A community that amplifies insights from top investors, backed by the performance and portfolio in their linked brokerage accounts.

8 subscribers

How to get URL link on X (Twitter) App

1/ “It's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong".

1/ “It's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong".

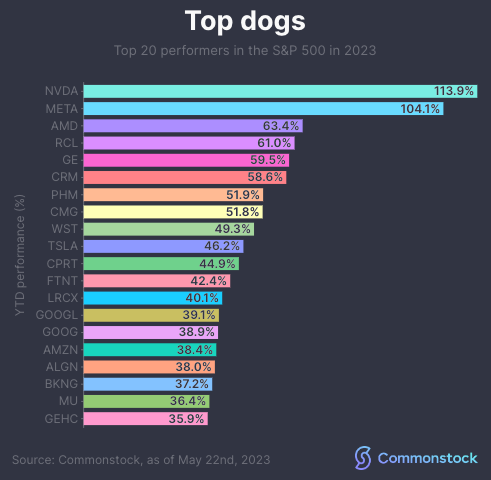

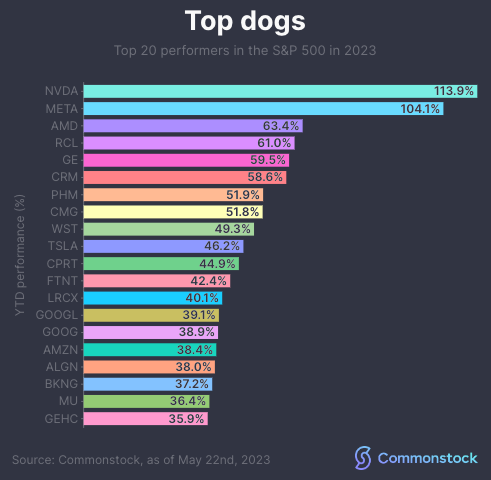

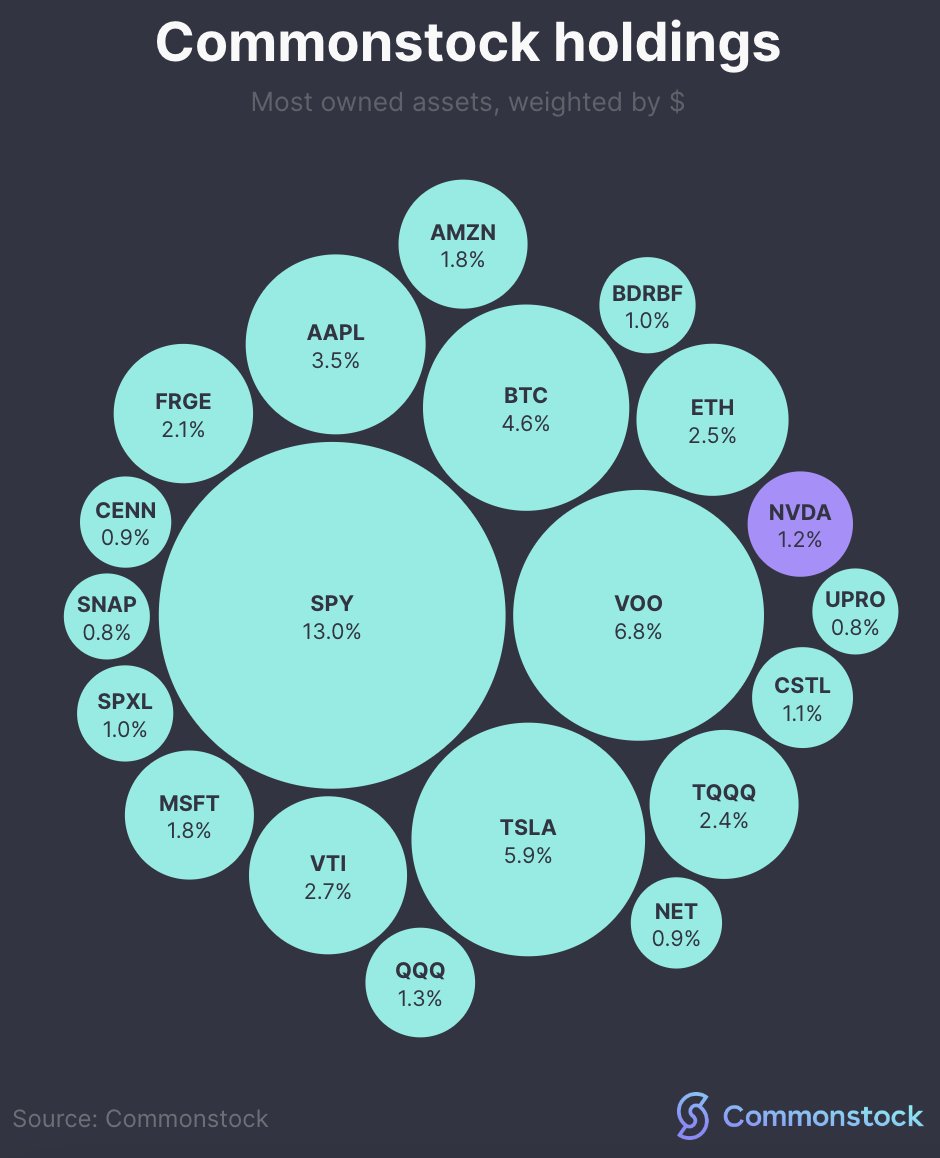

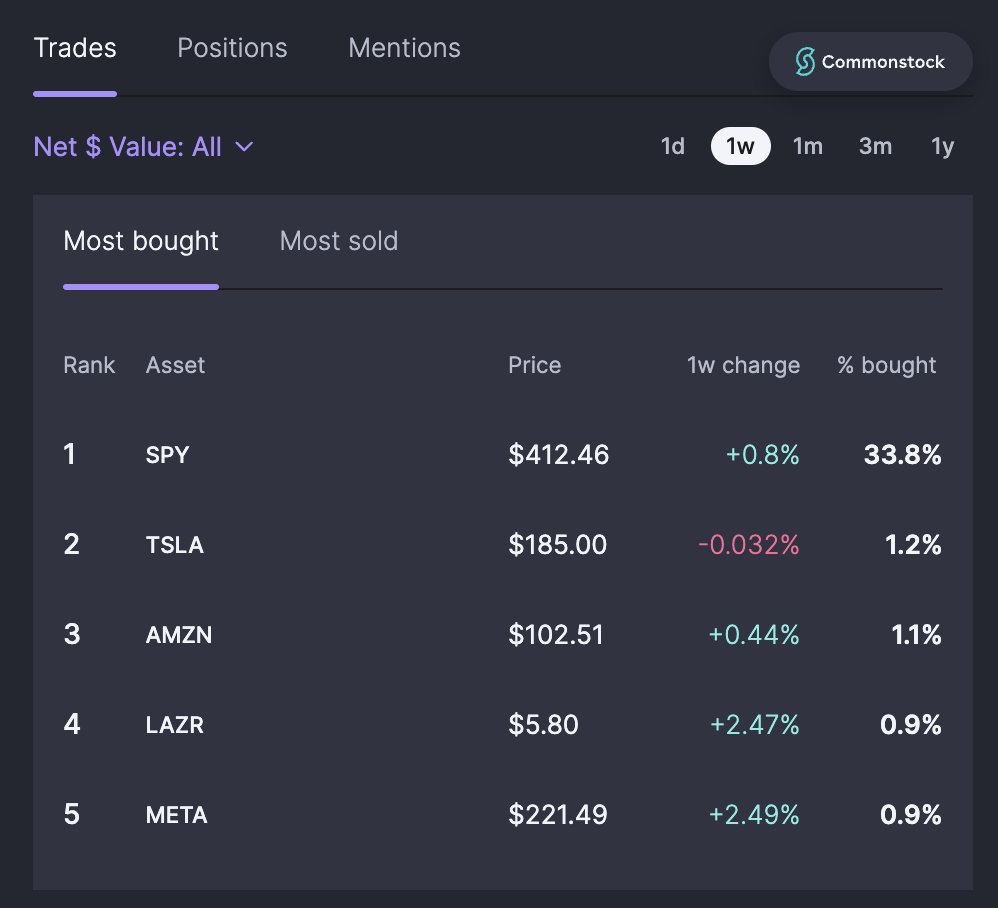

2/ Despite the incredible run in $NVDA the stock continues to be one of the most actively traded stocks amongst Commonstock investors.

2/ Despite the incredible run in $NVDA the stock continues to be one of the most actively traded stocks amongst Commonstock investors.

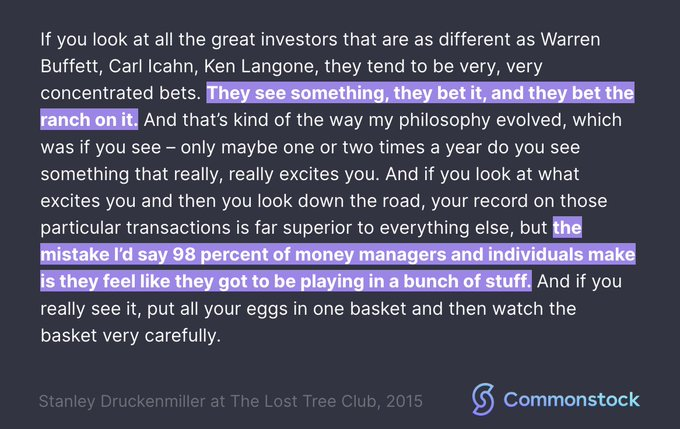

1/ "The mistake I’d say 98% of money managers and individuals make is they feel like they got to be playing in a bunch of stuff. And if you really see it, put all your eggs in one basket and then watch the basket very carefully".

1/ "The mistake I’d say 98% of money managers and individuals make is they feel like they got to be playing in a bunch of stuff. And if you really see it, put all your eggs in one basket and then watch the basket very carefully".

