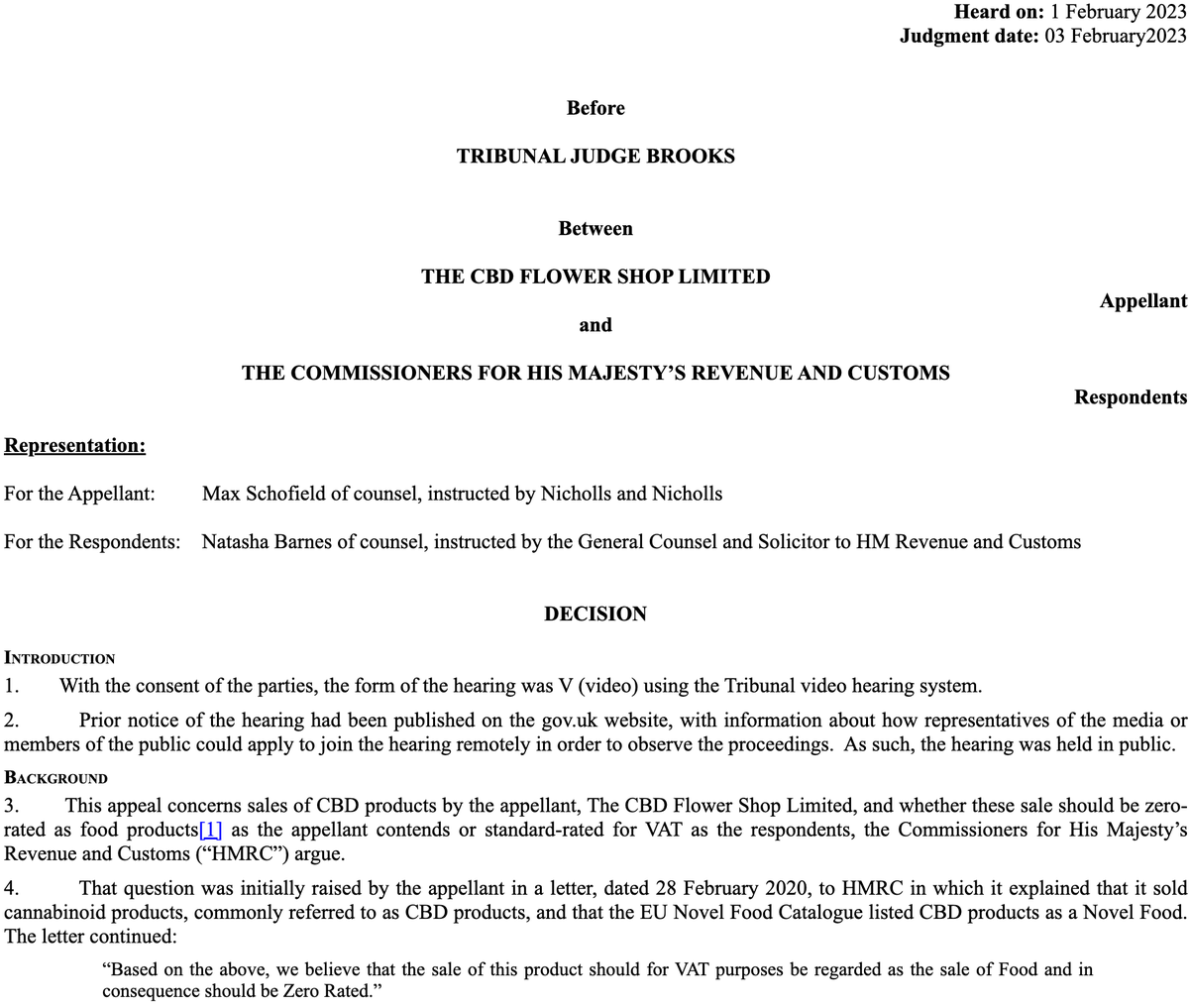

Super-fun VAT case coming soon on whether CBD "edibles" are a food benefiting from 0% VAT. bailii.org/uk/cases/UKFTT…

This was a preliminary hearing over whether HMRC could make a late new argument, that the products were illegal. #taxtwitter's own @maxschofield successfully argued they snoozed and losed.

Bad news for HMRC, who seem to have dropped the ball. Great news for connoisseurs of stupid VAT cases.

I'm hopeful this will join the A tier with jaffa cakes, mega marshmallows and, my favourite, the very specific rules for gingerbread men:

I'm hopeful this will join the A tier with jaffa cakes, mega marshmallows and, my favourite, the very specific rules for gingerbread men:

Why is VAT so stupid? Because any VAT exemption/zero rate has to be narrowly defined, and the definition will almost always be arbitrary.

The answer: have the absolute minimum number of exemptions and special rates. And, please god, don't create new ones: taxpolicy.org.uk/ebooks

The answer: have the absolute minimum number of exemptions and special rates. And, please god, don't create new ones: taxpolicy.org.uk/ebooks

h/t @PreachyPreach

• • •

Missing some Tweet in this thread? You can try to

force a refresh