MOST COMMON MISTAKES NEW ICT TRADERS MAKE (Mistakes that I Used to Make Myself)

This thread is a gold nugget... read it.

This thread is a gold nugget... read it.

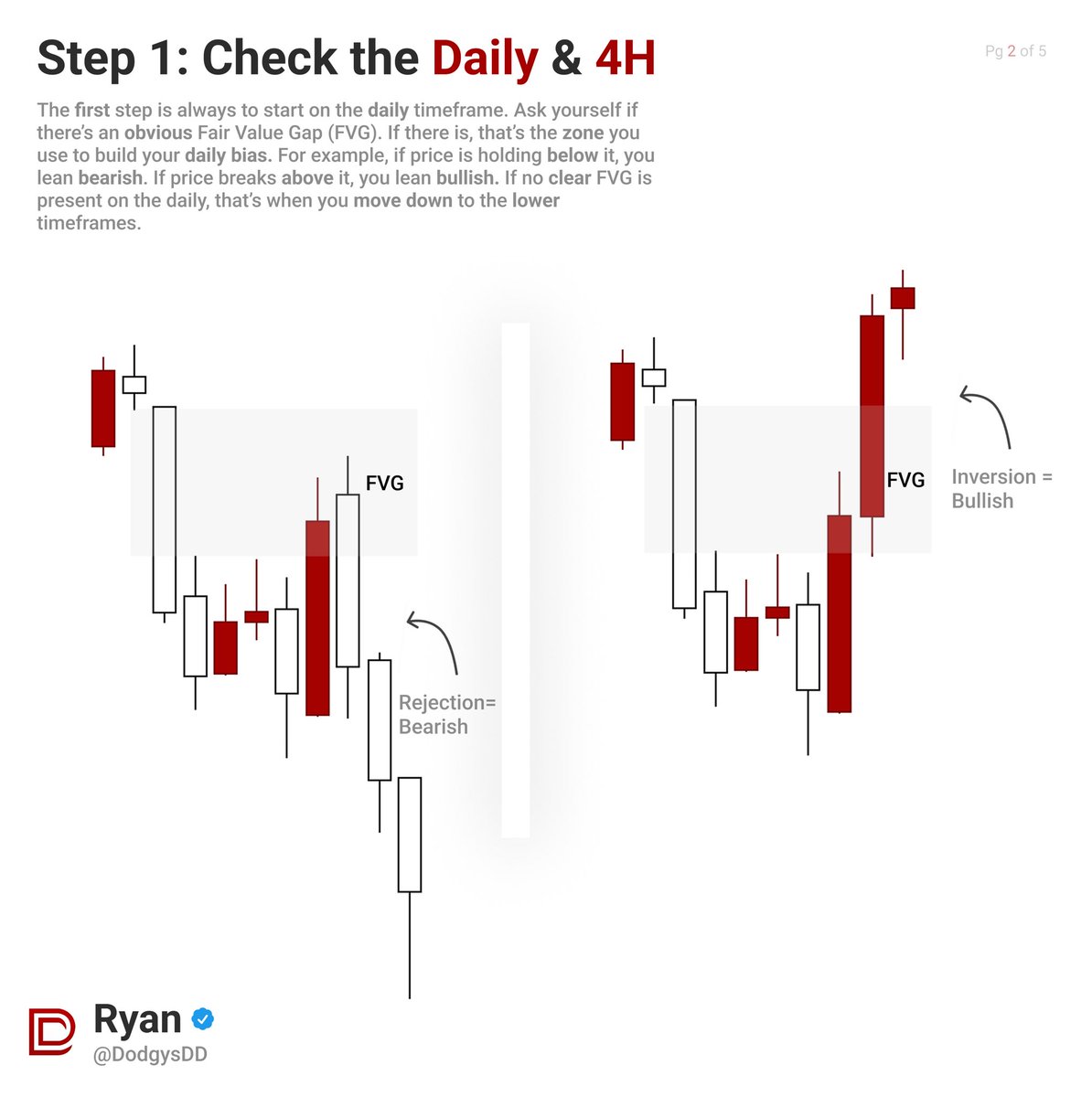

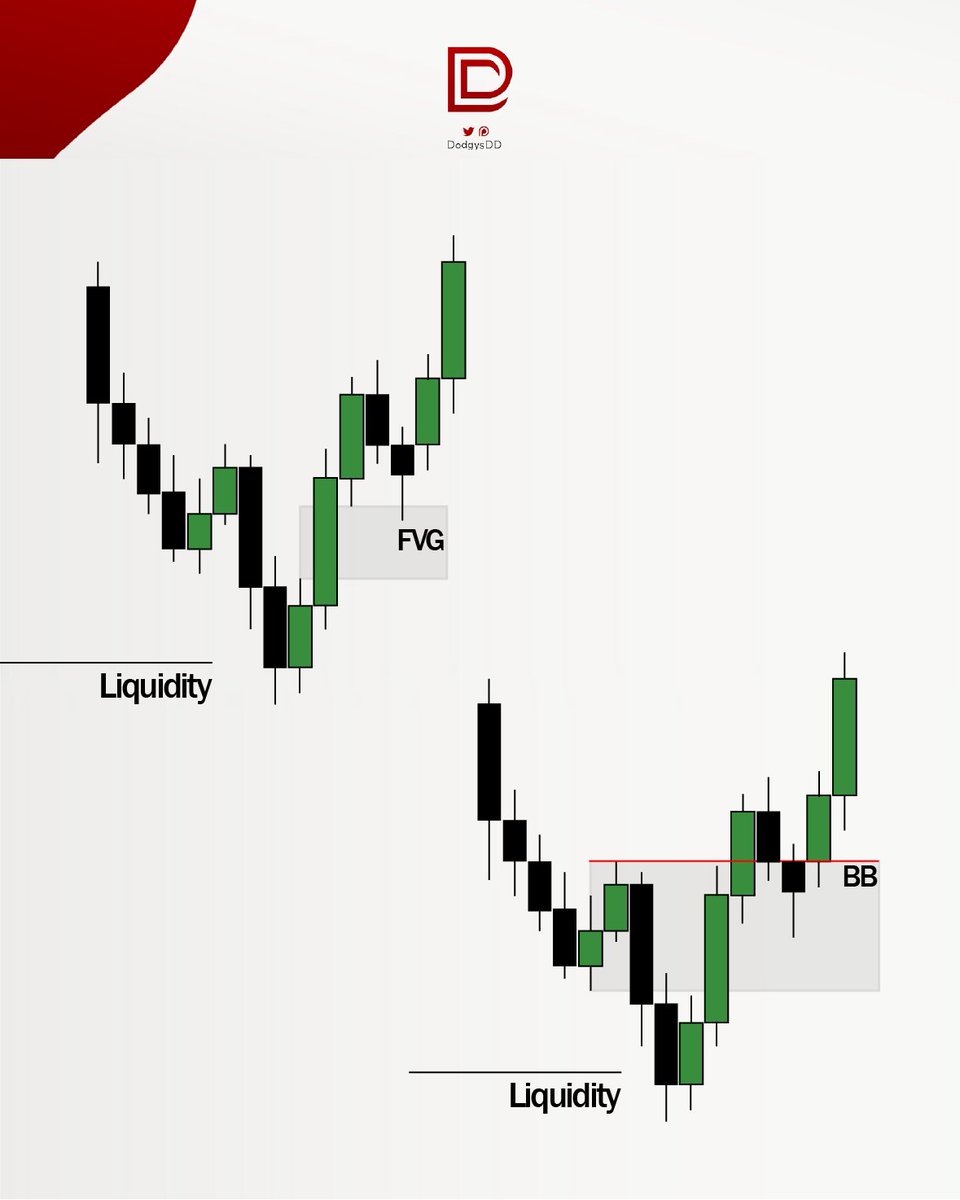

First of all, make sure you know what a fair value gap is. You long in a bullish fair value gap, and short inside the bearish one (on the retracement)

THE MOST COMMON MISTAKE

Shorting a bearish FVG and getting squeezed through. Longing a bullish FVG and getting knifed through.