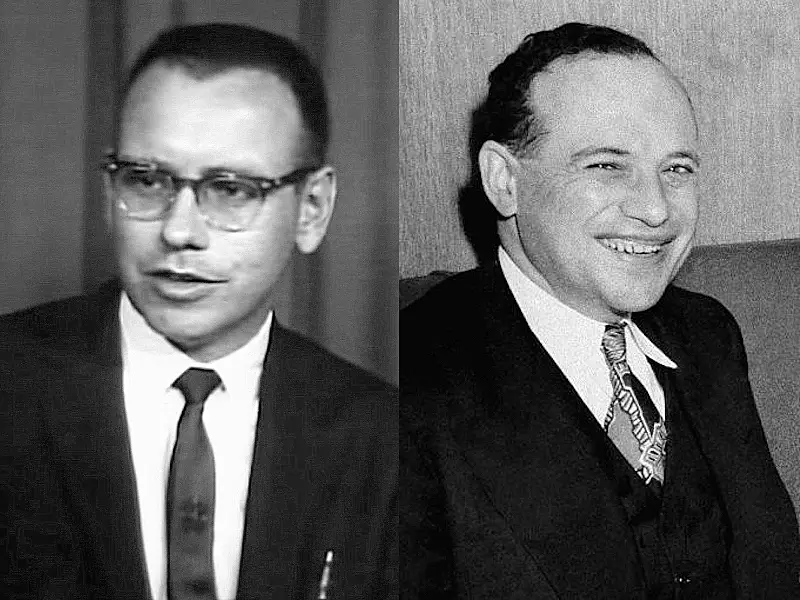

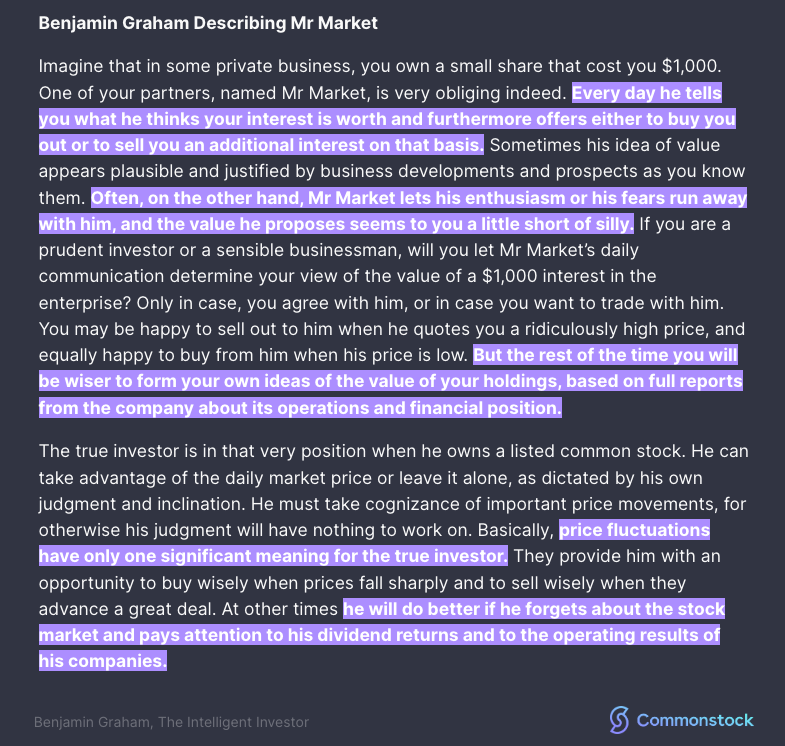

1/ The term "Mr Market" was coined by Graham to illustrate the fickle nature of the stock market.

1/ The term "Mr Market" was coined by Graham to illustrate the fickle nature of the stock market.

1/ "Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in corrections themselves."

1/ "Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in corrections themselves."

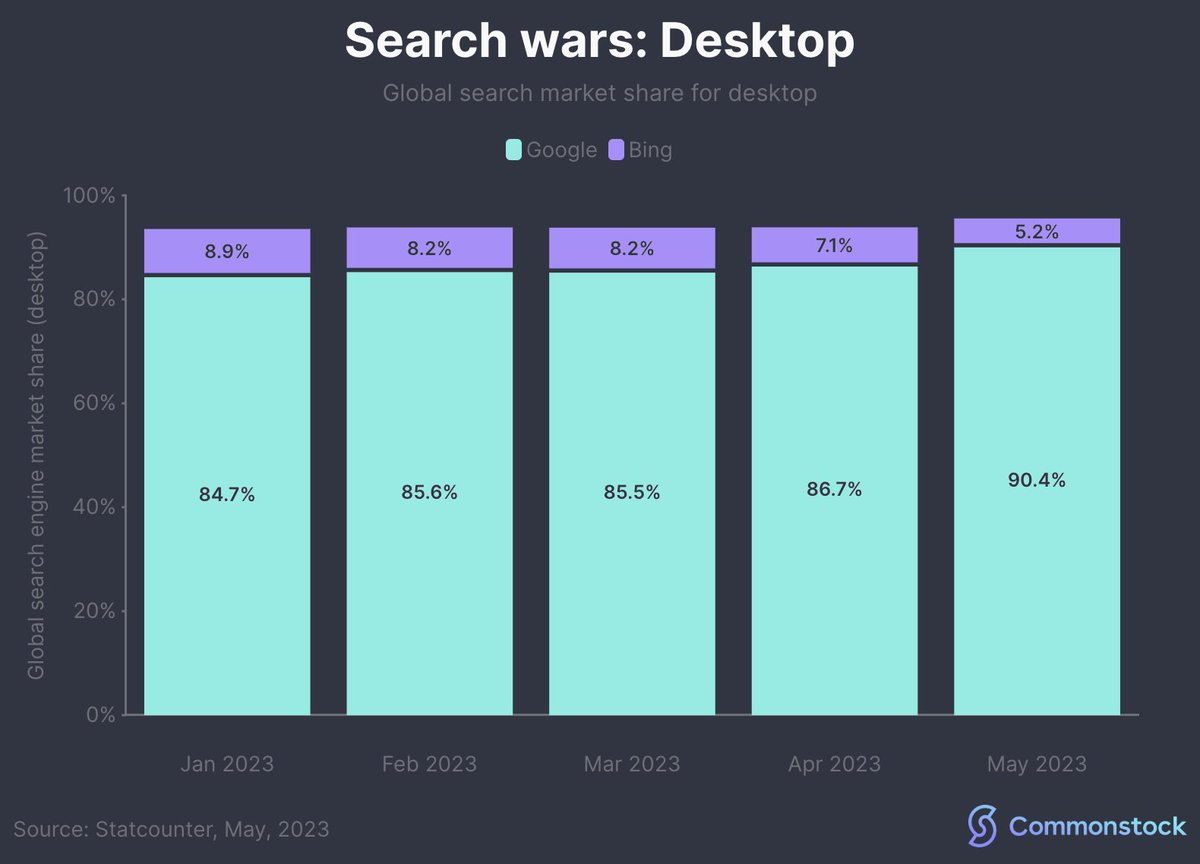

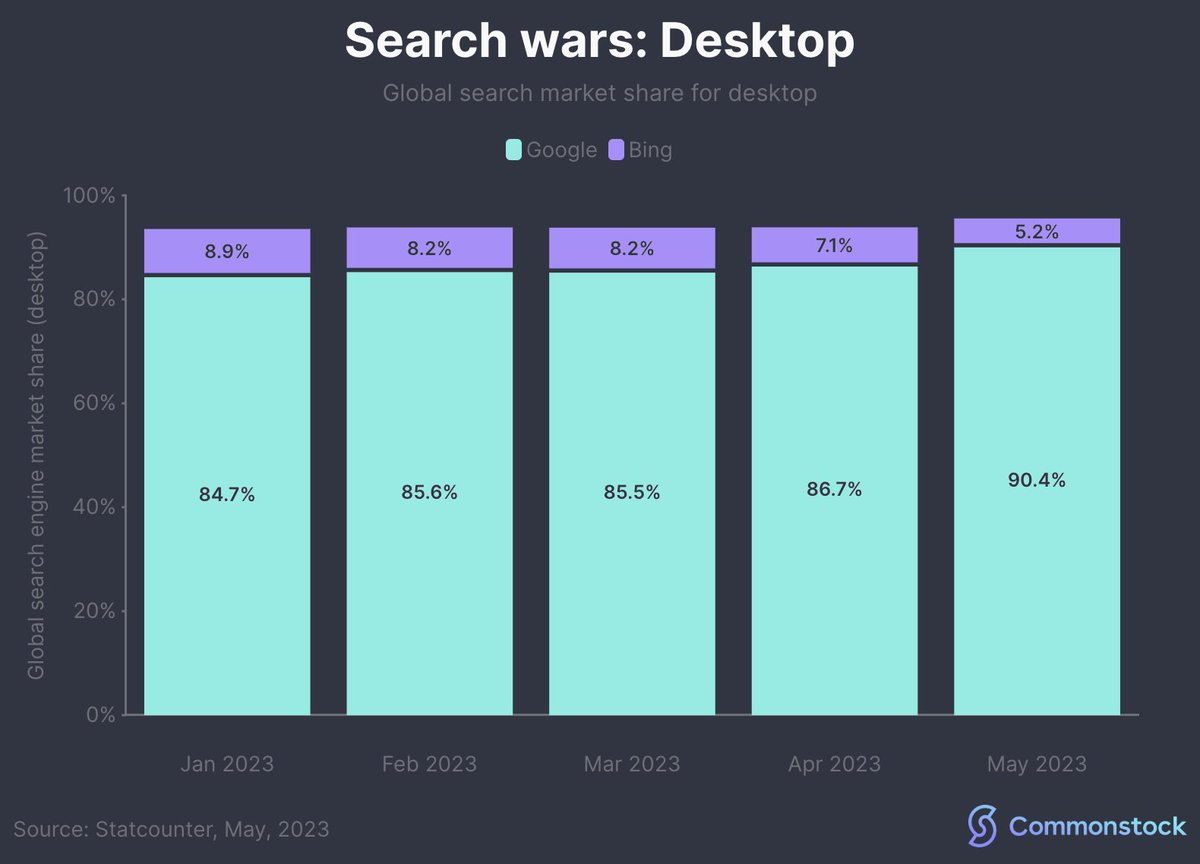

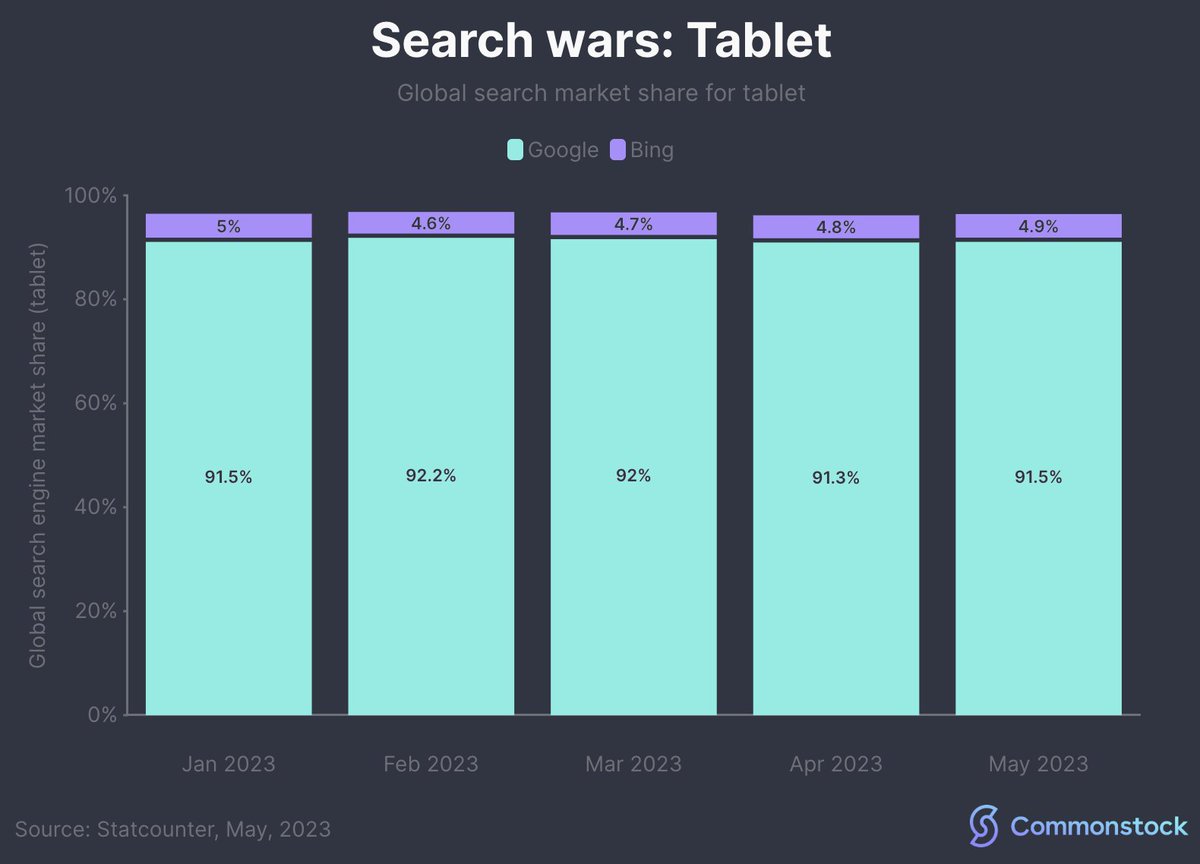

2/ Bing's share of tablet search has slowly increased over the past four months, now totalling 4.9%.

