1) 🗣 THIS ONE TRICK THAT THE IRS DOESN'T WANT YOU TO KNOW: USE GOD AS A TAX LOOPHOLE 🗣

One hedge fund has grown from $1B to $128B in 45 years while paying $0 in taxes.

It's not on Wall Street or Silicon Valley. It's in Utah.

The Mormon Church.

Check this out.

One hedge fund has grown from $1B to $128B in 45 years while paying $0 in taxes.

It's not on Wall Street or Silicon Valley. It's in Utah.

The Mormon Church.

Check this out.

2) So just how big is $128B?

Bigger than Tiger Global.

2x the size of Harvard's endowment.

More than 2x the size of the Vatican's trust.

$128B would be the 57th biggest country in the world by GDP.

How did a church in Utah build such a massive war chest?

Bigger than Tiger Global.

2x the size of Harvard's endowment.

More than 2x the size of the Vatican's trust.

$128B would be the 57th biggest country in the world by GDP.

How did a church in Utah build such a massive war chest?

3) Former church leader N. Eldon Tanner.

The Church long struggled with budget issues before Tanner, a lifelong entrepreneur, fixed its finances.

In the 60s, he began setting aside contributions each year for a rainy-day fund.

(Check out Tanner's story rsc.byu.edu/firm-foundatio…)

The Church long struggled with budget issues before Tanner, a lifelong entrepreneur, fixed its finances.

In the 60s, he began setting aside contributions each year for a rainy-day fund.

(Check out Tanner's story rsc.byu.edu/firm-foundatio…)

