📣 Announcing @SperaxUSD as our latest integration and vault partner

Factor = the infrastructure and liquidity layer for on-chain asset management!

Sperax = $USDs (a liquid staked stablecoin) and Demeter (aDEX Liquidity Manager).

Here's how we will work together 👇

/1

Factor = the infrastructure and liquidity layer for on-chain asset management!

Sperax = $USDs (a liquid staked stablecoin) and Demeter (aDEX Liquidity Manager).

Here's how we will work together 👇

/1

💰 $USDs is an Arbitrum native liquid staked stablecoin with built-in rewards - mint $USDs here: app.sperax.io/mint.

A yield baring stable also offers the potential for capital protection and we heard that capital protected products might be coming soon 👀

/2

A yield baring stable also offers the potential for capital protection and we heard that capital protected products might be coming soon 👀

/2

In addition, Sperax also offers a yield farming infrastructure product called Demeter.

Demeter offers out of the box Farming-as-a-Service infrastructure on Uniswap V3.

A perfect match for Factor offering multiple collaboration opportunities.

/3

Demeter offers out of the box Farming-as-a-Service infrastructure on Uniswap V3.

A perfect match for Factor offering multiple collaboration opportunities.

/3

🏭 Factor offers the building blocks for modular asset management vaults.

We integrate multiple DeFi assets to enable these protocols to optimize their products.

We enable vault creators to utilize these products to create innovative strategies.

The mutual benefits?

/4

We integrate multiple DeFi assets to enable these protocols to optimize their products.

We enable vault creators to utilize these products to create innovative strategies.

The mutual benefits?

/4

🔀 Firstly, integrations:

* Enables our Factor strategists to utilize $USDs in vaults

* Creates new use cases for $USDs (and $SPA) products

* Creates unique strategy options for Factor vault creators

* Drives TVL and revenue to both Factor and Sperax

/5

* Enables our Factor strategists to utilize $USDs in vaults

* Creates new use cases for $USDs (and $SPA) products

* Creates unique strategy options for Factor vault creators

* Drives TVL and revenue to both Factor and Sperax

/5

🏦 Secondly, partner vaults:

* One click access to $USDs or $SPA yields

* Novel creation and one click access to Demeter vaults

* Drives additional TVL to Sperax via the partner vault

* Factor and Sperax both earn vault fees as a revenue stream

/6

* One click access to $USDs or $SPA yields

* Novel creation and one click access to Demeter vaults

* Drives additional TVL to Sperax via the partner vault

* Factor and Sperax both earn vault fees as a revenue stream

/6

🤝 We will begin by integrating their $USDs and $SPA with Factor.

We will explore the potential for a $USDs and $FCTR pair on @CamelotDEX

We will make the Factor infrastructure available to power the Demeter front end vault creation.

/7

We will explore the potential for a $USDs and $FCTR pair on @CamelotDEX

We will make the Factor infrastructure available to power the Demeter front end vault creation.

/7

🧑🤝🧑 We're integrating with leading protocols to build the infrastructure and liquidity layer for DeFi.

Sperax has brought an innovative and unique product to market and we are delighted to be working with them.

We're looking forward to growing Arbitrum DeFi together.

/8

Sperax has brought an innovative and unique product to market and we are delighted to be working with them.

We're looking forward to growing Arbitrum DeFi together.