2/ Bing's share of tablet search has slowly increased over the past four months, now totalling 4.9%.

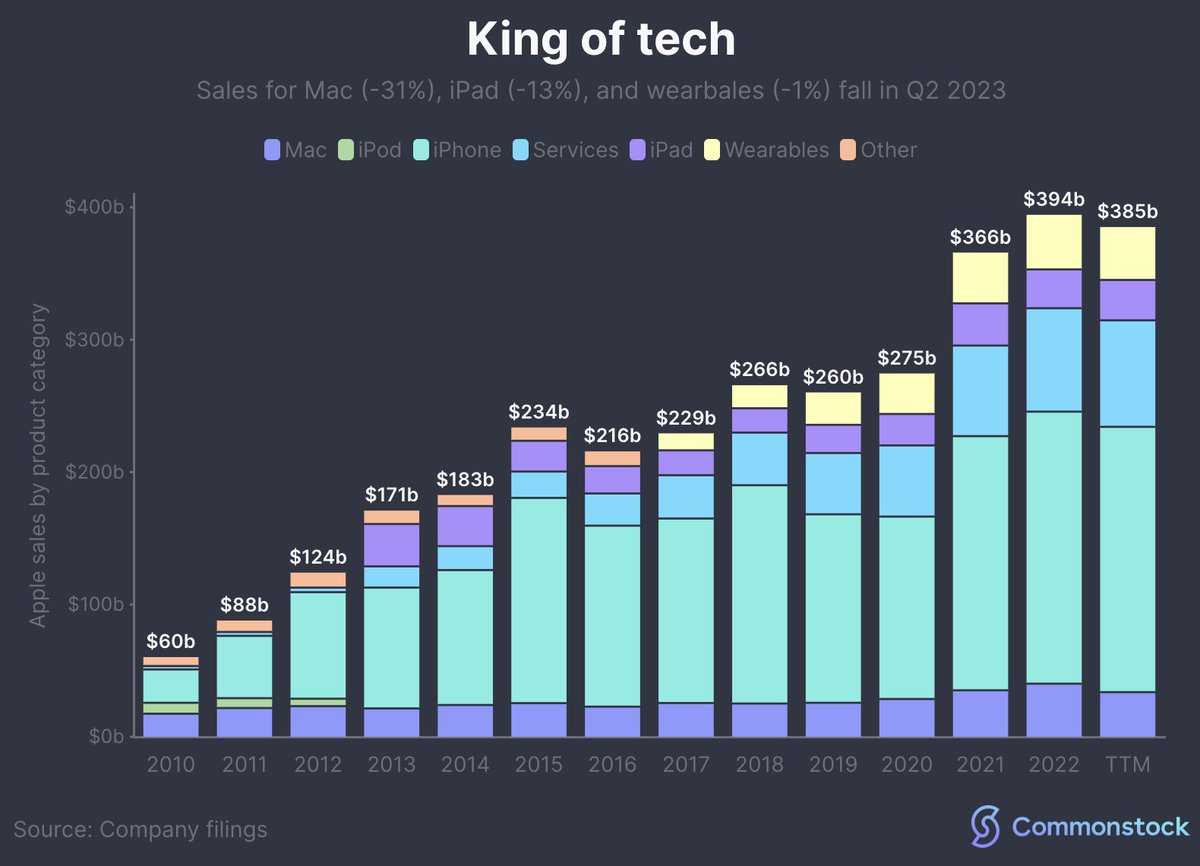

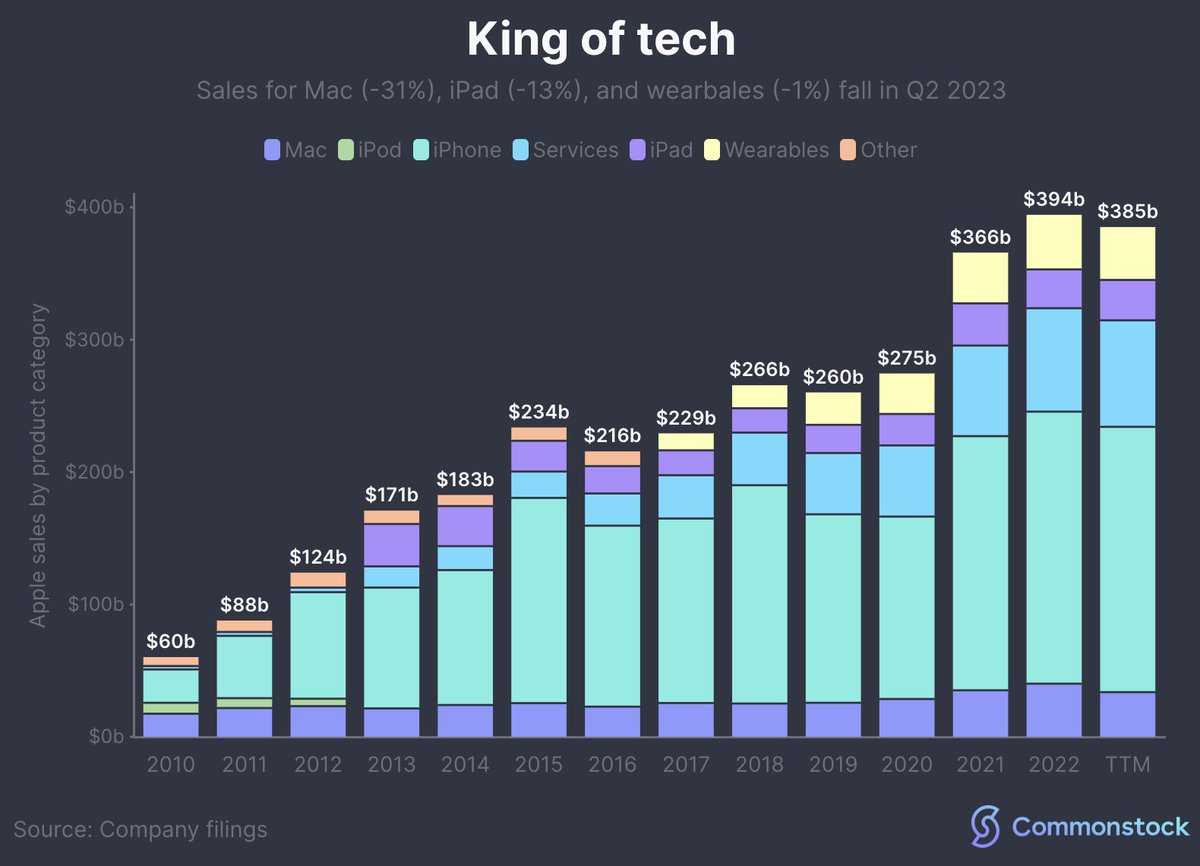

1/ While product revenues struggle, services hit record highs.

1/ While product revenues struggle, services hit record highs.