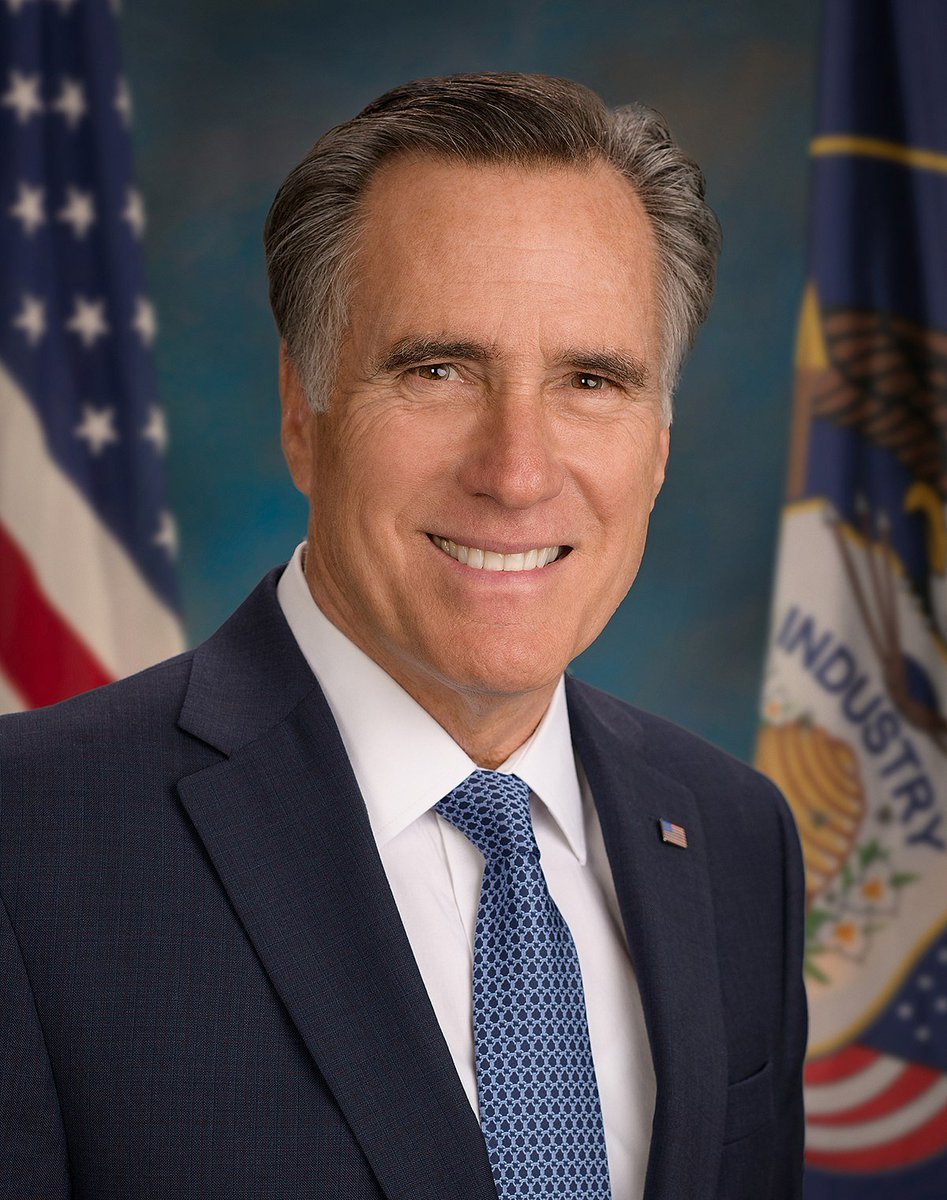

4) By the late 1970s, this "rainy day fund" was $1B managed by 3 employees. It's now 70 employees managing over $100B.

Mitt Romney once said, "I'm happy that they've not only saved for a rainy day, but for a rainy decade."

As the fund grew, the Church needed to adapt.

Mitt Romney once said, "I'm happy that they've not only saved for a rainy day, but for a rainy decade."

As the fund grew, the Church needed to adapt.

5) In 1997, the investment division of the Church was spun off into Ensign Peak Advisors (EP), a separate legal entity named after a hill that overlooks Salt Lake City.

It's important to note that EP was formed as a nonprophet (lmao) organization.

It's important to note that EP was formed as a nonprophet (lmao) organization.

6) Ensign made big real estate investments:

$562M land purchase in Florida that gave them ownership of 2% of the state

Outbid Bill Gates for a $200M piece of land in Washington

$100M hotel purchase in Maui

But if you think that's impressive, check their stock portfolio 😤

$562M land purchase in Florida that gave them ownership of 2% of the state

Outbid Bill Gates for a $200M piece of land in Washington

$100M hotel purchase in Maui

But if you think that's impressive, check their stock portfolio 😤

7) Ensign holds positions in more than 1800 companies.

Some of these include multi-billion dollar positions in tech giants like $MSFT and $APPL, a $1B+ stake in $FB, and a $400M+ stake in $TSLA.

But Ensign's best trade? GameStop.

Some of these include multi-billion dollar positions in tech giants like $MSFT and $APPL, a $1B+ stake in $FB, and a $400M+ stake in $TSLA.

But Ensign's best trade? GameStop.

8) The Church turned a 900% profit on the $GME short squeeze.

They accumulated 46,000 shares before the run up last January, and its position ballooned from $900k to $8.7M.

They managed to cash out with a fat profit. Nice.

So why are we just now hearing about this $100B fund?

They accumulated 46,000 shares before the run up last January, and its position ballooned from $900k to $8.7M.

They managed to cash out with a fat profit. Nice.

So why are we just now hearing about this $100B fund?

9) A 2019 whistleblower report.

David Nielsen, a former employee for Ensign, filed an IRS complaint alleging the church should have to pay taxes on investment returns from tithing funds and challenged the faith’s investment strategy, humanitarian efforts and tax-exempt status.

David Nielsen, a former employee for Ensign, filed an IRS complaint alleging the church should have to pay taxes on investment returns from tithing funds and challenged the faith’s investment strategy, humanitarian efforts and tax-exempt status.

10) Nielsen said in the complaint that the church’s investment arm had holdings worth between $99 billion and $101 billion.

He claimed Ensign Peak was not meeting IRS regulations for using a percentage of its funds annually for religious, educational or charitable purposes.

He claimed Ensign Peak was not meeting IRS regulations for using a percentage of its funds annually for religious, educational or charitable purposes.

11) Ensign quietly filed its first 13F in Q1 2020, and we saw the $100B portfolio first hand.

