Psychology behind REAL support/resistance👇

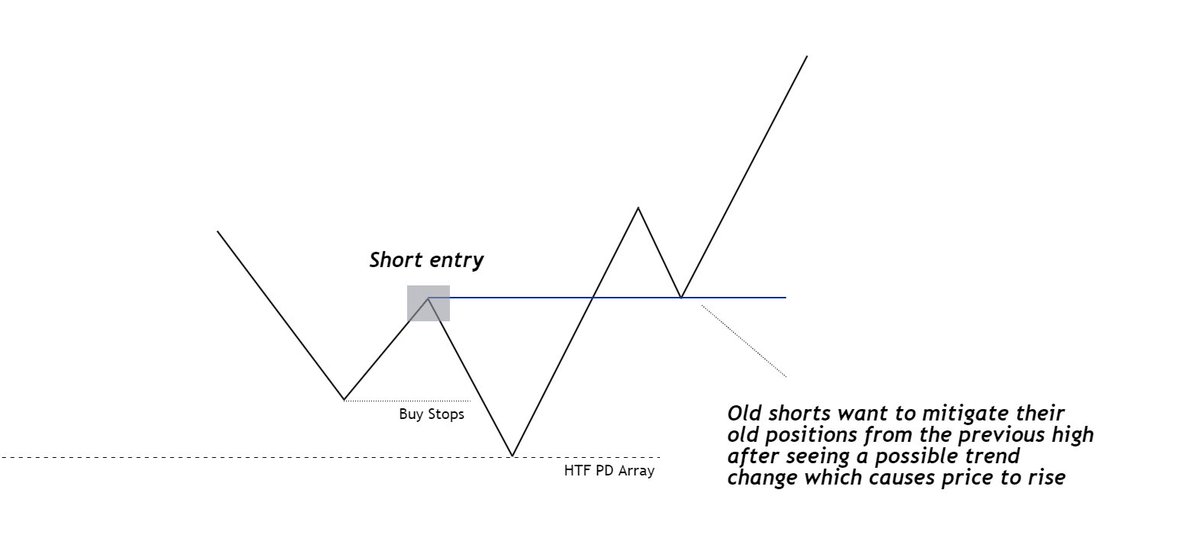

When there is liquidity above, breaker blocks are used as REAL support because the old short sellers who got in at that old high want to MITIGATE (cover) their positions at B/E and get in sync with the displacement higher

When there is liquidity above, breaker blocks are used as REAL support because the old short sellers who got in at that old high want to MITIGATE (cover) their positions at B/E and get in sync with the displacement higher

This makes so much sense psychologically. When shorts cover, price is bullish. So if shorts realize they are on the wrong side, they will try their best to get out at BE (at their original entry) which will cause prices to go higher from the bullish breaker block

Bullish breaker blocks must have hit sellside liquidity (sell stops) and it must be a green candle before the old down move

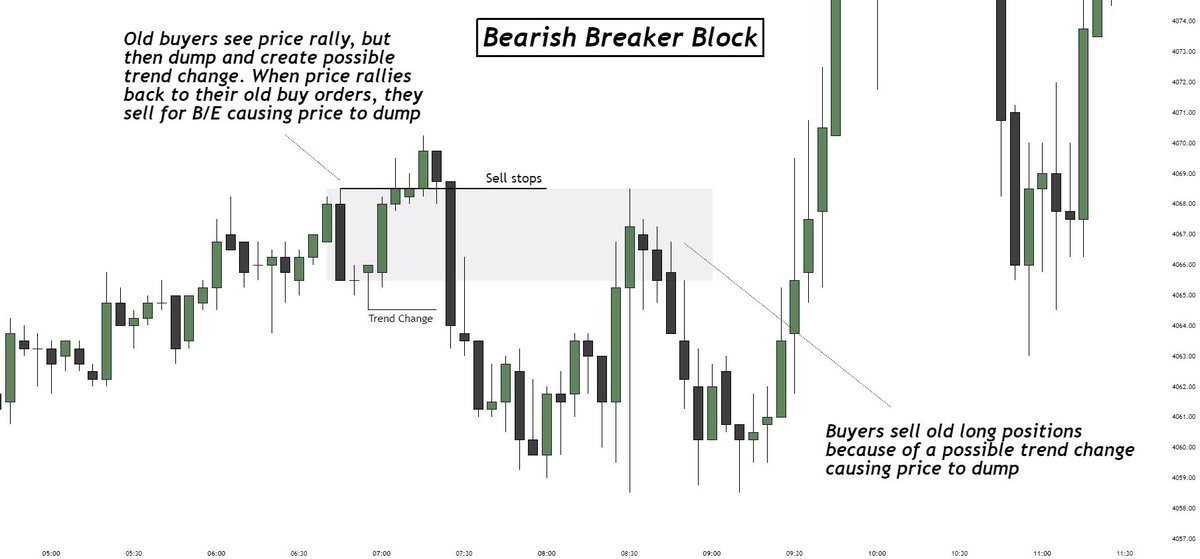

Bearish breaker blocks must have hit buyside liquidity (buy stops) and it must be a red candle before the old up move

Bearish breaker blocks must have hit buyside liquidity (buy stops) and it must be a red candle before the old up move

Same goes with a bearish breaker block. If you were long from the bounce (has to be a red candle before old up move) and you see price displace under the last higher low, you would be bearish. So now if price came back up to your entry you’d sell, which is causes price dump

I don’t know about you guys but learning indicators gave me no reason and confidence to long when the RSI was “overbought”

Stuff like this ACTUALLY tells me why and makes me much more confident. Might just be me but things to me have to make sense to provide me confidence

Stuff like this ACTUALLY tells me why and makes me much more confident. Might just be me but things to me have to make sense to provide me confidence

• • •

Missing some Tweet in this thread? You can try to

force a refresh