I used to take FVGs all the time and they would completely fail, but why does this happen?

Shorting a bearish FVG and getting squeezed through. Longing a bullish FVG and getting knifed through.

I used to take FVGs all the time and they would completely fail, but why does this happen?

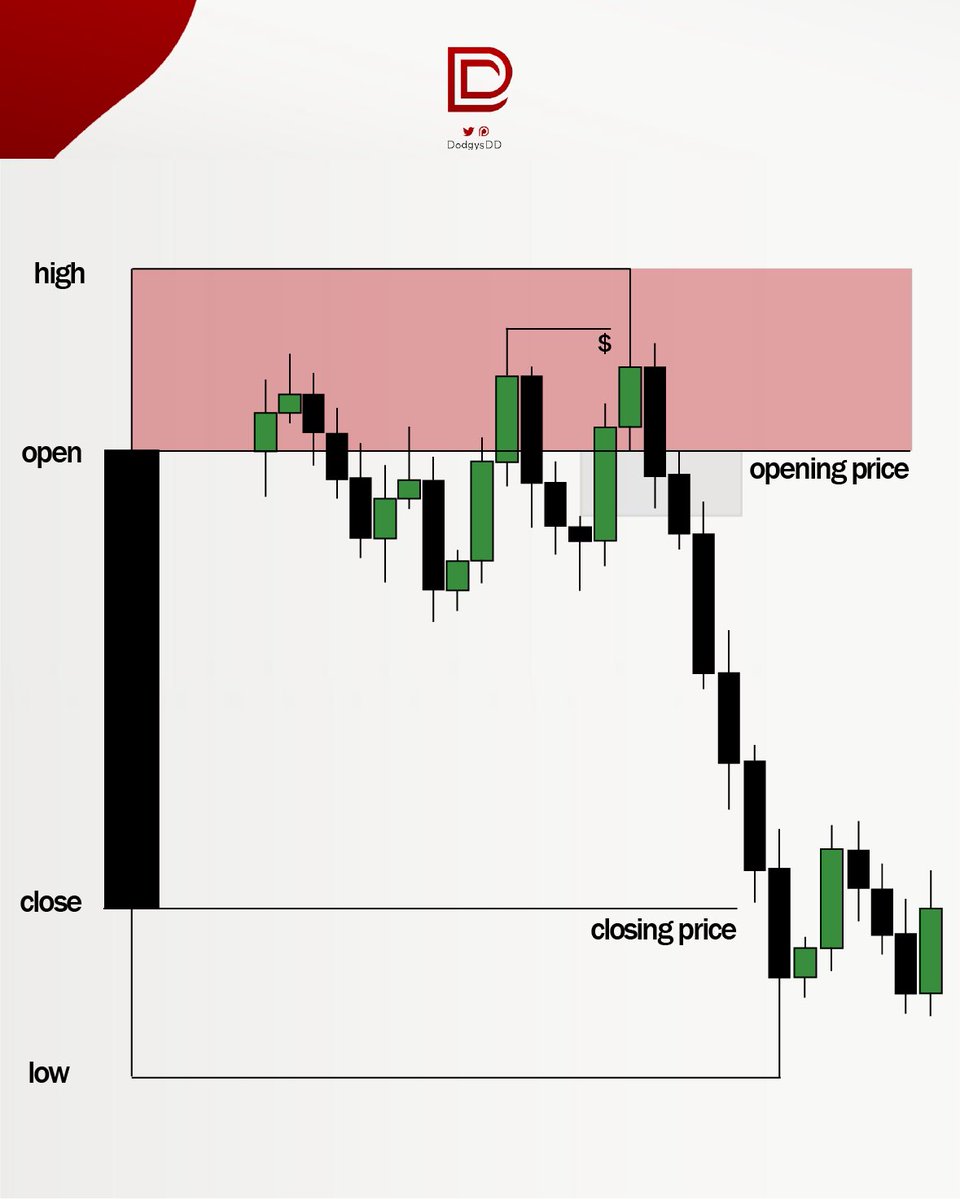

Well, this is quite obvious, but you definitely do not know where liquidity is. Now tell me, would you short this bearish FVG?

No, you would not. Well why? See those equal highs above? Usually that is where retail traders have their stop losses. FVGs are just used for entries. Liquidity always trumps FVGs. If you do not know where the market does not want to hunt, you will get wrecked

I have a personal rule where I never short a FVG with equal highs above, and never long with equal lows below. I would say about 85% of the time, this rule has saved me. The other 15%, the play works out, but who cares? Why would you want to long an FVG with equal lows and win

15% of the time?

You wouldn't. So who cares if it works. Oddly enough, today was the first day in a while where the short works with EQH above, but there were other reasons for this. Most of the time, I guarantee this will not work.

You wouldn't. So who cares if it works. Oddly enough, today was the first day in a while where the short works with EQH above, but there were other reasons for this. Most of the time, I guarantee this will not work.

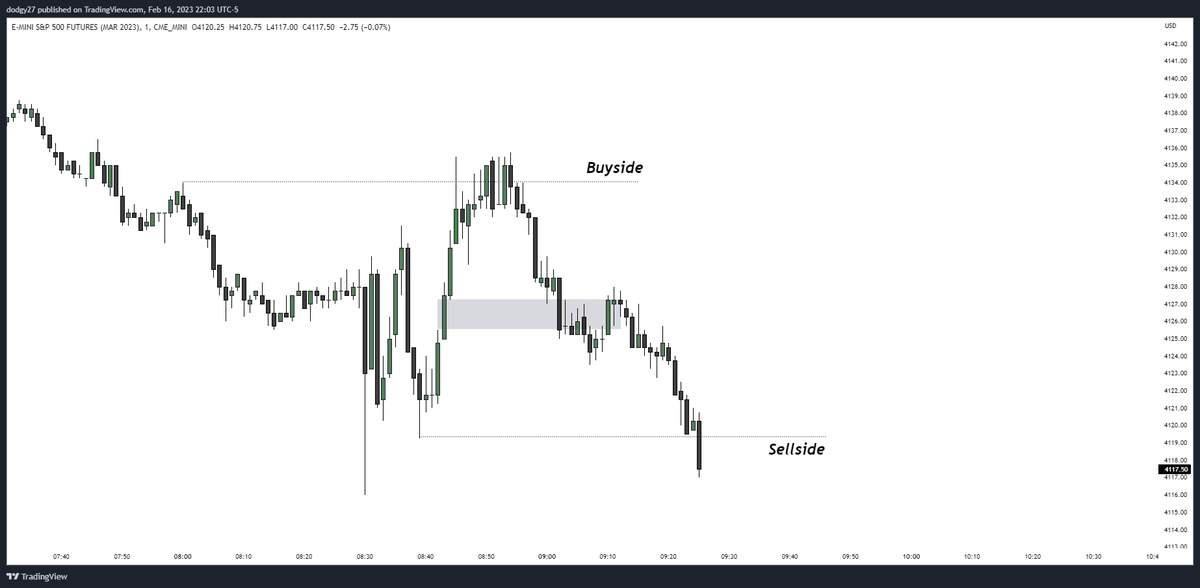

Check out this screenshot. I told my discord I would not short a textbook FVG with a MSS, Why? Well we had buy stops above (the equal highs) and that's where the market usually wants to hunt

ADDING ON TO THIS.

