#Specialsituation #Spinoff #Demerger #AARTIPHARM🧵

- Business overview

- Financials

- Valuations

- 1 year Concall highlights (Q1 FY22 to Q1FY23)

Took long to compile this

Retweet♻️ & Like👍

For wider reach

@soicfinance @itsTarH @Shubham_TLI @ValueEducator @Gautam__Baid

1/14

- Business overview

- Financials

- Valuations

- 1 year Concall highlights (Q1 FY22 to Q1FY23)

Took long to compile this

Retweet♻️ & Like👍

For wider reach

@soicfinance @itsTarH @Shubham_TLI @ValueEducator @Gautam__Baid

1/14

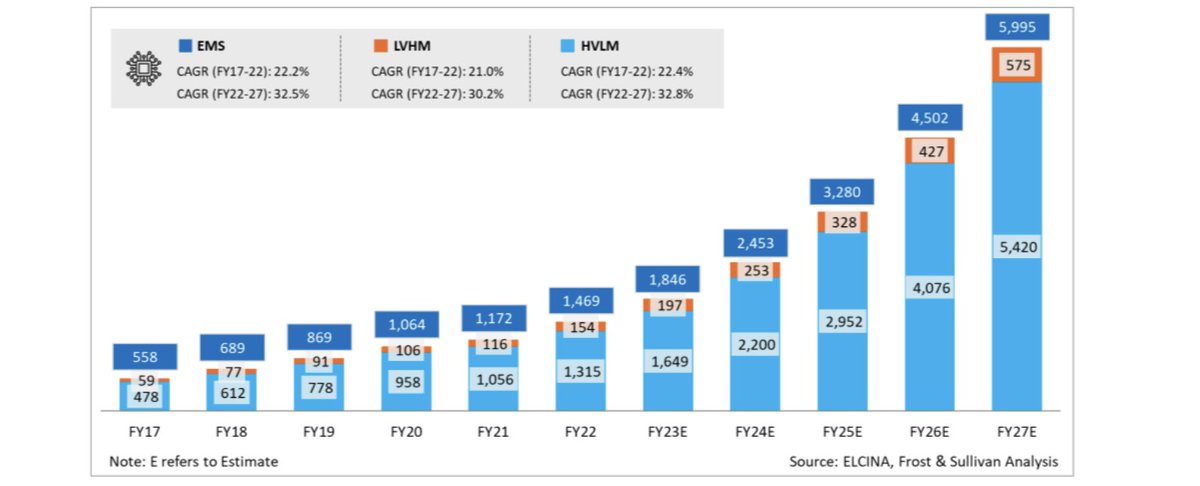

3/ Segments:

APIs & Intermediates for innovators & generic firms for a variety of applications like anti-cancer, anti-asthmatic, antihypertensive, oncology medicines.

Xanthine derivatives are used for beverages, as well as nutraceutical and other pharma applications.

APIs & Intermediates for innovators & generic firms for a variety of applications like anti-cancer, anti-asthmatic, antihypertensive, oncology medicines.

Xanthine derivatives are used for beverages, as well as nutraceutical and other pharma applications.

4/ Existing & upcoming units

CAPEX - Rs. 350 - 500 Cr.

Adding 50+ new products in APIs & Intermediates

CAPEX - Rs. 350 - 500 Cr.

Adding 50+ new products in APIs & Intermediates

5/ % Export revenue:

US - 27%

EU - 27%

ROW - 27%

China - 12%

Japan - 7%

*FY22 figures

US - 27%

EU - 27%

ROW - 27%

China - 12%

Japan - 7%

*FY22 figures

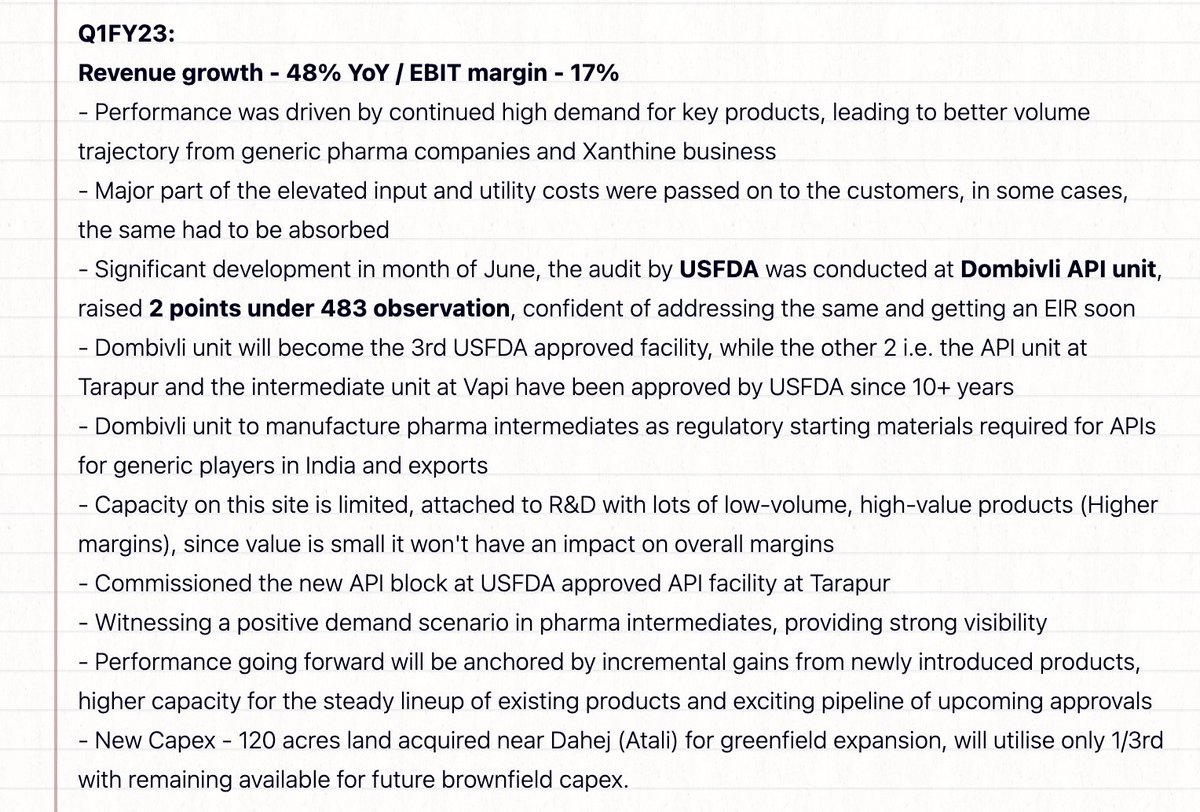

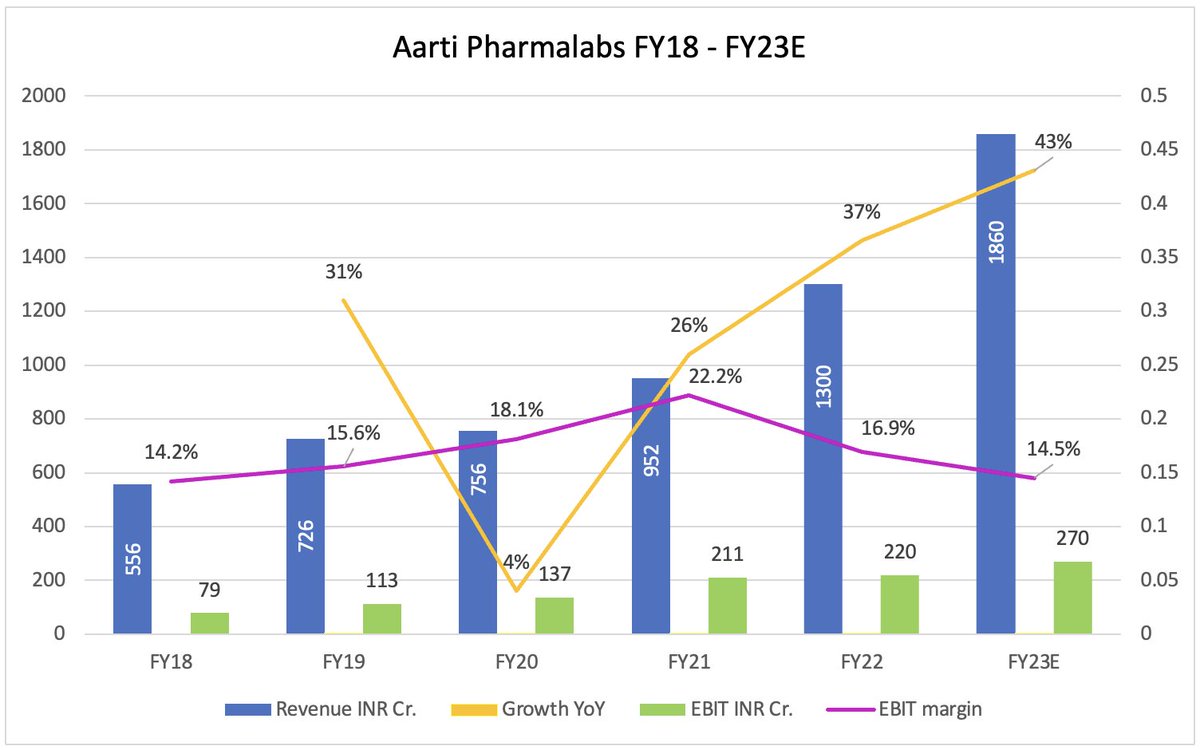

6/ Revenue & EBIT FY18 - FY23E (conservative est.)

- Revenue growing at 27% CAGR

- EBIT margins have fallen in recent times (industry wide)

*there is a difference of 100 Cr. sales in pre-demerger presentations. You'll see that in 7/

- Revenue growing at 27% CAGR

- EBIT margins have fallen in recent times (industry wide)

*there is a difference of 100 Cr. sales in pre-demerger presentations. You'll see that in 7/

7/ Declared post-demerger

Financials & Valuations at CMP 313

P/E - 14.9x

EV/EBITDA - 9.6x

Q4 FY23 sales is taken conservatively at 400cr.

Aarti Dugs, an inferior business (we'll see how its different below) gets:

P/E - 23x

EV/EBITDA - 14.5x

aartipharmalabs.com/investors/apl-…

Financials & Valuations at CMP 313

P/E - 14.9x

EV/EBITDA - 9.6x

Q4 FY23 sales is taken conservatively at 400cr.

Aarti Dugs, an inferior business (we'll see how its different below) gets:

P/E - 23x

EV/EBITDA - 14.5x

aartipharmalabs.com/investors/apl-…

12/