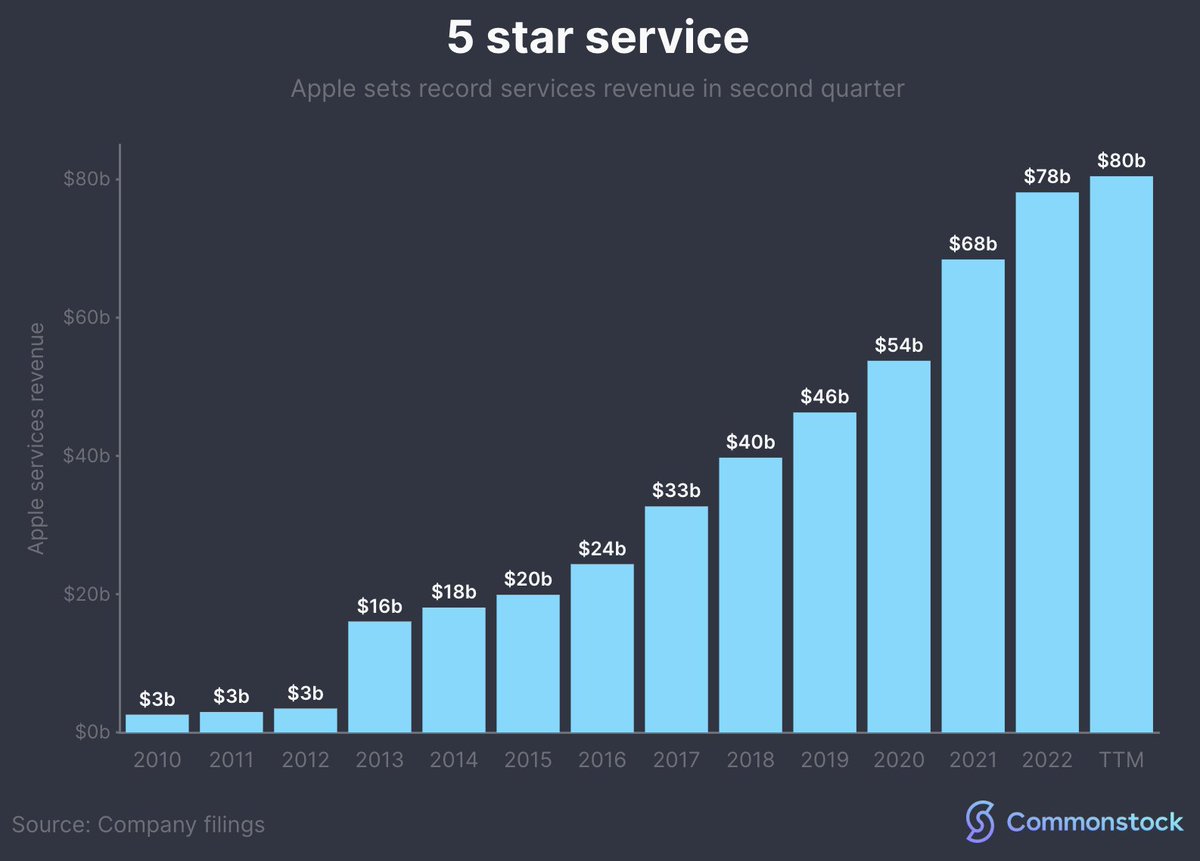

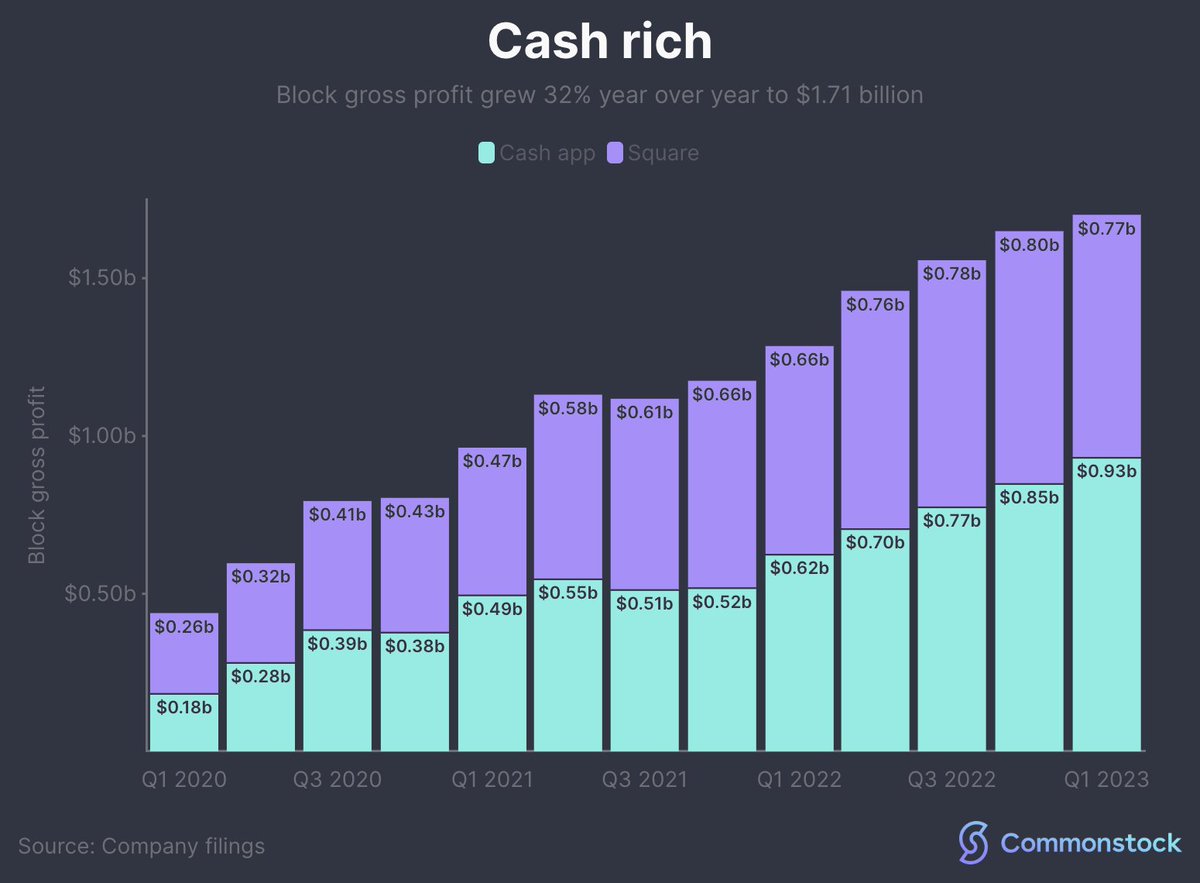

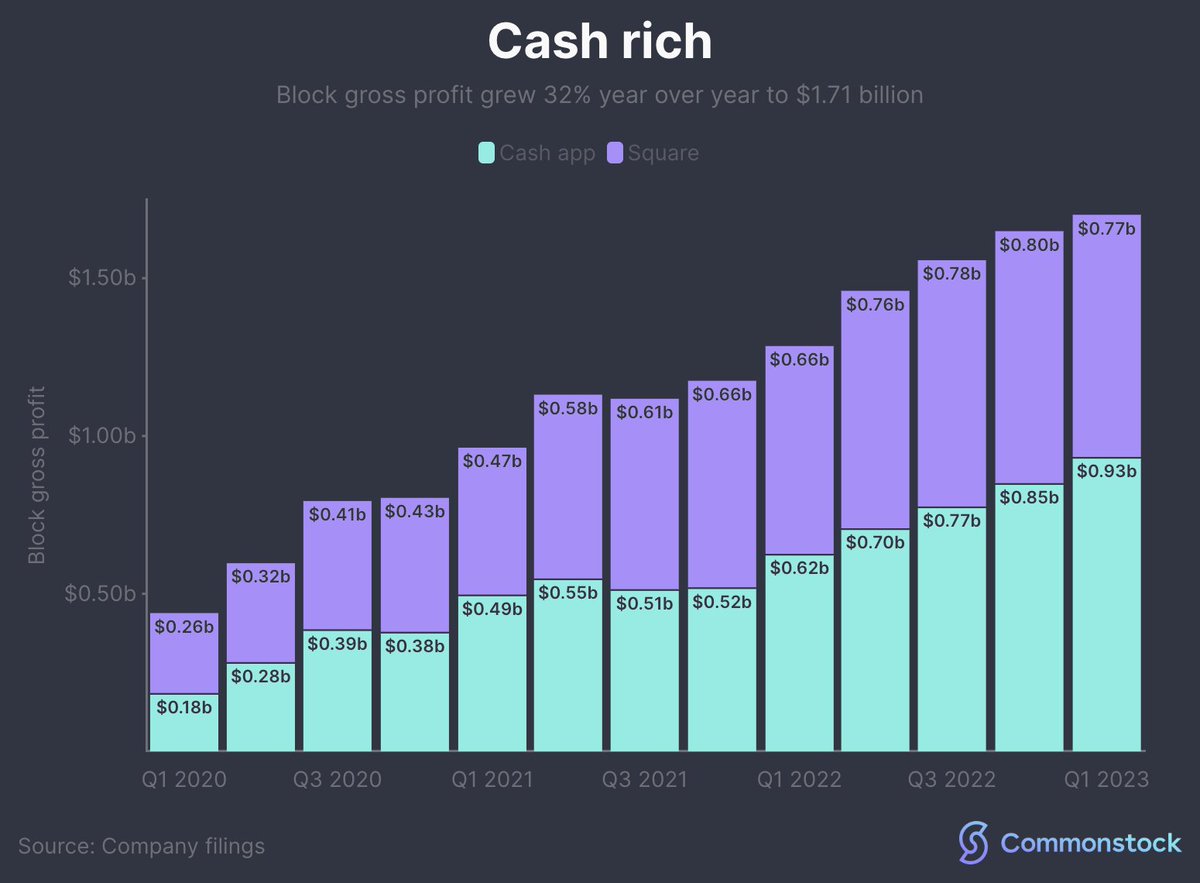

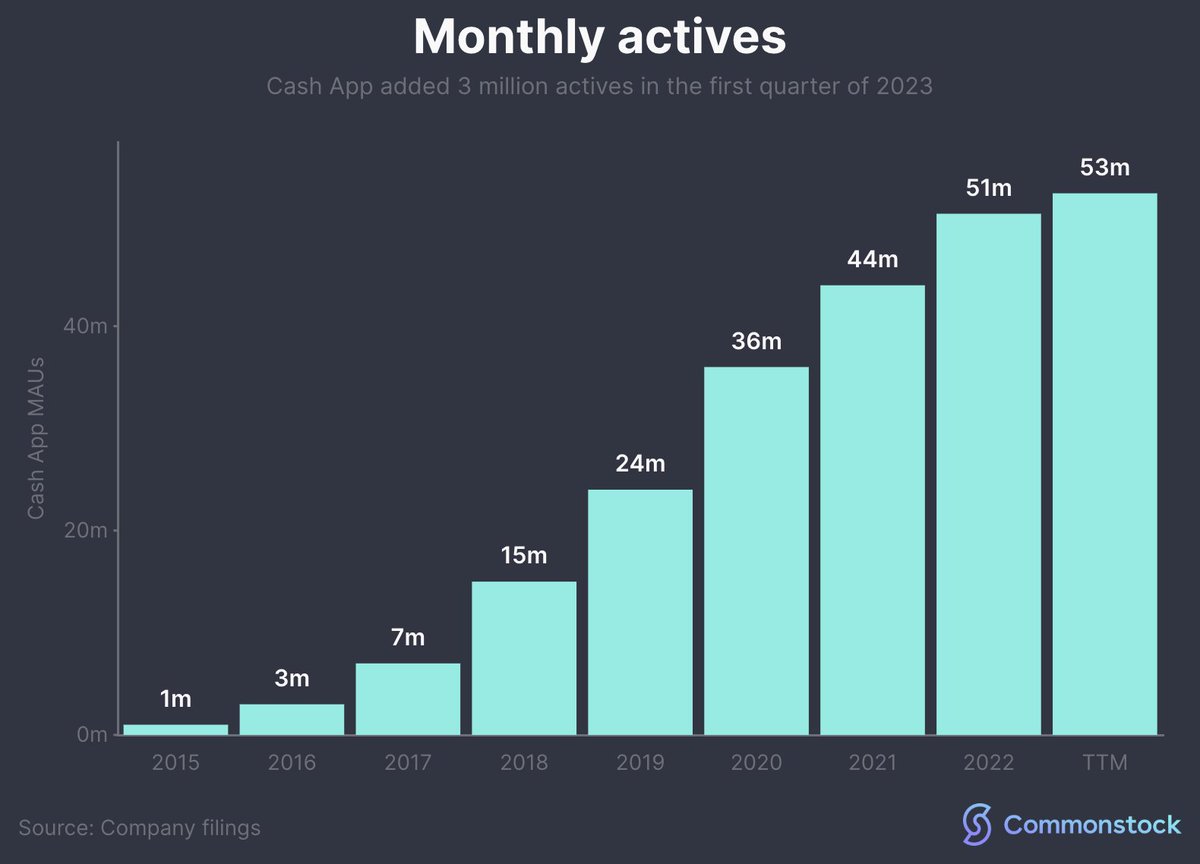

1/ Usage, inflows, and monetisation are all trending upwards at Cash App.

1/ Usage, inflows, and monetisation are all trending upwards at Cash App.

https://twitter.com/JoinCommonstock/status/1652965573045919744?s=20

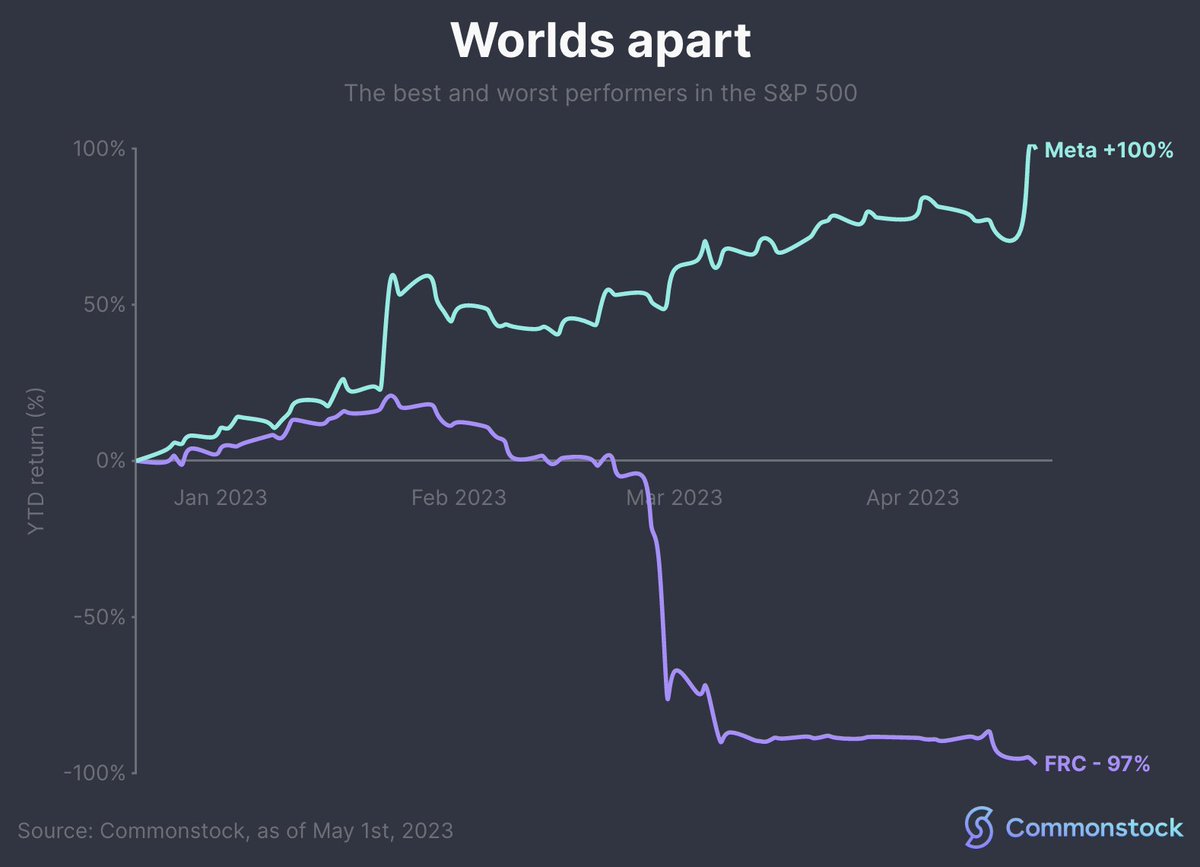

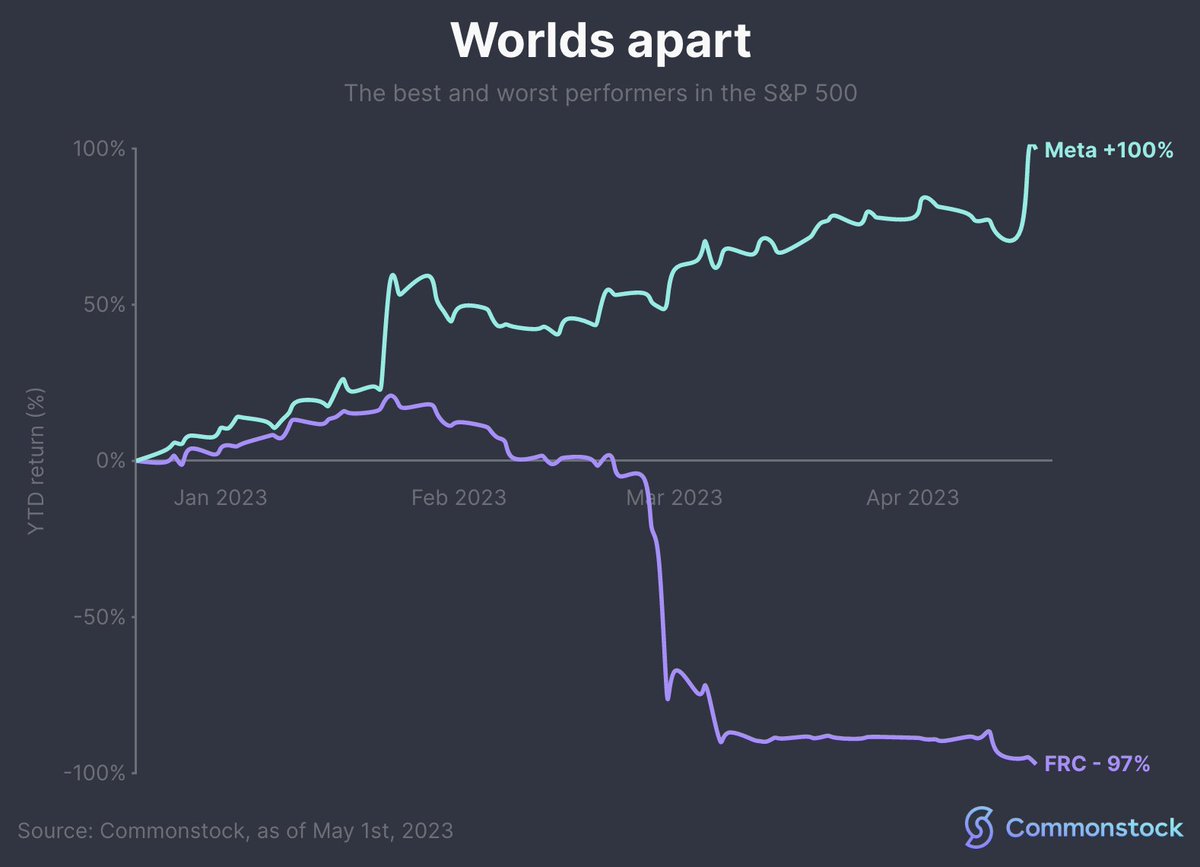

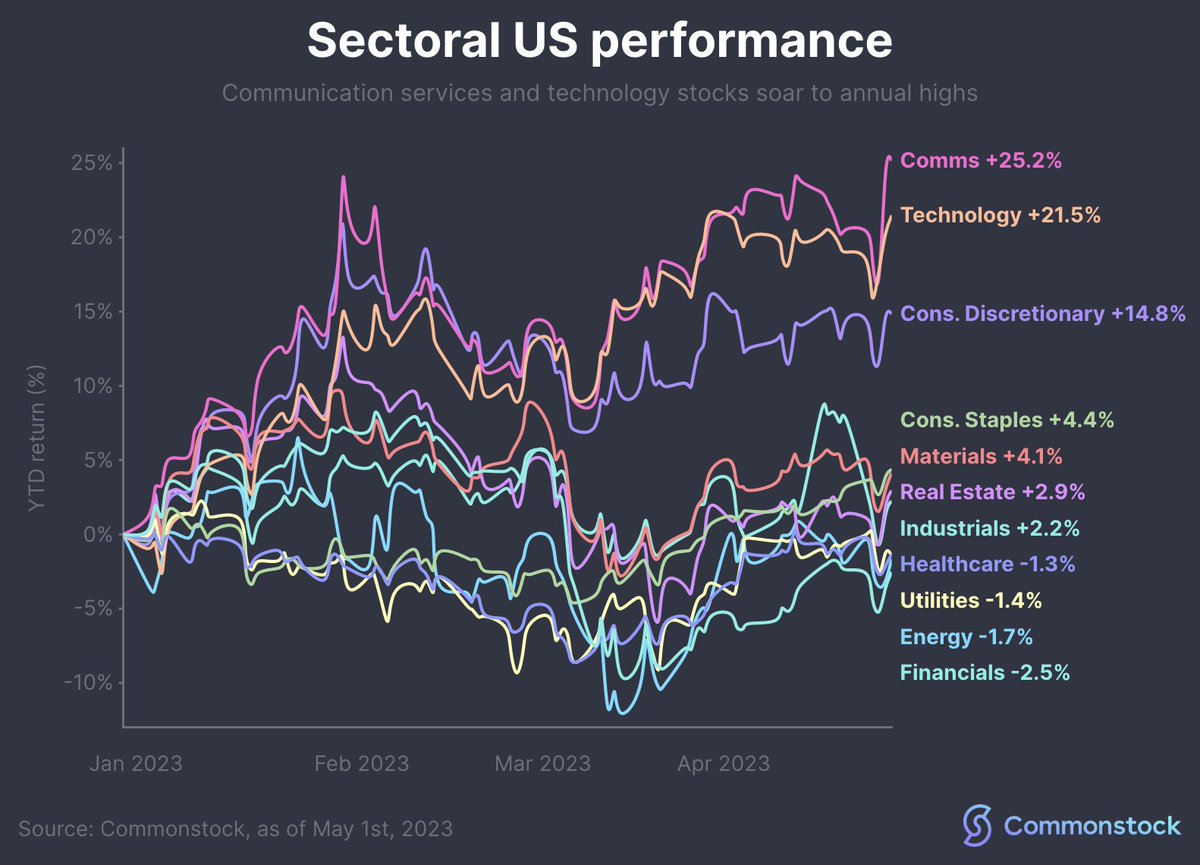

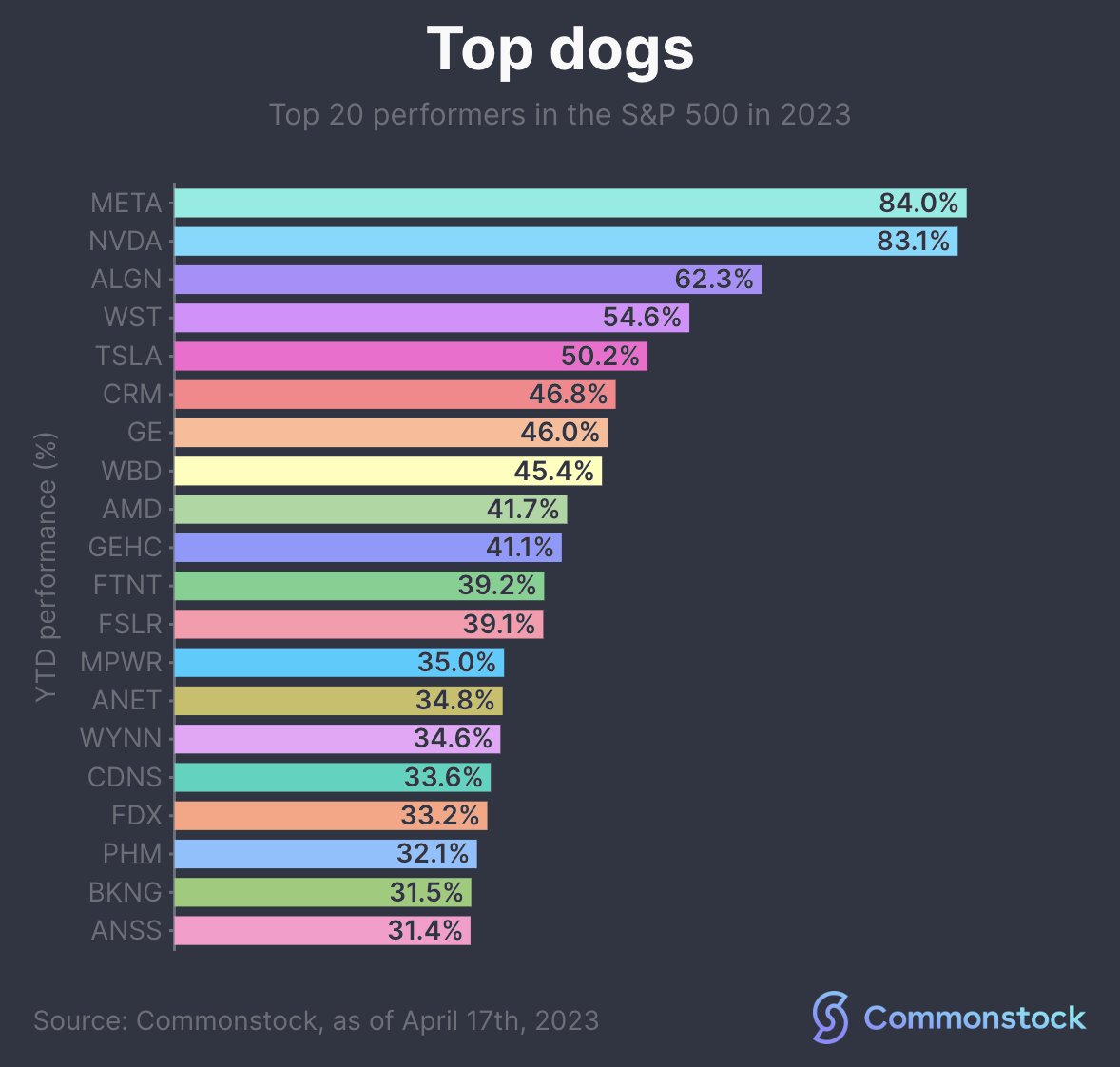

2/ Communication services and technology sectors came back from a minor slump to hit all-time highs for 2023.

