2/17

This version of Reserve’s rigorously audited and tested codebase kicks off our journey of enabling stable, asset-backed currencies for the world.

And in this post, we’ll explain how you can take part! 🔥

This version of Reserve’s rigorously audited and tested codebase kicks off our journey of enabling stable, asset-backed currencies for the world.

And in this post, we’ll explain how you can take part! 🔥

3/17

In this thread...

- The All Clear Milestone

- What Does Today Mean?

- What Comes Next?

In this thread...

- The All Clear Milestone

- What Does Today Mean?

- What Comes Next?

4/17

All Clear Milestone 🔥

Reserve Protocol was initially launched in Bogotá last October.

Since last July, we have engaged in five audits, along with constant internal testing, to provide RToken deployers and holders the most robust version of the protocol possible.

All Clear Milestone 🔥

Reserve Protocol was initially launched in Bogotá last October.

Since last July, we have engaged in five audits, along with constant internal testing, to provide RToken deployers and holders the most robust version of the protocol possible.

5/17

Our five auditors:

- Ackee

- Trail Of Bits

- Halborn

- Solidified

- Code4rena public audit

Our five auditors:

- Ackee

- Trail Of Bits

- Halborn

- Solidified

- Code4rena public audit

6/17

With this week's deployment of v2.0.0 of the protocol, we reach a version where we feel comfortable deploying capital into, and a version we feel comfortable inviting others to as well.

With this week's deployment of v2.0.0 of the protocol, we reach a version where we feel comfortable deploying capital into, and a version we feel comfortable inviting others to as well.

7/17

What does today mean?

From today, Reserve Protocol provides a permissionless platform for anyone to create yield-bearing, asset-backed currencies 🌎

What does today mean?

From today, Reserve Protocol provides a permissionless platform for anyone to create yield-bearing, asset-backed currencies 🌎

8/17

We call them RTokens, and they:

- are backed 1:1 by a diversified basket of any tokenized asset, including fiat stablecoins, any asset deployed into defi, and tokenized real world assets

- provide programmable rev sharing across holders, stakers, or Ethereum addresses

We call them RTokens, and they:

- are backed 1:1 by a diversified basket of any tokenized asset, including fiat stablecoins, any asset deployed into defi, and tokenized real world assets

- provide programmable rev sharing across holders, stakers, or Ethereum addresses

9/17

- are censorship-resistant

- have proof of reserves on-chain, 24/7

- are over-collateralized and governed by the community in a fully decentralized way.

- are censorship-resistant

- have proof of reserves on-chain, 24/7

- are over-collateralized and governed by the community in a fully decentralized way.