Mgt. seems to have been walking the talk with exception of some delay in capex going live and "closely" achieving the EBIT% guidance. Commentary is encouraging and growth has been at blistering pace - 27% CAGR FY18-23.

Mgt. seems to have been walking the talk with exception of some delay in capex going live and "closely" achieving the EBIT% guidance. Commentary is encouraging and growth has been at blistering pace - 27% CAGR FY18-23.

13/

Positives:

- Sales growth pace haven't slowed

- Higher scale/value prod + regulated mrkt mix

- Tarapur - 200-250Cr. potential in 3yrs

- 50+ new products launch

- Additional 350-500Cr capex over 3yrs

- Dombivli plant doesn't contribute much where there is USFDA issue

Positives:

- Sales growth pace haven't slowed

- Higher scale/value prod + regulated mrkt mix

- Tarapur - 200-250Cr. potential in 3yrs

- 50+ new products launch

- Additional 350-500Cr capex over 3yrs

- Dombivli plant doesn't contribute much where there is USFDA issue

14/

Close track:

- EBIT % falling (industry wide), have always guided for 18-20%

- Capex/New unit ramp up

- Incremental sales & high value prod. %

- USFDA issue resolved ?

- CDMO opp. ?

Disc: Small position

Not a Buy/sell recommendation

Close track:

- EBIT % falling (industry wide), have always guided for 18-20%

- Capex/New unit ramp up

- Incremental sales & high value prod. %

- USFDA issue resolved ?