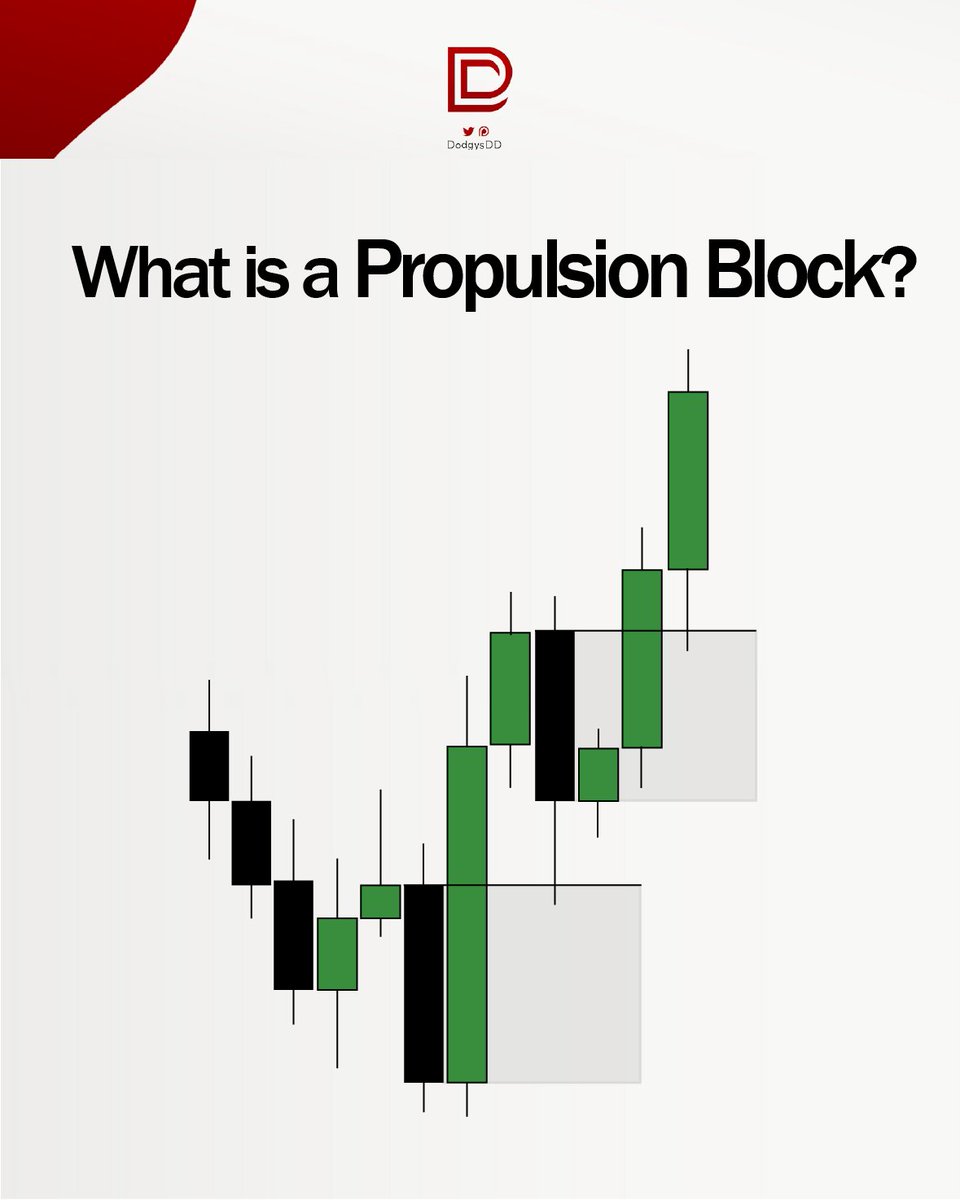

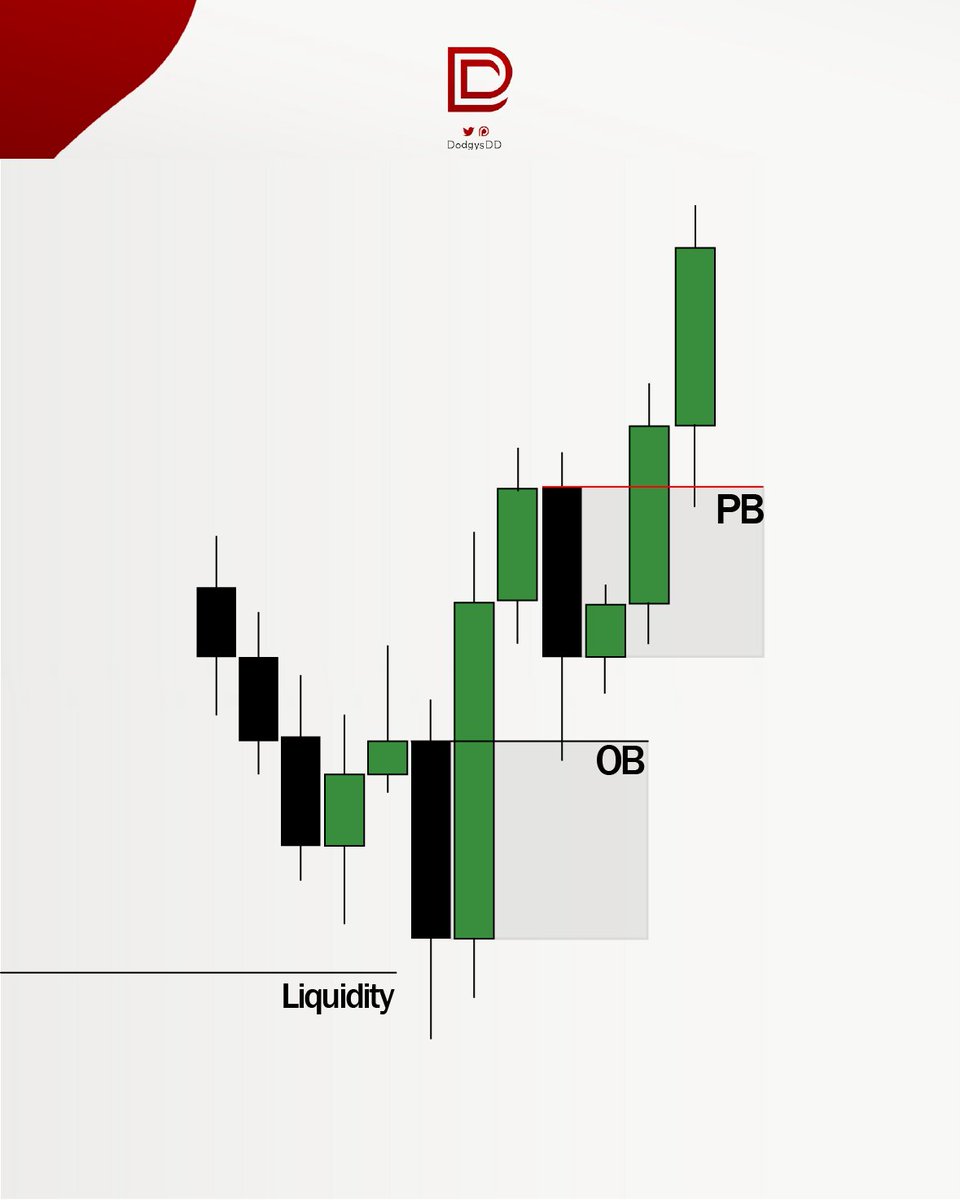

You probably do not have a good grasp of the models. In this picture are the buy and sell models. Follow @_0dte so you can see pictures of them every day.

They look something like this, but it is objective and you do not need the boxes.

