On the precipice of evolution, we arrive at a solution.

It’s time to get technical.

The rise of the Relic.

Part 2 of 4

A 🧵

It’s time to get technical.

The rise of the Relic.

Part 2 of 4

A 🧵

2/ In part 1, we explained that DeFi systems such as the MasterChef contract and veTokenmoics have become industry-wide standards.

https://twitter.com/beethoven_x/status/1616512064826273792?s=20&t=hb7yIV5tEHr6r5N-uKUBNA

3/ Upon analysis, It was evident that while renowned and revolutionary, both systems had major drawbacks.

The Reliquary presented itself as an innovative solution.

The Reliquary presented itself as an innovative solution.

4/ In Part 2, we go under the hood and discover why this is so.

We will uncover:

🔹 A Mature Yield model.

🔹 What is a Maturity Curve?

🔹 How do deposits Impact maturity?

🔹 The (NFT) solution to locking.

We will uncover:

🔹 A Mature Yield model.

🔹 What is a Maturity Curve?

🔹 How do deposits Impact maturity?

🔹 The (NFT) solution to locking.

5/ The Reliquary is an innovative primitive that offers an evolution of the MasterChef contract.

It also offers an alternative solution to the shortcomings of the current vote escrowed model.

It also offers an alternative solution to the shortcomings of the current vote escrowed model.

6/ This comes down to two key factors:

1⃣ A mature yield distribution model.

2⃣ Flexible, transferable, and composable NFTs

Let's break it down.

1⃣ A mature yield distribution model.

2⃣ Flexible, transferable, and composable NFTs

Let's break it down.

7/ 1⃣ A mature yield distribution model.

Compared to the MasterChef contract, the Reliquary emits liquidity mining rewards not only based on your staked LP size but also the age or ‘maturity’ of your staked LP.

Compared to the MasterChef contract, the Reliquary emits liquidity mining rewards not only based on your staked LP size but also the age or ‘maturity’ of your staked LP.

8/ 2⃣ Flexible, transferable, and composable NFTs

Additionally, through the use of financial NFTs, the Reliquary offers you the freedom and flexibility to enter a position without having to lock any capital away.

Additionally, through the use of financial NFTs, the Reliquary offers you the freedom and flexibility to enter a position without having to lock any capital away.

9/ A mature new model.

The core concept behind maturity is about finding a middle ground between the user and the protocol.

Quite simply, Reliquary is a system that encourages users to align behaviorally with the protocol.

The core concept behind maturity is about finding a middle ground between the user and the protocol.

Quite simply, Reliquary is a system that encourages users to align behaviorally with the protocol.

10/ Rather than locking tokens away, the Reliquary persuades users / DAOs to earn additional incentives/governance power by cultivating a position that grows over time.

In simple terms, the longer a position is held the more potent it becomes.

In simple terms, the longer a position is held the more potent it becomes.

11/ Maturity is broken down into various tiers or stages each of which corresponds to different levels of development.

As you approach a higher level of maturity, you gain access to higher amounts of liquidity mining rewards until the maximum level of maturity is obtained.

As you approach a higher level of maturity, you gain access to higher amounts of liquidity mining rewards until the maximum level of maturity is obtained.

12/ So, what kind of time frame are we talking about?

One of the features inherent to Reliquary is the ability for protocols to define their own specific maturity profile.

One of the features inherent to Reliquary is the ability for protocols to define their own specific maturity profile.

13/ This all comes down to the Maturity Curve the protocol utilises.

How about some examples?

Here are two 👇

• Linear Maturity

• Exponential Maturity

How about some examples?

