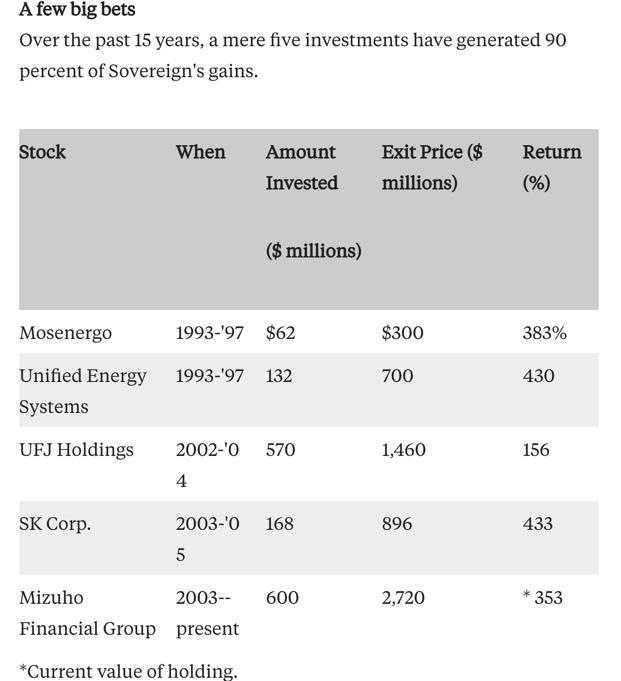

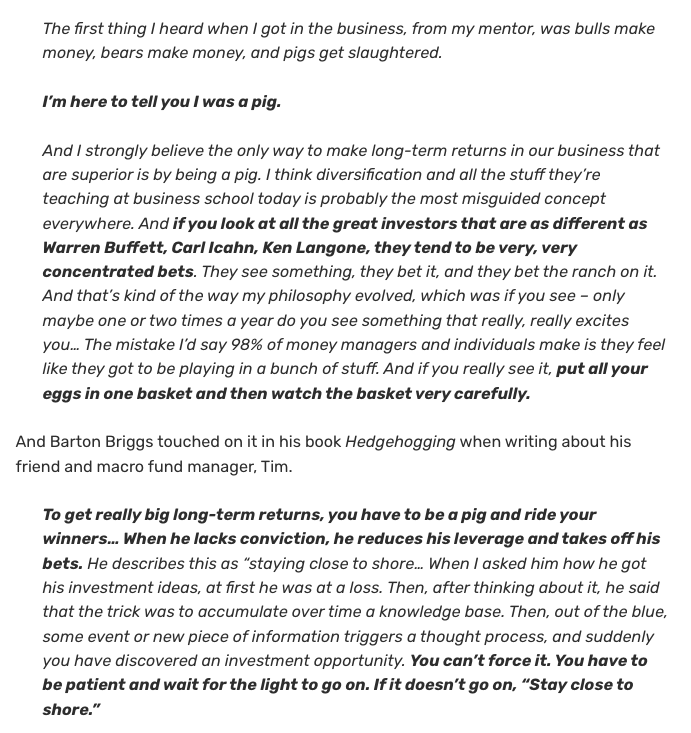

Insight 1: Big Bets Only

The Chandler Brothers bet BIG.

They plowed their entire fund into HK real estate.

Then invested 75% of their fund in one company (Telebras).

Then invested $1B+ into money-losing Japanese banks.

5 stocks generated 90% of returns for 15 years!

The Chandler Brothers bet BIG.

They plowed their entire fund into HK real estate.

Then invested 75% of their fund in one company (Telebras).

Then invested $1B+ into money-losing Japanese banks.

5 stocks generated 90% of returns for 15 years!

Insight 2: Invest During Max Pessimism

Did you notice that EVERY investment involved intense pessimism?

• Hong Kong: Depressed prices, China takeover, lease lapse

• Brazil: Runaway inflation, restricted foreign investment, unrest

• Japan Banks: Recession, losses, debt

🤔

Did you notice that EVERY investment involved intense pessimism?

• Hong Kong: Depressed prices, China takeover, lease lapse

• Brazil: Runaway inflation, restricted foreign investment, unrest

• Japan Banks: Recession, losses, debt

🤔

Insight 3: Earned Patience

Distressed investing requires EARNED patience.

The Chandler Brothers did the fundamental work to develop a variant perception.

Which allowed them to hold through 50%+ drawdowns.

How do you get this patience?

Deep fundamental research.

Distressed investing requires EARNED patience.

The Chandler Brothers did the fundamental work to develop a variant perception.

Which allowed them to hold through 50%+ drawdowns.

How do you get this patience?

Deep fundamental research.

Recap: The Three Investing Insights

• Big Bets Only

• Invest During Maximum Pessimism

• Earned Patience Through Deep Research

The best part is you can incorporate these insights into your strategy TODAY. macro-ops.com/the-chandler-b…

• Big Bets Only

• Invest During Maximum Pessimism

• Earned Patience Through Deep Research

The best part is you can incorporate these insights into your strategy TODAY. macro-ops.com/the-chandler-b…

Wrapping Up: Where To Learn More

Two other great resources for studying the Chandler Brothers:

• @NeckarValue thread:

• Institutional Investor Article: institutionalinvestor.com/article/b150nr…

I hope you enjoy learning more about this dynamic duo!

Two other great resources for studying the Chandler Brothers:

• @NeckarValue thread:

https://twitter.com/NeckarValue/status/1431258474726494214

• Institutional Investor Article: institutionalinvestor.com/article/b150nr…

I hope you enjoy learning more about this dynamic duo!

• • •

Missing some Tweet in this thread? You can try to

force a refresh