You probably do not have a good grasp of the models. In this picture are the buy and sell models. Follow @_0dte so you can see pictures of them every day.

They look something like this, but it is objective and you do not need the boxes.

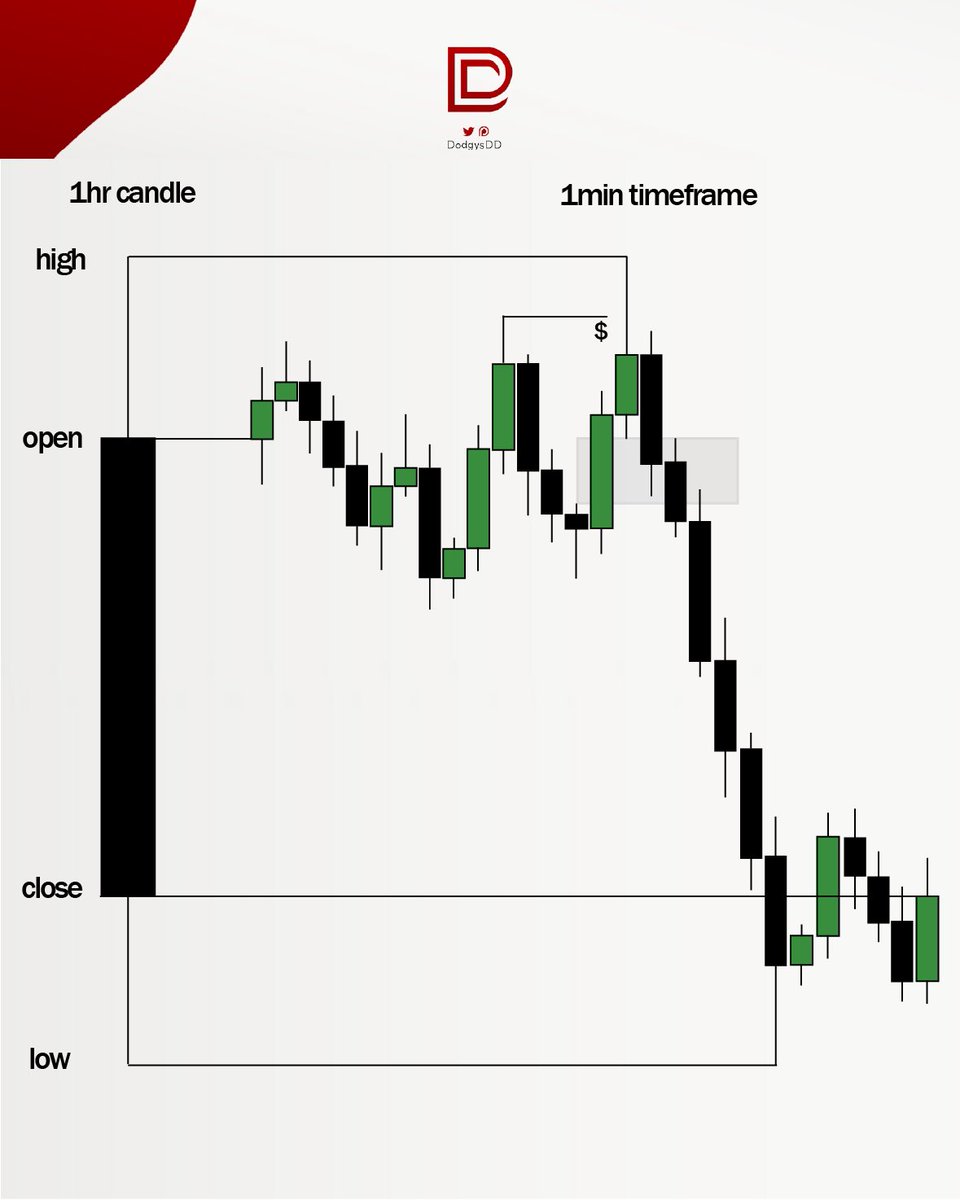

Here are a few real annotated examples. In all these examples you will notice there is some sort of obvious high or the low is the target. If you see what looks like accumulations and that "curve" and us holding bullish orderblocks, its probably a buy model.