Here are two 👇

• Linear Maturity

• Exponential Maturity

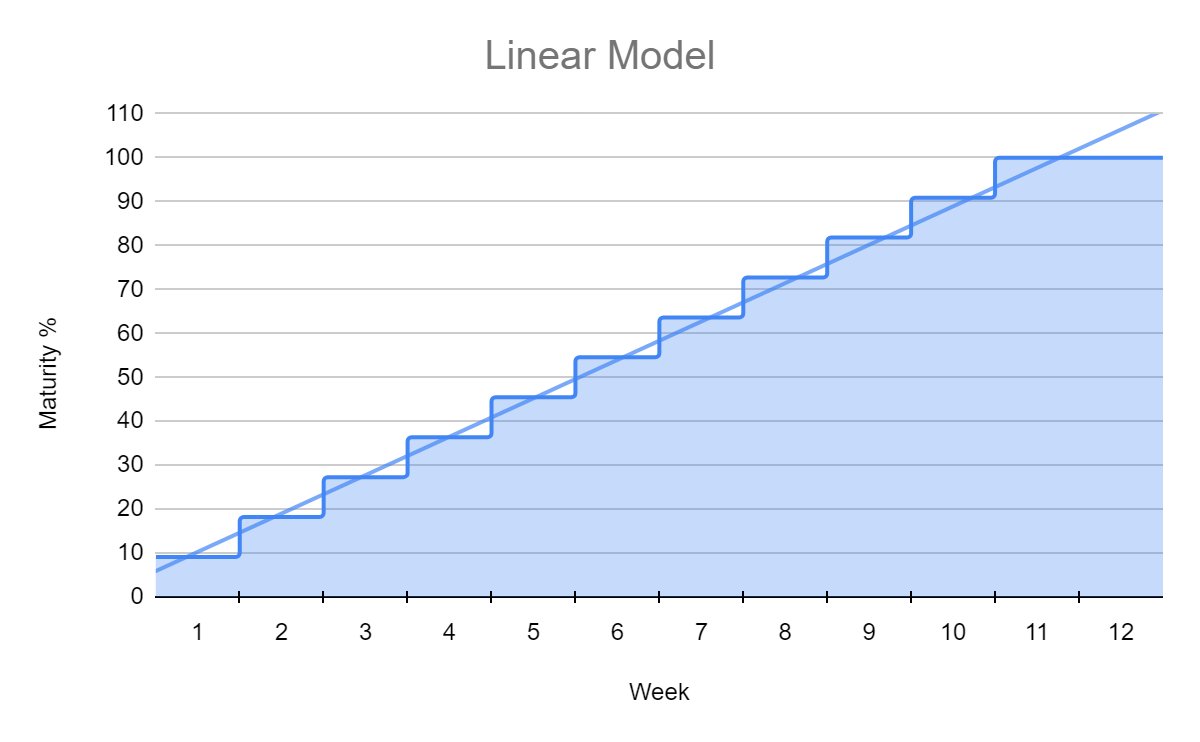

14/ The simplest maturity model would be linear.

You would receive rewards that increase in equal amounts each week until reaching maximum maturity.

Simple!

You would receive rewards that increase in equal amounts each week until reaching maximum maturity.

Simple!

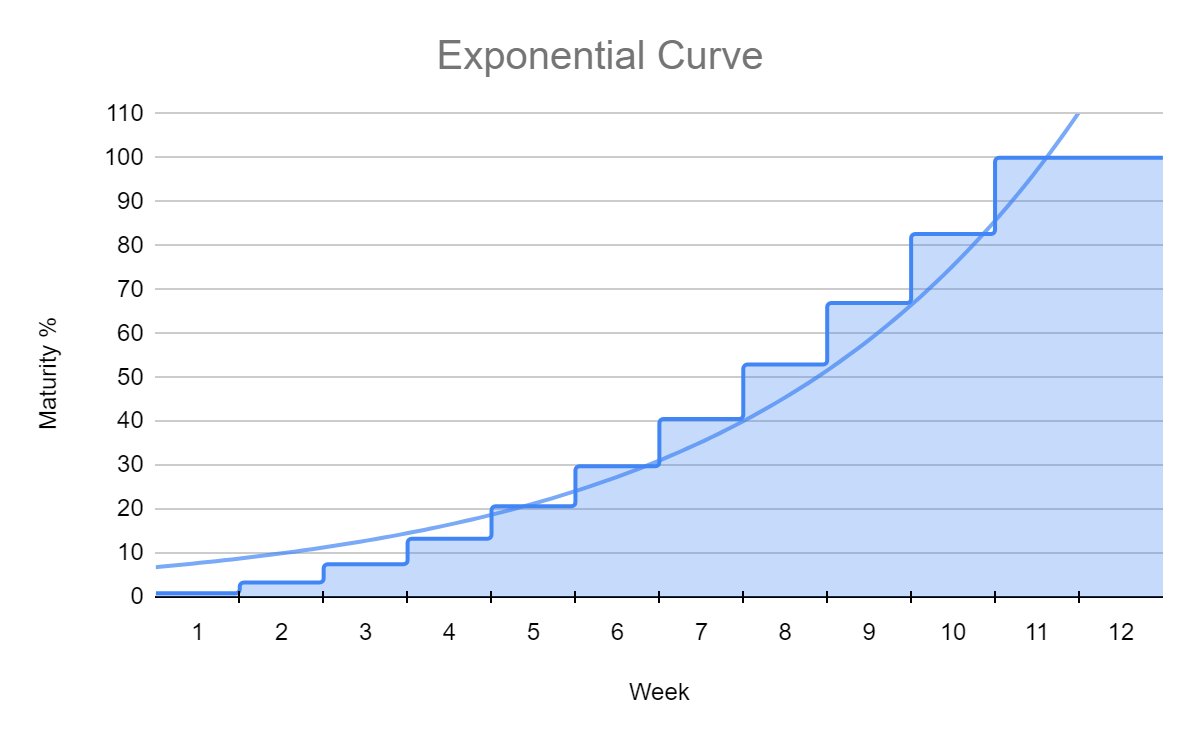

15/ Alternatively, protocols could implement an exponential maturity model.