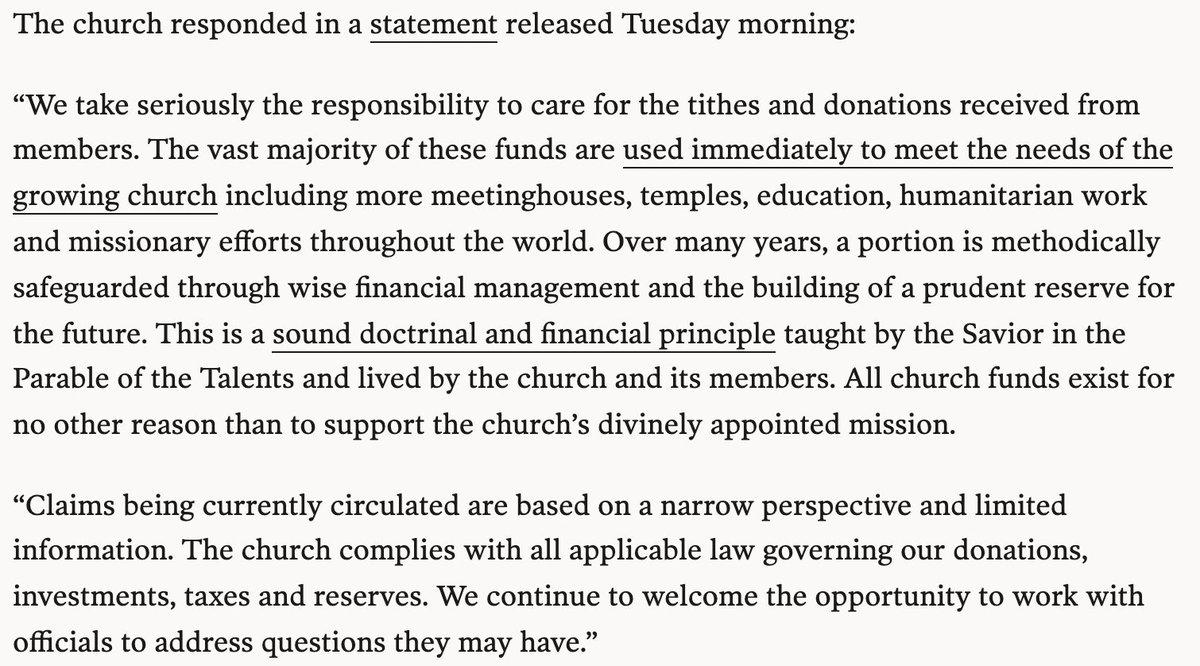

The church answered the allegations with the statements shown below.

"$2.2B" in aid, or an average of $64.7M per year since '85 sounds good. Except Ensign grew by $100B in that period.

The church answered the allegations with the statements shown below.

"$2.2B" in aid, or an average of $64.7M per year since '85 sounds good. Except Ensign grew by $100B in that period.

12) Romney was right about saving for a rainy decade.

The church claimed that "investments can be accessed in times of hardship or to meet the emerging needs of a growing, global faith in its mission to preach the gospel to all nations."

Some members weren't impressed.

The church claimed that "investments can be accessed in times of hardship or to meet the emerging needs of a growing, global faith in its mission to preach the gospel to all nations."

Some members weren't impressed.

13) David Nolan was a devout Mormon and father of 6 whose business collapsed a few years ago.

He approached his bishop for help paying his mortgage, and he was offered $40 for food.

Cool.

Nolan was understandably pissed when the $100B report came out.

So he turned to music.

He approached his bishop for help paying his mortgage, and he was offered $40 for food.

Cool.

Nolan was understandably pissed when the $100B report came out.

So he turned to music.

14) A musician by trade, Nolan wrote "The Good Shepherds" to satirize the church's enormous portfolio and stinginess.

An excerpt is attached below.

Apparently, the whistleblower report didn't sit well with many members of the congregation.

An excerpt is attached below.

Apparently, the whistleblower report didn't sit well with many members of the congregation.

15) TLDR: The Mormon Church made $100B tax-free, and no one knew about it til a whistleblower report.

And now the SEC just fined 'em for hiding some assets. Classic.

And now the SEC just fined 'em for hiding some assets. Classic.

Sources:

washingtonpost.com/religion/2021/…

markets.businessinsider.com/news/stocks/mo…

sec.gov/edgar/browse/?…

sltrib.com/religion/2021/…

bloomberg.com/news/photo-ess….

washingtonpost.com/religion/2021/…

markets.businessinsider.com/news/stocks/mo…

sec.gov/edgar/browse/?…

sltrib.com/religion/2021/…

bloomberg.com/news/photo-ess….

Anyways, sign up for my blog. It's one of like 3 finance blogs that doesn't suck. Today I wrote about why virtue signaling blows.

youngmoney.co/subscribe

youngmoney.co/subscribe

• • •

Missing some Tweet in this thread? You can try to

force a refresh