A year ago today, I was party to what I hope is the biggest stitch-up I'll ever see close up: the pushing through by the JNC of a savage cut in future accrual in @USSpensions based on an self-evidently unsound valuation rooted in pandemic-induced market turmoil. 1/

https://twitter.com/Sam_Marsh101/status/1496217532079955975

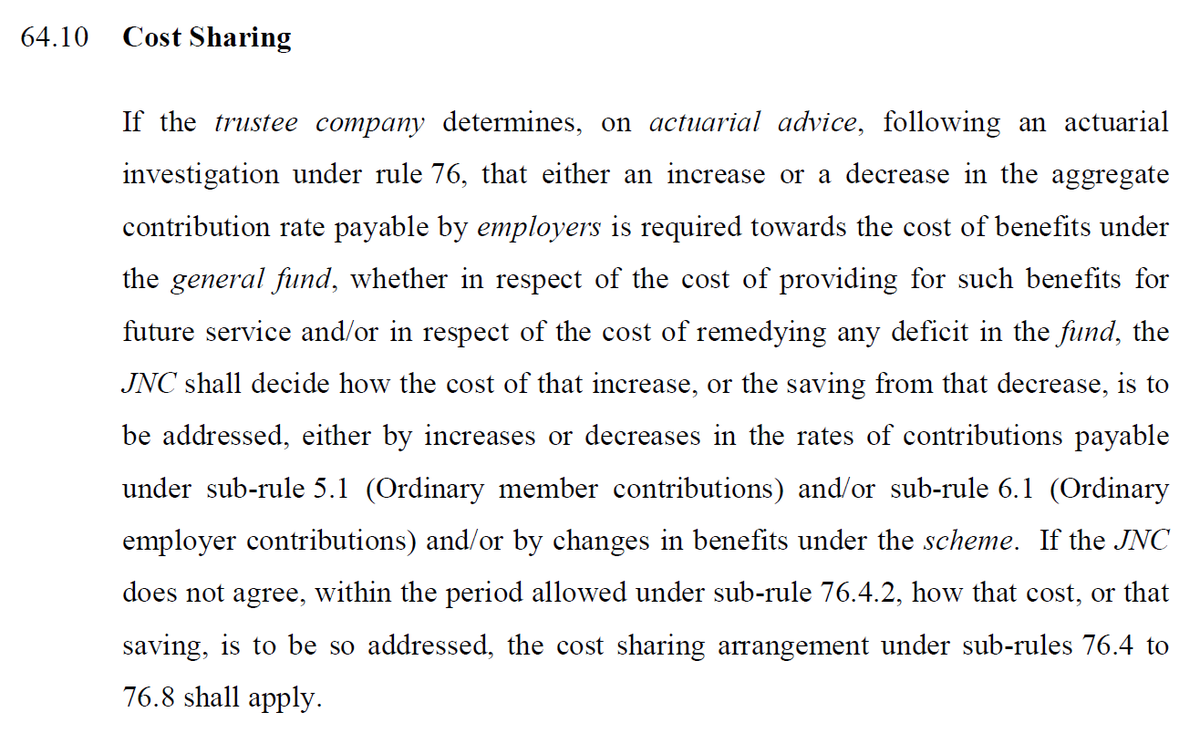

It was awful. Nothing was fair or right about the decision taken that day. The scheme's rules had been bent, probably breached, by @USSPensions to skew things in favour of @UniversitiesUK, who themselves lied to their members about @UCU's counter-proposal to ensure it sank. 2/

We hoped that the JNC chair might be receptive to the charges we laid about process, but the legal advice they received gave the all-clear. That legal advice couldn't answer the key question we posed about @USSpensions apparent rule breach, but that didn't seem to matter. 3/

It didn't matter, because this was never about fairness or proper process or anything of that kind, it was all about ensuring the 'right' outcome for those at the top. Lawyers, actuaries, executives, directors and consultants decided what would happen, and made sure it did. 4/

And yet, we're now on the verge of getting our benefits back. So bad was the decision that it's it lasted less than a year before it has become absolutely clear that it was unsound. Will anyone take the rap for that? 5/

https://twitter.com/ucu/status/1626706252620242952

Possibly not, but maybe they already have. Bill Galvin, the Chief Exeuctive of @USSPensions is moving on after a decade of what seem like concerted efforts to close the defined benefit scheme, thankfully unsuccessfully. 6/

The stich-up of 22/2/22 will linger long in my memory, and was enough to end my formal involvement in the @USSpensions saga. Rigged committees aren't my bag. I'm very grateful for @cupofassam, Jackie Grant and others who have taken up the mantle. 7/

I said I wanted to see last year's decision examined by the courts, but last year's marking and assessment boycott, a cycling accident, a new baby and life generally have dampened my enthusiasm for making that happen. 8/

https://twitter.com/Sam_Marsh101/status/1498965154939248645

It also seems likely that things have swung in the favour of the scheme's members, through a combination of data and industrial strength, meaning benefits may be restored without the need for the courts to order them to be. 9/

In any case, should we see benefits restored, the Galvin years at #USS will go down as an excellent case study in power dynamics, and how industrial strength was able to resist a major attack on terms and conditions, and I'm very proud to have played my part. #ucuRISING 10/10

PS You can read more about what happened a year ago here:

https://twitter.com/Sam_Marsh101/status/1498965120449499136

@threadreaderapp: unroll, please!

• • •

Missing some Tweet in this thread? You can try to

force a refresh