the stories and narratives around the impact of #odte are pretty contorted. one of them is that the volume of these began increasing in June'22 and because there are net sellers (really?) it goes to explain a decline in vol since then. here's an alternative explanation -->

simply put, equity vol follows realized vol (carry matters most) and realized vol has been driven by the market's ability to see where the Fed is going. that path became clearer as the hiking cycle matured and inflation cooperated...the $MOVE fell and the $VIX followed. -->

first chart is 1w ATM implied the $SPX since June'22 along with 1m realized. Interestingly, by June, 1m realized was 30...what might the implied vol be? pretty darn close to 30 as well. hard to argue that the decline in implied isn't a function of the decline in realized.

Dec'22 saw realized vol below 20. VIX closed '22 at 22. So, what caused the decline in realized? A much stronger argument can be made that the initial pop in realized was due to unwelcome inflation prints, a Fed playing catch-up as it ditched "transitory" and a surge in rate vol.

below, MOVE (top panel), 2 year nominal and 2 year b/e from 2021 ("we are not even thinking about thinking about raising...") to mid 2022. these all moved from the outrageously low levels that persisted in 2021, quickly readjusting...they took equity vol higher in the process

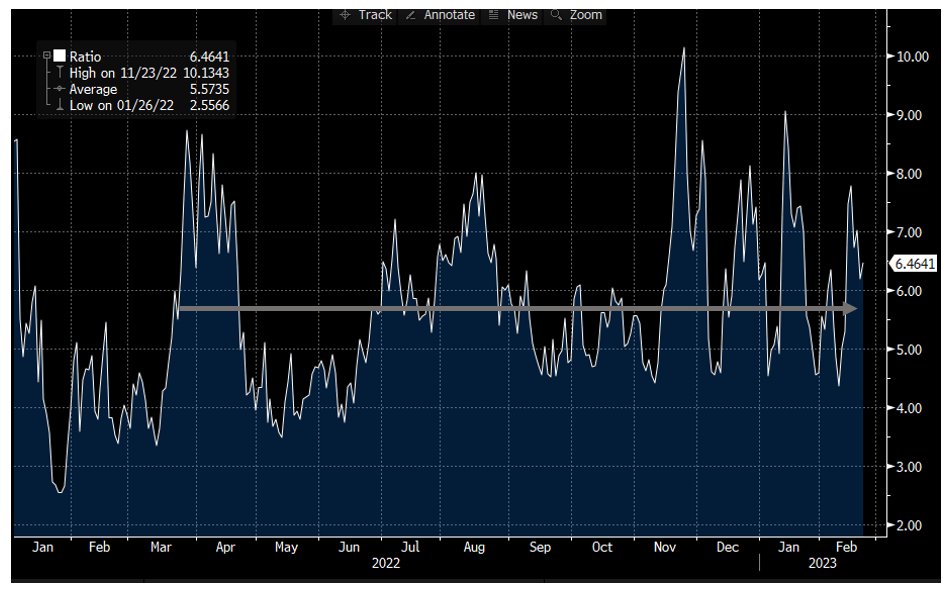

MOVE reverted over the summer, but again reached 160 in October and, again, VIX surpassed 30. the MOVE / VIX ratio (not to be thought of as having mathematical importance but to simply make a point) has been stable between 5 and 7ish. call it the 120/20 regime.

the argument here is that macro developments vastly explain the increase (from 2021 transitory), the episodic bursts, and the ultimate decrease of vol. the idea that sellers are flooding the market with these very high gamma ODTEs doesn't jibe with pricing.

we are told that outright sellers of options are engaging in risk premium generation programs. why? the short rate is nearly 5% and the excess carry doesn't look all that appealing. the premium of the VIX to realized in 2022 was below the 30th %ile in 2022 over last 20 years.

the massive equity vol blowup in 2020 (AIMCO, Allianz, Malachite) left the short vol trade politically untenable at many institutions. 2021 was a great year for the strategy for anyone left to pick up the pieces, but to re-engage in a program of options that expire SAME day?

you'd be selling the risk police internally on a back-test that included in recent history 3 successive days when the SPX had a move of greater than 9%. March 13, 16 and 17th of 2020... -9.5%, +9.3% and down 12%, respectively. "ummm, we excluded those for special circumstances"

and if these outright investors "sell the straddle and go to lunch" (as the saying goes), the buyers would seem to be having an awful time, tripping over themselves hedging and eating time decay. Not obvious at all that this is happening. 2022 had 45 daily SPX moves > +/-2%!

note that just 2 of these moves occurred past November 10th, the day of the giant 5.5% up move in the SPX on the Oct CPI print. That print took a lot of the uncertainty out of the market and bought Powell some time...the market settled in.

in 2017, the dynamic of dangerous short vol exposure was a real thing. the product sizes in the VIX ETP complex were huge and there was something for everyone: vol was both remarkably cheap AND remarkably expensive at the same time. the carry was fantastic...

the VIX averaged 11 and change, roughly 60%(!) higher than realized vol did. the Sharpe of vol selling in 2017 was between 3 and 5 depending on how you might measure it. BUT...all the selling sowed the seeds of its own demise. pushing implied so low and generating so much profit

along the way that got stuffed back into the same trade at eroding margins of safety, the powder keg was properly set for Volmaggedon. this is not that, not even close. no one has effectively made the case that this market is sufficiently lopsided

now as it was then. and re-hedging in SPX is quite different than re-hedging in VIX futures. in conclusion, on the sell-side and in financial press, it's "publish or perish"...our need to connect cause and effect is mostly on display here. Volmaggedon 2.0? Maybe another time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh