1/20

This week, I'm exploring @pendle_fi, a project enabling yield tokenization, and why I believe it could grow into an absolute monster in the near future.

Disclaimer: I hold a bag of $PENDLE.

Let's dive in: 🧵.

This week, I'm exploring @pendle_fi, a project enabling yield tokenization, and why I believe it could grow into an absolute monster in the near future.

Disclaimer: I hold a bag of $PENDLE.

Let's dive in: 🧵.

2/20

While a couple players have been building since the previous bull market, yield tokenization is a narrative that has yet to gain traction in DeFi, despite being one of its most crucial building block.

While a couple players have been building since the previous bull market, yield tokenization is a narrative that has yet to gain traction in DeFi, despite being one of its most crucial building block.

3/20

In TardFi, institutional players rely on various hedges to protect their positions, such as future yield contracts.

The interest derivative market in TardFi is estimated to be worth over $400T in notional value. @pendle_fi is bringing this market to DeFi.

In TardFi, institutional players rely on various hedges to protect their positions, such as future yield contracts.

The interest derivative market in TardFi is estimated to be worth over $400T in notional value. @pendle_fi is bringing this market to DeFi.

4/20

In crypto, yield is the very core element of DeFi, and everyone is hunting for the best yield on one's held assets.

Yield farming is usually limited to staking the underlying asset or providing liquidity to AMMs, and fluctuates wildly between bull and bear markets.

In crypto, yield is the very core element of DeFi, and everyone is hunting for the best yield on one's held assets.

Yield farming is usually limited to staking the underlying asset or providing liquidity to AMMs, and fluctuates wildly between bull and bear markets.

5/20

@pendle_fi has created a market to tokenize the future yield that is generated by yield-bearing tokens.

This enables various strategies such as:

• long assets at a discount

• fix yield for low-risk, stable growth

• leverage exposure to future yield streams

@pendle_fi has created a market to tokenize the future yield that is generated by yield-bearing tokens.

This enables various strategies such as:

• long assets at a discount

• fix yield for low-risk, stable growth

• leverage exposure to future yield streams

6/20

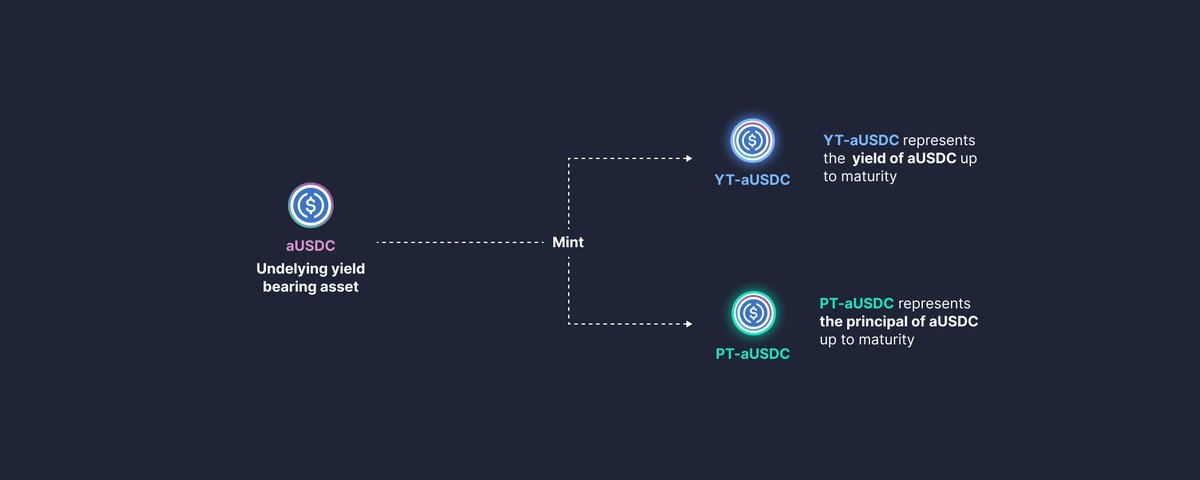

@pendle_fi does this by wrapping yield-bearing tokens into standardized yield tokens (SY).

