A better way to LP—now live on Uniswap v3 & v4. Trade options on any token, strike, and size. Learn more: https://t.co/1VPfKqPWcd

How to get URL link on X (Twitter) App

Uniswap LPs are getting wrecked.

Uniswap LPs are getting wrecked.

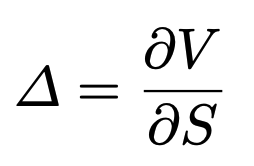

In Uniswap v3, LPs earn fees from traders as their liquidity facilitates trades. Panoptic extends this by introducing the concept of streamia, where option sellers continually earn these trading fees as streaming premia.

In Uniswap v3, LPs earn fees from traders as their liquidity facilitates trades. Panoptic extends this by introducing the concept of streamia, where option sellers continually earn these trading fees as streaming premia.

How to Earn Pips:

How to Earn Pips:

2/8 ⏳ What are timescales?

2/8 ⏳ What are timescales?

2/6 Following the ETF announcement, the crypto market experienced volatility compression. Both BTC and ETH implied vol moved sharply downward.

2/6 Following the ETF announcement, the crypto market experienced volatility compression. Both BTC and ETH implied vol moved sharply downward.

Trader 0x376f has a huge lead on all $AVAX traders, currently sitting in first place with +57.34% PnL. Looks like 0x376f tested out a 0.3 AVAX put (left) that lost $0.44 in streamia before doubling down on a 7 AVAX contract (right)!

Trader 0x376f has a huge lead on all $AVAX traders, currently sitting in first place with +57.34% PnL. Looks like 0x376f tested out a 0.3 AVAX put (left) that lost $0.44 in streamia before doubling down on a 7 AVAX contract (right)!

We are partnering with @TheTNetwork to bring Bitcoin options to Base. Get rewarded for trading $tBTC options over the next 2 weeks!

We are partnering with @TheTNetwork to bring Bitcoin options to Base. Get rewarded for trading $tBTC options over the next 2 weeks!

Missed our latest quest? Don't worry, you can still participate in our trading contests on @Base and @Avax! Over $11,000 in prizes!

Missed our latest quest? Don't worry, you can still participate in our trading contests on @Base and @Avax! Over $11,000 in prizes! https://twitter.com/1504185345860022274/status/1726616770755367304

2/16 In this thread we'll:

2/16 In this thread we'll:

https://twitter.com/Panoptic_xyz/status/1620829599402971136

2/25 In this thread we'll cover:

2/25 In this thread we'll cover:

2/12 First of all: why is Uni V3 a financial NFT platform?

2/12 First of all: why is Uni V3 a financial NFT platform?

https://twitter.com/Panoptic_xyz/status/1621252130815483904