1/ Have you ever wondered why some #DeFi projects choose to burn tokens, while others distribute them to their token holders?

Let's take a closer look at the benefits and drawbacks of these two methods, with the example of the $DEXT token from @DEXToolsApp .

Let's take a closer look at the benefits and drawbacks of these two methods, with the example of the $DEXT token from @DEXToolsApp .

2/ First, let's talk about burning tokens. When a project burns #Tokens , they are permanently removed from circulation, which reduces the total supply of the token. This can be beneficial for token holders, as it can increase the value of their tokens due to the reduced supply.

3/ Burning tokens can create a sense of stability for the token price, as it reduces the sell pressure on the market. This is because the tokens that would have been sold are no longer available, and as a result, buyers may be willing to pay more to acquire the remaining tokens

4/ On the other hand, distributing tokens can be seen as more attractive for token holders who are looking for more immediate benefits. When tokens are distributed, token holders receive a certain percentage of the profits generated by the #Project .

5/ This can be particularly beneficial for long-term holders who are interested in participating in the project's growth and success.

6/ However, the drawback of distributing tokens is that it can increase volatility in the token's price, as buyers may be more likely to buy when the #APY is high and more likely to sell when it's low.

7/ Quick example with $DEXT.

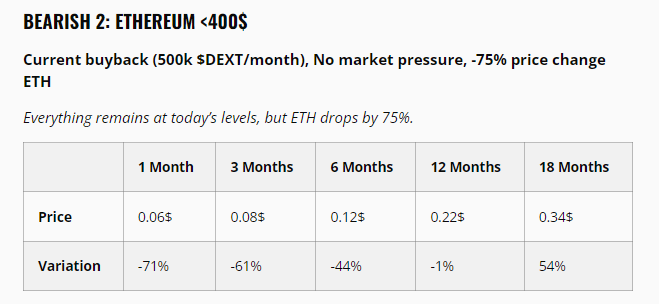

Currently DEXTools makes buy-backs of around 500k $DEXT/month.

Now let's imagine:

No market pressure (no buy/sell of $DEXT)

-75% price change for ETH

Thanks to this model, we can estimate the price action of $DEXT considering our assumptions.

Currently DEXTools makes buy-backs of around 500k $DEXT/month.

Now let's imagine:

No market pressure (no buy/sell of $DEXT)

-75% price change for ETH

Thanks to this model, we can estimate the price action of $DEXT considering our assumptions.

8/ I believe this is where you need to stop for one second.

You’ve read that correctly. If Ethereum loses 75% but $DEXT maintains current buybacks, It will be at break-even in just 1 year. And +50% in 1.5 years.

That’s the power of buybacks.

You’ve read that correctly. If Ethereum loses 75% but $DEXT maintains current buybacks, It will be at break-even in just 1 year. And +50% in 1.5 years.

That’s the power of buybacks.

9/ Clearly, this price action would not be possible with the mechanism of revenue share to token holders. So, which method is better?

10/ Well, it really depends on the goals and values of the project and its token holders. In conclusion, whether a project decides to burn or distribute tokens is an important decision that can impact the value, stability, and growth of the project.

11/ By understanding the pros and cons of each method, token holders can make more informed decisions about which projects to invest in and support.

12/ Special thanks to @TheMonteDev that wrote a fantastic article called “QUANTITATIVE ANALYSIS OF THE DEXTOOLS DEFLATIONARY MODEL” where I found useful info about $DEXT price action in different scenarios.

Here you can find the link of the article: bc.army/quantitative-a…

Here you can find the link of the article: bc.army/quantitative-a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh