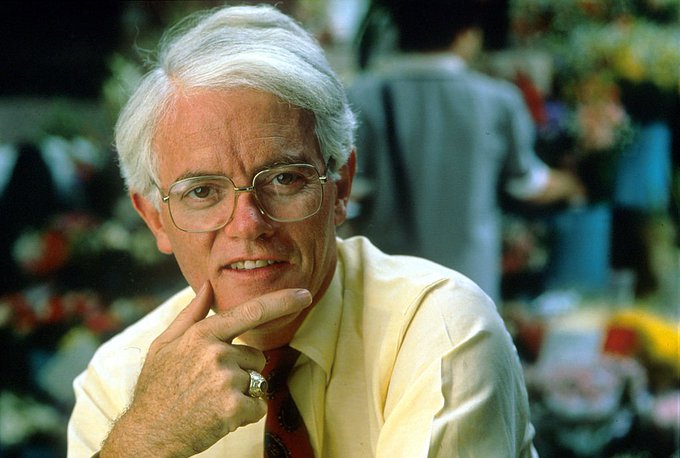

Peter Lynch ran the Magellan Fund from 1977 to 1990, where he generated a CAGR of 29.2%.

Starting with $20 million, the fund would grow to $14 billion by the time he left.

These 12 quotes will make you a better investor.

THREAD

Starting with $20 million, the fund would grow to $14 billion by the time he left.

These 12 quotes will make you a better investor.

THREAD

1. "Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in corrections themselves."

- Focus on what you know and can control.

- Focus on what you know and can control.

2. "Know what you own, and know why you own it."

- Never borrow conviction from others. Do your own research and build your own assumptions.

- Never borrow conviction from others. Do your own research and build your own assumptions.

3. "An important key to investing is to remember that stocks are not lottery tickets."

- Think of stocks as businesses, not tickers on a screen.

- Think of stocks as businesses, not tickers on a screen.

4. “Just because you buy a stock and it goes up does not mean you are right. Just because you buy a stock and it goes down does not mean you are wrong."

- In the short term, markets are voting machines.

- In the short term, markets are voting machines.

5. "There is always something to worry about. Avoid weekend thinking and ignoring the latest dire predictions of the newscasters. Sell a stock because the company’s fundamentals deteriorate, not because the sky is falling."

- Signal > noise.

- Signal > noise.

6. “You have to let the big ones make up for your mistakes. In this business, if you're good, you're right six times out of ten. You're never going to be right nine times out of ten.”

- You don't need to be right on every investment but maintain a solid average.

- You don't need to be right on every investment but maintain a solid average.

7. “Some stocks go up 20-30% and they get rid of it and they hold onto the dogs. And it's sort of like watering the weeds and cutting out the flowers. You want to let the winners run.”

- Let your winners pay for your losers. Don't sell your winners to double down on losers.

- Let your winners pay for your losers. Don't sell your winners to double down on losers.

8. "Stocks are a safe bet, but only if you stay invested long enough to ride out the corrections. When you sell in desperation, you always sell cheap."

- Time in the market > Timing the market

- Time in the market > Timing the market

9. “Never invest in a company without understanding its finances. The biggest losses in stocks come from companies with poor balance sheets."

- Revenue is great, but cash is the lifeblood of a business.

- Revenue is great, but cash is the lifeblood of a business.

10. “I don’t know anyone who said on their deathbed: ‘Gee, I wish I’d spent more time at the office'".

- Invest so that you can increase your free time in later life. Remember to enjoy the present while you build your future."

- Invest so that you can increase your free time in later life. Remember to enjoy the present while you build your future."

11. “You can’t see the future through a rearview mirror."

- The market is a forward-looking machine, don't spend too long looking into the past. Spend more time discovering the winners of tomorrow.

- The market is a forward-looking machine, don't spend too long looking into the past. Spend more time discovering the winners of tomorrow.

12. “The typical big winner in the Lynch portfolio generally takes three to ten years to play out."

- Investors need the patience to wait for the results that come from holding long-term. They are not linear.

- Investors need the patience to wait for the results that come from holding long-term. They are not linear.

• • •

Missing some Tweet in this thread? You can try to

force a refresh