1/25 DeFi Options Trading Is Powerful!

There can be unlimited upside…😈

But also unlimited downside 😣

Every trader should know how to create these 18 options strategies in @Panoptic_xyz for any crypto asset, any strike, any size:

❤️ & rt 👇

There can be unlimited upside…😈

But also unlimited downside 😣

Every trader should know how to create these 18 options strategies in @Panoptic_xyz for any crypto asset, any strike, any size:

❤️ & rt 👇

2/25 In this thread we'll cover:

1. ⤵️

2. 📞

3. 🤸🏽♂️

4. 🙅♀️😵

5. 💎🦎

6. 🦖

7. 🥌🦋

8. 📞🧈

9. 🦸♂️🐂

10. ⤵️🧈

11. 🦸♂️🐻

12. 🥌🦅

13. 📅🧈

14. ↗️🧈

15. ⚖️🧈

16. 🦇

17. 🦓

18. 🦓🦓🦓

1. ⤵️

2. 📞

3. 🤸🏽♂️

4. 🙅♀️😵

5. 💎🦎

6. 🦖

7. 🥌🦋

8. 📞🧈

9. 🦸♂️🐂

10. ⤵️🧈

11. 🦸♂️🐻

12. 🥌🦅

13. 📅🧈

14. ↗️🧈

15. ⚖️🧈

16. 🦇

17. 🦓

18. 🦓🦓🦓

3/25 Think $HEX is worthless?

"Put" your money where your mouth is:

Buy a "put"⤵️ Panoption!

Substantial upside 😈

Limited downside 😋

Bearish ⬇️

Short LP position

"Put" your money where your mouth is:

Buy a "put"⤵️ Panoption!

Substantial upside 😈

Limited downside 😋

Bearish ⬇️

Short LP position

4/25 Want to make a "call" that $APE will go up?

Buy a "call"📞 Panoption!

Unlimited upside 😈

Limited downside 😋

Bullish ⬆️

Short LP position + long asset

Buy a "call"📞 Panoption!

Unlimited upside 😈

Limited downside 😋

Bullish ⬆️

Short LP position + long asset

5/25 "Straddling" the line b/c you can't tell if $BLUR is going to go ⬆️ or ⬇️?

Buy a "straddle"🤸🏽♂️ on Panoptic!

Unlimited upside 😈

Limited downside 😋

Delta neutral 🫥

Call + Put (same strike)

Buy a "straddle"🤸🏽♂️ on Panoptic!

Unlimited upside 😈

Limited downside 😋

Delta neutral 🫥

Call + Put (same strike)

6/25 Feel like you're being strangled by excessive market volatility on $SHIB?

Buy a "strangle"🙅♀️😵 on Panoptic!

Unlimited upside 😈

Limited downside 😋

Delta neutral 🫥

Call (higher strike) + Put (lower strike)

Buy a "strangle"🙅♀️😵 on Panoptic!

Unlimited upside 😈

Limited downside 😋

Delta neutral 🫥

Call (higher strike) + Put (lower strike)

7/25 Feeling a "little" bullish on $UNI?

How about a "jade lizard" 💎🦎

Limited upside 😋

Substantial downside 😣

Neutral-to-bullish ↗️

Short strangle + long OTM call

How about a "jade lizard" 💎🦎

Limited upside 😋

Substantial downside 😣

Neutral-to-bullish ↗️

Short strangle + long OTM call

8/25 A variation of 💎🦎 is the "big lizard" 🦖

Sell a straddle instead of a strangle on Panoptic!

Useful when you believe the price will hover around the current price.

Limited upside 😋

Substantial downside 😣

Neutral-to-bullish ↗️

Short straddle + long OTM call

Sell a straddle instead of a strangle on Panoptic!

Useful when you believe the price will hover around the current price.

Limited upside 😋

Substantial downside 😣

Neutral-to-bullish ↗️

Short straddle + long OTM call

9/25 Think $LINK will stay rangebound?

Float like an "iron butterfly"! 🥌🦋

Like a 🦖, except you're protected on both sides.

Limited upside 😋

Limited downside 😋

Delta neutral 🫥

Short straddle + long strangle

Float like an "iron butterfly"! 🥌🦋

Like a 🦖, except you're protected on both sides.

Limited upside 😋

Limited downside 😋

Delta neutral 🫥

Short straddle + long strangle

10/25 Bullish on $ETH but don't expect a huge surge?

Buy a "call spread" on Panoptic! 📞🧈

Limited upside 😋

Limited downside 😋

Bullish ⬆️

Long call (lower strike) + short call (higher strike)

Buy a "call spread" on Panoptic! 📞🧈

Limited upside 😋

Limited downside 😋

Bullish ⬆️

Long call (lower strike) + short call (higher strike)

11/25 Are you hoping for a "Better Tomorrow"?

How about a "Super Bull"? 🦸♂️🐂

Like a 📞🧈, but for the more bullish among us.

Limited upside 😋

Substantial downside 😣

Super-bullish ⬆️⬆️

Long call spread + short OTM put

How about a "Super Bull"? 🦸♂️🐂

Like a 📞🧈, but for the more bullish among us.

