FVG Enthusiast ◎ Educator ◎ Free Discord ⤵️

Building @smartpropfirm 🧱

38 subscribers

How to get URL link on X (Twitter) App

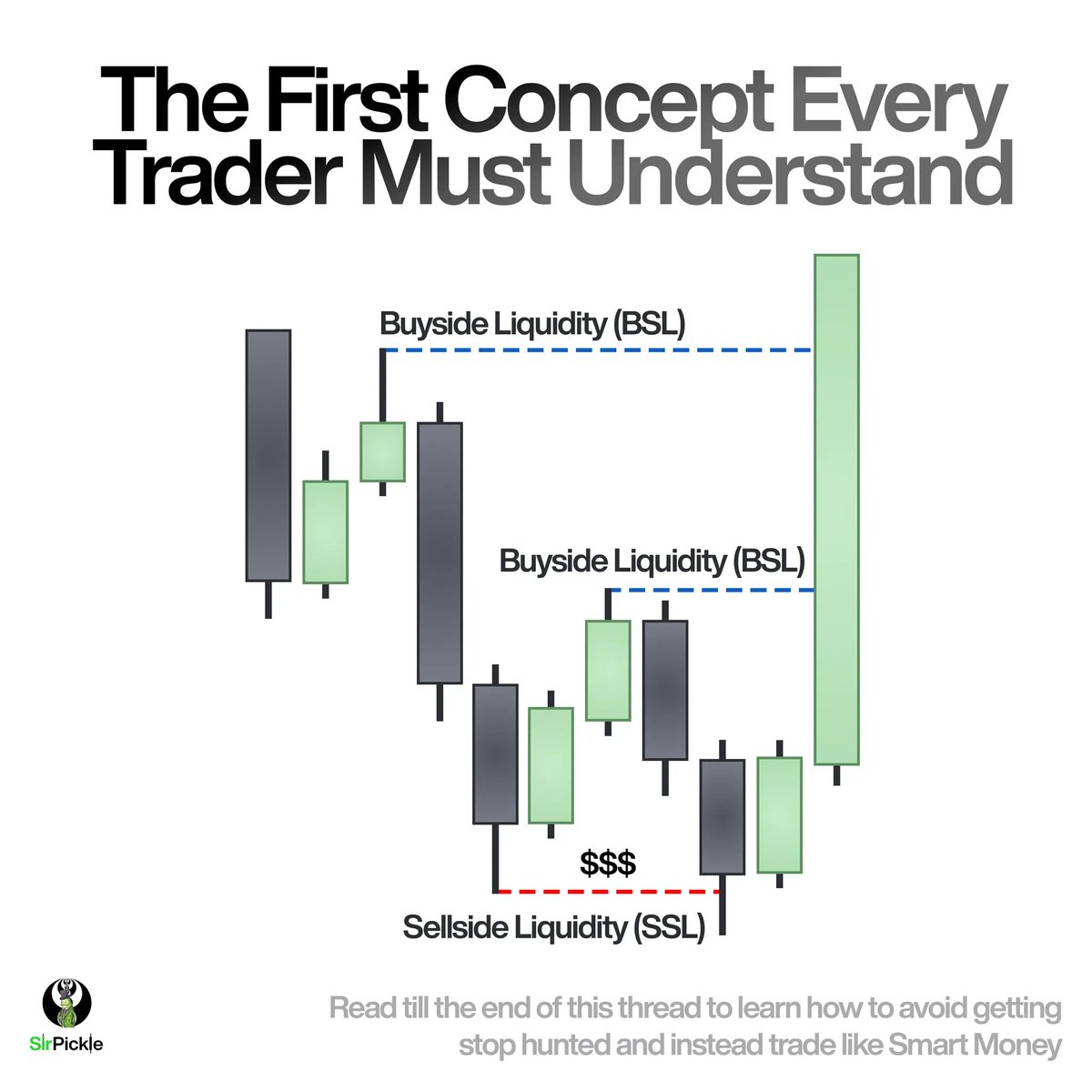

