This sounds bad until you realize that the change in "global M2 liquidity" doesn't correlate with the performance of $SPX (1/2)

https://twitter.com/SethCL/status/1627304562078937089

$SPX fell 20% while the "BOJ balance sheet" expanded, and then when the balance sheet started to contract, $SPX rallied 16% (arrows). News you can use

The "BOJ balance sheet" doubled and the Nikkei gained just 3% pa. #morecowbell

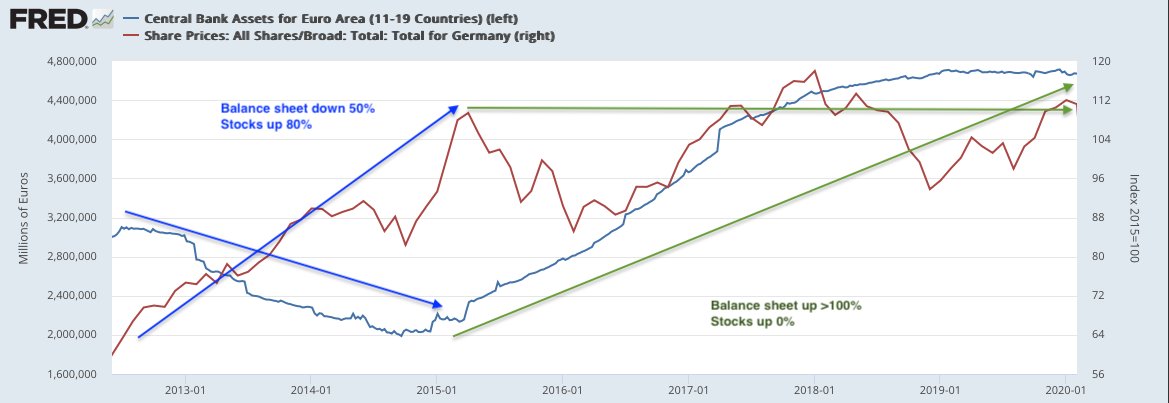

First, the Euro CB balance sheet contracted 50% and stocks rallied 80% (blue arrows). Then the balance sheet more than doubled and stocks did...nothing (green arrows).

• • •

Missing some Tweet in this thread? You can try to

force a refresh