Limited upside 😋

Substantial downside 😣

Super-bullish ⬆️⬆️

Long call spread + short OTM put

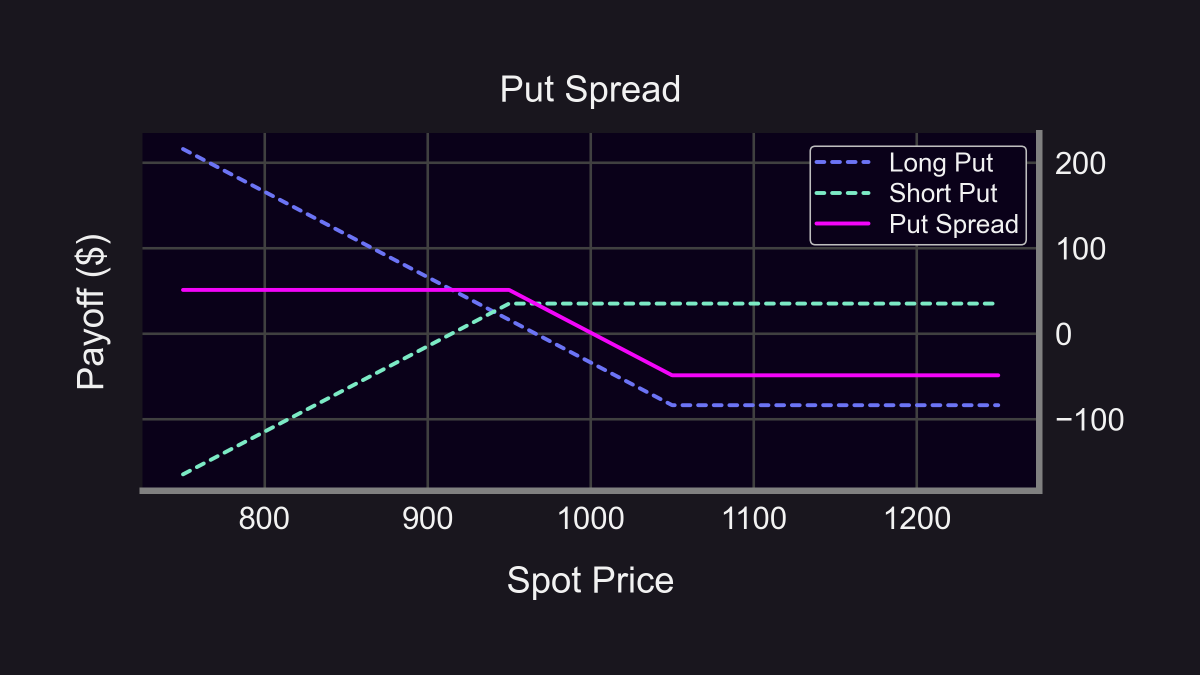

12/25 Anon "spreading" rumors that $USDC is in trouble, but don't expect a huge drop?

Buy a put "spread" on Panoptic! ⤵️🧈

Limited upside 😋

Limited downside 😋

Bearish ⬇️

Long put (higher strike) + short put (lower strike)

Buy a put "spread" on Panoptic! ⤵️🧈

Limited upside 😋

Limited downside 😋

Bearish ⬇️

Long put (higher strike) + short put (lower strike)

13/25 Look! Up in the sky! It's a bird! It's a plane!

It's "Super Bear"! 🦸♂️🐻

Like a ⤵️🧈, but for the more bearish among us.

Limited upside 😋

Unlimited downside 😳

Super-bearish ⬇️⬇️

Long put spread + short OTM call

It's "Super Bear"! 🦸♂️🐻

Like a ⤵️🧈, but for the more bearish among us.

Limited upside 😋

Unlimited downside 😳

Super-bearish ⬇️⬇️

Long put spread + short OTM call

14/25 Think an "upcoming announcement" is gonna be a nothingburger? 🚫🍔

Take flight with a short "iron condor"! 🥌🦅

Limited upside 😋

Limited downside 😋

Delta neutral 🫥

Short call spread + short put spread

Take flight with a short "iron condor"! 🥌🦅

Limited upside 😋

Limited downside 😋

Delta neutral 🫥

Short call spread + short put spread

15/25 Long-term bullish on $ETH but need more capital?

Buy a "call calendar spread" on Panoptic! 📞📅🧈

Limited upside 😋

Limited downside 😋

Delta neutral 🫥

Long long-term call + short short-term call (same strike)

Buy a "call calendar spread" on Panoptic! 📞📅🧈

Limited upside 😋

Limited downside 😋

Delta neutral 🫥

Long long-term call + short short-term call (same strike)

16/25 Panoptic mimics payoffs from long-term expiries through wide-ranged LP positions.