So, let's say we see something like this with a very obvious high above. Do I know at this time this a buy model? No, I would want to see bullish discount PD rays expected and I would want to see old bearish FVGs ran through. At this point Im looking for a long off the Daily

Volume Imbalance, but I am not quite sure if we will hit that top buyside.

Now look at this. Once I see this old bearish fair value gap broken through, now I am pretty confident it's a buy model. So if I still have runners from the 1 min FVG entry I will scale at the opposite

Now look at this. Once I see this old bearish fair value gap broken through, now I am pretty confident it's a buy model. So if I still have runners from the 1 min FVG entry I will scale at the opposite

side PD arrays. So here, and here.

By this point I am pretty sure the high will be hit, but it takes screen time to study these models. I know the opposite side bearish FVGs worked for a scalp, but sometimes these will get squeezed through and you will get wrecked. Check 2nd pic

By this point I am pretty sure the high will be hit, but it takes screen time to study these models. I know the opposite side bearish FVGs worked for a scalp, but sometimes these will get squeezed through and you will get wrecked. Check 2nd pic

What I used to do is short in these bearish fair value gaps before some high was hit, and I would get wrecked. Even if it works, stop doing it. More than not it won't work. Also, if some sort of major buyside was taken, do not long. Same with shorts and sellside.

In the first picture, you can see we took the 8:00 am high, so why would you want to long? First picture it does not work. Second picture it does. It's not consistent enough to slap a FVG after hitting liquidity unless you have a good idea of a HTF model going on

Key Points:

See if we are close to an obvious high or low, such as yesterdays low of day, overnight high/low, or EQH/EQH. Take the fair value gaps in the proper PD array going to those levels, but once we hit the level, re-assess and don't long after buyside liquidity is purged

See if we are close to an obvious high or low, such as yesterdays low of day, overnight high/low, or EQH/EQH. Take the fair value gaps in the proper PD array going to those levels, but once we hit the level, re-assess and don't long after buyside liquidity is purged

Learning these models took me screen time to find live but once you do, it's money. @zeussy_mmxm is good at spotting them in real time

SECOND COMMON MISTAKE: Taking fair value gaps with no displacement.

For you more advanced guys, I totally understand taking FVGs with no displacement is fine if you know where liquidity is, but for you new guys, it is best to wait for good displacement. Check out these charts

For you more advanced guys, I totally understand taking FVGs with no displacement is fine if you know where liquidity is, but for you new guys, it is best to wait for good displacement. Check out these charts

FINAL COMMON MISTAKE. Longing fair value gaps in premium and shorting fair value gaps in discount.

For you advanced ICT guys, I get this works, but has to be right scenario. Newer guys, don't do it. You will have better RR longing FVGs in discount than you will in premium.

For you advanced ICT guys, I get this works, but has to be right scenario. Newer guys, don't do it. You will have better RR longing FVGs in discount than you will in premium.

Here's a good model to look for if you want to take a bullish FVG. (Same goes for bearish but opposite):

Liquidity purged(Could be PDH, PDL, EQH, EQL)

Strong displacement over lower high (w volume)

FVG in discount

Buyside above (buy model or EQH above)

Liquidity purged(Could be PDH, PDL, EQH, EQL)

Strong displacement over lower high (w volume)

FVG in discount

Buyside above (buy model or EQH above)

Anyways, this is it for now. This is pretty basic, I break some of these rules in different scenarios but this is where I would get wrecked when I first started ICT. Hope you guys learned something:)

Discord link: discord.gg/BnuyCdcP

Discord link: discord.gg/BnuyCdcP

• • •

Missing some Tweet in this thread? You can try to

force a refresh