10/17

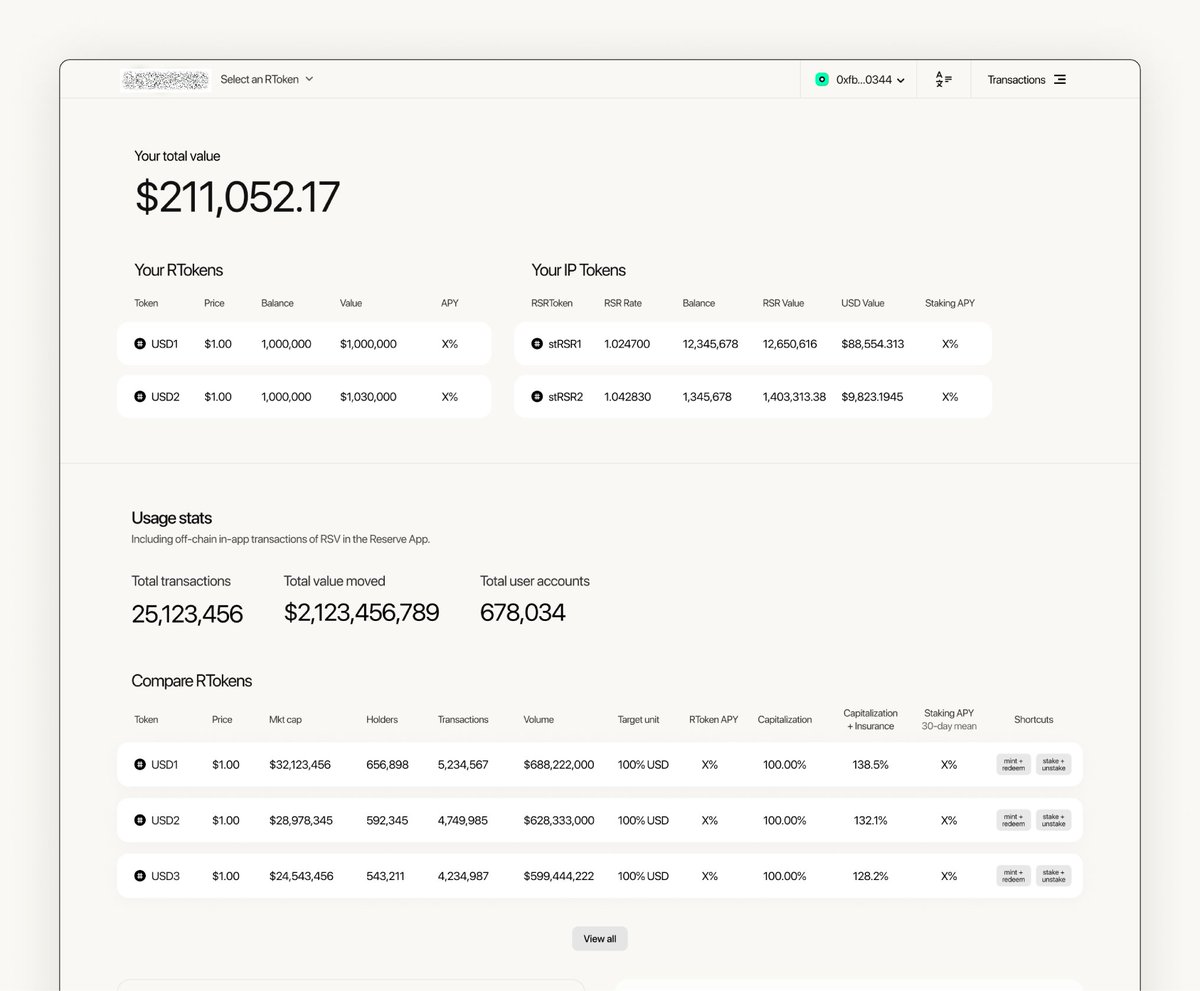

And today you will see press around the launch of our first RToken, the $eUSD - already deployed by @mobilecoin!

You can check it out at 👉 Register.app

And today you will see press around the launch of our first RToken, the $eUSD - already deployed by @mobilecoin!

You can check it out at 👉 Register.app

11/17

As RTokens are deployed and TVLs increase, you may see reasons to stake $RSR on them.

RSR stakers earn revenue from yield-bearing collaterals in exchange for over-collateralization, protecting against defaults.

We ask holders to inspect RTokens and make choices wisely!

As RTokens are deployed and TVLs increase, you may see reasons to stake $RSR on them.

RSR stakers earn revenue from yield-bearing collaterals in exchange for over-collateralization, protecting against defaults.

We ask holders to inspect RTokens and make choices wisely!

12/17

And, with our Reserve cautiousness, even though we have tested rigorously: as with all new smart contracts, please proceed at your own risk.

This baby is new to the world!

And, with our Reserve cautiousness, even though we have tested rigorously: as with all new smart contracts, please proceed at your own risk.

This baby is new to the world!

13/17

Our goal is enabling the world to find alternatives to inflation-prone currencies, giving everyone in the world the power to maintain their purchasing power across time, and across borders.

Our goal is enabling the world to find alternatives to inflation-prone currencies, giving everyone in the world the power to maintain their purchasing power across time, and across borders.

14/17

In the beginning, we are looking to collaborate with the defi community to unlock the power of programmable money, through methods such as:

1️⃣ Creative RTokens designs

2️⃣ Collateral plugin development

3️⃣ RTokens integrations into defi

In the beginning, we are looking to collaborate with the defi community to unlock the power of programmable money, through methods such as:

1️⃣ Creative RTokens designs

2️⃣ Collateral plugin development

3️⃣ RTokens integrations into defi

15/17

So for those attending #EthDenver, we are holding a $70k Hackathon ⚡️

Come join us and build!

So for those attending #EthDenver, we are holding a $70k Hackathon ⚡️

Come join us and build!

https://twitter.com/reserveprotocol/status/1628136926111797267

16/17

What comes next?

Today, the pendulum swings from "quietly building" to "letting the world in", as we help foster the adoption of asset-backed currency, useable by all, with a focus on stability over time.

What comes next?

Today, the pendulum swings from "quietly building" to "letting the world in", as we help foster the adoption of asset-backed currency, useable by all, with a focus on stability over time.

17/17

We invite all builders, heroes and dreamers...

who can see a world where money is stable and useable over decades, and want to make that a reality

...to join us at discord.gg/8g73pMejUq

We invite all builders, heroes and dreamers...

who can see a world where money is stable and useable over decades, and want to make that a reality

...to join us at discord.gg/8g73pMejUq

• • •

Missing some Tweet in this thread? You can try to

force a refresh