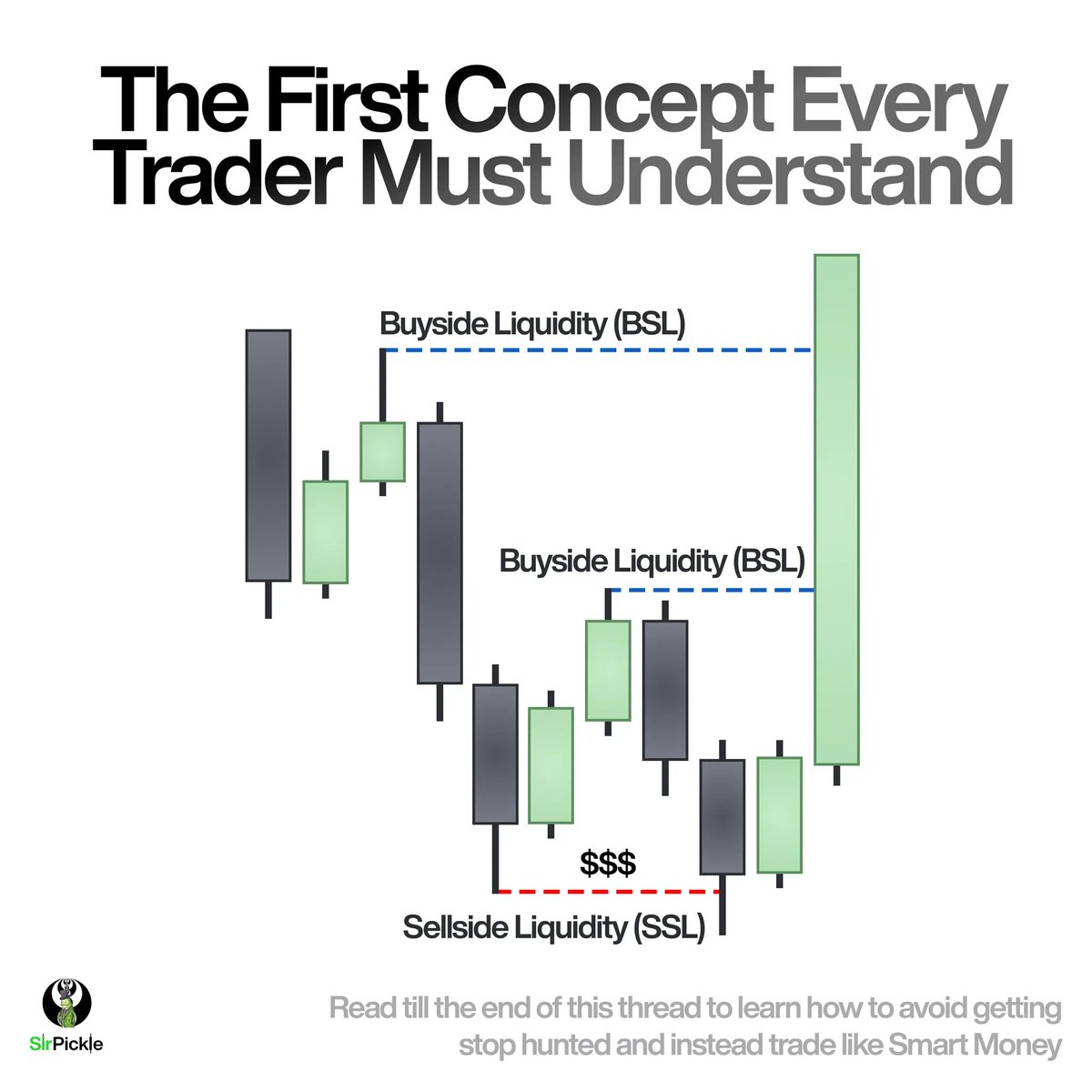

First, You Must Understand What Liquidity Is…

First, You Must Understand What Liquidity Is…

What Is A Fair Value Gap?

What Is A Fair Value Gap?

