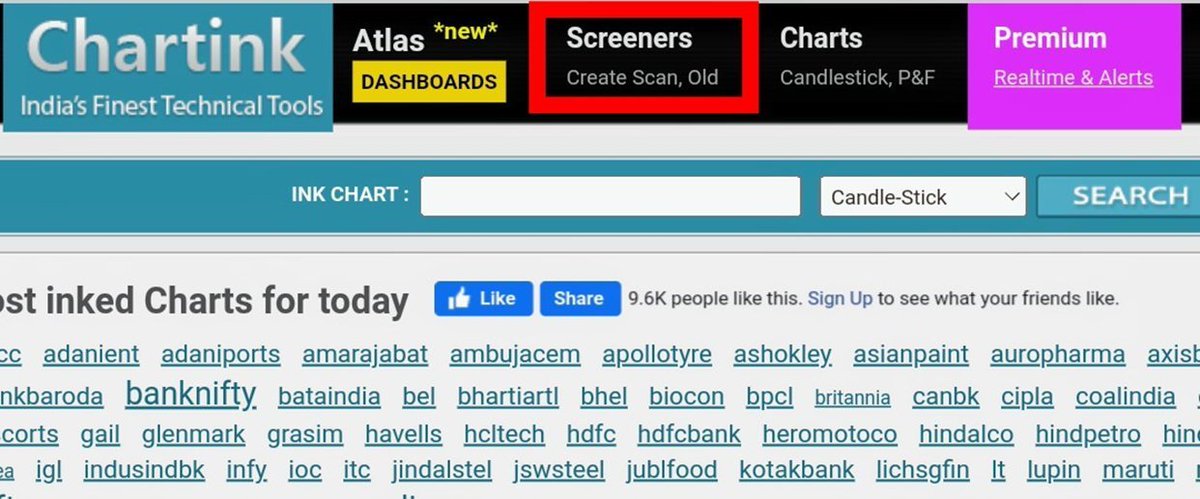

𝗛𝗼𝘄 𝘁𝗼 𝗰𝗿𝗲𝗮𝘁𝗲 𝘆𝗼𝘂𝗿 𝗼𝘄𝗻 𝗖𝗵𝗮𝗿𝘁𝗶𝗻𝗸 𝗦𝗰𝗿𝗲𝗲𝗻𝗲𝗿

🧵 Thread 🧵

[1/15]

🧵 Thread 🧵

[1/15]

𝗖𝗵𝗮𝗿𝘁𝗶𝗻𝗸 𝗦𝗰𝗿𝗲𝗲𝗻𝗲𝗿 is a Stock screening tool that is useful to screen stocks based on Technical & Fundamentals.

🔸 It scans stocks by using technical indicators like RSI, MACD, divergences, etc.

🔸 It also uses fundamental tools like Book Value, EPS,PE etc

[2/15]

🔸 It scans stocks by using technical indicators like RSI, MACD, divergences, etc.

🔸 It also uses fundamental tools like Book Value, EPS,PE etc

[2/15]

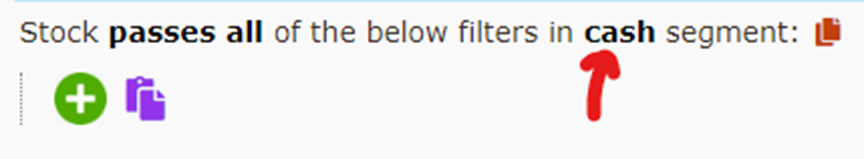

𝗙𝗶𝗿𝘀𝘁 𝗦𝘁𝗲𝗽 𝗧𝗼 𝗙𝗶𝗹𝘁𝗲𝗿 𝗦𝘁𝗼𝗰𝗸𝘀

We can select segments of stocks of our choice, e.g. cash or futures stocks, Nifty 100 etc.

Click on green ‘+’ icon to add conditions.

[4/15]

We can select segments of stocks of our choice, e.g. cash or futures stocks, Nifty 100 etc.

Click on green ‘+’ icon to add conditions.