2/ Communication services and technology sectors came back from a minor slump to hit all-time highs for 2023.

1/ "Don’t focus on making money, focus on protecting what you have".

1/ "Don’t focus on making money, focus on protecting what you have".

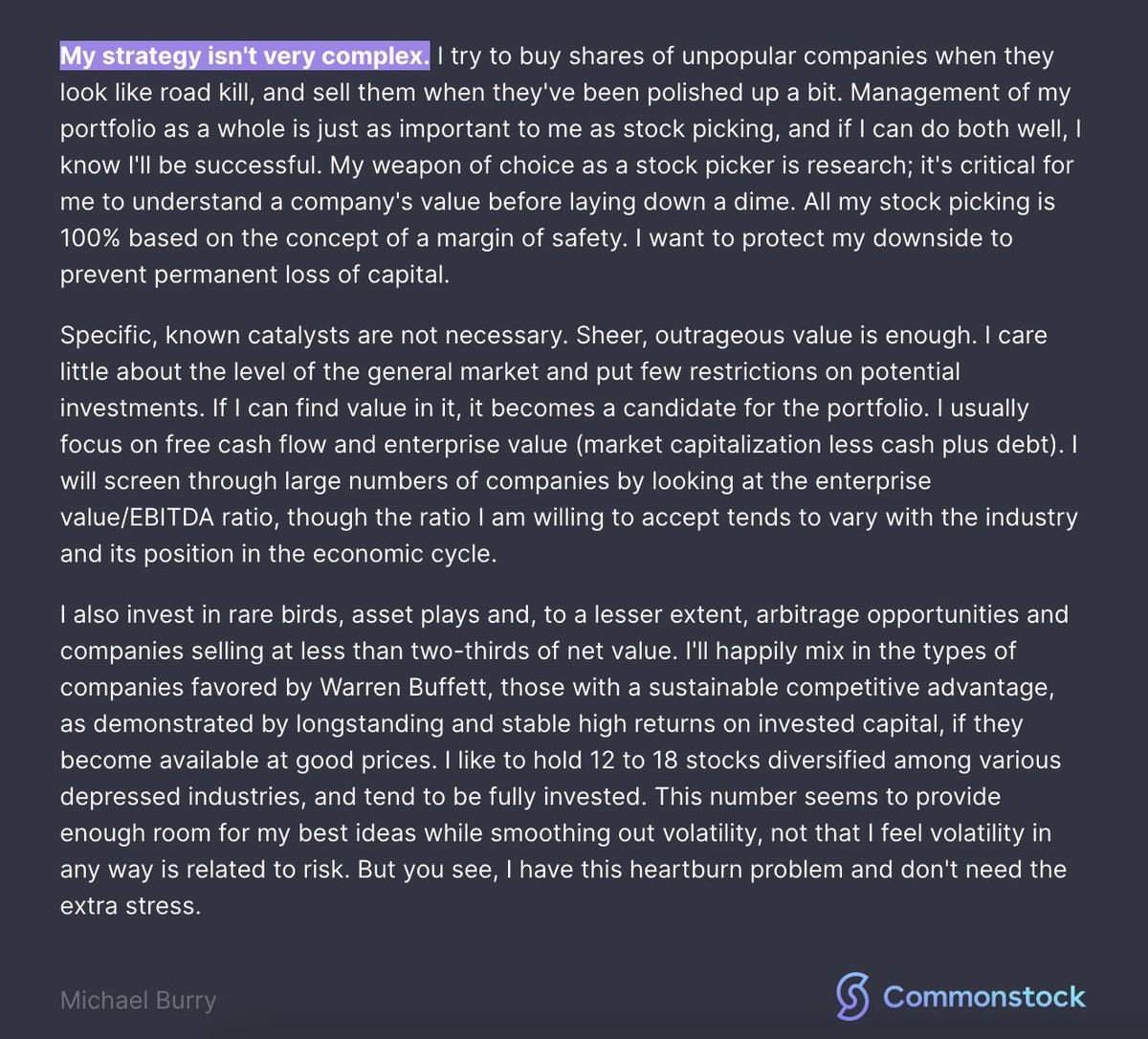

1/His weapon of choice? Research.

1/His weapon of choice? Research.

2/ Despite the incredible run $NVDA has had in 2023, investors continue to buy and hold.

2/ Despite the incredible run $NVDA has had in 2023, investors continue to buy and hold.

1/ As a student Buffet read a copy of The Intelligent Investor and it changed his life.

1/ As a student Buffet read a copy of The Intelligent Investor and it changed his life.