Rather than increasing linearly, the maturity profile showcases an exponential curve with your rewards suddenly and rampantly increasing past an inflexion point.

Rather than increasing linearly, the maturity profile showcases an exponential curve with your rewards suddenly and rampantly increasing past an inflexion point.

16/ The above are just two examples of possible Maturity models.

The Reliquary contract is open source, so any protocol that chooses to implement the model has free reign to design the specific maturity profile it will utilize.

The Reliquary contract is open source, so any protocol that chooses to implement the model has free reign to design the specific maturity profile it will utilize.

17/Interesting. But, what ACTUALLY is maturity?

The maturity of a specific position is defined as "the elapsed seconds since the entry of your position."

Different levels/tranches are the elapsed second requirements set by the protocol.

The maturity of a specific position is defined as "the elapsed seconds since the entry of your position."

Different levels/tranches are the elapsed second requirements set by the protocol.

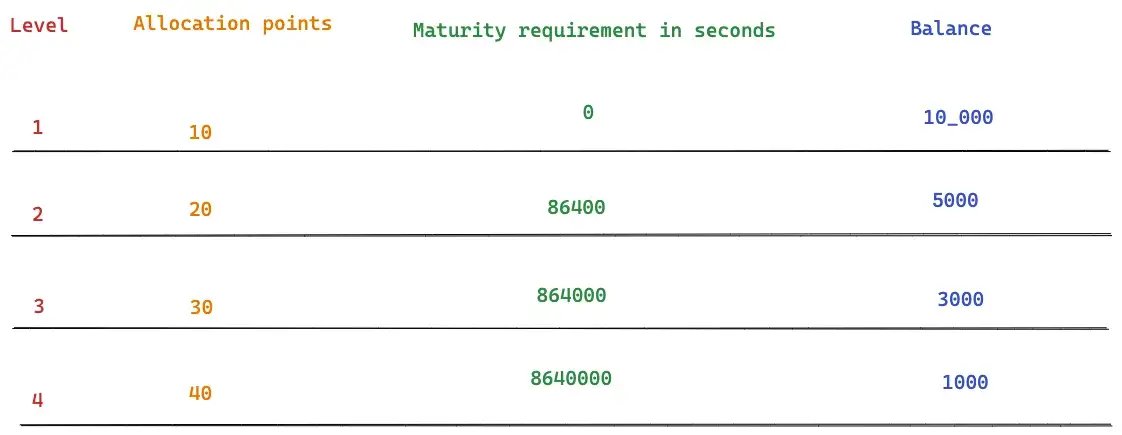

18/ Each maturity level that you pass boosts your position's rewards more than the previous level.

With each increasing level, the allocation points that flow to a position increase.