- CDMO opp. ?

Disc: Small position

Not a Buy/sell recommendation

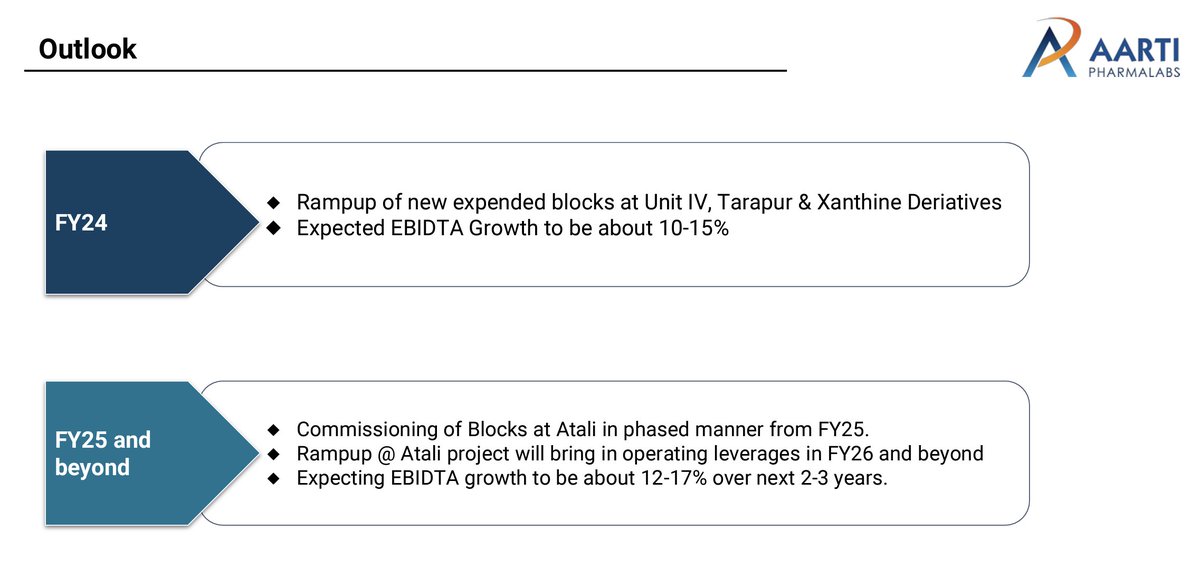

#Aartipharm just gave guidance for the next few yrs. Slowdown compared to last yr but this will likely translate into 19-20% PAT growth.

#Aartipharm Q1FY24 Highlights

- EBITDA margin guidance 20% + or - 2

- Expect to achieve 10-15% EBITDA growth guidance for FY24

- See ValuePickr for AGM notes

- EBITDA margin guidance 20% + or - 2

- Expect to achieve 10-15% EBITDA growth guidance for FY24

- See ValuePickr for AGM notes

Insight from presentation, they have resolved USFDA issue at Dombivili API/Intermediates plant, now USFDA approved.

Xanthine:

- To make RM inhouse - Q2FY24, will be independent of China in Xanthine Chemistry

- Capacity increased by 1K TPA to 5K TPA

- Increasing volumes to offset value decline

- Largest domestic co.

- Cost of production is similar to China

- Competing with China & one EU player

- To make RM inhouse - Q2FY24, will be independent of China in Xanthine Chemistry

- Capacity increased by 1K TPA to 5K TPA

- Increasing volumes to offset value decline

- Largest domestic co.

- Cost of production is similar to China

- Competing with China & one EU player

CMO/CDMO:

- Operate from Phase 2 onwards

- Focus on scale up & commercialisation

- Expect this higher margins segment to grow to a reasonable size in coming years with potential to become 10% of FY24 sales

- Operate from Phase 2 onwards

- Focus on scale up & commercialisation

- Expect this higher margins segment to grow to a reasonable size in coming years with potential to become 10% of FY24 sales

• • •

Missing some Tweet in this thread? You can try to

force a refresh