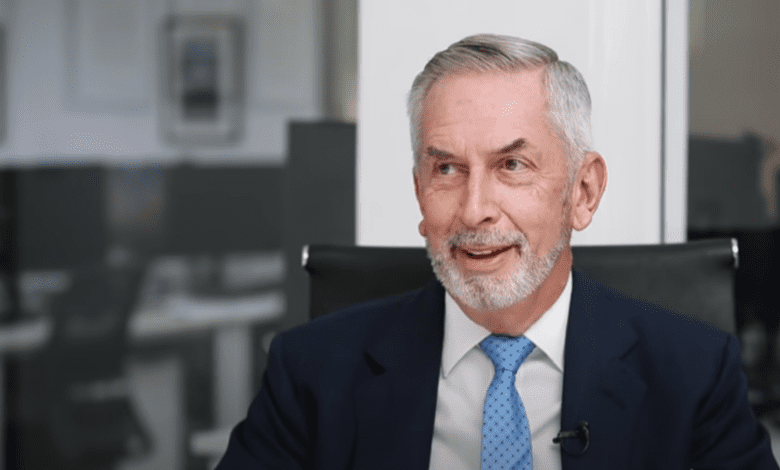

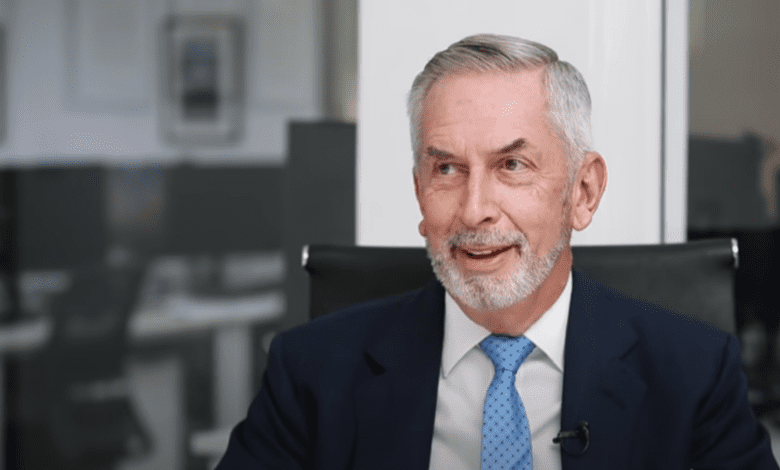

1. Fundsmith's desired companies:

1. Fundsmith's desired companies:

1. Whatever outcome you prepare for, know that it can be considerably worse.

1. Whatever outcome you prepare for, know that it can be considerably worse.

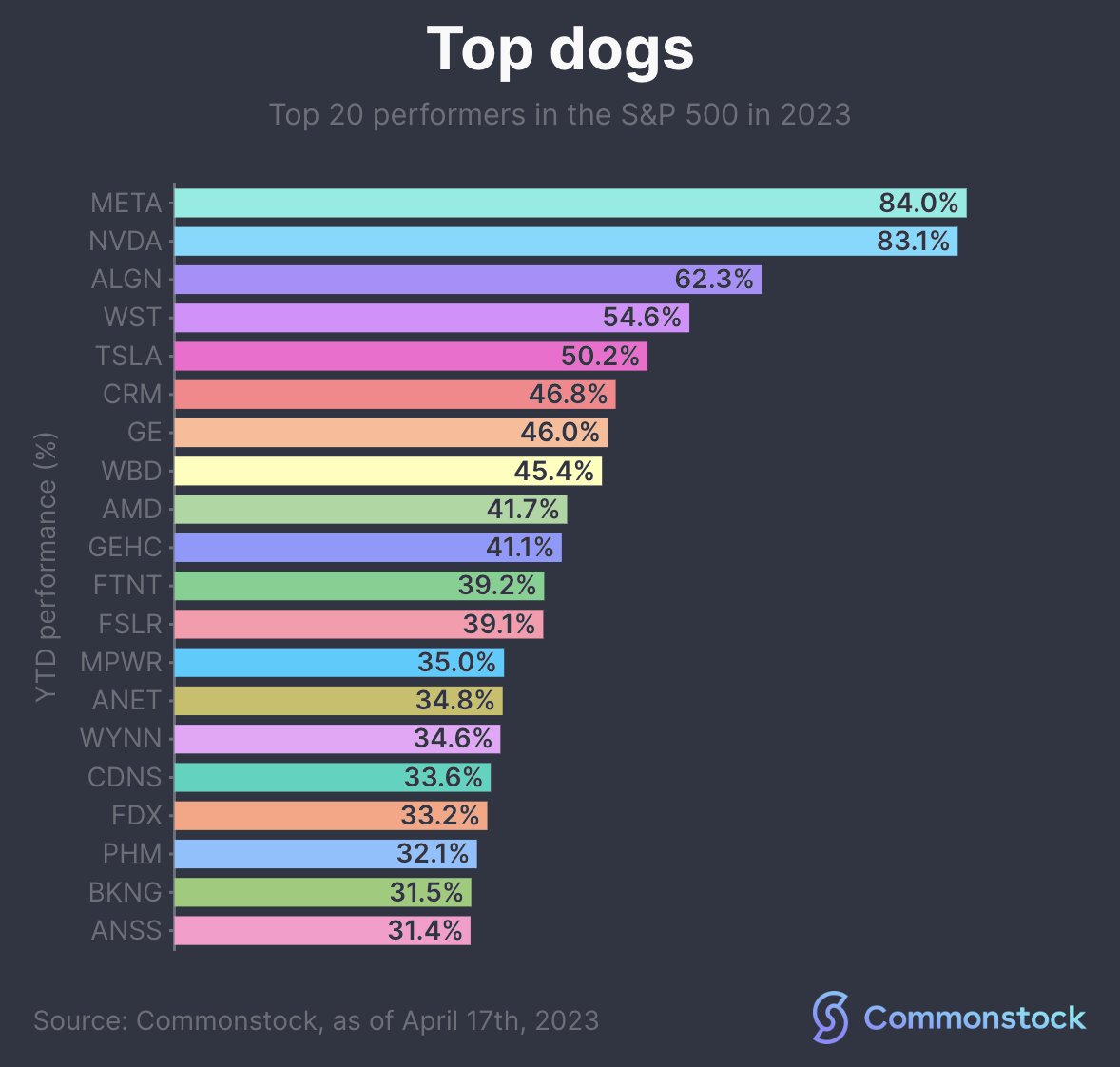

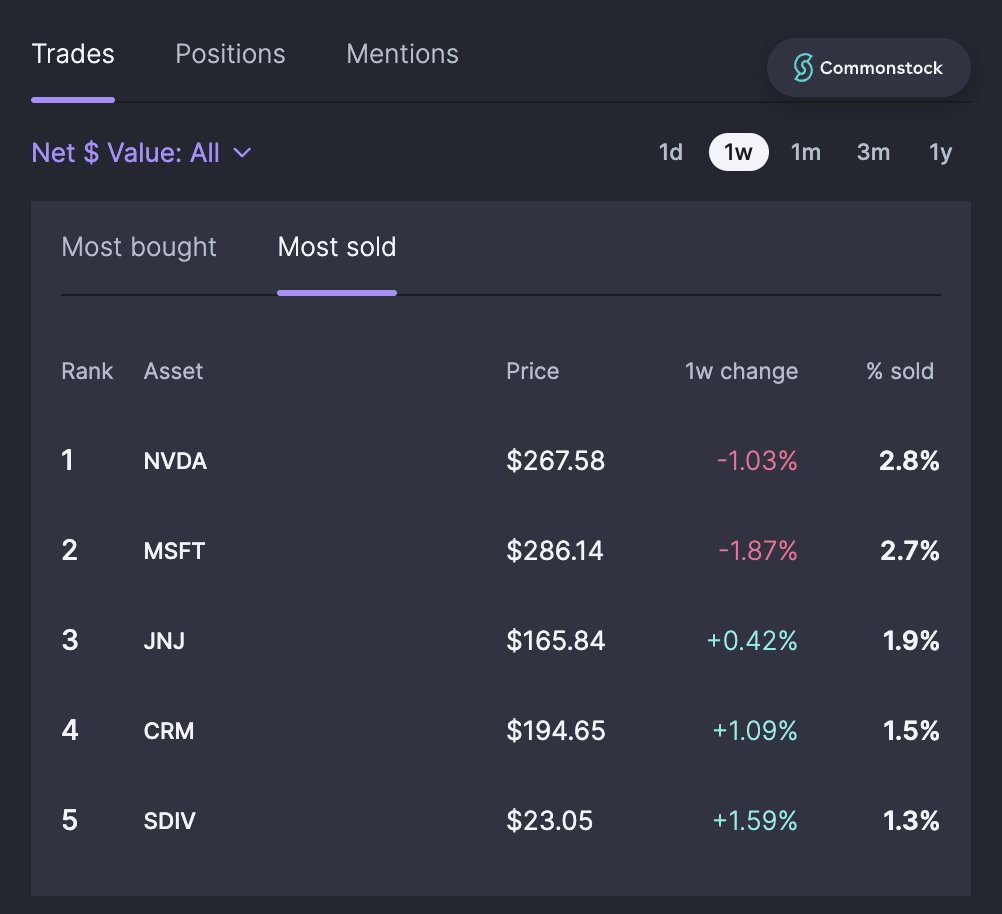

2. Our investor data shows that $NVDA saw the largest selling volumes last week, while $META appeared as the stock with the 5th largest buying volumes, behind $LAZR $AMZN $TSLA and $SPY.

2. Our investor data shows that $NVDA saw the largest selling volumes last week, while $META appeared as the stock with the 5th largest buying volumes, behind $LAZR $AMZN $TSLA and $SPY.

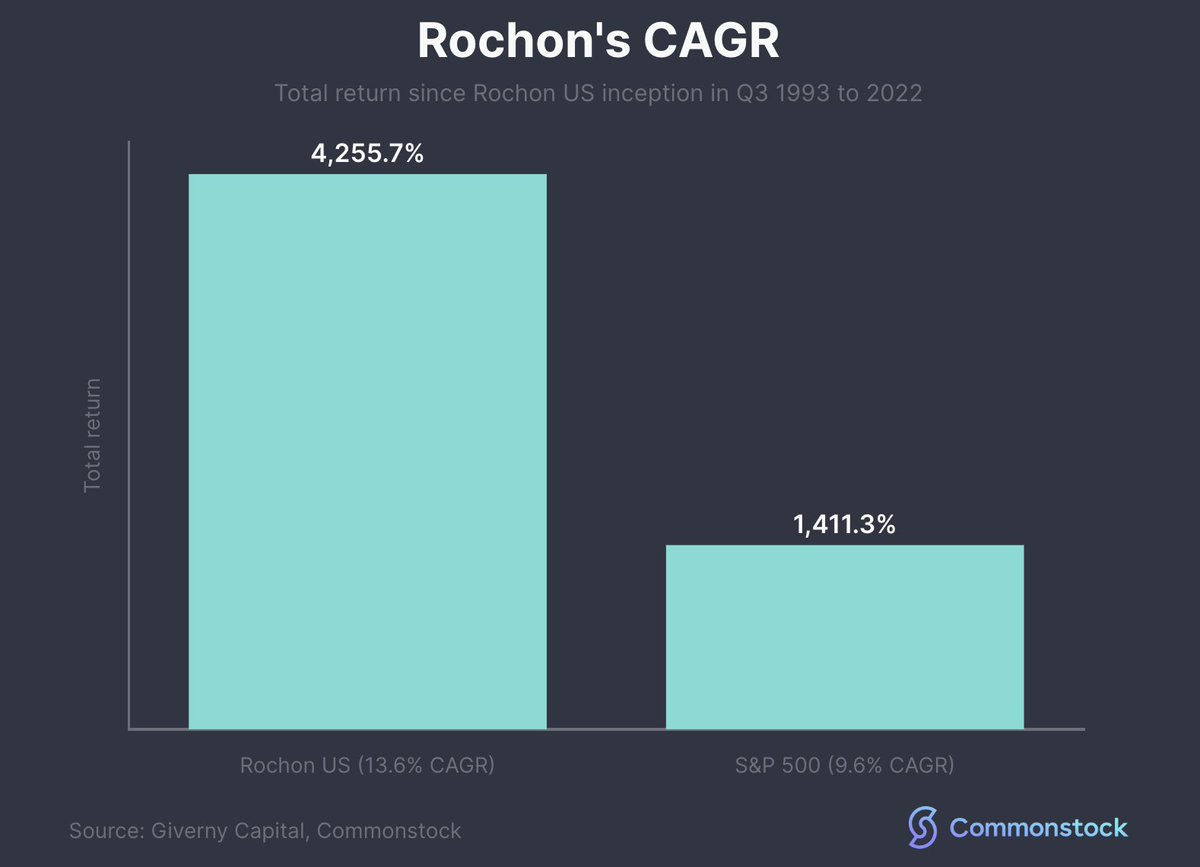

1. Rochon's Global & US portfolios underperformed their respective indexes in 2022, but the long-term CAGRs of each are unquestioned.

1. Rochon's Global & US portfolios underperformed their respective indexes in 2022, but the long-term CAGRs of each are unquestioned.

1. The term "Mr Market" was coined by Graham to illustrate the fickle nature of the stock market.

1. The term "Mr Market" was coined by Graham to illustrate the fickle nature of the stock market.

1. In his book, The Dhandho Investor, he lays out the nine core principles of his framework.

1. In his book, The Dhandho Investor, he lays out the nine core principles of his framework.

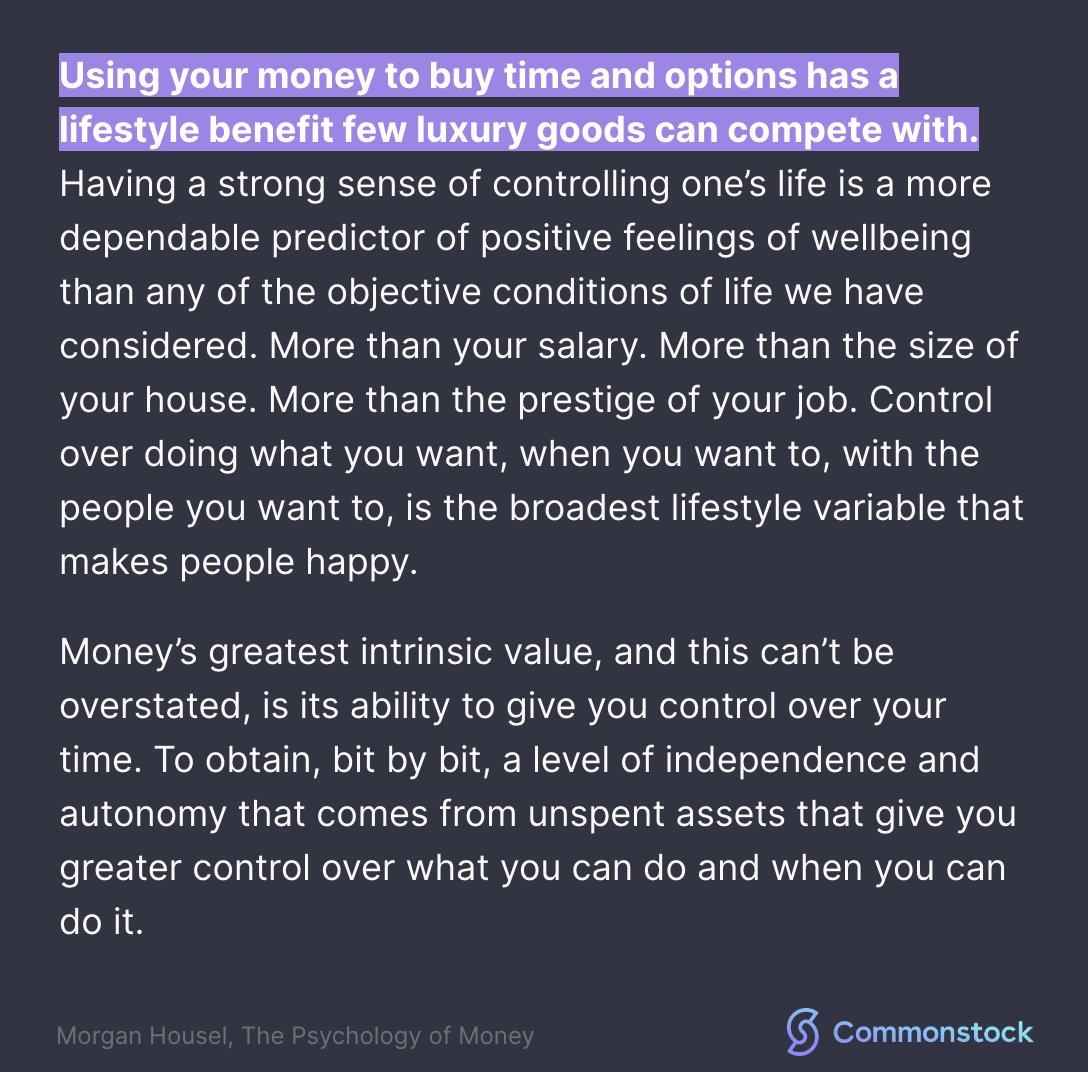

1. "Money’s greatest intrinsic value, and this can’t be overstated, is its ability to give you control over your time".