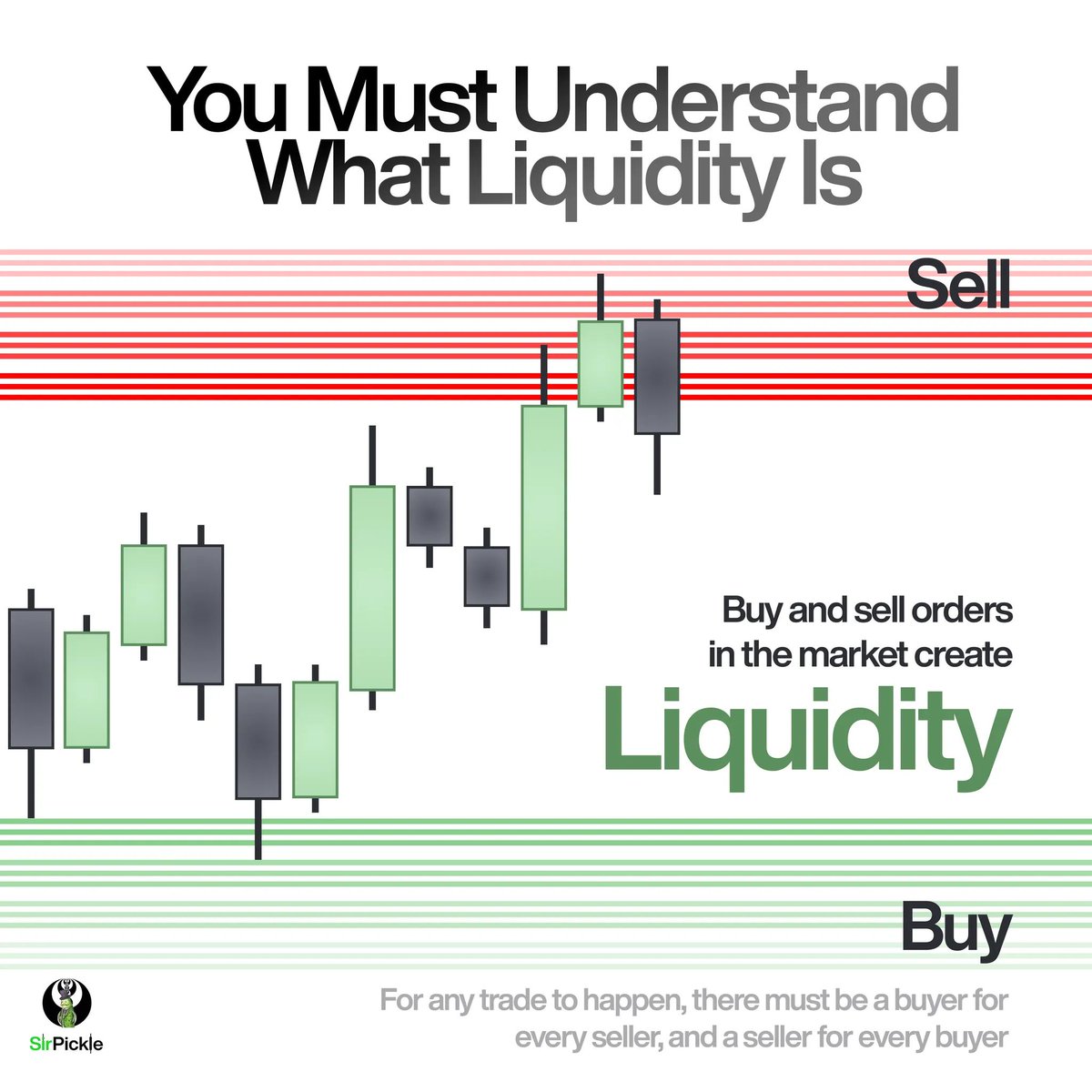

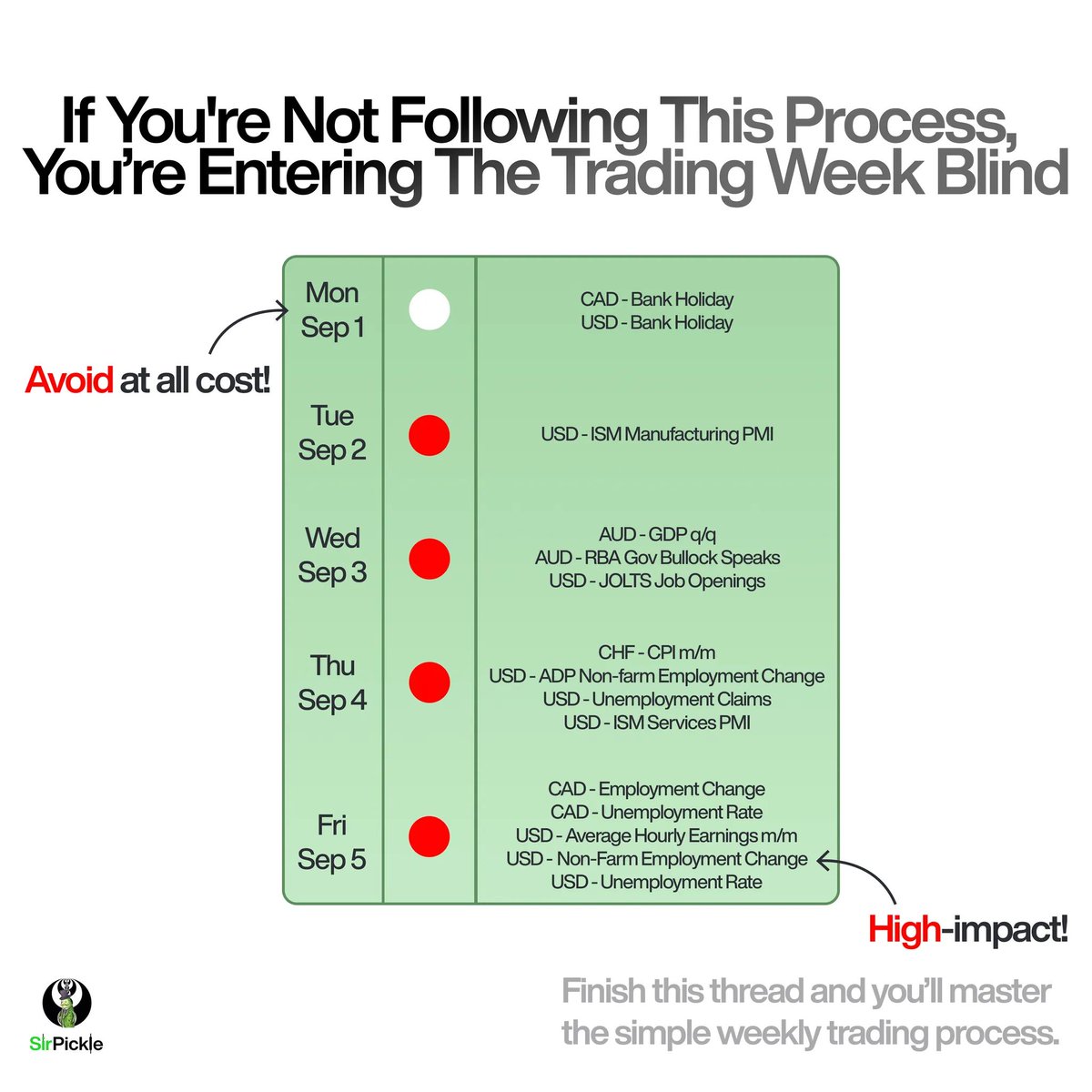

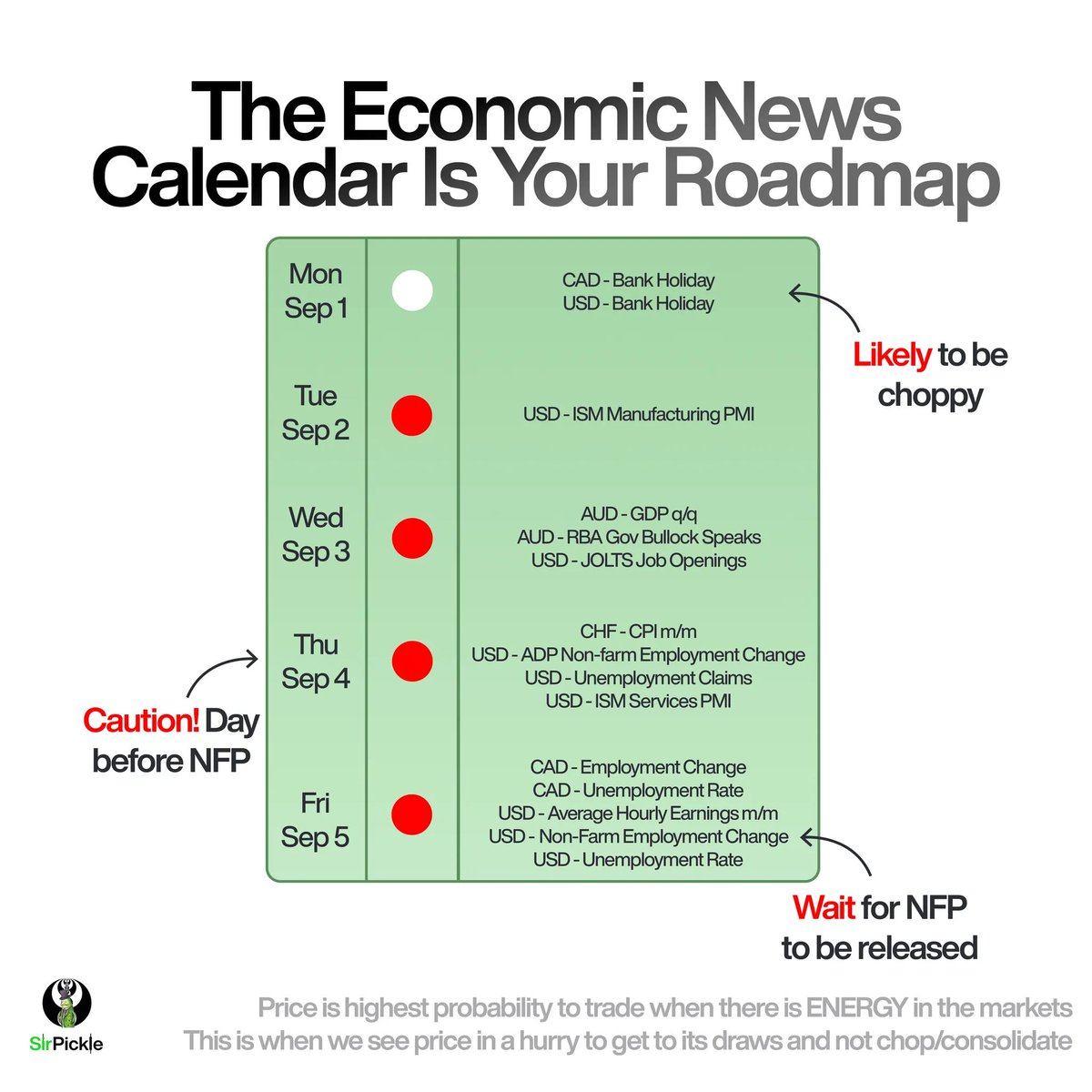

The economic news calendar is your roadmap.

The economic news calendar is your roadmap.

Orderflow and Candlestick Logic

Orderflow and Candlestick Logic

Magnet theory rule states that the higher the timeframe, the stronger the pull.

Magnet theory rule states that the higher the timeframe, the stronger the pull.

