You might know me from UCU/maths/pensions/Sheffield/elsewhere. Trustee director of the USS pensions scheme and ex-UCU national negotiator.

How to get URL link on X (Twitter) App

Senate is the "academic authority" of @SheffieldUni according to the University's own description, which the VC's copied-and-pasted text omitted. Council turns to Senate for advice on decisions related to academic matters. And there's established process for that advice. 2/

Senate is the "academic authority" of @SheffieldUni according to the University's own description, which the VC's copied-and-pasted text omitted. Council turns to Senate for advice on decisions related to academic matters. And there's established process for that advice. 2/

https://twitter.com/Sam_Marsh101/status/1700182700101927111

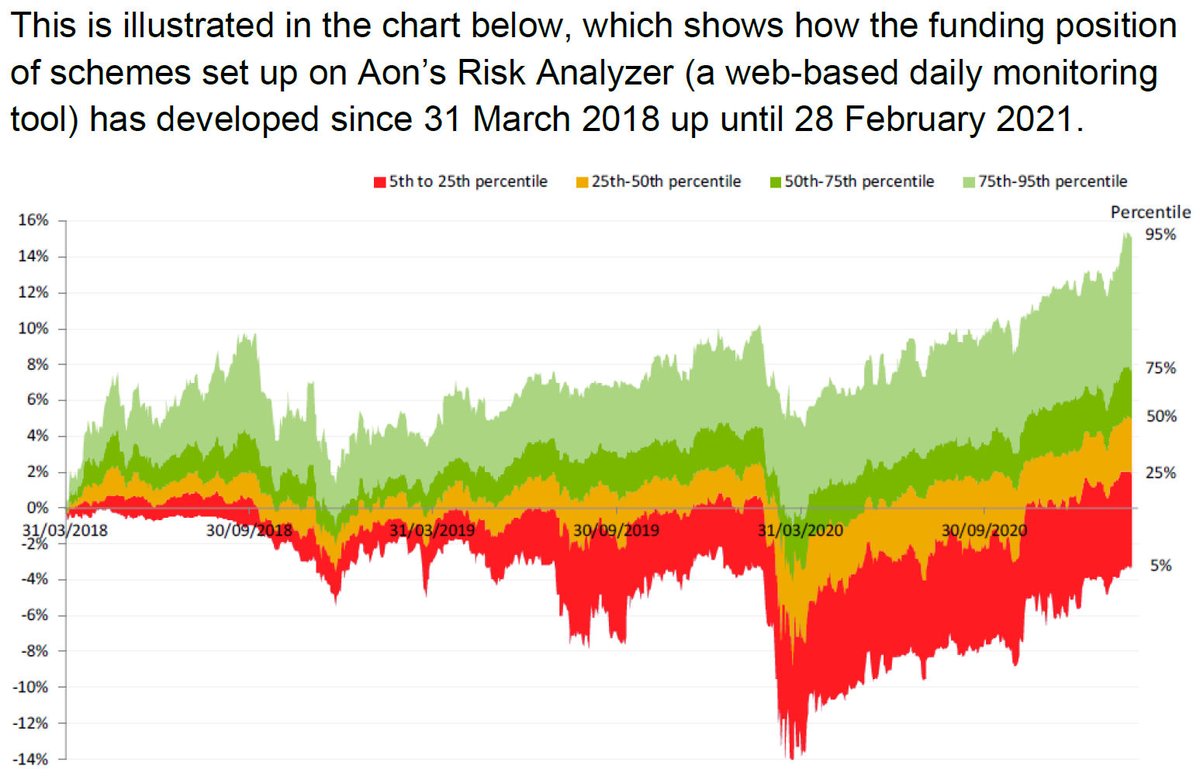

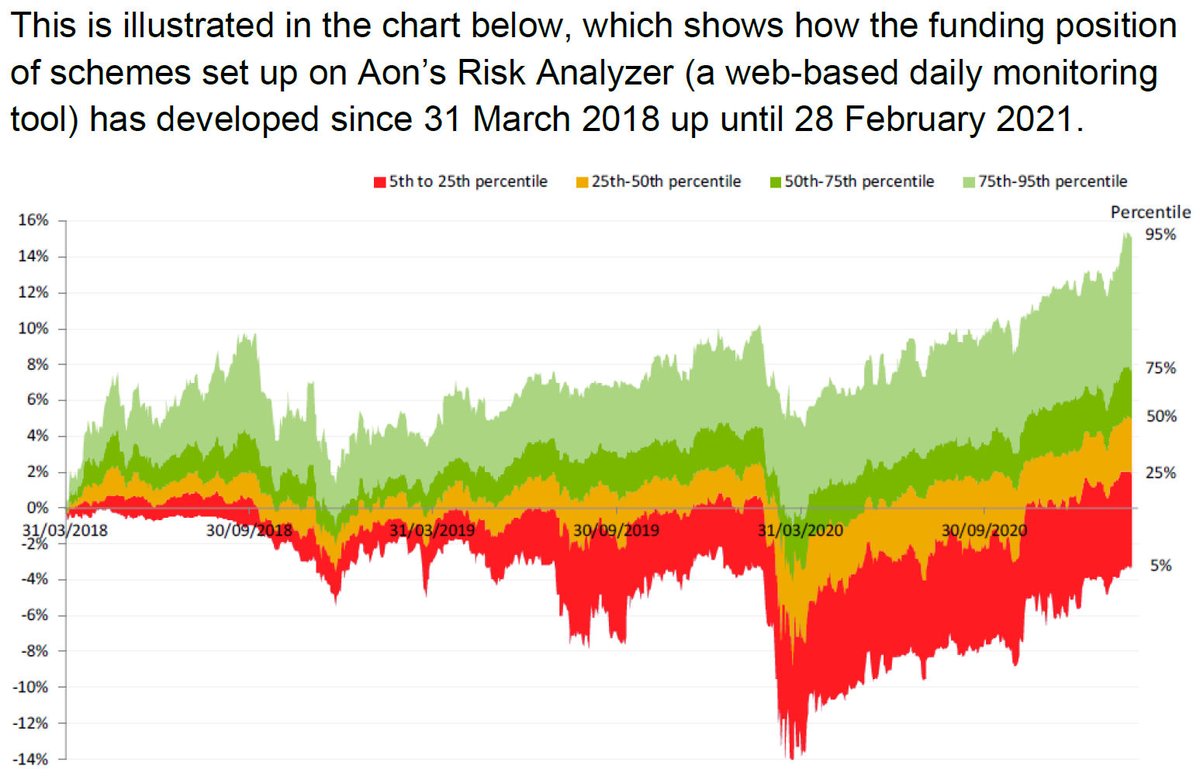

@USSpensions I think @RedActuary and Derek Benstead of @FirstActuarial deserve a huge amount of credit for pointing out that time would be strongly in our favour in this story, proved absolutely right.

@USSpensions I think @RedActuary and Derek Benstead of @FirstActuarial deserve a huge amount of credit for pointing out that time would be strongly in our favour in this story, proved absolutely right.

Of course, @Barker4Kate joined as chair of the board partway through the 2020 valuation (though it was Eastwood's hawkish board that set the tone for it) and Galvin hasn't yet exited, but last I heard he was due to leave by the end of March. 2/

Of course, @Barker4Kate joined as chair of the board partway through the 2020 valuation (though it was Eastwood's hawkish board that set the tone for it) and Galvin hasn't yet exited, but last I heard he was due to leave by the end of March. 2/

https://twitter.com/Sam_Marsh101/status/1496217532079955975It was awful. Nothing was fair or right about the decision taken that day. The scheme's rules had been bent, probably breached, by @USSPensions to skew things in favour of @UniversitiesUK, who themselves lied to their members about @UCU's counter-proposal to ensure it sank. 2/

https://twitter.com/DrJoGrady/status/1594710424146042882If they don't send you home, they may struggle to deduct pay.