1. "Money’s greatest intrinsic value, and this can’t be overstated, is its ability to give you control over your time".

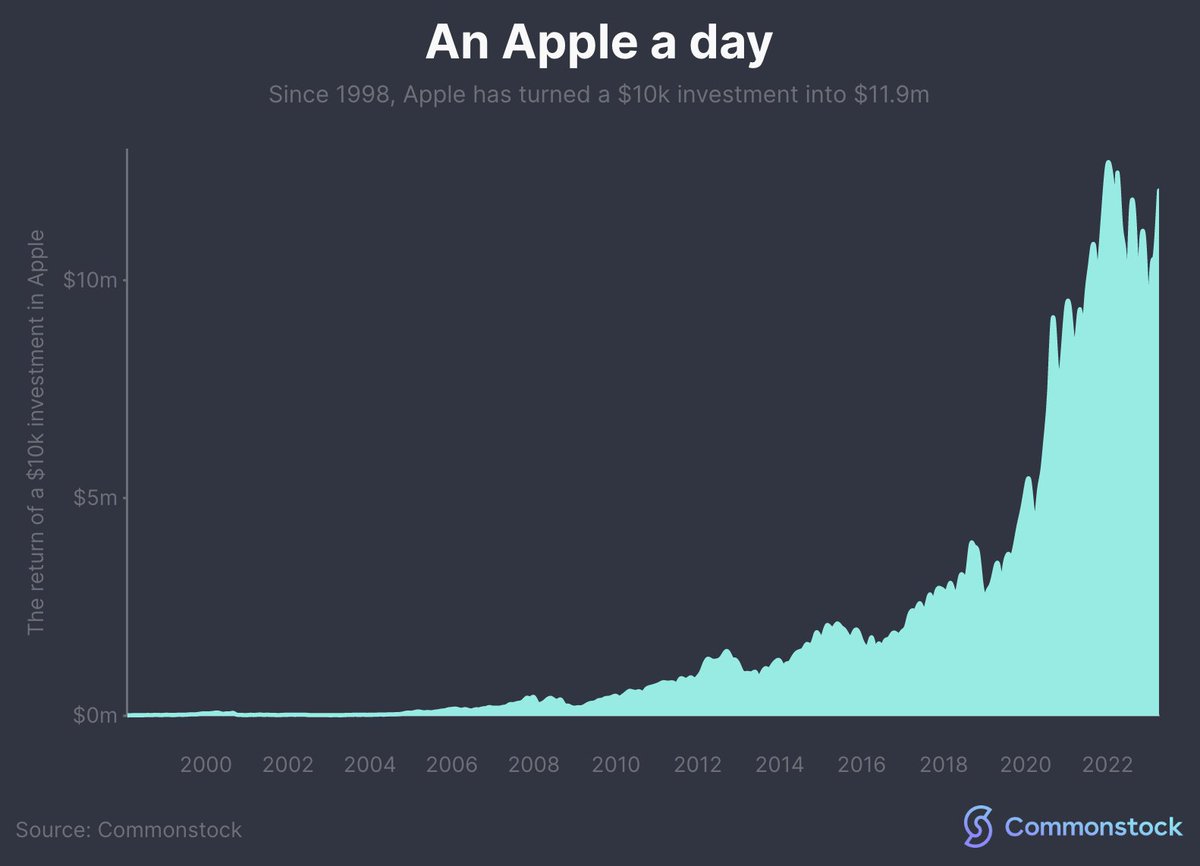

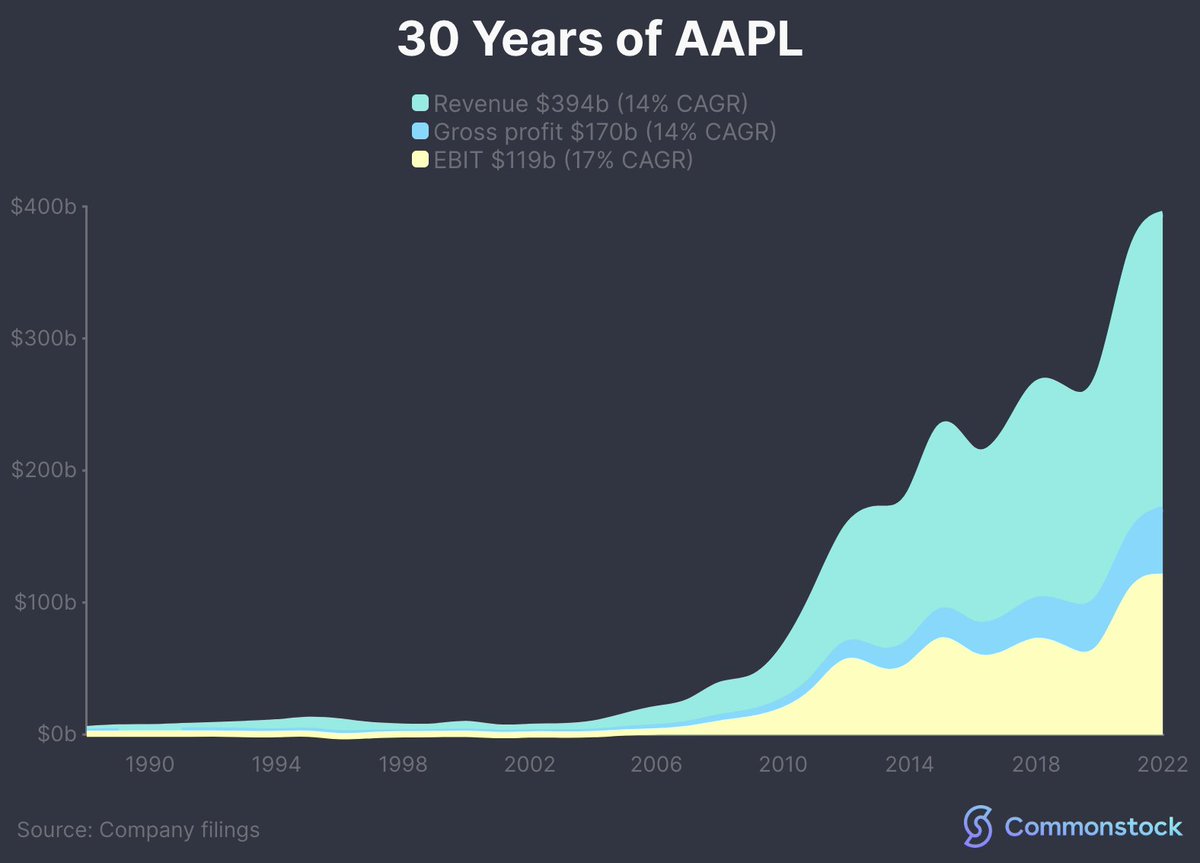

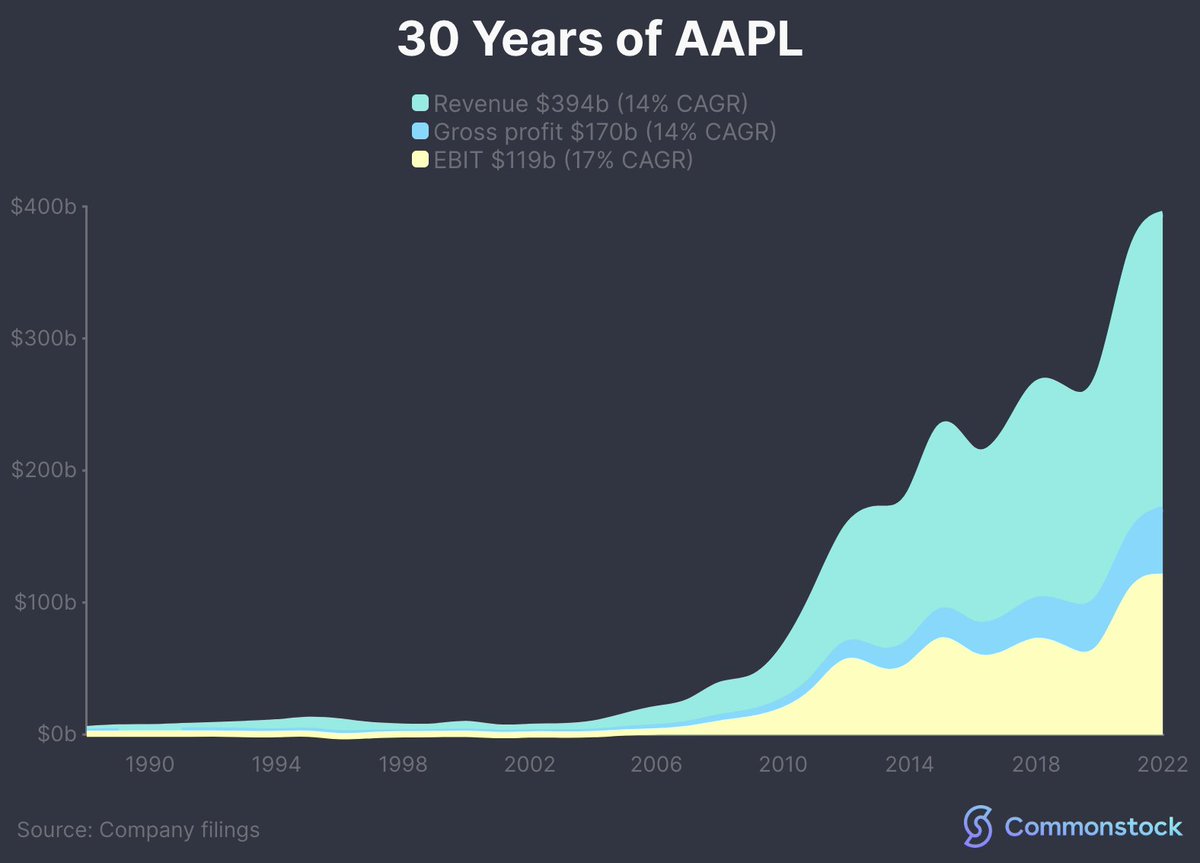

1. If you had the foresight to invest $10,000 in $AAPL in 1988, you would be a millionaire today; eleven times over.

1. If you had the foresight to invest $10,000 in $AAPL in 1988, you would be a millionaire today; eleven times over.