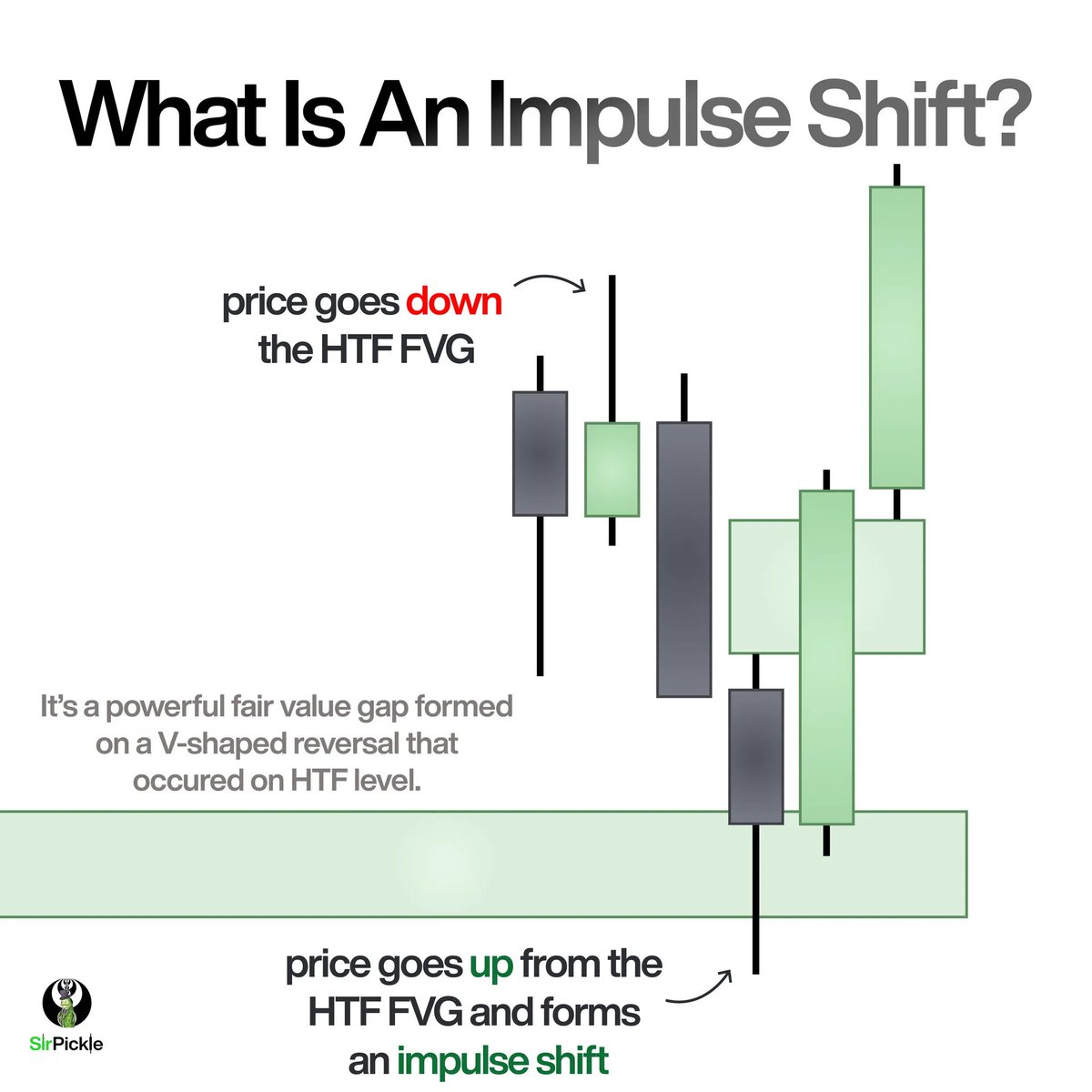

𝗪𝗵𝗮𝘁 𝗶𝘀 𝗮𝗻 𝗜𝗺𝗽𝘂𝗹𝘀𝗲 𝗦𝗵𝗶𝗳𝘁?

𝗪𝗵𝗮𝘁 𝗶𝘀 𝗮𝗻 𝗜𝗺𝗽𝘂𝗹𝘀𝗲 𝗦𝗵𝗶𝗳𝘁?

Before we proceed, you need to know about swing points.

Before we proceed, you need to know about swing points.

What is a Fair Value Gap?

What is a Fair Value Gap?

What is a “killzone”?

What is a “killzone”?