SY are then split into their principal (PT) and yield (YT) component, which allow them to be traded on their custom AMM.

Let's take an exemple with numbers.

@pendle_fi does this by wrapping yield-bearing tokens into standardized yield tokens (SY).

SY are then split into their principal (PT) and yield (YT) component, which allow them to be traded on their custom AMM.

Let's take an exemple with numbers.

7/20

Imagine you're holding 100 $aUSDC. With an APY of 5%, after a year you will have 105 $aUSDC in your wallet.

With @pendle_fi, instead of waiting a year, you can split your $aUSDC into 100 $aUSDC-PT and 5 $aUSDC-YT.

You now have several options.

Imagine you're holding 100 $aUSDC. With an APY of 5%, after a year you will have 105 $aUSDC in your wallet.

With @pendle_fi, instead of waiting a year, you can split your $aUSDC into 100 $aUSDC-PT and 5 $aUSDC-YT.

You now have several options.

8/20

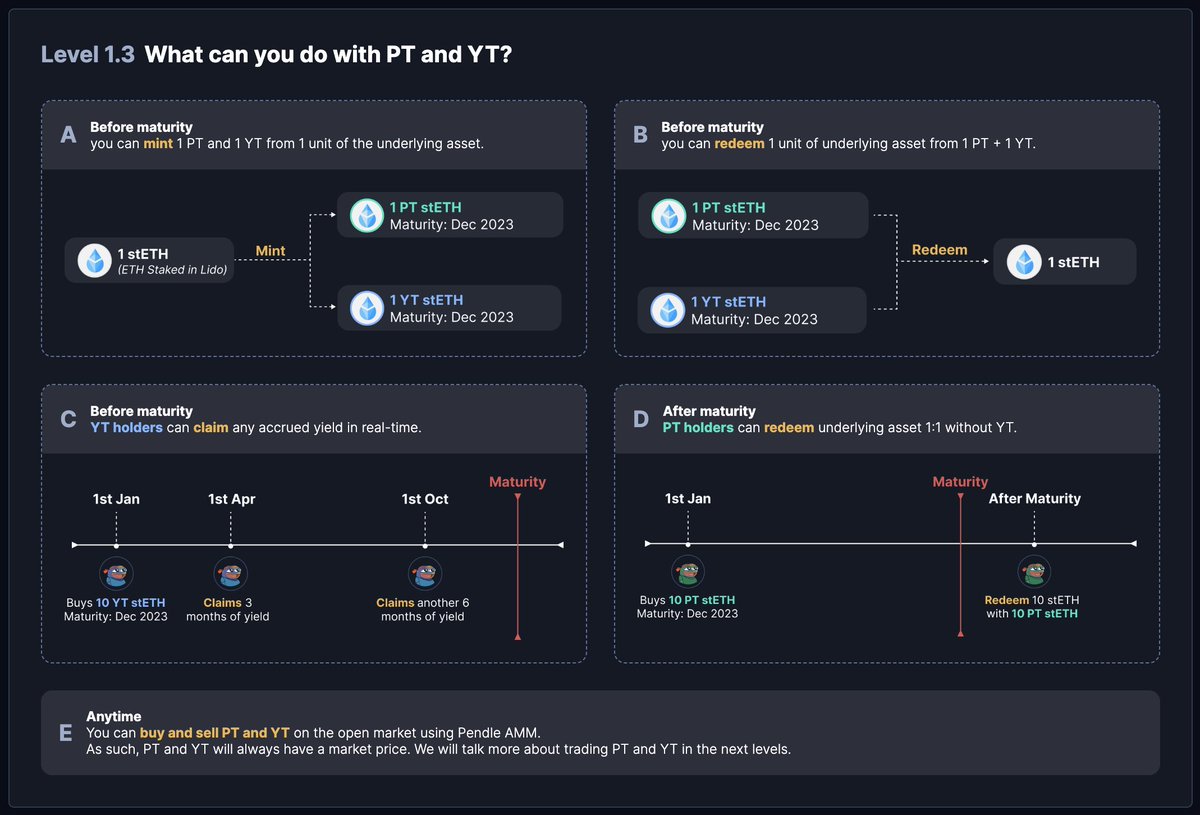

If you believe the yield will go down:

You can that profit immediately by selling your $aUSDC-YT on the market for ~$5. You will then need to buyback the 5 $aUSDC-YT (hopefully cheaper) at a later date to redeem your principal.

Easy money.

If you believe the yield will go down:

You can that profit immediately by selling your $aUSDC-YT on the market for ~$5. You will then need to buyback the 5 $aUSDC-YT (hopefully cheaper) at a later date to redeem your principal.

Easy money.

9/20

If you merely want to secure your yield without speculating on it, you can just sell the YT for $5 and use that money however you desire.

Come back after a year and your principal will be unlocked. You just tokenized your future yield and used it upfront!

If you merely want to secure your yield without speculating on it, you can just sell the YT for $5 and use that money however you desire.

Come back after a year and your principal will be unlocked. You just tokenized your future yield and used it upfront!

10/20

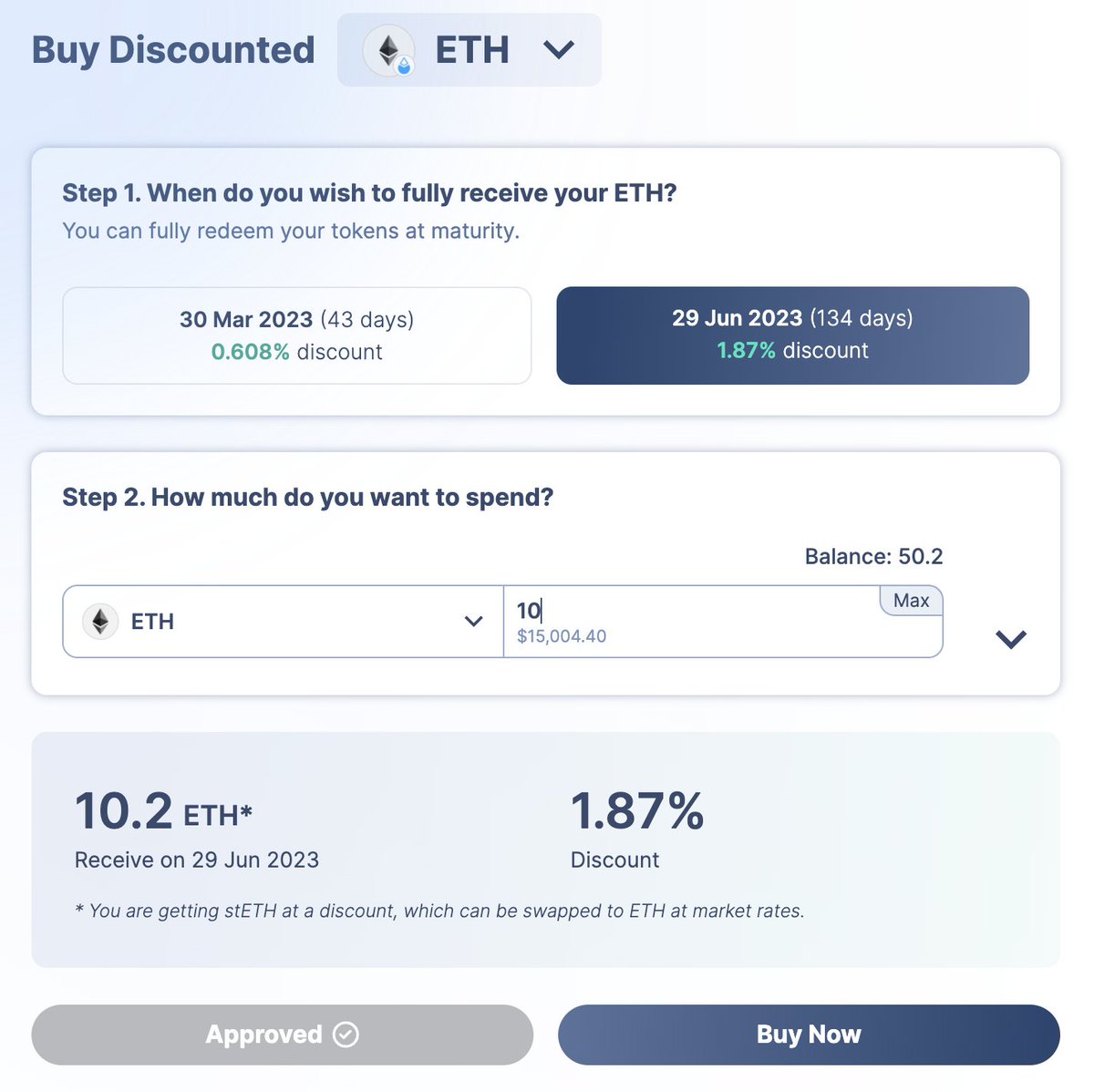

Pretty cool isn't it? Well it gets better.

Thanks to future yield tokenization, one can effectively buy assets at a big discount by splitting it into PT and YT and selling YT to other buyers at the time as buying the principal.

Pretty cool isn't it? Well it gets better.

Thanks to future yield tokenization, one can effectively buy assets at a big discount by splitting it into PT and YT and selling YT to other buyers at the time as buying the principal.

11/20

Let's say $ETH sells at a 5% discount with a one year maturity.

You can now buy 100 $ETH for the price of 95, as the future yield will be tokenized and sold on the market to make up for the price difference.

Let's say $ETH sells at a 5% discount with a one year maturity.

You can now buy 100 $ETH for the price of 95, as the future yield will be tokenized and sold on the market to make up for the price difference.

12/20

You can now wait for a year to claim your 100 $ETH at a discount.

Or you can exit your position early, and still capture some of the profit generated.

You can now wait for a year to claim your 100 $ETH at a discount.

Or you can exit your position early, and still capture some of the profit generated.

13/20

More strategies are available, such as longing the yield if you expect it to go up in the future, or complex arbitrage and delta hedging including several assets...

The documentation goes into greater details and you can check it out here: docs.pendle.finance.

More strategies are available, such as longing the yield if you expect it to go up in the future, or complex arbitrage and delta hedging including several assets...

The documentation goes into greater details and you can check it out here: docs.pendle.finance.

14/20

Pendle is not a new protocol. They've been building since 2021!

They never gained traction in the previous bull market as the product was complicated to use and the yield pretty low compared to what was available.

But their latest v3 changes that.

Pendle is not a new protocol. They've been building since 2021!

They never gained traction in the previous bull market as the product was complicated to use and the yield pretty low compared to what was available.

But their latest v3 changes that.

15/20

The protocol recently added #LSD tokens $wsETH and $rETH.

As the popularity of this narrative is growing, I believe the team has reached product market fit.

You can now provide liquidity and get insane APY on your $ETH (between 22%-50% at the time of this writing).

The protocol recently added #LSD tokens $wsETH and $rETH.

As the popularity of this narrative is growing, I believe the team has reached product market fit.

You can now provide liquidity and get insane APY on your $ETH (between 22%-50% at the time of this writing).

16/20

Another available token is $APE, which you can acquire at a huge discount or further boost your yield (which I am doing, being bullish on @yugalabs).

Adding NFT related tokens, especially a blue chip, is a smart move by the team.

Now let's take a look at the metrics.

Another available token is $APE, which you can acquire at a huge discount or further boost your yield (which I am doing, being bullish on @yugalabs).

Adding NFT related tokens, especially a blue chip, is a smart move by the team.

Now let's take a look at the metrics.

17/20

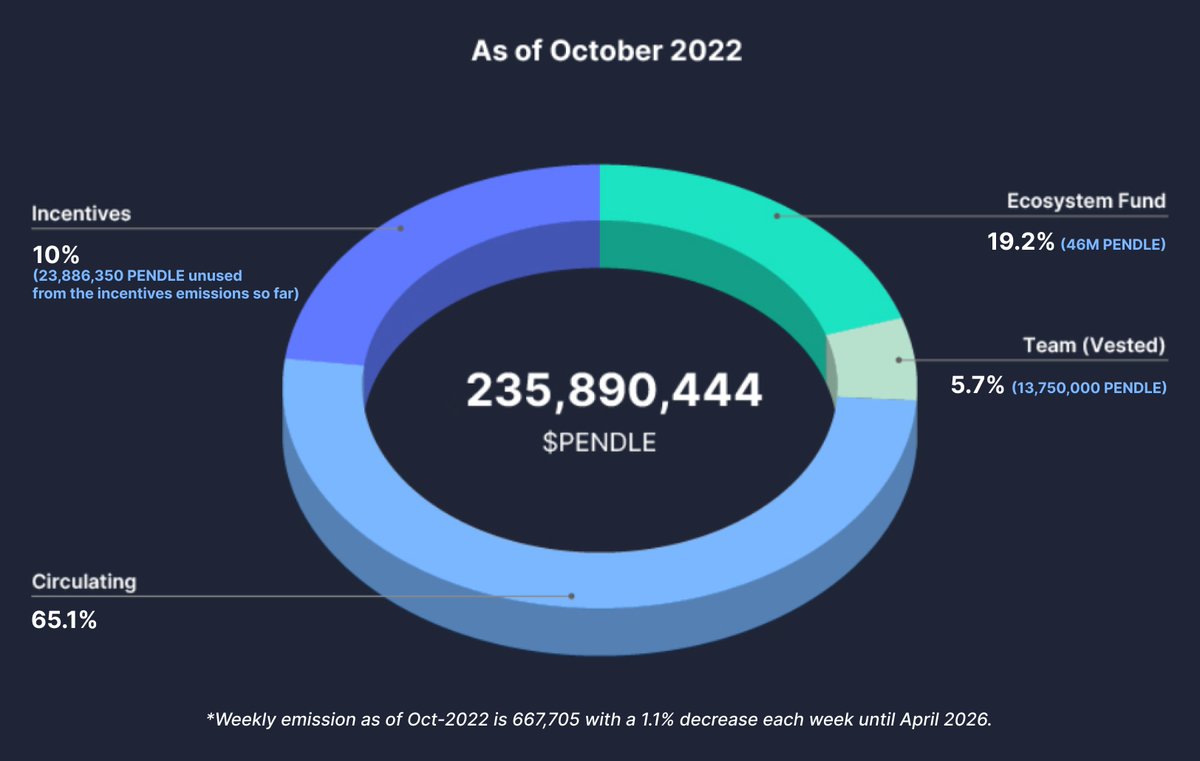

Currently, there is a TVL of $17.5M in the protocol, which greatly exceeds the current market capitalization of $PENDLE of $12M.

The FDV is at $29.1M.

Note that most team tokens are already vested, the final unlock being in April 2023.

Currently, there is a TVL of $17.5M in the protocol, which greatly exceeds the current market capitalization of $PENDLE of $12M.

The FDV is at $29.1M.

Note that most team tokens are already vested, the final unlock being in April 2023.

18/20

@pendle_fi also added the option to lock your $PENDLE into $vePENDLE in order to boost yield and direct emissions to your preferred pool via voting, in the usual $veToken fashion.

Currently, 26M $PENDLE are being locked, which is around 15% of the circulating supply.

@pendle_fi also added the option to lock your $PENDLE into $vePENDLE in order to boost yield and direct emissions to your preferred pool via voting, in the usual $veToken fashion.

Currently, 26M $PENDLE are being locked, which is around 15% of the circulating supply.

19/20

The team is constantly delivering hard, the fundamentals are there, and it is just lacking a bit of exposure and a narrative to really get going.

Which is why $PENDLE is an absolute buy and hold for me.

The team is constantly delivering hard, the fundamentals are there, and it is just lacking a bit of exposure and a narrative to really get going.

Which is why $PENDLE is an absolute buy and hold for me.

20/20

I hope you've found this thread helpful.

Follow me @nauhcner for more research on DeFi and NFT projects and negative IQ posts.

Also remember to like/retweet the first tweet below if you want to support me 🙏.

I hope you've found this thread helpful.

Follow me @nauhcner for more research on DeFi and NFT projects and negative IQ posts.

Also remember to like/retweet the first tweet below if you want to support me 🙏.

https://twitter.com/nauhcner/status/1625365378372341761

• • •

Missing some Tweet in this thread? You can try to

force a refresh