[4/15]

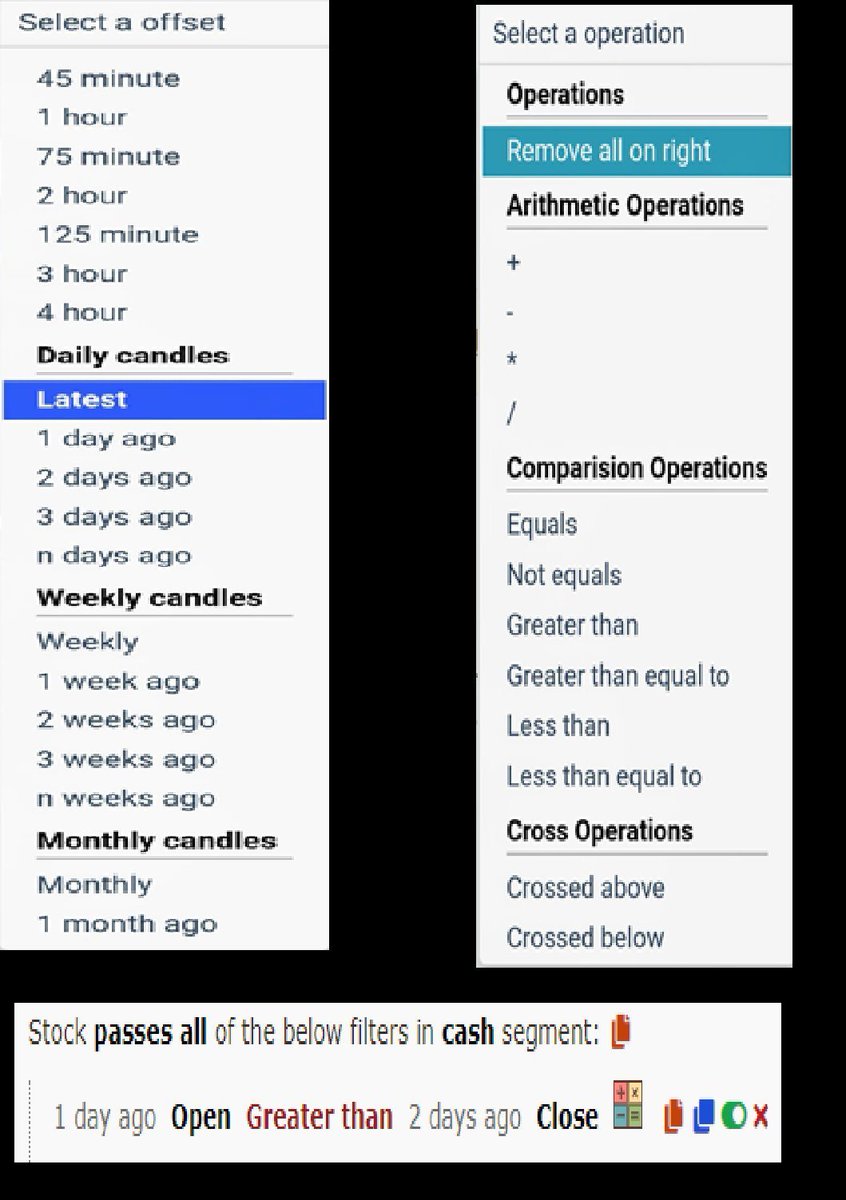

𝗖𝗮𝗻𝗱𝗹𝗲 𝗧𝗶𝗺𝗲𝗳𝗿𝗮𝗺𝗲𝘀 & 𝗖𝗼𝗺𝗽𝗮𝗿𝗶𝘀𝗼𝗻 𝗢𝗽𝗲𝗿𝗮𝘁𝗼𝗿𝘀

🔸 We can select any timeframe of candles in Chartink, from minutes to years.

🔸 And compare two candles using comparison operators like 𝘌𝘲𝘶𝘢𝘭 𝘵𝘰 or 𝘎𝘳𝘦𝘢𝘵𝘦𝘳 𝘛𝘩𝘢𝘯 , crossovers etc

[5/15]

🔸 We can select any timeframe of candles in Chartink, from minutes to years.