𝗪𝗵𝗮𝘁 𝗶𝘀 𝘁𝗵𝗲 𝗟𝗮𝘄 𝗼𝗳 𝗟𝗮𝗿𝗴𝗲 𝗡𝘂𝗺𝗯𝗲𝗿𝘀?🔢

𝗪𝗵𝗮𝘁 𝗶𝘀 𝘁𝗵𝗲 𝗟𝗮𝘄 𝗼𝗳 𝗟𝗮𝗿𝗴𝗲 𝗡𝘂𝗺𝗯𝗲𝗿𝘀?🔢

𝗧𝗵𝗲 𝗳𝗶𝗿𝘀𝘁 𝘀𝘁𝗲𝗽 𝘁𝗼 𝗯𝗲𝗰𝗼𝗺𝗶𝗻𝗴 𝗮 𝗵𝗶𝗴𝗵𝗲𝗿 𝘁𝗶𝗺𝗲𝗳𝗿𝗮𝗺𝗲 (𝗛𝗧𝗙) 𝗮𝗻𝗮𝗹𝘆𝘀𝗶𝘀 𝗲𝘅𝗽𝗲𝗿𝘁… 1️⃣

𝗧𝗵𝗲 𝗳𝗶𝗿𝘀𝘁 𝘀𝘁𝗲𝗽 𝘁𝗼 𝗯𝗲𝗰𝗼𝗺𝗶𝗻𝗴 𝗮 𝗵𝗶𝗴𝗵𝗲𝗿 𝘁𝗶𝗺𝗲𝗳𝗿𝗮𝗺𝗲 (𝗛𝗧𝗙) 𝗮𝗻𝗮𝗹𝘆𝘀𝗶𝘀 𝗲𝘅𝗽𝗲𝗿𝘁… 1️⃣

First, let’s define this simple and specific logic.🧠

First, let’s define this simple and specific logic.🧠

𝗜𝗳 𝘆𝗼𝘂’𝗿𝗲 𝗻𝗲𝘄 𝘁𝗼 𝗺𝘆 𝗰𝗼𝗻𝘁𝗲𝗻𝘁, 𝗜 𝗮𝗹𝘄𝗮𝘆𝘀 𝗹𝗼𝗼𝗸 𝗳𝗼𝗿 𝗵𝗶𝗴𝗵𝗲𝗿 𝘁𝗶𝗺𝗲𝗳𝗿𝗮𝗺𝗲 𝗰𝗼𝗻𝘁𝗲𝘅𝘁 𝗶𝗻 𝗲𝘃𝗲𝗿𝘆 𝘁𝗿𝗮𝗱𝗲.✌️

𝗜𝗳 𝘆𝗼𝘂’𝗿𝗲 𝗻𝗲𝘄 𝘁𝗼 𝗺𝘆 𝗰𝗼𝗻𝘁𝗲𝗻𝘁, 𝗜 𝗮𝗹𝘄𝗮𝘆𝘀 𝗹𝗼𝗼𝗸 𝗳𝗼𝗿 𝗵𝗶𝗴𝗵𝗲𝗿 𝘁𝗶𝗺𝗲𝗳𝗿𝗮𝗺𝗲 𝗰𝗼𝗻𝘁𝗲𝘅𝘁 𝗶𝗻 𝗲𝘃𝗲𝗿𝘆 𝘁𝗿𝗮𝗱𝗲.✌️

𝗙𝗶𝗿𝘀𝘁, 𝘄𝗵𝗮𝘁 𝗶𝘀 𝗢𝗥𝗗𝗘𝗥𝗙𝗟𝗢𝗪?🤔

𝗙𝗶𝗿𝘀𝘁, 𝘄𝗵𝗮𝘁 𝗶𝘀 𝗢𝗥𝗗𝗘𝗥𝗙𝗟𝗢𝗪?🤔

If you’ve been following me for a while, you know that all of my swing trades are almost identical to each other🪞

If you’ve been following me for a while, you know that all of my swing trades are almost identical to each other🪞

Being a good and consistent trader means you know how to spot low-probability conditions🔍

Being a good and consistent trader means you know how to spot low-probability conditions🔍

First, let’s define what CURRENCY FUTURES are📝

First, let’s define what CURRENCY FUTURES are📝

The key to understanding Breakaway Gaps (BAGs) are first knowing what are Fair value gaps (FVGs).

The key to understanding Breakaway Gaps (BAGs) are first knowing what are Fair value gaps (FVGs).

A fair value gap is simply the gap between 3 candles.

A fair value gap is simply the gap between 3 candles.