With the markets roaring back to life after a wild 2022, retail interest is slowly seeping back into the space.

In 2021, NFTs were responsible for onboarding huge waves of retail into crypto.

In 2023, as retail interest returns, an emerging sector, #NFTFi, could benefit.

In 2021, NFTs were responsible for onboarding huge waves of retail into crypto.

In 2023, as retail interest returns, an emerging sector, #NFTFi, could benefit.

1/ If NFTs and DeFi had a child, it would be NFTFi

NFTFi is essentially the intersection of DeFi and NFTs, bringing functions that are traditionally rooted in finance to the NFT space.

Think: borrowing, lending, derivatives, all with your NFTs.

NFTFi is essentially the intersection of DeFi and NFTs, bringing functions that are traditionally rooted in finance to the NFT space.

Think: borrowing, lending, derivatives, all with your NFTs.

2/ With NFTFi, you can take a loan on your NFT exposing you to upside on both your coins and NFT.

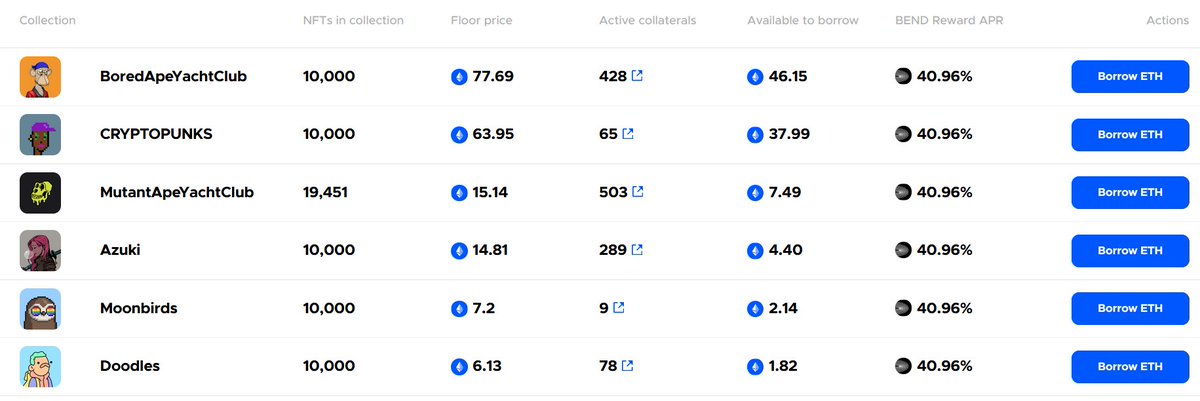

Protocols such as @BendDAO, @the_x2y2, @JPEGd69 and many more have long provided such services.

In fact, there are currently 428 Bored Apes being lent out right now, on BendDAO!

Protocols such as @BendDAO, @the_x2y2, @JPEGd69 and many more have long provided such services.

In fact, there are currently 428 Bored Apes being lent out right now, on BendDAO!

3/ NFT lending is probably the most utilised aspect of NFTFi at the moment, being one of the earliest primitives to emerge in this space.

At the point of writing this thread, we are fast approaching 50,000 loans made against NFTs.

A pretty big milestone for NFTFi! ✌️

At the point of writing this thread, we are fast approaching 50,000 loans made against NFTs.

A pretty big milestone for NFTFi! ✌️

https://twitter.com/1kxnetwork/status/1623362988693499904

4/ On the flip side, users might rent NFTs for specific NFT perks.

For an NFT-enabled game, NFTs can be borrowed for a specific period. Users can post collateral, in tokens, to receive the NFT for said period.

@TakerProtocol is one example, building for NFT lending and rentals.

For an NFT-enabled game, NFTs can be borrowed for a specific period. Users can post collateral, in tokens, to receive the NFT for said period.

@TakerProtocol is one example, building for NFT lending and rentals.

5/ But that's not all, with the growth of the NFTFi space, protocols have also emerged to fractionalise NFTs and trade them as fungible tokens.

This lowers the barrier to entry for expensive NFTs, allowing smaller retail players to participate in the upside of blue-chips.

This lowers the barrier to entry for expensive NFTs, allowing smaller retail players to participate in the upside of blue-chips.

6/ Moreover, this allows for better price discovery due to increased liquidity.

@NFTX_ is currently facilitating this feature, allowing blue-chips like CryptoPunks to be traded in a fungible manner using $PUNK on a DEX.

@NFTX_ is currently facilitating this feature, allowing blue-chips like CryptoPunks to be traded in a fungible manner using $PUNK on a DEX.

7/ Beyond fractionaliation, derivatives have also been built to support options for NFTs, which can be used to protect against sudden drops in NFT value and to further unlock value from NFTs.

https://twitter.com/0xKira_/status/1500105897401454601

8/ Some other interesting projects in NFTFi include:

• @Tribe3Official: NFT perp trading to participate in NFT price movements

• @tessera: Fractionalised ownership via auction, where a group of interested buyers to bid and contribute to an auction to own a specific NFT

• @Tribe3Official: NFT perp trading to participate in NFT price movements

• @tessera: Fractionalised ownership via auction, where a group of interested buyers to bid and contribute to an auction to own a specific NFT

9/ With the recent return of interest in the markets, while far from all-time highs, NFT volumes have also shown signs of bottoming.

With more bullish conditions, we may also start to see the formation of the next NFT cycle.

With more bullish conditions, we may also start to see the formation of the next NFT cycle.

10/ Combined with the increasing focus on more user-friendly interfaces and seamless onboarding to crypto, this could very well create the perfect storm for the NFTFi space.

https://twitter.com/krybharat/status/1432695531680243721

11/ However, one might also argue that the NFTFi space only serves a very small, niche, segment of the market as DeFi circles and NFT circles only barely intersect, as @ElBarto_Crypto rightly points out.

https://twitter.com/elbarto_crypto/status/1616856383642648577

12/ Additionally, NFTFi protocols often have to rely on NFT pricing oracles for their functions, a system which is hardly perfect yet.

NFT pricing is difficult as each NFT is unique. To assign the floor price to the entire collection would be unfair to holders of rares.

NFT pricing is difficult as each NFT is unique. To assign the floor price to the entire collection would be unfair to holders of rares.

And that's a wrap! Many thanks to @gabrieltanhl for his inputs for this thread 🤝

What do you think about the NFTFi space going into 2023?

Let us know below 👇

What do you think about the NFTFi space going into 2023?

Let us know below 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh