ICT GEM💎

Understanding Intermediate Term Highs/Lows🧠⬇️

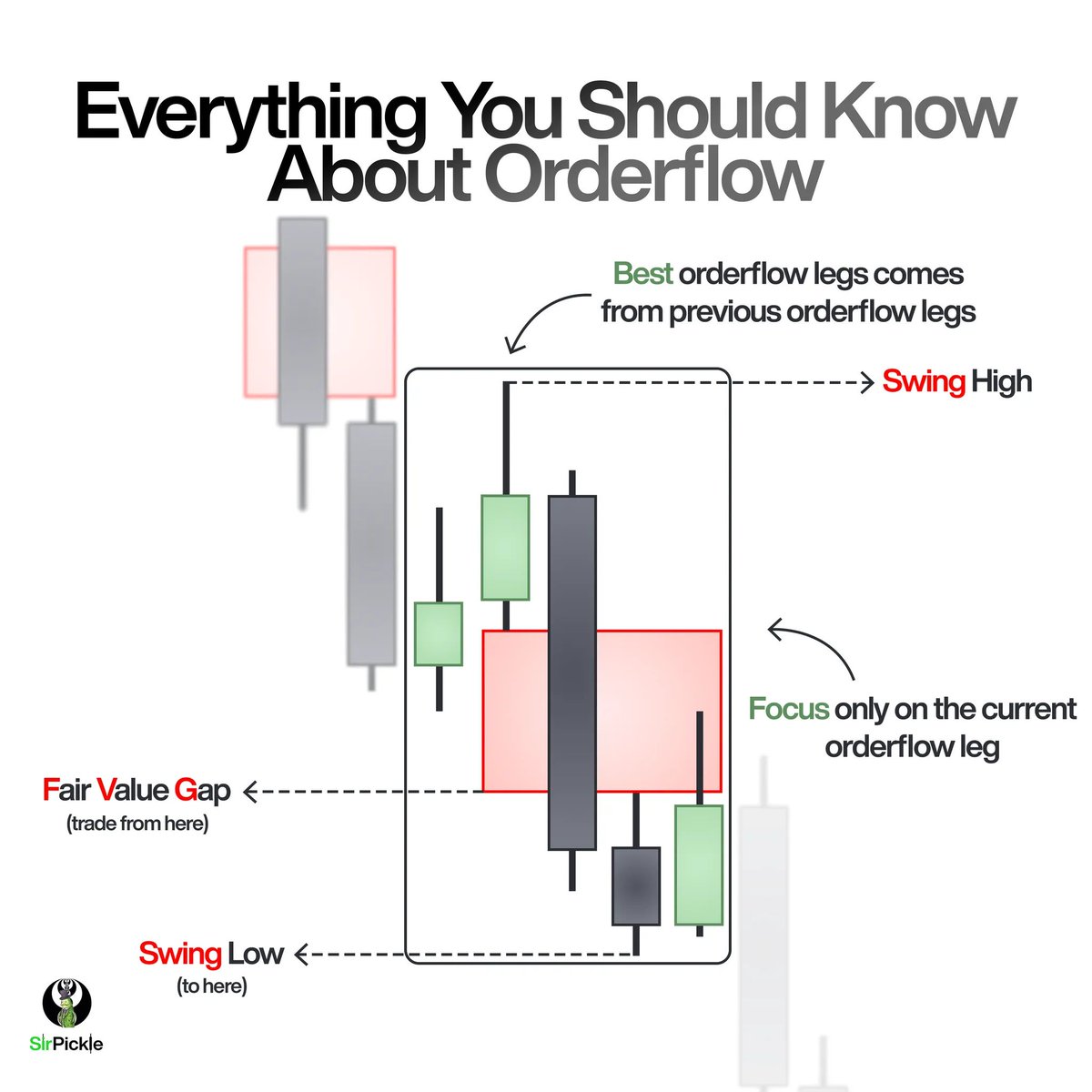

-Every single time price rebalances an old imbalance, that swing high or low should be immediately labeled as an ITH/ITL

-If we break beneath an ITH/ITL, we have a significant break in market structure👁️

#Tradingtips

Understanding Intermediate Term Highs/Lows🧠⬇️

-Every single time price rebalances an old imbalance, that swing high or low should be immediately labeled as an ITH/ITL

-If we break beneath an ITH/ITL, we have a significant break in market structure👁️

#Tradingtips

ITHs/ITLs have TWO classifications:

1⃣) ITH that has a lower STH to the left of it and lower STH to the right of it (flip logic around for ITL)

2⃣)Trades back up to an imbalance to rebalance

1⃣) ITH that has a lower STH to the left of it and lower STH to the right of it (flip logic around for ITL)

2⃣)Trades back up to an imbalance to rebalance

• • •

Missing some Tweet in this thread? You can try to

force a refresh