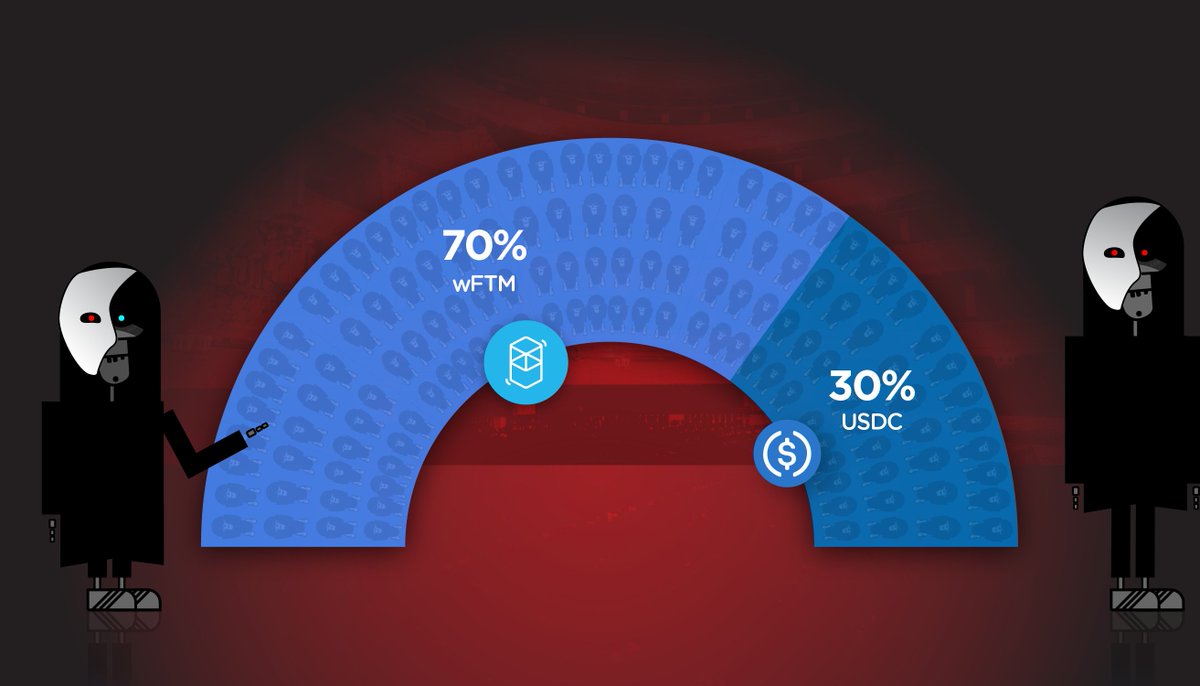

An example of this is shown below.

With each increasing level, the allocation points that flow to a position increase.

An example of this is shown below.

19/ Whereas the MasterChef contract distributes rewards to positions solely based on the fraction of your share of the total pool balance, the Reliquary also takes into account your position's maturity.

20/ For more technical information, @0xSkly works through exactly how this is calculated with step-by-step instructions in the factual and helpful article below.

medium.com/beethoven-x/re…

medium.com/beethoven-x/re…

21/ We've learnt that maturity is a function of the time you have held a position.

Thus, it makes sense that anytime you add to a position, your position becomes less mature.

Time only moves forward, after all...

Thus, it makes sense that anytime you add to a position, your position becomes less mature.

Time only moves forward, after all...

22/ However, instead of the position's maturity resetting to the base level, the Reliquary takes a weighted average of your new position's size relative to the initial entry.

The calculation is shown below 👇

The calculation is shown below 👇

23/ A general rule:

If you hold 1000 LP tokens and then deposit 10 more, the maturity will suffer a 1% penalty.

On the other hand, if you hold a balance of 10 LP tokens and deposit 1000 more, the maturity will suffer a 99% penalty.

If you hold 1000 LP tokens and then deposit 10 more, the maturity will suffer a 1% penalty.

On the other hand, if you hold a balance of 10 LP tokens and deposit 1000 more, the maturity will suffer a 99% penalty.

24/ What if you don't want to negatively impact your position?

Well...

Unlike the normal MasterChef contract, you can mint as many positions as you like.

This comes down to one fundamental difference:

Staked positions are not bound to a wallet address but to an NFT.

Well...

Unlike the normal MasterChef contract, you can mint as many positions as you like.

This comes down to one fundamental difference:

Staked positions are not bound to a wallet address but to an NFT.

25/ Rather than receiving an LP token as a receipt of a staked position, you receive a financial NFT known as a Relic.

You are free to mint as many Relics as you wish, with each one starting from level 0 maturity.

You are free to mint as many Relics as you wish, with each one starting from level 0 maturity.

26/ Transferable and flexible.

You can split, shift and merge Relics together.

You are also free to exit the position and remove the underlying LP tokens at any point!

You can split, shift and merge Relics together.

You are also free to exit the position and remove the underlying LP tokens at any point!

27/ A composable NFT receipt also allows for the possibility of secondary marketplaces.

As position rewards are dependent on time duration, the market will likely price mature positions higher than an immature position of the same size.

Time is valuable!

As position rewards are dependent on time duration, the market will likely price mature positions higher than an immature position of the same size.

Time is valuable!

28/ Besides liquidity mining rewards, Reliquary can also distribute voting power for governance tokens.

Innovative and evolving.

Voting power is no longer dictated by how long you are willing to lock tokens for, but by how long you have been a participant in the protocol!

Innovative and evolving.

Voting power is no longer dictated by how long you are willing to lock tokens for, but by how long you have been a participant in the protocol!

29/ The Reliquary allows you to enter an ecosystem and engage in governance, without being constrained to lock away capital.

Aligning your incentive to participate with the desired outcomes of the protocol in a more wholesome manner!

Aligning your incentive to participate with the desired outcomes of the protocol in a more wholesome manner!

30/ An innovative evolution. A progression of the ordinary into the beauty of the unknown.

The Rise of the Relic is imminent.

Keep your eyes peeled for part 3, where we break down the specifics regarding the $fBEETS Relic.

The Rise of the Relic is imminent.

Keep your eyes peeled for part 3, where we break down the specifics regarding the $fBEETS Relic.

https://twitter.com/beethoven_x/status/1623301377618329601?s=20&t=e0UQrXEYhi2Z-UHVALJaHA

• • •

Missing some Tweet in this thread? You can try to

force a refresh