A summary of announcements/highlights from #AGBT23 (in no particular order):

#AGBT23 cfDNA methylation profiling as a blood biomarker for Congestive Heart Failure. This is from the same team that gave you the @GrailBio Methylation Atlas, now applied to biomarker discovery. genomeweb.com/sequencing/agb…

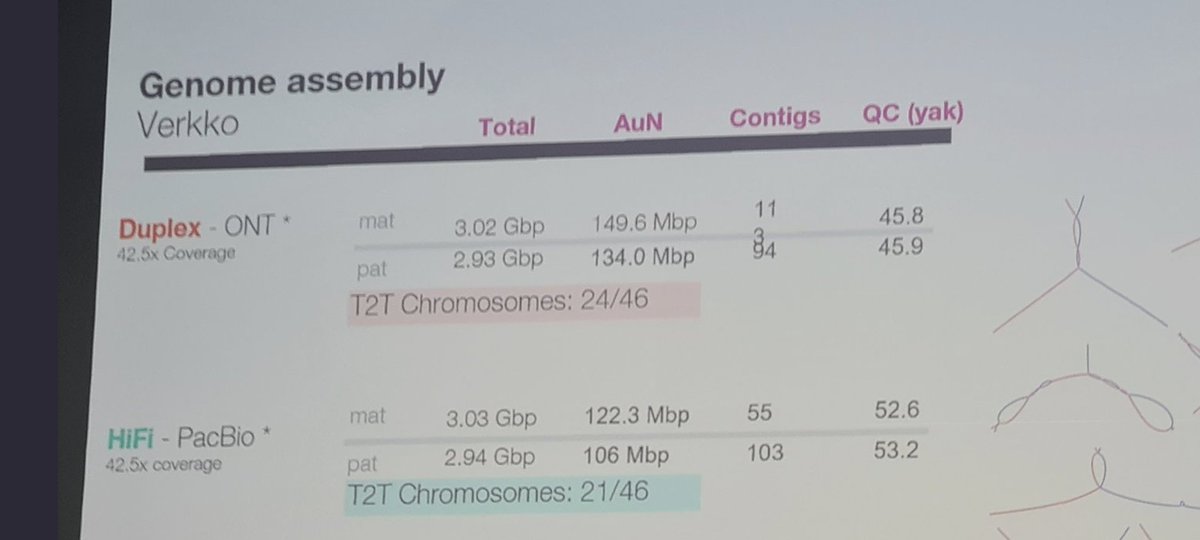

#AGBT23 Miga on the comparison between PacBio Revio and Oxford @nanopore High Duplex / UltraLong reads. PacBio 21/46 T2T and ONT 24/46 (higher is better). Ultralong reads scaffolding for both (unconfirmed) would mean ONT lead is even bigger.

#AGBT23 Nebula Genomics announces the $175 "Deep genome" offering. The caveat is that it requires a subscription which puts the total up to $450. That's the first sub-$200 genome 30x direct to consumer offering, discounting the subscription.

#AGBT23 Illumina Infinity reads are indeed the Longas "noisy polymerase" method (renamed land-marking). Unconfirmed 5x mark-up in $/Gb compared to short-reads, unconfirmed 5-10kb+ DNA sequence lengths.

#AGBT23 BD Rhapsody, single cell partitioning system, microwell tech, 1 cell + 1 bead/well. Cells lysed, retrieve beads, cDNA synthesis. New HT system, 8 lane cartridge, 267k microwells, 320k cells, partial use of cartridge. 24 plex, scCITE-Seq. Unconfirmed: Celsee tech.

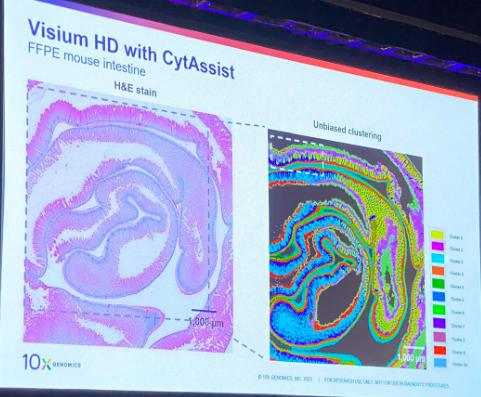

#AGBT23 @10xGenomics roadmap includes 5,000-plex RNA probes on Xenium imaging, and allele and Isoform mapping in situ; claim of no upper bound for density of RCA probes in situ.

#AGBT23 @10xGenomics, Chromium X/iX single cell updates, 1M > 8M cells/chip, 3', 5'-, ATAC, cell surface proteins. New 'Flex', any sample, cells fixed before analysis, 5x more multiplexing scale, more genes/cell. FFPE data looked better than frozen!

#AGBT23 Both @CompleteGenomic's and @ElemBio technologies capable of paired-end sequencing of inserts of 2kb and 3kb. Unconfirmed limit of Illumina NovaSeq at ~600bp? Unconfirmed limit of Illumina NextSeq 1000/2000 could be even lower?

#AGBT23 @CompleteGenomic's DNBSEQ-T7 pricing model for 3 sequencers and reagent commitment down to $1.5/Gb or $150/genome. Announced DNBSEQ-T20 capable of sequencing 50,000 genomes a year with machine included in the reagents for <$100/genome. linkedin.com/pulse/complete…

And final highlight, first known interaction in the world between Flo-Rida and genomicists. Unconfirmed: there will be a new music video recorded where Flo-Rida entourage is all from genomics community.

• • •

Missing some Tweet in this thread? You can try to

force a refresh