https://twitter.com/Sam_Marsh101/status/1498562751639265280The Joint Negotiating Committee is an oddity, unique among UK pension schemes. It was a hard-won concession extracted by the union during the formation of the scheme in the 1970s. If the misapplication of the rules by #USS is allowed to stand, I believe it is effectively dead. 2/

1. Stop publishing data

1. Stop publishing data

https://twitter.com/bethanstaton/status/1494748965618728960@FT @bethanstaton @USSEmployers @ucu @UniversitiesUK The #USS dispute is now well and truly on fire, as eyes turn towards the formal JNC meeting(s) next week. Higher Education disputes also ramp up, with more universities brought into the action over the fundmantal Four Fights dispute.

https://twitter.com/ucu/status/1494737218895757317

https://twitter.com/Sam_Marsh101/status/149384895214333542628 Jan (cont): "If we receive confirmation, we will formally consult employers on [UCU's proposals]"

https://twitter.com/ucu/status/14327475305053102111. The valuation date

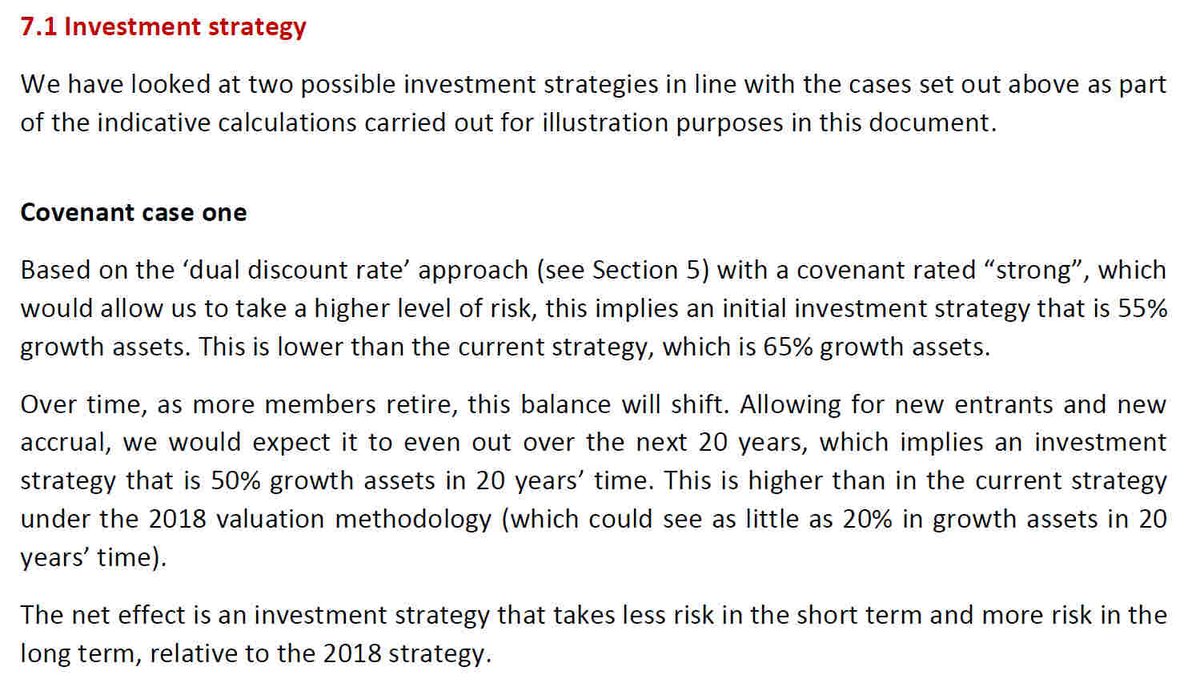

https://twitter.com/Sam_Marsh101/status/1303410998003539969I will try and keep this as accessible as possible, because #USS can't be allowed to bluff their way through this stuff. First, a recap. What was wrong with Test 1? 2/