/8

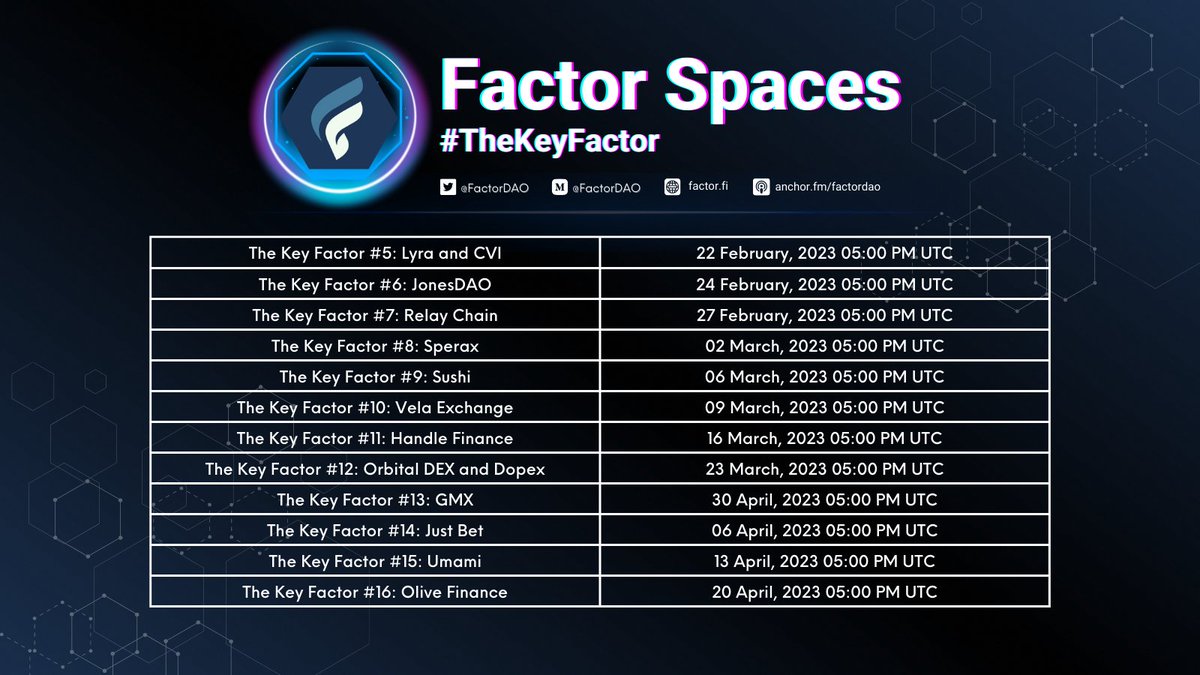

🎙️ We will be hosting Olive on #TheKeyFactor podcast.

If you'd like to learn more about both projects and how we will work together keep an eye out for the announcement, set your reminders and tune in!

Check out our upcoming guests!

/9

If you'd like to learn more about both projects and how we will work together keep an eye out for the announcement, set your reminders and tune in!

Check out our upcoming guests!

/9

📊 If you're interested in Factor then check out our fair launch for the $FCTR token.

We are live now one the link below. See the next Tweet for all necessary links so that you can do your research.

app.camelot.exchange/launchpad/fact…

/10

We are live now one the link below. See the next Tweet for all necessary links so that you can do your research.

app.camelot.exchange/launchpad/fact…

/10

🧑🏫 Learn more about @FactorDAO and $FCTR using the links below:

🌐 Web: factor.fi

📚 Notion: factorlaunch.notion.site/Factor-DAO

📣 Docs: docs.factor.fi

📝 Medium: medium.com/@FactorDAO/

🐦 Twitter: @FactorDAO

👾 Discord: discord.gg/factor

/11

🌐 Web: factor.fi

📚 Notion: factorlaunch.notion.site/Factor-DAO

📣 Docs: docs.factor.fi

📝 Medium: medium.com/@FactorDAO/

🐦 Twitter: @FactorDAO

👾 Discord: discord.gg/factor

/11

So you like @FactorDAO? Our public sale is live here:

app.camelot.exchange/launchpad/fact…

And we've got you covered with all the details below!

medium.com/@FactorDAO/fct…

app.camelot.exchange/launchpad/fact…

And we've got you covered with all the details below!

medium.com/@FactorDAO/fct…

• • •

Missing some Tweet in this thread? You can try to

force a refresh