🔸 And compare two candles using comparison operators like 𝘌𝘲𝘶𝘢𝘭 𝘵𝘰 or 𝘎𝘳𝘦𝘢𝘵𝘦𝘳 𝘛𝘩𝘢𝘯 , crossovers etc

[5/15]

Example: 𝗥𝗦𝗜 , 𝗘𝗠𝗔 𝗮𝗻𝗱 𝗠𝗔𝗖𝗗

🔸 Daily RSI greater than 70 & close above EMA 50

🔸 Latest means Daily timeframe 1 day ago means Yesterday and so on

🔸 MACD Bearish or Bullish Cross

[6/15]

🔸 Daily RSI greater than 70 & close above EMA 50

🔸 Latest means Daily timeframe 1 day ago means Yesterday and so on

🔸 MACD Bearish or Bullish Cross

[6/15]

𝗜𝗻𝘀𝗶𝗱𝗲 𝗕𝗮𝗿 𝗖𝗮𝗻𝗱𝗹𝗲

🔸 An Inside Bar is a candle that’s “covered” by the prior candle.

🔸 Scan to filter stocks from Nifty 500 where the latest 15 minutes candle is an inside bar.

🔸 [0] means latest candle & [-1] means previous candle

[7/15]

🔸 An Inside Bar is a candle that’s “covered” by the prior candle.

🔸 Scan to filter stocks from Nifty 500 where the latest 15 minutes candle is an inside bar.

🔸 [0] means latest candle & [-1] means previous candle

[7/15]

𝗠𝗼𝘃𝗶𝗻𝗴 𝗔𝘃𝗲𝗿𝗮𝗴𝗲 𝗖𝗿𝗼𝘀𝘀𝗼𝘃𝗲𝗿,𝗩𝗼𝗹𝘂𝗺𝗲 𝗖𝗼𝗻𝗱𝗶𝘁𝗶𝗼𝗻 & %𝗖𝗵𝗮𝗻𝗴𝗲

🔸 20 EMA crossing above 50 EMA

🔸 Latest Volume greater than 1.5 times of 20 days average volume.

🔸 % Change more than 2%

[8/15]

🔸 20 EMA crossing above 50 EMA

🔸 Latest Volume greater than 1.5 times of 20 days average volume.

🔸 % Change more than 2%

[8/15]

𝗕𝘂𝗹𝗹𝗶𝘀𝗵 𝗗𝗶𝘃𝗲𝗿𝗴𝗲𝗻𝗰𝗲 𝗦𝗰𝗮𝗻

🔸 Divergence means that the indicator is moving in the opposite direction compared to the price.

🔸 If RSI is making higher highs-higher lows while the price is making lower highs-lower lows, it is termed as Bullish Divergence.

[9/15

🔸 Divergence means that the indicator is moving in the opposite direction compared to the price.

🔸 If RSI is making higher highs-higher lows while the price is making lower highs-lower lows, it is termed as Bullish Divergence.

[9/15

𝟱𝟮 𝗪𝗲𝗲𝗸𝘀 𝗛𝗶𝗴𝗵 𝗕𝗿𝗲𝗮𝗸𝗼𝘂𝘁 & 𝗡𝗲𝗮𝗿 𝟱𝟮 𝗪𝗲𝗲𝗸𝘀 𝗟𝗼𝘄

🔸 Future stocks closing above 52 weeks high or 252 days high.

🔸 Stocks near 52 weeks low zone, maximum 10% above 52 weeks low.

[10/15]

🔸 Future stocks closing above 52 weeks high or 252 days high.

🔸 Stocks near 52 weeks low zone, maximum 10% above 52 weeks low.

[10/15]

𝗙𝘂𝗻𝗱𝗮𝗺𝗲𝗻𝘁𝗮𝗹 𝗦𝗰𝗮𝗻𝘀

🔸 Stocks with 200% yearly profit jump.

🔸 Stocks with market cap more than 3000 Cr & paying more than 100% dividend.

[11/15]

🔸 Stocks with 200% yearly profit jump.

🔸 Stocks with market cap more than 3000 Cr & paying more than 100% dividend.

[11/15]

Youtube Video Part 1 : Basics of Chartink Screener

Part 2: Indicator :

[12/15]

Part 2: Indicator :

[12/15]

9 Imp Chartink Screener :

[13/15]

https://twitter.com/JayneshKasliwal/status/1507325237880561668?s=20

[13/15]

Download the Techno Charts Android App :

bit.ly/TechnoChartsApp and get Free Access to Course

iOS - apps.apple.com/in/app/myinsti…

Org Code - CDGWMO

[14/15]

bit.ly/TechnoChartsApp and get Free Access to Course

iOS - apps.apple.com/in/app/myinsti…

Org Code - CDGWMO

[14/15]

• • •

Missing some Tweet in this thread? You can try to

force a refresh