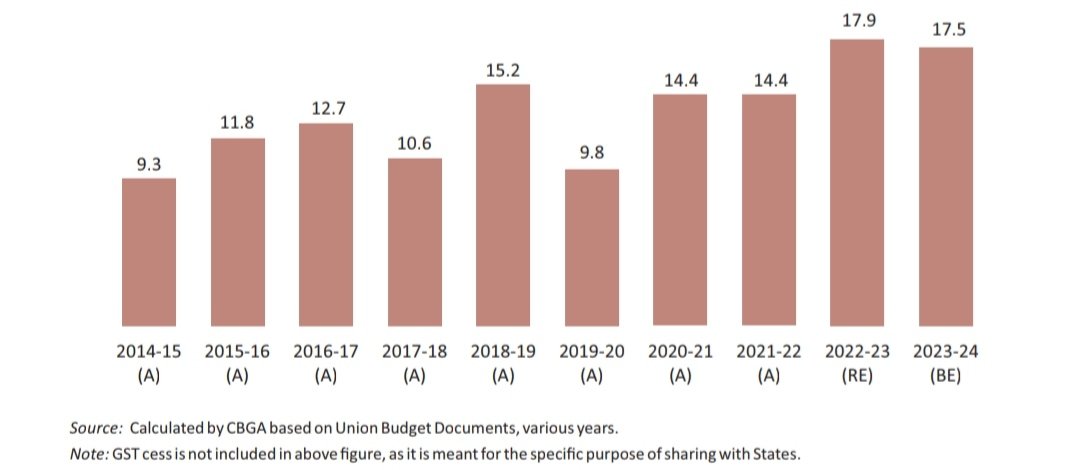

The share of tax collection that is NOT to be shared with States has been increasing.

This increase is on account of the policy changes that the Union Government has brought, such as:

[ Increasing share of non-sharable Tax Collection (%) 👇]

This increase is on account of the policy changes that the Union Government has brought, such as:

[ Increasing share of non-sharable Tax Collection (%) 👇]

- Introduction of Special Additional Duty of Excise on Motor Spirit

-Road and Infrastructure Cess in 2020-21,

-Agriculture Infrastructure and Development Cess in 2021-22.

-Road and Infrastructure Cess in 2020-21,

-Agriculture Infrastructure and Development Cess in 2021-22.

Because of these changes, in FY 2022-23 and FY 2023-24, more than 17 percent of central tax collection will be outside the divisible pool.

Hence States will not be able to get the full benefit of high growth of central tax collections.

Hence States will not be able to get the full benefit of high growth of central tax collections.

Many States have faced fiscal strain which got acute during the pandemic when:-

1. A fall in resources was accompanied with

2. The need for higher spending

3. Lower-than-expected growth rate of GST collections in many States.

1. A fall in resources was accompanied with

2. The need for higher spending

3. Lower-than-expected growth rate of GST collections in many States.

The combined fiscal deficit of all States jumped from Rs 5.25 lakh crore or 2.6 per cent of GDP in 2019-20 to Rs 8.05 lakh crore or 4.1 per cent of GDP in 2020-21

When GST was introduced, States were guaranteed 14% annual growth rate for which a GST compensation cess was levied.

When GST was introduced, States were guaranteed 14% annual growth rate for which a GST compensation cess was levied.

However, in 2019-20 and 2020-21, even the combined collection from GST and GST compensation cess fell short of the 14 per cent growth target by Rs 70,000 crore and Rs 83,000 crore, respectively.

When GST was implemented, State Governments had to surrender close to 52 per cent of their taxing rights towards GST, while the Union Government had to surrender only about 29 per cent.

Thus State Governments have less room now to generate additional resources on their own and have a higher dependency on GST and other transfers from the Union Government.

There is a need for State Governments to be able to have more regular and reliable sources of receipts.

There is a need for State Governments to be able to have more regular and reliable sources of receipts.

Since the economic liberalisation in 1991, the broader trend has been to facilitate trade by reducing trade barriers including customs duties.

The hope was that this would lead to India becoming a part of the global supply chain and hence increase domestic manufacturing.

The hope was that this would lead to India becoming a part of the global supply chain and hence increase domestic manufacturing.

This did not turn out to be true.

In 2018-19, the Union Government reversed that trend and increased customs duties on a number of items to incentivise domestic manufacturing by import-substitution.

In 2018-19, the Union Government reversed that trend and increased customs duties on a number of items to incentivise domestic manufacturing by import-substitution.

The use of incentives or subsidies to promote foreign investment has its pitfalls and hence need to be designed in a manner which ensures creation of a production eco-system.

Else, incentives or subsidies are prone to be abused such that companies engage in manufacturing

Else, incentives or subsidies are prone to be abused such that companies engage in manufacturing

as long as the incentive exists and then shift the process, once incentives end.

Given the large scale of resources involved, the Government should increase transparency in the scheme.

Given the large scale of resources involved, the Government should increase transparency in the scheme.

One way to do so would be to publish a statement similar to output/outcome document which will provide the details of fund allocation, fund disbursed, amount of goods manufactured, value added, level of export, employment generated, and so on.

Such a disclosure will not only help citizens to know the details, but will also allow comprehensive evaluation of such a policy, which can help in assessing the efficiency and effectiveness as well as improve the outcomes of incentives given to manufactures.

The message that common people have to understand is that systematically, the Union Government headed by BJP is making policies that suck out our money through special cess, on which our federal state cannot claim a share.

Our Money, in the hands of a team we do not trust

Our Money, in the hands of a team we do not trust

In a way, the Union Government led by @narendramodi is itself becoming another Adani. Our Money is taken away by the #ModiGovt, neither as a Fixed Deposit, nor as an Equity share.

This Money will NOT be returned in any form. This will be used by them on any way they wish.

This Money will NOT be returned in any form. This will be used by them on any way they wish.

• • •

Missing some Tweet in this thread? You can try to

force a refresh