For example:

• Narrow range (r = 1.087) ↔️ 1 day expiry

• Wide range (r = 1.6) ↔️ 1 month expiry

(Assuming 100% annual volatility)

For example:

• Narrow range (r = 1.087) ↔️ 1 day expiry

• Wide range (r = 1.6) ↔️ 1 month expiry

(Assuming 100% annual volatility)

17/25 A variation of 📅🧈 is the "diagonal spread" ↗️🧈

Also called a "Poor Man's Covered call" — useful when you expect minor price movement.

Limited upside 😋

Limited downside 😋

Bullish ⬆️

Long long-term call + short short-term call (different strikes)

Also called a "Poor Man's Covered call" — useful when you expect minor price movement.

Limited upside 😋

Limited downside 😋

Bullish ⬆️

Long long-term call + short short-term call (different strikes)

18/25 Neutral-to-bullish, with a price target for $WBTC in mind?

Buy a "Call Ratio Spread" on Panoptic! 📞⚖️🧈

Limited upside 😋

Unlimited downside 😳

Neutral-to-bullish ↗️

1 long call (lower strike) + 2 short calls (higher strike)

Buy a "Call Ratio Spread" on Panoptic! 📞⚖️🧈

Limited upside 😋

Unlimited downside 😳

Neutral-to-bullish ↗️

1 long call (lower strike) + 2 short calls (higher strike)

19/25 Expect some small price movement on $LDO but not sure which direction?

Try "BATMAN" 🦇

Limited upside 😋

Unlimited downside 😳

Delta neutral 🫥

Call ratio spread + put ratio spread

Try "BATMAN" 🦇

Limited upside 😋

Unlimited downside 😳

Delta neutral 🫥

Call ratio spread + put ratio spread

20/25 Want to go long?

A "ZEBRA spread" may be what you're looking for! 🦓

A synthetic replacement for longs: ~100 delta position with very low capital requirements.

Unlimited upside 😈

Limited downside 😋

Bullish ⬆️

Capital efficient 💸

2 ITM long calls + 1 ATM short call

A "ZEBRA spread" may be what you're looking for! 🦓

A synthetic replacement for longs: ~100 delta position with very low capital requirements.

Unlimited upside 😈

Limited downside 😋

Bullish ⬆️

Capital efficient 💸

2 ITM long calls + 1 ATM short call

21/25 Bullish, but want to hedge downside tail risk?

Try "ZEEHBS"! 🦓🦓🦓

Unlimited upside 😈

Limited downside 😋

Delta neutral 🫥

Call ZEBRA spread + put ZEBRA spread, this one is special 🤪

Try "ZEEHBS"! 🦓🦓🦓

Unlimited upside 😈

Limited downside 😋

Delta neutral 🫥

Call ZEBRA spread + put ZEBRA spread, this one is special 🤪

22/25 Caveats:

• Panoptions are perpetual options with streaming premia rather than upfront premia, so payoff curves may differ from above

• Panoption premia depends on a number of factors including the underlying price path and LP width

More on this later 😉 #ResearchBites

• Panoptions are perpetual options with streaming premia rather than upfront premia, so payoff curves may differ from above

• Panoption premia depends on a number of factors including the underlying price path and LP width

More on this later 😉 #ResearchBites

23/25 Summary:

⤵️=Put

📞=Call

🤸🏽♂️=Straddle

🙅♀️😵=Strangle

💎🦎=Jade lizard

🦖=Big lizard

🥌🦋=Iron butterfly

📞🧈=Call spread

🦸♂️🐂=Super bull

⤵️🧈=Put spread

🦸♂️🐻=Super bear

🥌🦅=Iron condor

📅🧈=Calendar spread

↗️🧈=Diagonal spread

⚖️🧈=Ratio spread

🦇=BATS

🦓=ZEBRA

🦓🦓🦓=ZEEHBS

⤵️=Put

📞=Call

🤸🏽♂️=Straddle

🙅♀️😵=Strangle

💎🦎=Jade lizard

🦖=Big lizard

🥌🦋=Iron butterfly

📞🧈=Call spread

🦸♂️🐂=Super bull

⤵️🧈=Put spread

🦸♂️🐻=Super bear

🥌🦅=Iron condor

📅🧈=Calendar spread

↗️🧈=Diagonal spread

⚖️🧈=Ratio spread

🦇=BATS

🦓=ZEBRA

🦓🦓🦓=ZEEHBS

24/25 Disclaimer:

📢 None of this should be taken as financial advice.

📢 None of this should be taken as financial advice.

25/25 Comment below with questions.

Follow @Panoptic_xyz and @brandonly1000 for more #ResearchBites and other key updates!

Check out our blog 👉 panoptic.xyz/blog

Star & follow our GitHub repo 👉 github.com/panoptic-labs/…

🤝 Like & Retweet if you found this thread helpful!

Follow @Panoptic_xyz and @brandonly1000 for more #ResearchBites and other key updates!

Check out our blog 👉 panoptic.xyz/blog

Star & follow our GitHub repo 👉 github.com/panoptic-labs/…

🤝 Like & Retweet if you found this thread helpful!

https://twitter.com/Panoptic_xyz/status/1628530117118169088

• • •

Missing some Tweet in this thread? You can try to

force a refresh